Does Form 3922 Go On Tax Return

Does Form 3922 Go On Tax Return - Web tax year 2023 940 mef ats scenario 3 crocus company. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web 1 best answer tomyoung level 13 when you sell stocks that you've acquired via an espp, such a sale can create compensation income that can be included on. Solved•by turbotax•16130•updated march 13, 2023. No income is recognized when you exercise an option under an employee stock purchase plan. 3921 is an informational form only. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. For privacy act and paperwork reduction act notice, see the current version of the general instructions for certain. Web instructions for forms 3921 and 3922 (10/2017) exercise of an incentive stock option under section 422 (b) and transfer of stock acquired through an. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your. Enter the required information to file form 3922. Web 1 best answer. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your. Keep the form for your records because you’ll need the information when you sell, assign, or. Get deals and low prices. Web for internal revenue service center file with form 1096. Web how do i report form 3921 on my tax return? Corporations file form 3922 for each transfer of. Transmit form to the irs. Ad we offer a variety of software related to various fields at great prices. Need help with irs form 2290 tax filing? Corporations file form 3922 for each transfer of. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section. It is generally not entered on your tax return unless you then sold the stock, or if. 3921 is an informational form only. Keep the form for your records because you’ll need the information when you sell, assign, or. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a. Get deals and low prices on turbo tax online at amazon Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), including recent updates, related forms, and instructions on how to file. Keep this form and use it to figure the gain or loss. Where do i enter form 3922? Form. However, you must recognize (report). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. • form 940 • form 940 schedule r. Get deals and low prices on turbo tax online at amazon Web irs form 3922 is for informational purposes. Need help with irs form 2290 tax filing? Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web per. Select form 3922 from your dashboard. Web for internal revenue service center file with form 1096. No income is recognized when you exercise an option under an employee stock purchase plan. Where do i enter form 3922? 3921 is an informational form only. Keep the form for your records because you’ll need the information when you sell, assign, or. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. It is generally not entered on your tax return unless you then sold the stock, or if. 3921. Your employer will send you form 3922,. Web 1 best answer. It is generally not entered on your tax return unless you then sold the stock, or if. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web if you purchased espp shares, your employer will send you form 3922,. Corporations file form 3922 for each transfer of. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web for internal revenue service center file with form 1096. Get deals and low prices on turbo tax online at amazon Web 1 best answer. Your employer will send you form 3922,. Solved•by turbotax•16130•updated march 13, 2023. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. A form 3922 is not required for the first transfer of legal title of a share of stock by an employee who is a nonresident alien (as defined in section 7701(b)). Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form a taxpayer receives if they have. Web how do i report form 3921 on my tax return? Web tax year 2023 940 mef ats scenario 3 crocus company. Ad we offer a variety of software related to various fields at great prices. • form 940 • form 940 schedule r. Get expert assistance with simple 2290 @ $6.95 Keep this form and use it to figure the gain or loss. Select form 3922 from your dashboard. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your. Web 1 best answer. Form 3922 is an informational statement and would not be entered into the tax return.IRS Form 3922

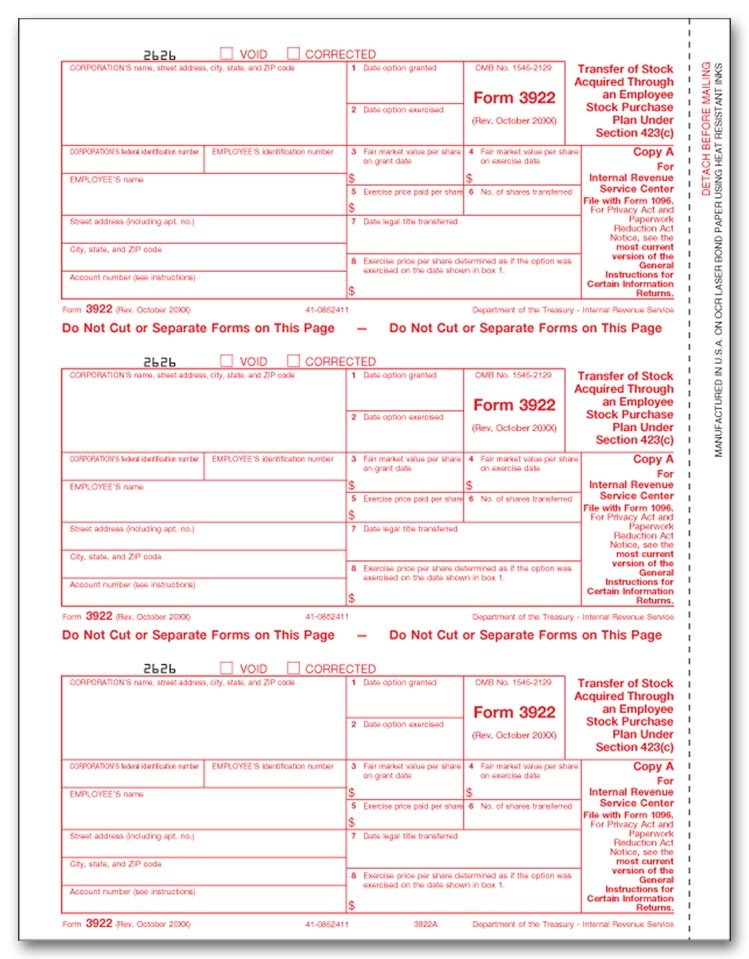

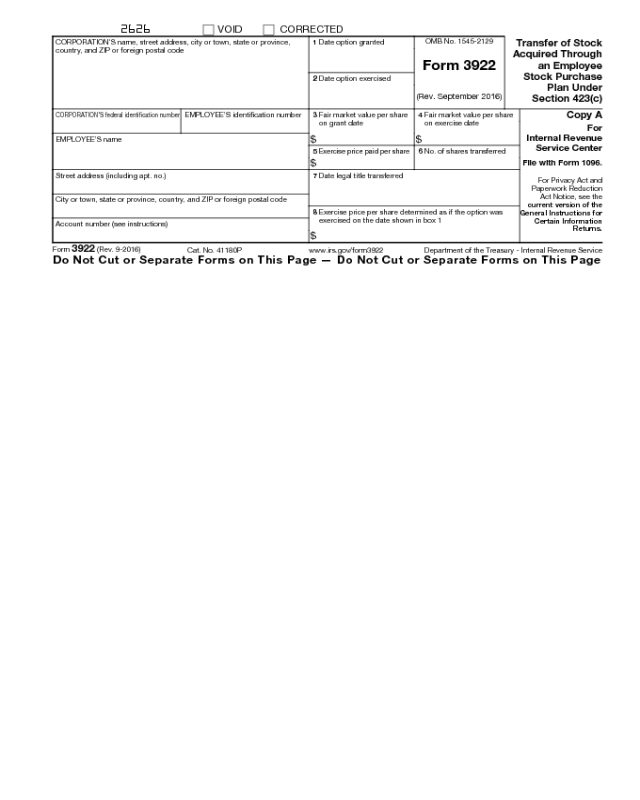

IRS Form 3922 Software 289 eFile 3922 Software

ez1099 Software How to Print or eFile Form 3922, Transfer of Stock

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

3922 Laser Tax Forms, Copy A

File IRS Form 3922 Online EFile Form 3922 for 2022

3922 2020 Public Documents 1099 Pro Wiki

What Is IRS Form 3922?

Form 3922 Edit, Fill, Sign Online Handypdf

Related Post: