Does Everyone Have A Schedule 2 Tax Form

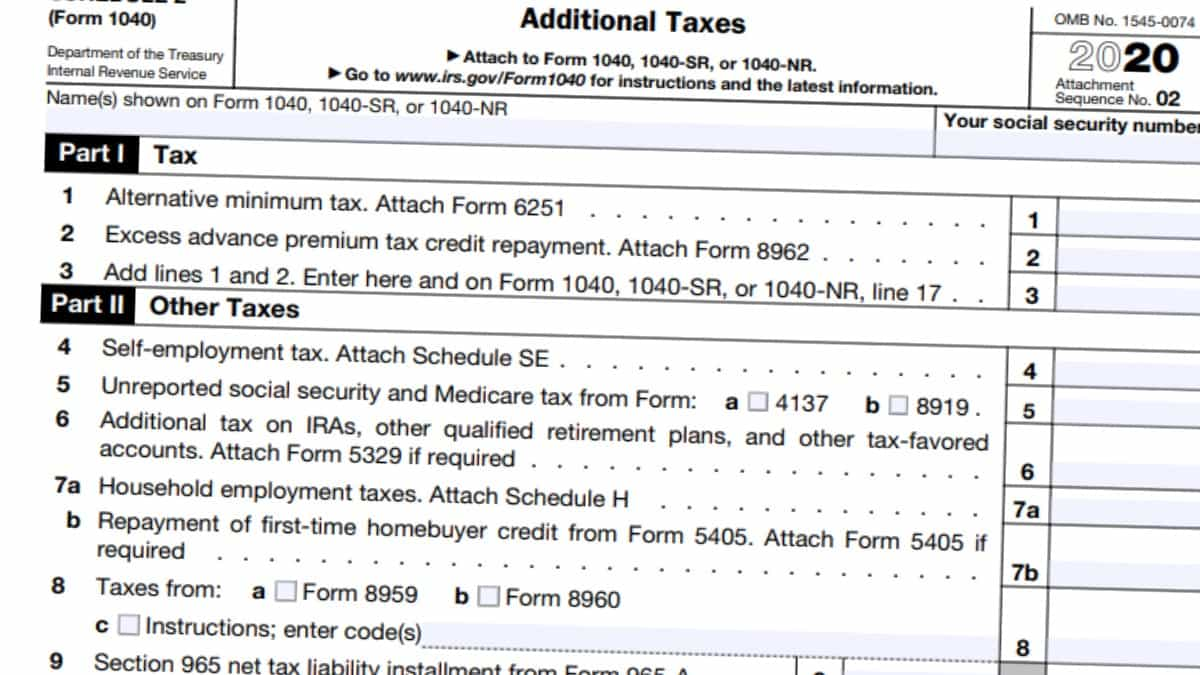

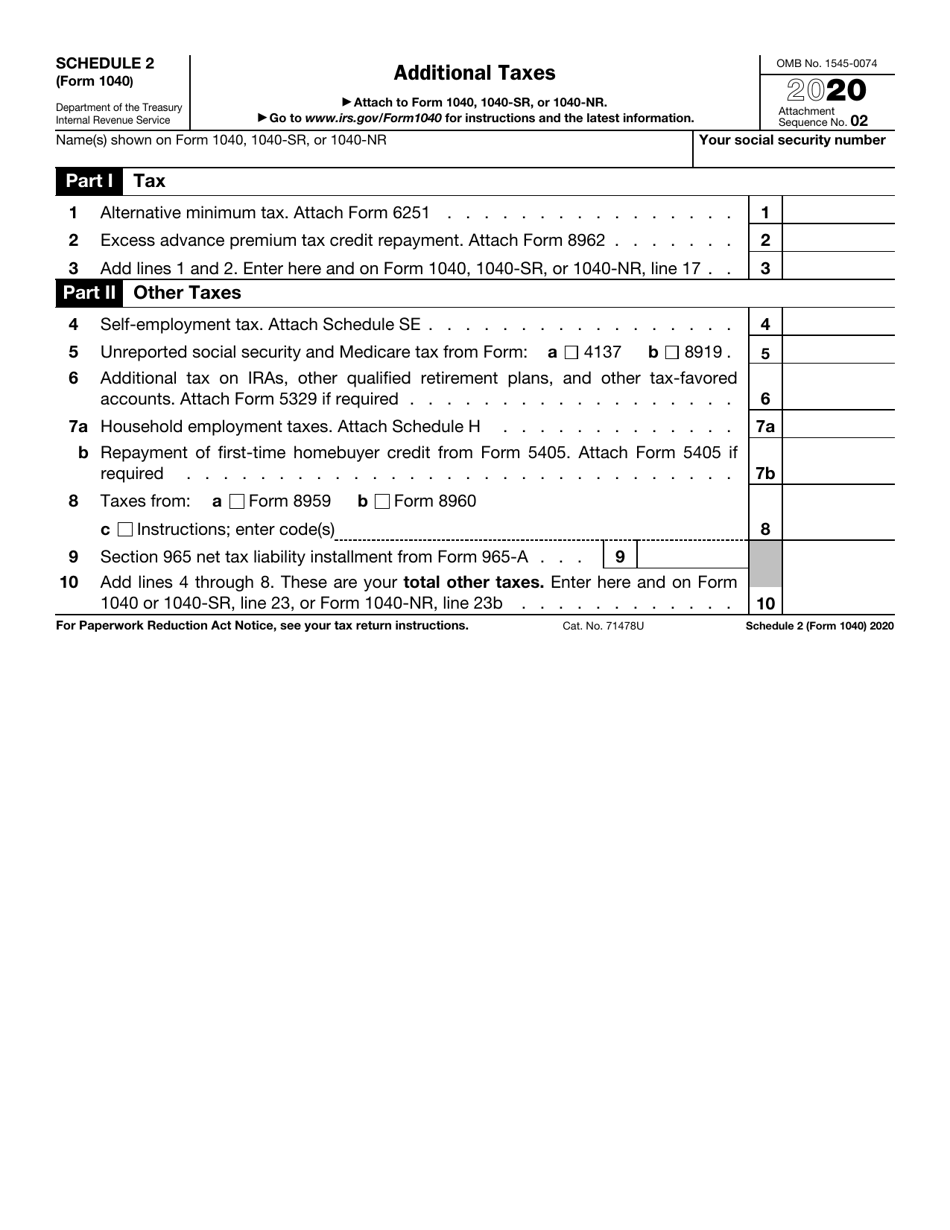

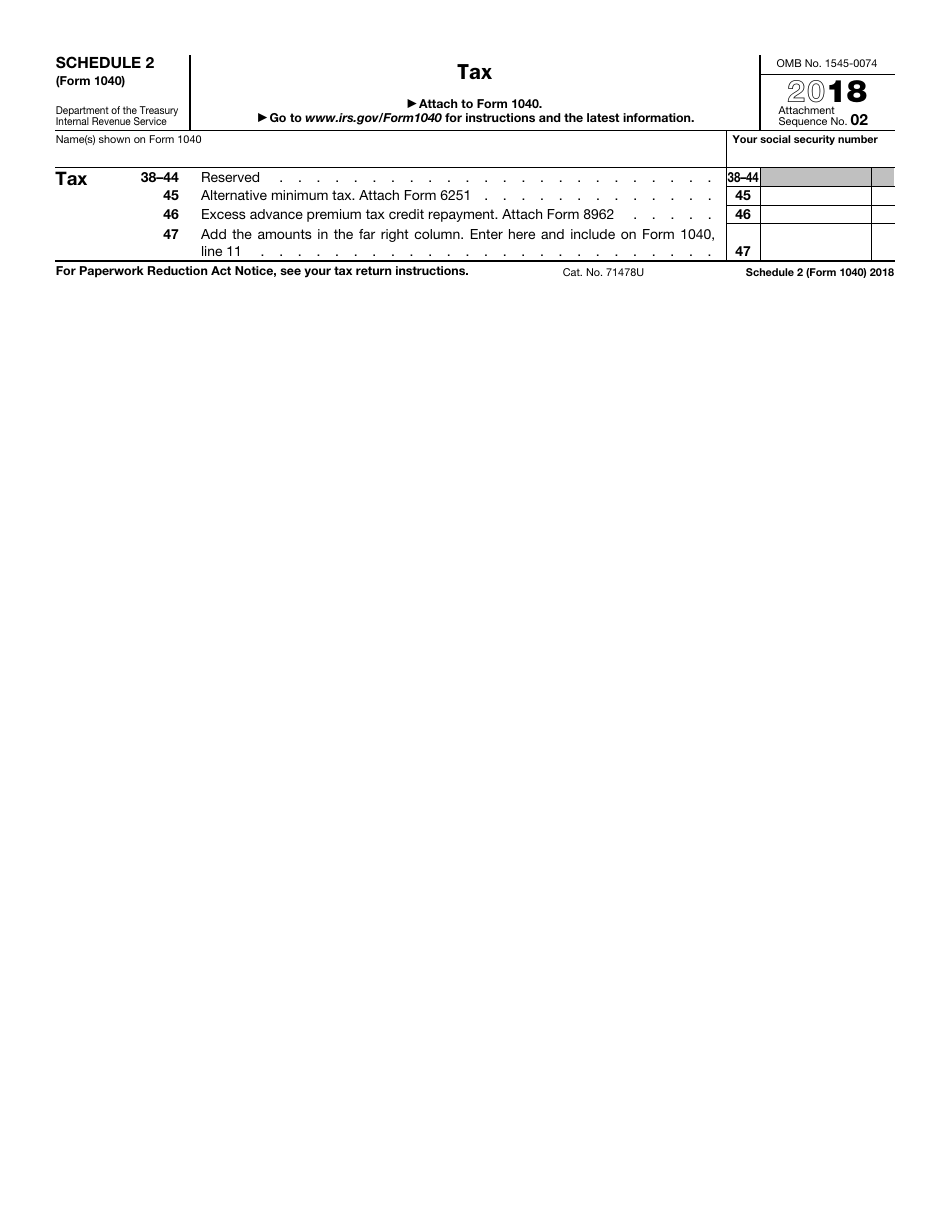

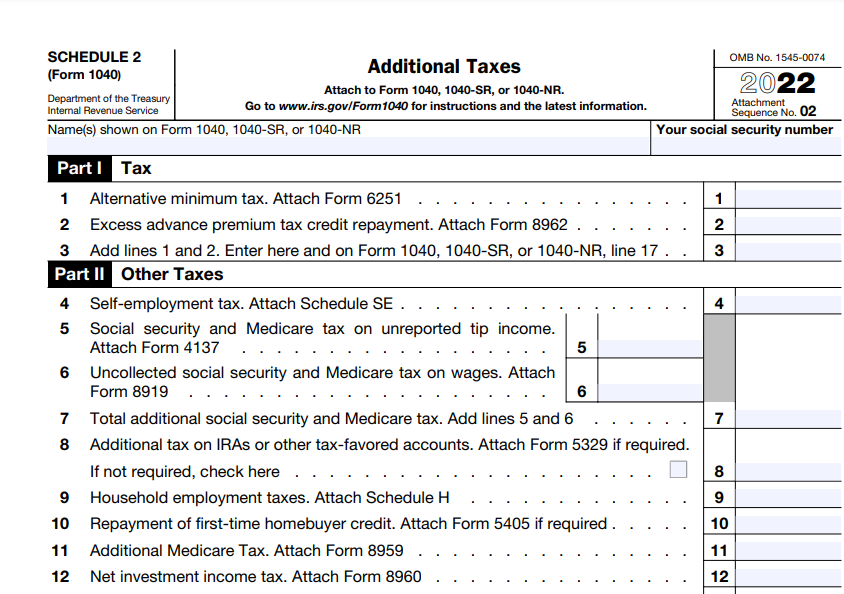

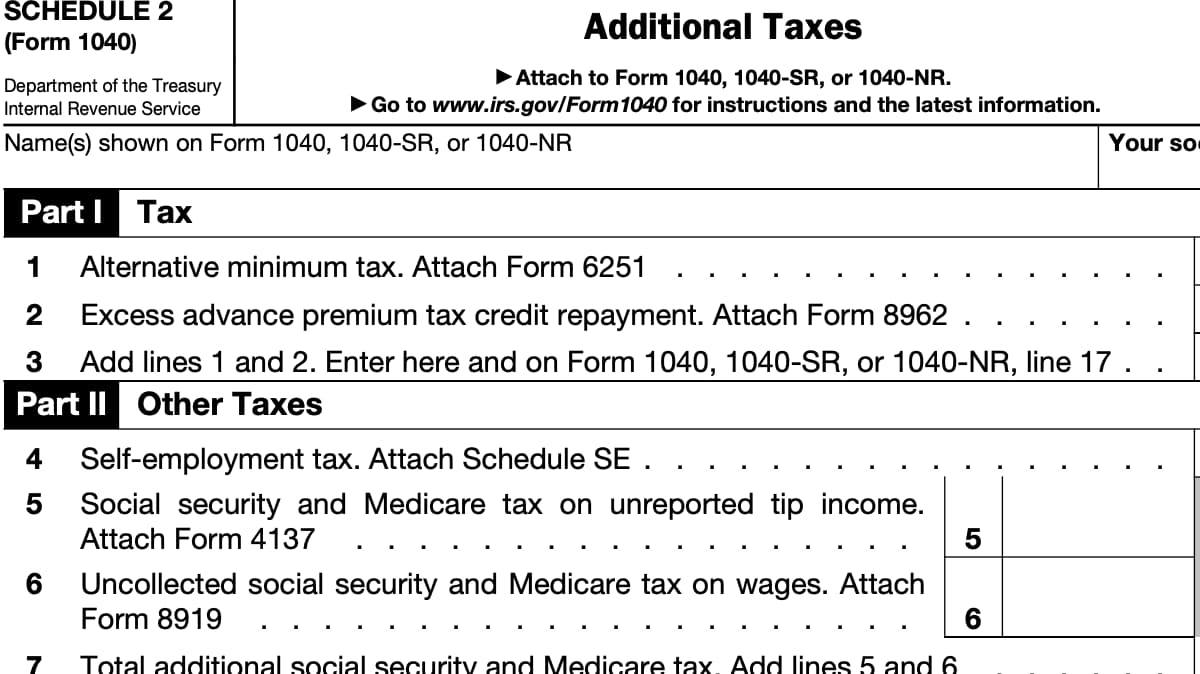

Does Everyone Have A Schedule 2 Tax Form - If entries are made on. Ad get deals and low prices on turbo tax online at amazon. Web schedule 2 is a short form that includes just a few lines. Web the irs added schedule 2 (along with five other new schedules) when it revised the 1040 tax return for the 2018 tax year. You then enter the total deductions on your form 1040. Complete, edit or print tax forms instantly. We offer a variety of software related to various fields at great prices. Schedule a is required in any year you choose to itemize your deductions. Web purpose of schedule a. Although this program supports many forms and schedules, only the most. Schedule a is required in any year you choose to itemize your deductions. Form 1040 schedule 2 includes two parts: You then enter the total deductions on your form 1040. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Where is your arizona tax refund money. Although this program supports many forms and schedules, only the most. Stuff you’ll need if you want to. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Web no schedule 2 form but need it for a question. Taxpayers who need to repay a portion of. Web schedule 2 is a short form that includes just a few lines. Department of the treasury internal revenue service. Web schedule a is a place to tally various itemized deductions you want to claim. The schedule is getting updated —. It directs users to subtract line 46 from. Some people do not need any of the six schedules, and some people might only need. Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace 3. Web no schedule 2 form but need it for a question. Web schedule 2, tax. You then enter the total deductions on your form 1040. It directs users to subtract line 46 from. It provides lines for reporting alternative minimum tax, or amt, and. However, that's a bit misleading, as the calculations that go into the numbers you'll put on those lines are. Web no schedule 2 form but need it for a question. Some people do not need any of the six schedules, and. We offer a variety of software related to various fields at great prices. However, that's a bit misleading, as the calculations that go into the numbers you'll put on those lines are. Schedule 2 part i tax. Web 1 answer sorted by: Stuff you’ll need if you want to. Go to www.irs.gov/form1040 for instructions and the latest information. Web no schedule 2 form but need it for a question. Web the irs added schedule 2 (along with five other new schedules) when it revised the 1040 tax return for the 2018 tax year. Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace. Tax and other taxes. taxpayers who need to complete this form include: Form 1040 schedule 2 includes two parts: Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. Department of the treasury internal revenue service. 1 in several previous years, i have filed 8889 without a. We offer a variety of software related to various fields at great prices. Web 1 answer sorted by: Form 1040 schedule 2 includes two parts: Web the new tax forms for 2018 have a form 1040 and six possible schedules. Web the irs added schedule 2 (along with five other new schedules) when it revised the 1040 tax return for. Where is your arizona tax refund money. Web no schedule 2 form but need it for a question. Schedule 2 part i tax. However, that's a bit misleading, as the calculations that go into the numbers you'll put on those lines are. The schedule is getting updated —. You then enter the total deductions on your form 1040. We offer a variety of software related to various fields at great prices. Get ready for tax season deadlines by completing any required tax forms today. Where is your arizona tax refund money. Question 86 of fafsa application for 2018 asks for parents income tax. Web the irs added schedule 2 (along with five other new schedules) when it revised the 1040 tax return for the 2018 tax year. Web purpose of schedule a. Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace 3. Although this program supports many forms and schedules, only the most. The schedule is getting updated —. However, that's a bit misleading, as the calculations that go into the numbers you'll put on those lines are. It provides lines for reporting alternative minimum tax, or amt, and. 1 in several previous years, i have filed 8889 without a schedule 1 due to no adjustments to be made through schedule 1 and never had any. The schedule has seven categories of expenses: Web 2022 instructions for schedule 8812 (2022) 2022 credits for qualifying children and other dependents introduction use schedule 8812 (form 1040) to figure your child tax credit. Department of the treasury internal revenue service. Schedule 2 part i tax. Ad get deals and low prices on turbo tax online at amazon. Stuff you’ll need if you want to. Web schedule a is a place to tally various itemized deductions you want to claim.2018 form 1040 schedule 2 Fill Online, Printable, Fillable Blank

Form 1040 Schedule 2 A Comprehensive Guide For Taxpayers Eso Events 2023

2020 2021 Schedule 2 Additional Taxes 1040 Form

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

IRS Form 1040 Schedule 2 Download Fillable PDF or Fill Online

IRS Form 1040 Schedule 2 2018 Fill Out, Sign Online and Download

IRS Form 1040 Schedule 2. Additional Taxes Forms Docs 2023

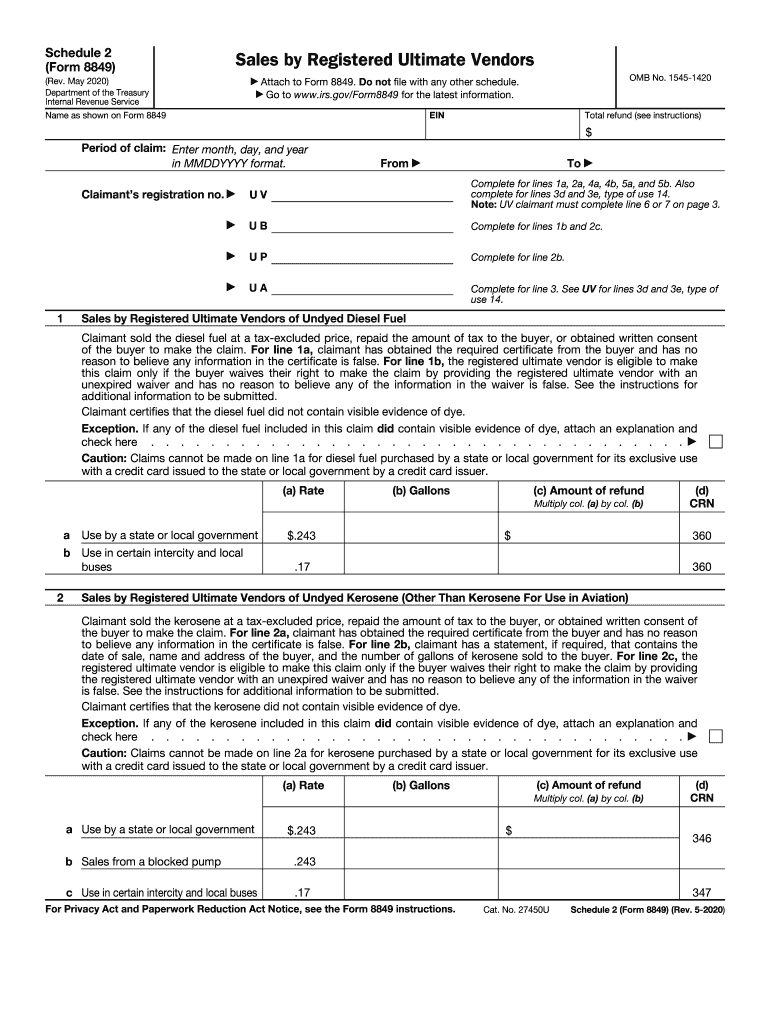

IRS 8849 Schedule 2 20202021 Fill and Sign Printable Template Online

Schedule 2 Online File PDF

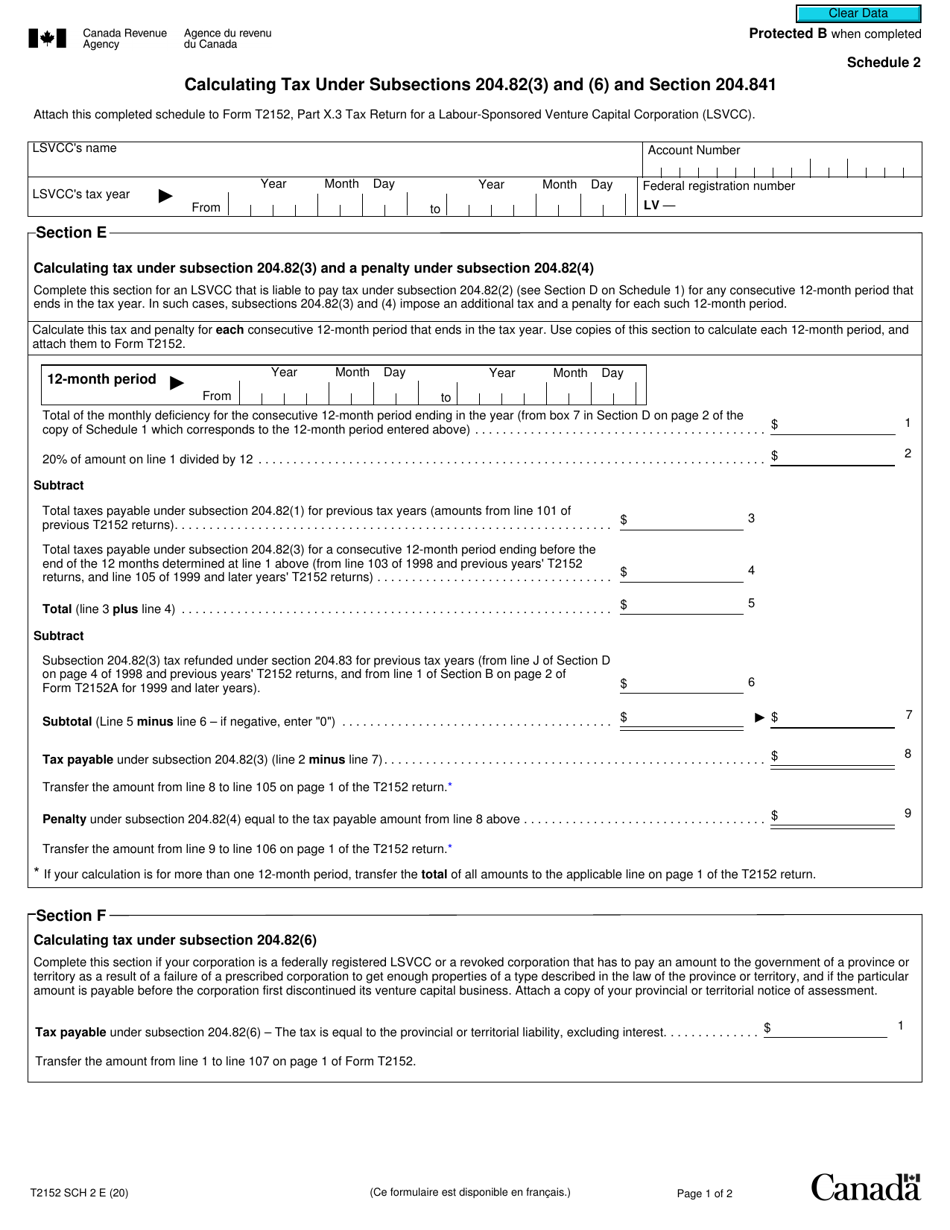

Form T2152 Schedule 2 Download Fillable PDF or Fill Online Calculating

Related Post: