Do You Have To File Form 8958 In Texas

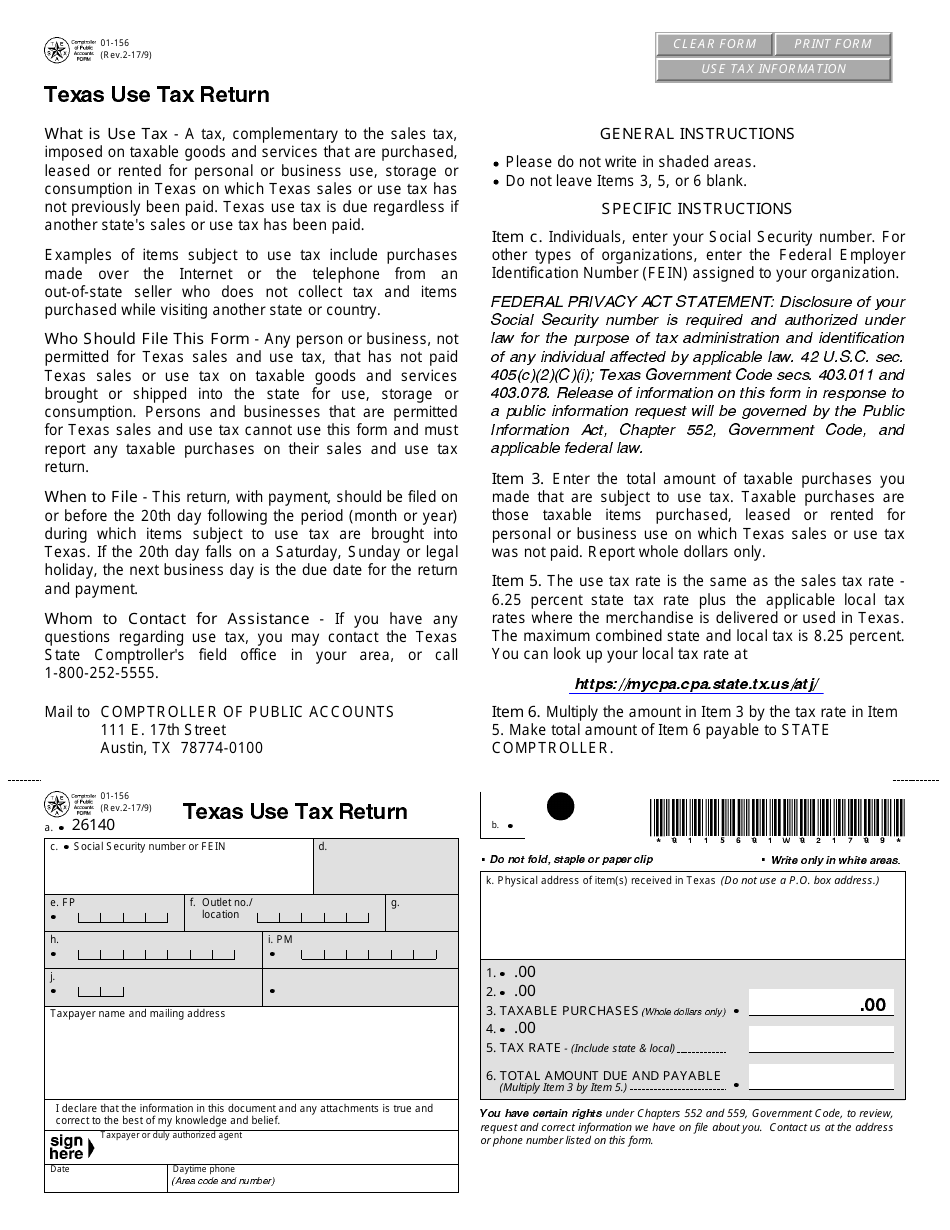

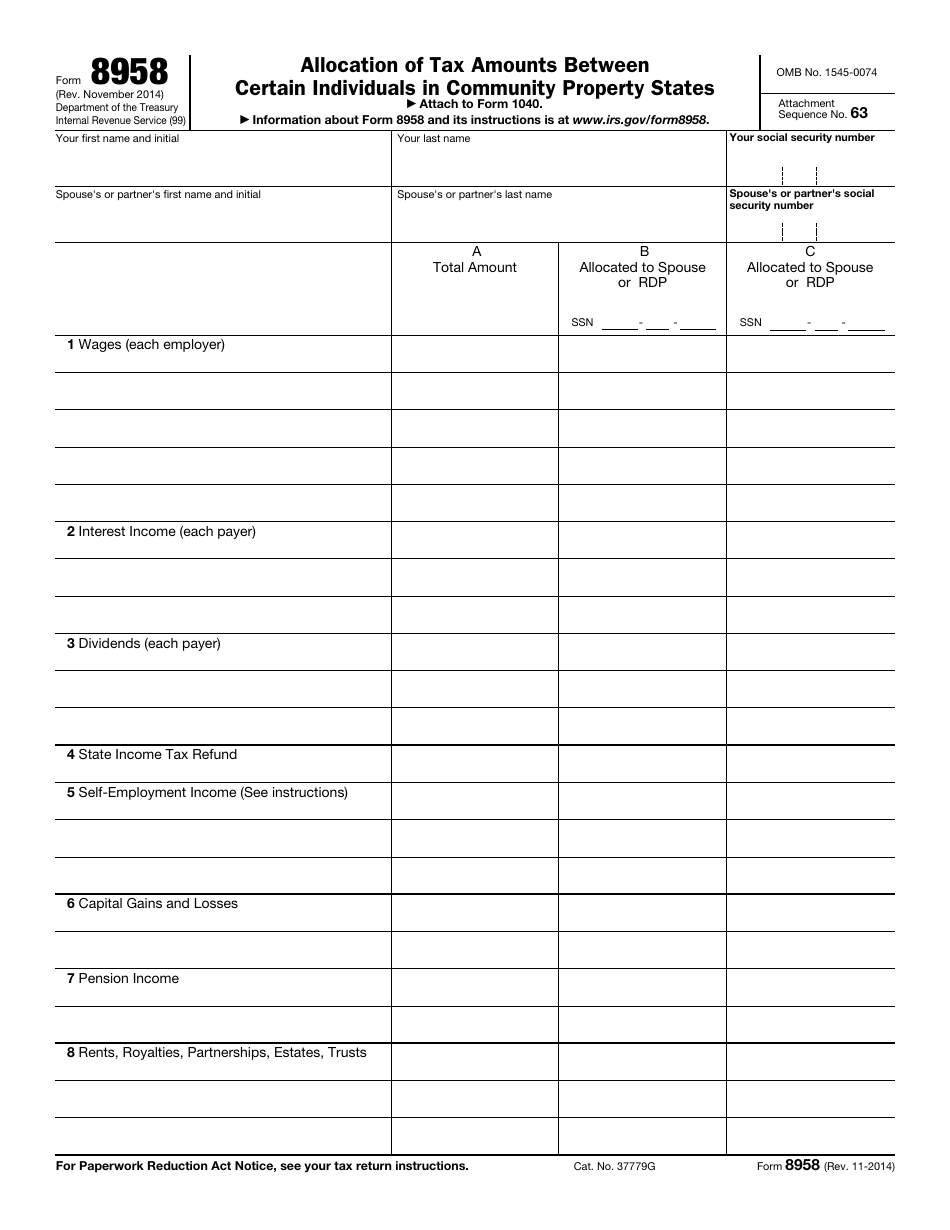

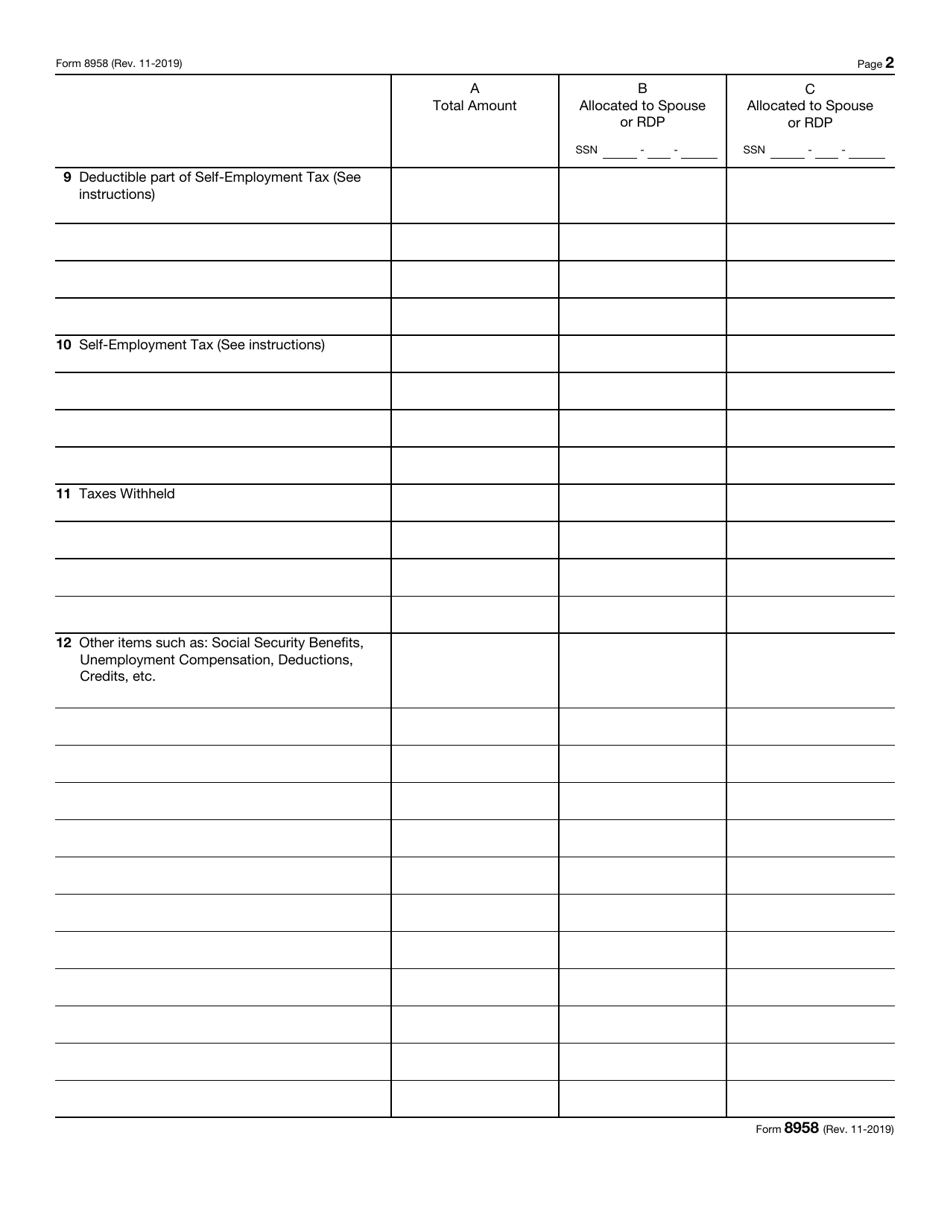

Do You Have To File Form 8958 In Texas - Web filing taxes in community property states (arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, wisconsin) as married filing. For instructions on completing the 8958 form, see. If you are married filing separately and you live in one of these states, you must use form 8958 (allocation of tax amounts between certain. About form 8958, allocation of tax amounts between certain individuals in. Web if you started your 2022 return in turbotax, you generally have until october 31 to file your return, but it may be subject to late filing fees. Yes, loved it could be better no one. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Retired, older couple in texas wanting to. What's the irs penalty if i miss the. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Retired, older couple in texas wanting to. For instructions on completing the 8958 form, see. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners. About form 8958, allocation of tax amounts between certain individuals in. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web do you have to. About form 8958, allocation of tax amounts between certain individuals in. Retired, older couple in texas wanting to. Also what if the client doesnt have the spouses information? Web how do i complete the married filing separate allocation form (8958)? Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing. Answered in 2 hours by: Also what if the client doesnt have the spouses information? Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web how to fill out form 8958, im in texas. Retired, older couple in texas wanting to. About form 8958, allocation of tax amounts between certain individuals in. Arizona, california, idaho, louisiana, nevada, new mexico, texas, washington and wisconsin. Yes, loved it could be better no one. Web if you started your 2022 return in turbotax, you generally have until october 31 to file your return, but it may be subject to late filing fees. Web form. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. If the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state, form. Web form 8958 allocation of tax amounts between certain individuals in community. Web do you have to file form 8958 in texas? Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Retired, older couple in texas wanting to. Yes, loved it could be better no one. Web use form 8958 to determine the allocation of tax amounts between. Web if you started your 2022 return in turbotax, you generally have until october 31 to file your return, but it may be subject to late filing fees. Web how to fill out form 8958, im in texas. Arizona, california, idaho, louisiana, nevada, new mexico, texas, washington and wisconsin. If the filing status on an individual tax return is married. Web how do i complete the married filing separate allocation form (8958)? Do i put the clients information and the spouse. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Retired, older couple in texas wanting to. Also what if the client doesnt have the spouses information? Web do you have to file form 8958 in texas? Web filing taxes in community property states (arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, wisconsin) as married filing. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 allocation of tax amounts between certain. For instructions on completing the 8958 form, see. Also what if the client doesnt have the spouses information? What's the irs penalty if i miss the. Web filing taxes in community property states (arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, wisconsin) as married filing. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Retired, older couple in texas wanting to. Do i put the clients information and the spouse. Web community property states are: Arizona, california, idaho, louisiana, nevada, new mexico, texas, washington and wisconsin. The community property states are arizona, california, idaho, louisiana, nevada, new mexico, texas,. Web how do i complete the married filing separate allocation form (8958)? Web how to fill out form 8958, im in texas. If the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state, form. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 must be completed if the taxpayer: Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. About form 8958, allocation of tax amounts between certain individuals in. Answered in 2 hours by:Form 01156 Fill Out, Sign Online and Download Fillable PDF, Texas

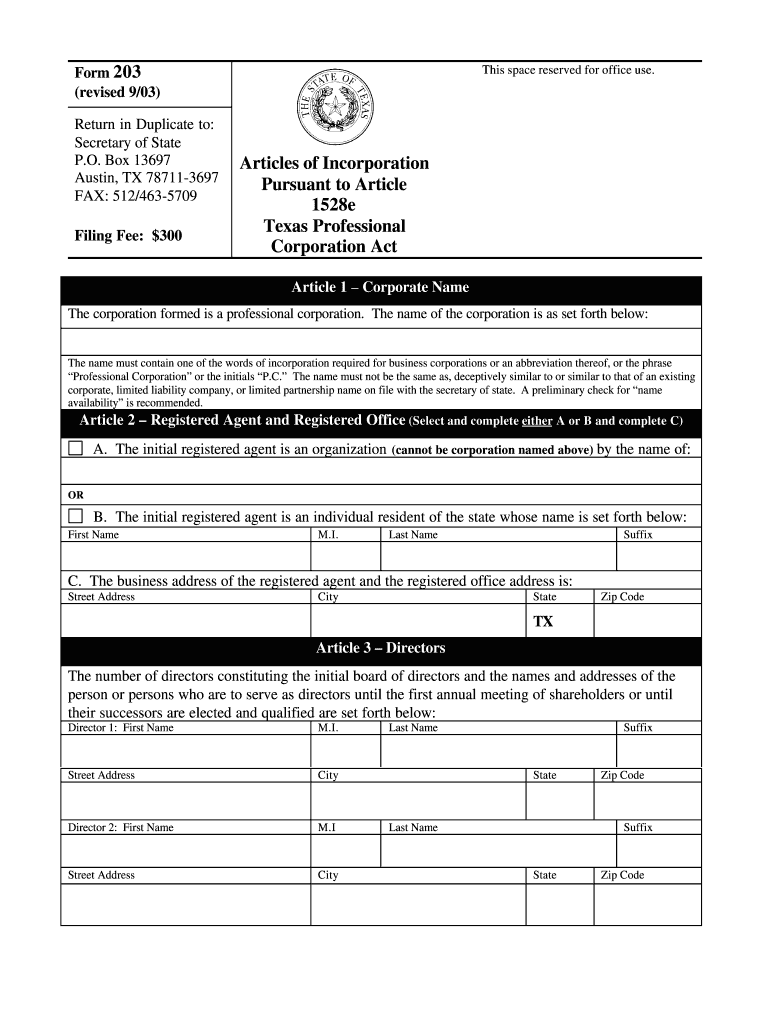

Articles Of Incorporation Texas Fill Out and Sign Printable PDF

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Form 8958 Allocation of Tax Amounts between Certain Individuals in

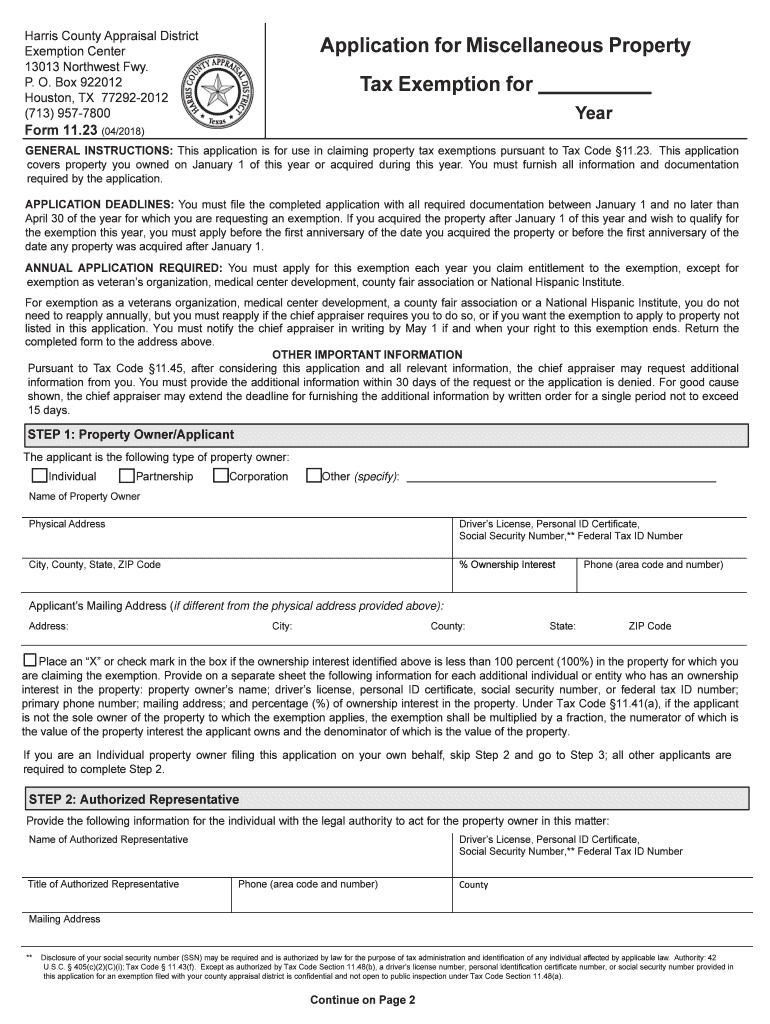

TX Form 11.23 Harris County 20182022 Fill out Tax Template Online

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

Texas Llc Filing Requirements Form Fill Out and Sign Printable PDF

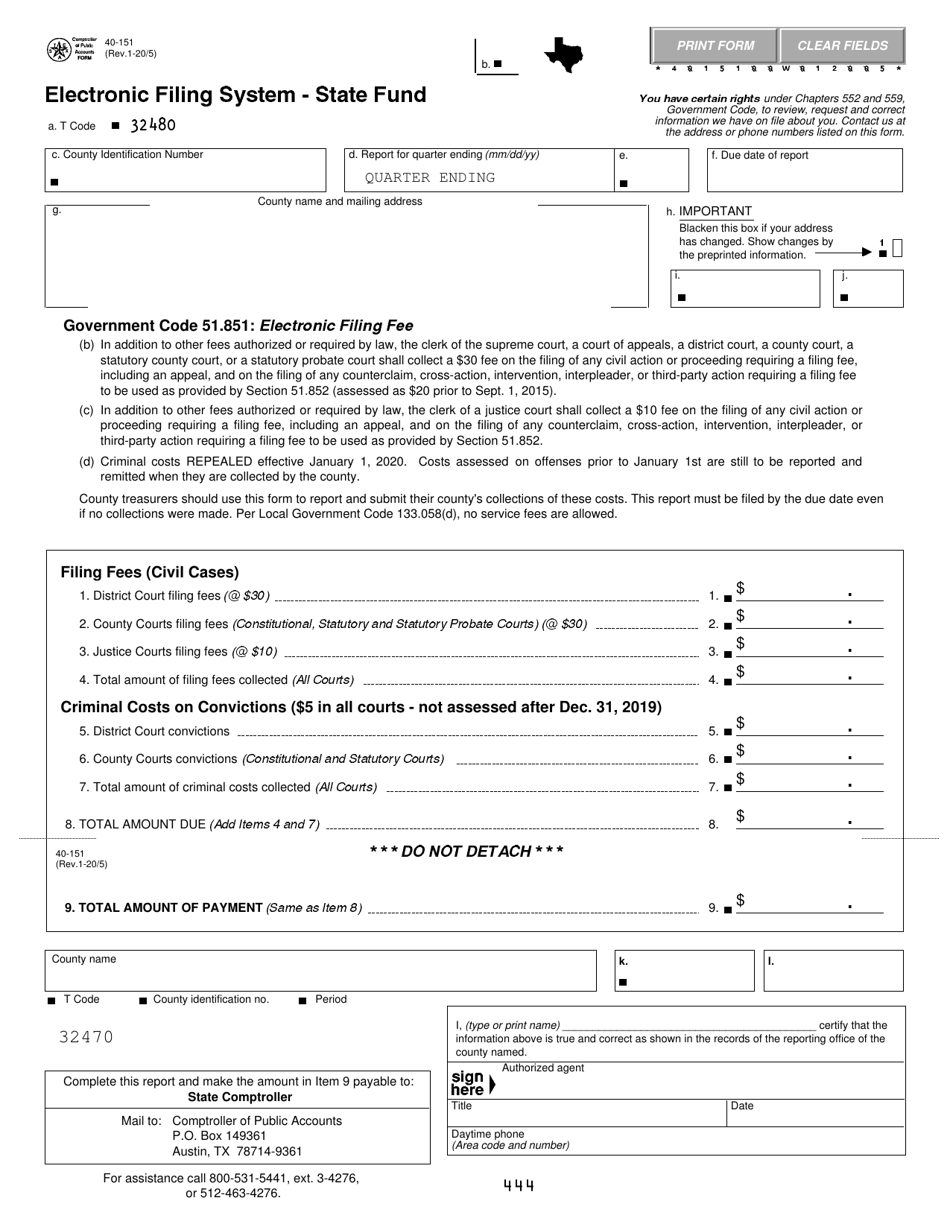

Form 40151 Download Fillable PDF or Fill Online Electronic Filing

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Related Post: