Due Diligence Form 8867

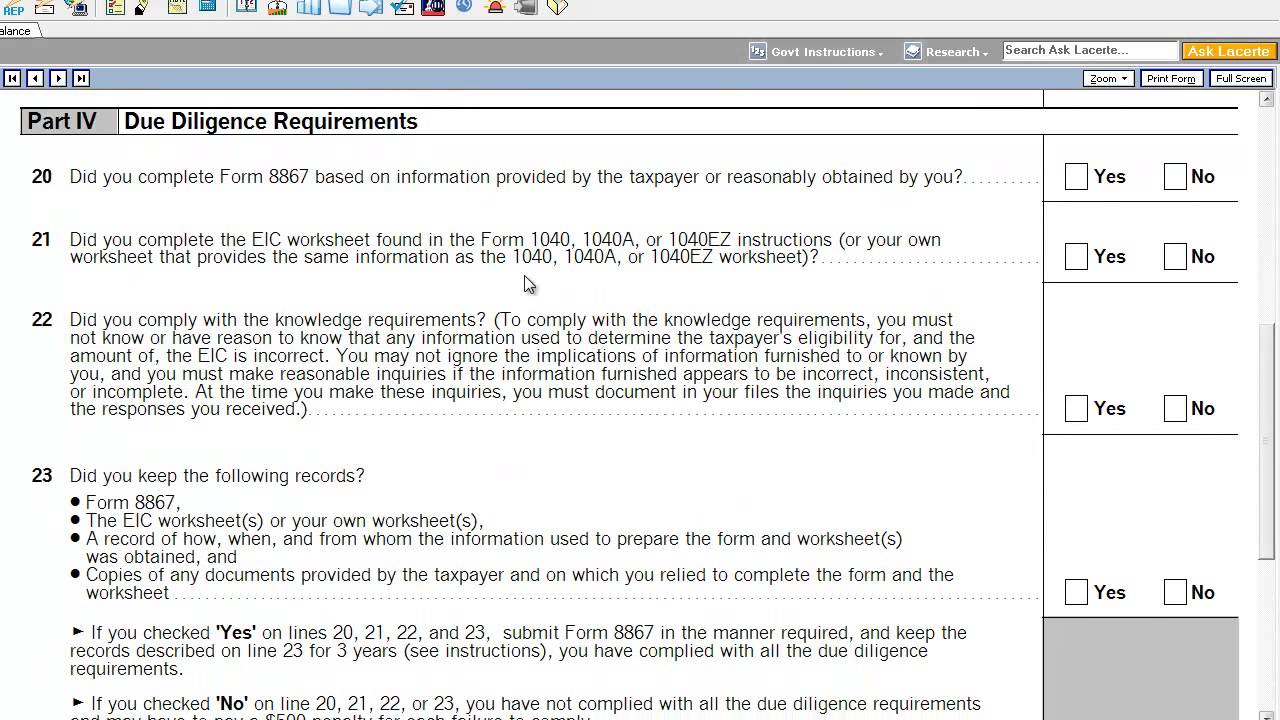

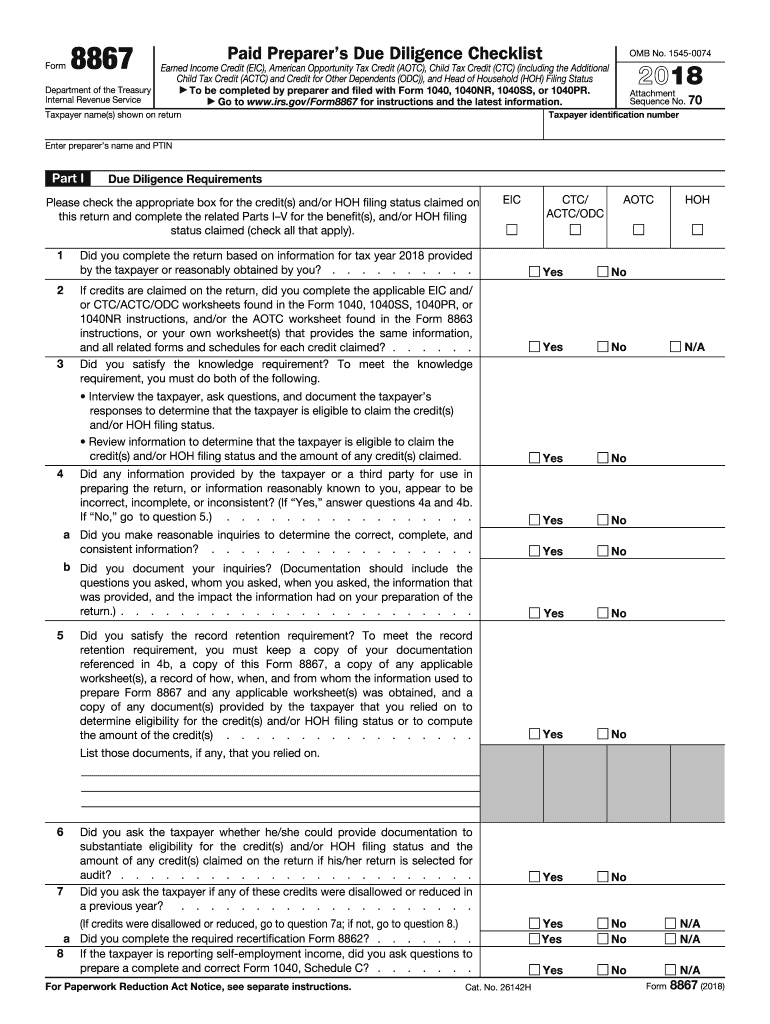

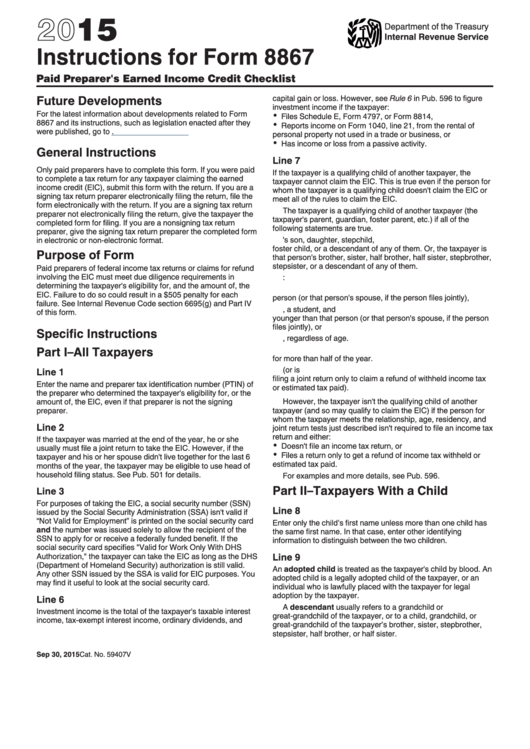

Due Diligence Form 8867 - Earned income credit (eic), american. Web when form 8867 is required, the program will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web paid preparers of federal income tax returns or claims for refund involving the earned income credit (eic) must meet due diligence requirements in determining the taxpayer's. Paid preparer’s due diligence checklist. When form 8867 is required, lacerte will generate the. Premier expertise, industry knowledge, and unparalleled responsiveness on complex matters. Complete, edit or print tax forms instantly. Consequences of not meeting your due diligence requirements. December 2021) department of the treasury internal revenue service. Department of the treasury internal revenue service. Web the four due diligence requirements. Web get ready for form 8867 and related due diligence. This is not intended as tax advice. To document my compliance with due diligence requirements for head of household filing status, the. As a paid tax return preparer, you must exercise due diligence to determine whether a taxpayer. Paid preparers of federal income tax returns or claims for refund involving the earned income credit (eic) must not only ask. Keep a copy of the worksheets or computations used to compute the amount. As a paid tax return preparer, you must exercise due diligence to determine whether a taxpayer. Web get ready for form 8867 and related due diligence.. Department of the treasury internal revenue service. Earned income credit (eic), american. Web part iv—due diligence questions for returns claiming aotc. Web get ready for form 8867 and related due diligence. Consequences of not meeting your due diligence requirements. Web paid preparers of federal income tax returns or claims for refund involving the earned income credit (eic) must meet due diligence requirements in determining the taxpayer's. By aaron borden, meadows collier, dallas, tx. Paid preparer’s due diligence checklist. Paid preparer’s due diligence checklist. Earned income credit (eic), american. Consequences of not meeting your due diligence requirements. Web the four due diligence requirements. Keep a copy of the worksheets or computations used to compute the amount. Web must i use form 8867 as part of the due diligence process? Use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Earned income credit (eic), american. Web below, you'll find information about entering form 8867, paid preparer's due diligence checklist, in lacerte. Web get ready for form 8867 and related due diligence. For each student who qualifies for the american opportunity credit, the taxpayer may be able to claim a. Web your clients can find out if they are eligible for. This is not intended as tax advice. Earned income credit (eic), american. Keep a copy of the worksheets or computations used to compute the amount. Web the four due diligence requirements. Earned income credit (eic), american. By aaron borden, meadows collier, dallas, tx. The “paid preparer’s due diligence checklist” (otherwise. Get ready for tax season deadlines by completing any required tax forms today. Paid preparer’s due diligence checklist. Web must i use form 8867 as part of the due diligence process? Use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web below, you'll find information about entering form 8867, paid preparer's due diligence checklist, in lacerte. Paid preparer’s due diligence checklist. Web the four due diligence requirements. Premier expertise, industry knowledge, and unparalleled responsiveness on complex matters. When form 8867 is required, lacerte will generate the. This is a guide on the knowledge requirements for entering due diligence notes to support form 8867 into the taxslayer pro program. December 2021) department of the treasury internal revenue service. Paid preparer’s due diligence checklist. By aaron borden, meadows collier, dallas, tx. Earned income credit (eic), american. Web part iv—due diligence questions for returns claiming aotc. Web the four due diligence requirements. Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. Complete, edit or print tax forms instantly. Paid preparer’s due diligence checklist. Premier expertise, industry knowledge, and unparalleled responsiveness on complex matters. To document my compliance with due diligence requirements for head of household filing status, the. The “paid preparer’s due diligence checklist” (otherwise. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. When form 8867 is required, lacerte will generate the. A paid tax return preparer is required to exercise due diligence when preparing a client's tax return or. Web get ready for form 8867 and related due diligence. Web below, you'll find information about entering form 8867, paid preparer's due diligence checklist, in lacerte. December 2021) department of the treasury internal revenue service. Ad our clients and their advisors rely on our premier expertise and deep industry knowledge. Earned income credit (eic), american. Paid preparers of federal income tax returns or claims for refund involving the earned income credit (eic) must not only ask. Department of the treasury internal revenue service. Paid preparer’s due diligence checklist.EIC Due Diligence (Form 8867) Tax Hound College

EIC Due Diligence (Form 8867) Tax Hound College

due diligence requirements checklist Fill Online, Printable, Fillable

Fillable Online Form 8867 Paid Preparer's Due Diligence Checklist Fax

Form 8867, Paid Preparer's Earned Credit Checklist YouTube

Form 8867 Fill out & sign online DocHub

Instructions For Form 8867 Paid Preparer'S Earned Credit

EIC Due Diligence (Form 8867) Tax Hound College

8867 Paid Preparers Due Diligence Checklist IRS Tax Forms Fill and

EIC Due Diligence (Form 8867) Tax Hound College

Related Post: