Irs Form 966

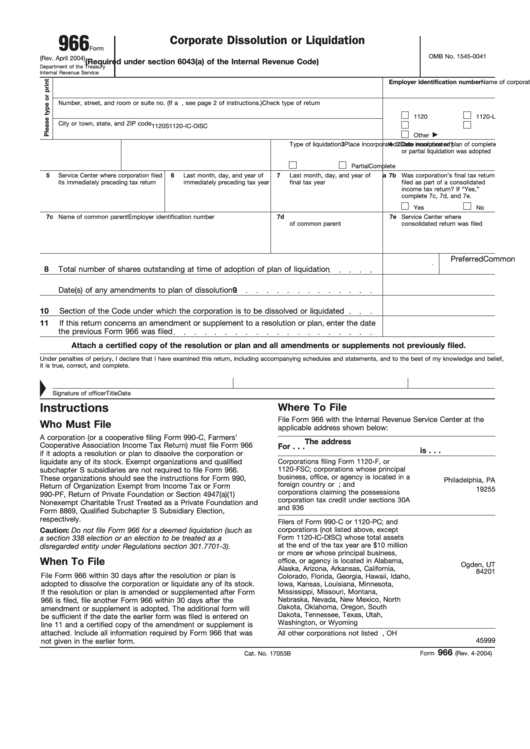

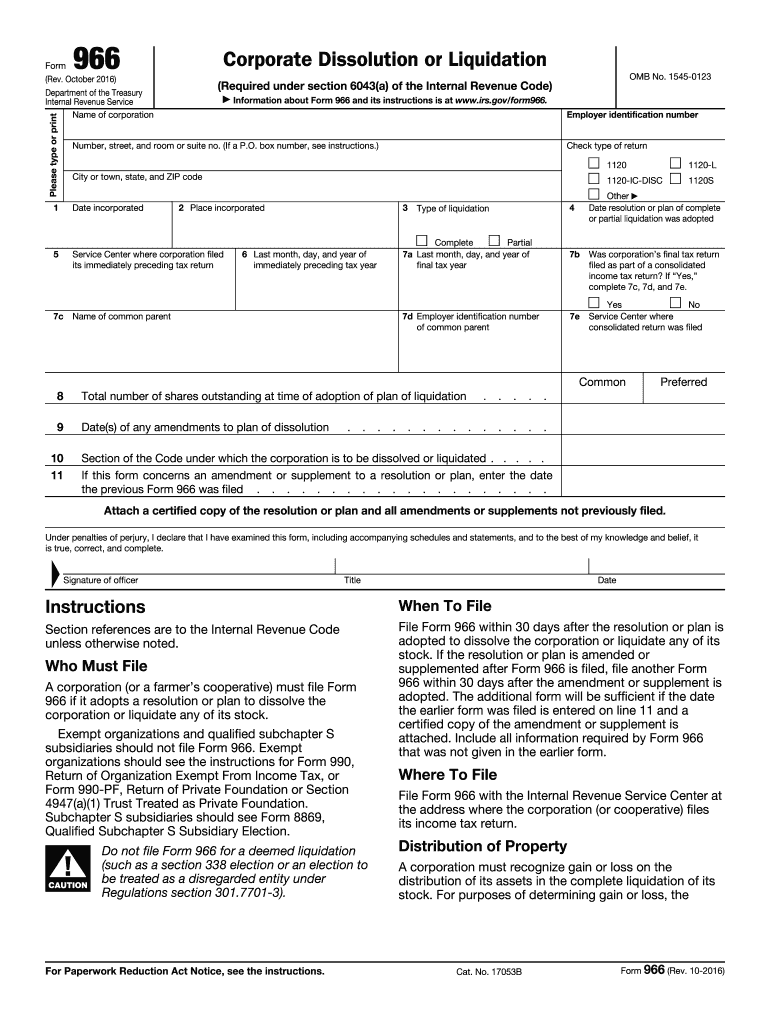

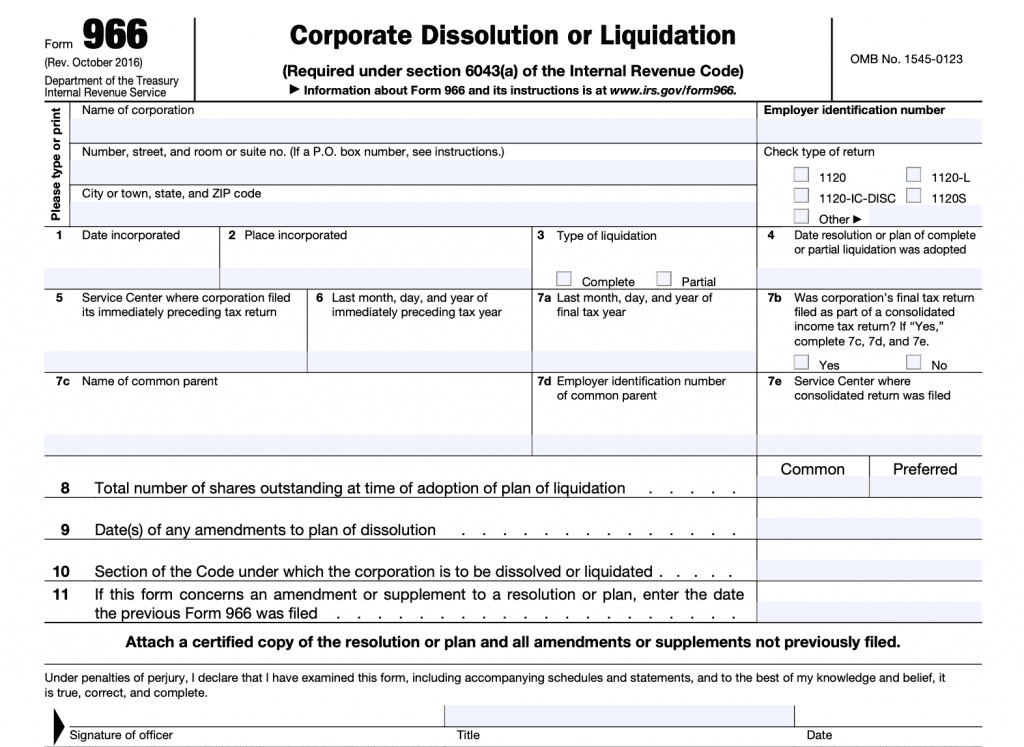

Irs Form 966 - Web irs form 966, also known as the corporate dissolution or liquidation form, is a requirement for corporations and llcs when they decide to dissolve or liquidate. Web completing irs form 966 domestic corporations and foreign corporations that pay taxes in the united states are required to complete irs form 966. Recalcitrant account holders with u.s. Estimate how much you could potentially save in just a matter of minutes. Learning about the law or the form 6 min. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the. Make sure to file irs form 966 after you. Are you going to dissolve your corporation during the tax year? The steps to complete this. Ad access irs tax forms. In this situation, you are responsible for notifying all. Web an rdcffi must file form 8966 to report a u.s. Ad we help get taxpayers relief from owed irs back taxes. Recalcitrant account holders with u.s. Are you going to dissolve your corporation during the tax year? Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to. Web completing irs form 966 domestic corporations and foreign corporations that pay taxes in the united. Ad we help get taxpayers relief from owed irs back taxes. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web once a corporation adopts a plan of liquidation and files the proper state paperwork (if required), it must send form 966, corporate dissolution or liquidation,. Web within 30 days after. Web irs form 966, also known as the corporate dissolution or liquidation form, is a requirement for corporations and llcs when they decide to dissolve or liquidate. Get ready for tax season deadlines by completing any required tax forms today. 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): In this situation, you are. Tax return must file form 966 if required under section 6043(a). Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the. Complete, edit or print tax forms instantly. Web completing irs form 966 domestic. 2 part v pooled reporting type 1 check applicable pooled reporting type (check only one): Recalcitrant account holders with u.s. Complete, edit or print tax forms instantly. Web irs form 966, also known as the corporate dissolution or liquidation form, is a requirement for corporations and llcs when they decide to dissolve or liquidate. In this situation, you are responsible. Tax return must file form 966 if required under section 6043(a). Recalcitrant account holders with u.s. Web an rdcffi must file form 8966 to report a u.s. Along with the form, you must send in a certified copy of the director's. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution. Get ready for tax season deadlines by completing any required tax forms today. Along with the form, you must send in a certified copy of the director's. The steps to complete this. Make sure to file irs form 966 after you. Account for which it has reporting obligations as a condition of its applicable rdcffi status. Web employer's quarterly federal tax return. Recalcitrant account holders with u.s. Within 30 days of the resolution adopted, an irs form 966 must be filed. Do they mean the resolution made in the. Tax return must file form 966 if required under section 6043(a). Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Within 30 days of the resolution adopted, an irs form 966 must be filed. Along with the form, you must send in a certified copy of the director's. Web a corporation must file form 966 if its adopts a resolution or plan to dissolve the corporation or. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Do they mean the resolution made in the. Along with the form, you must send in a certified copy of the director's. Exempt organizations are not required to file form 966. Within 30 days of the resolution adopted, an irs form 966 must be filed. Web irs form 966, also known as the corporate dissolution or liquidation form, is a requirement for corporations and llcs when they decide to dissolve or liquidate. October 2016)department of the treasuryinternal revenue servicename of corporationomb no. Account for which it has reporting obligations as a condition of its applicable rdcffi status. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock, the. Web a corporation must file form 966 if its adopts a resolution or plan to dissolve the corporation or liquidate any of its stock. Ad access irs tax forms. Complete, edit or print tax forms instantly. In this situation, you are responsible for notifying all. Web 966corporate dissolution or liquidationplease type or printform(rev. Solved • by intuit • 7 • updated 1 year ago. Tax return must file form 966 if required under section 6043(a). Web an rdcffi must file form 8966 to report a u.s. Recalcitrant account holders with u.s. Are you going to dissolve your corporation during the tax year?How to Complete IRS Form 966 Bizfluent

Internal Revenue Fill Online, Printable, Fillable, Blank pdfFiller

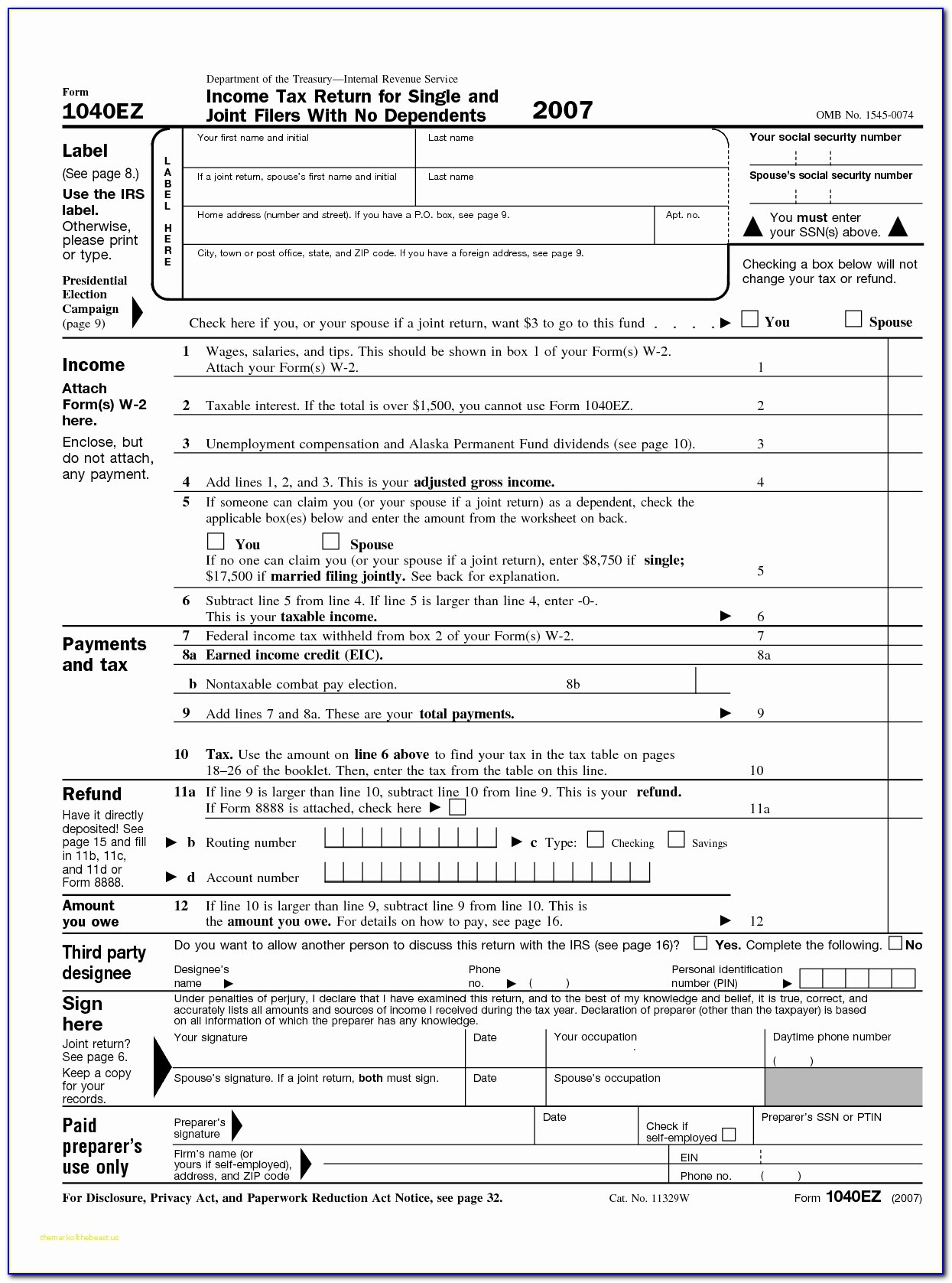

Free Printable Irs Tax Forms Printable Form 2023

Fillable Form 966 2004 Corporate Dissolution Or Liquidation printable

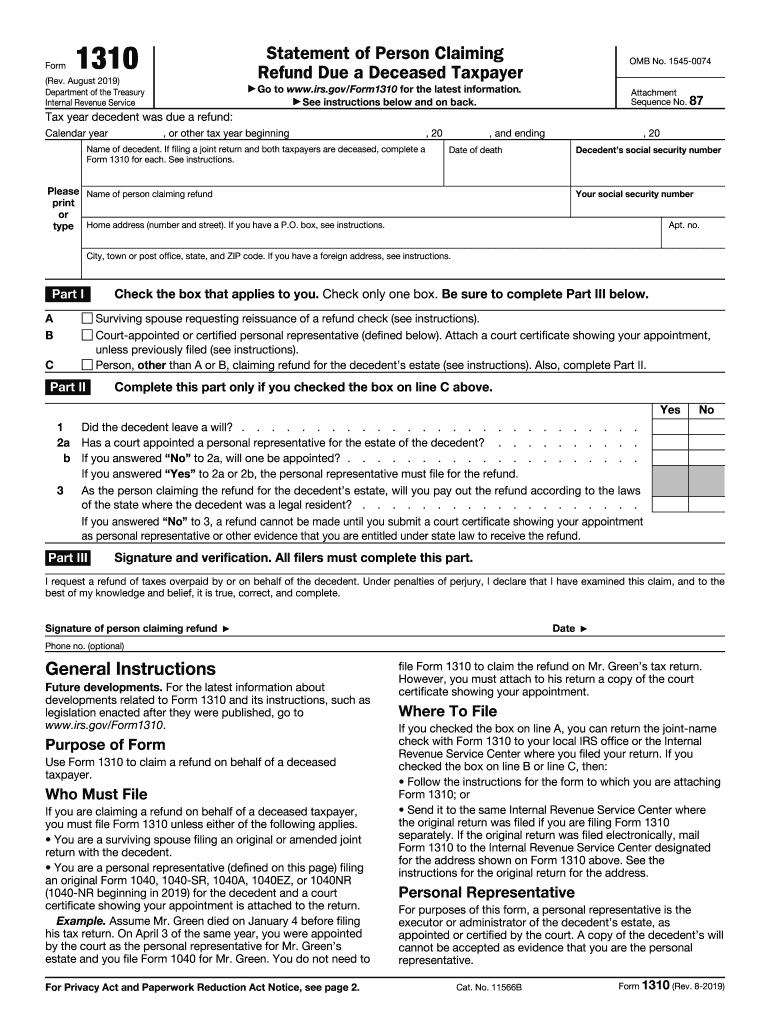

Irs form 1310 Fill out & sign online DocHub

IRS 966 2016 Fill and Sign Printable Template Online US Legal Forms

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

IRS Form 966 A Guide to Corporate Dissolution or Liquidation

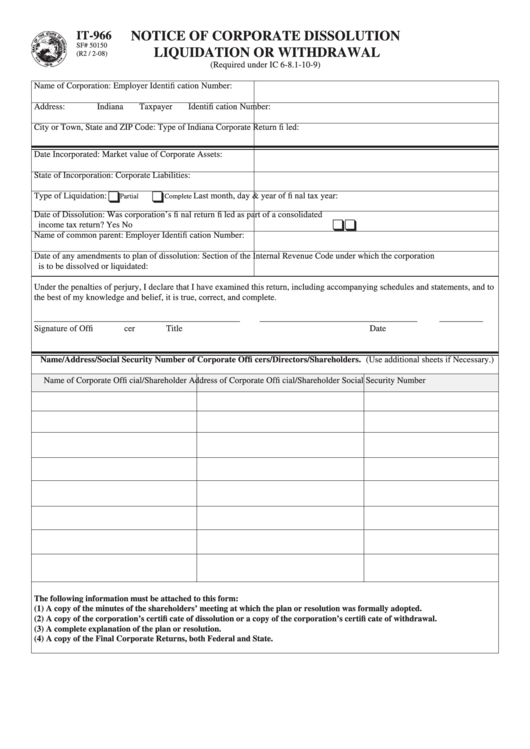

Fillable Form It966 Notice Of Corporate Dissolution Liquidation Or

Related Post: