Debt Snowball Form

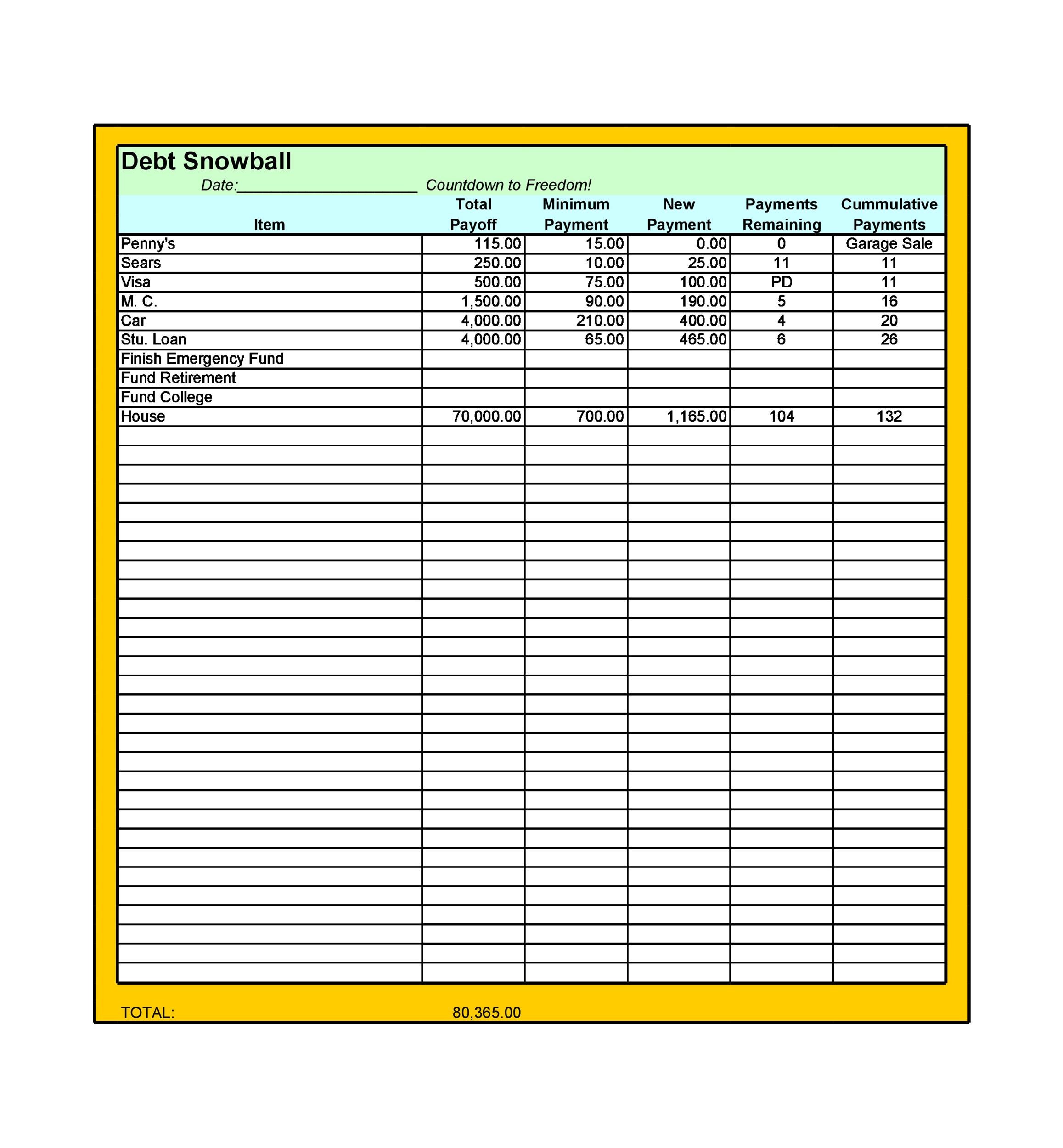

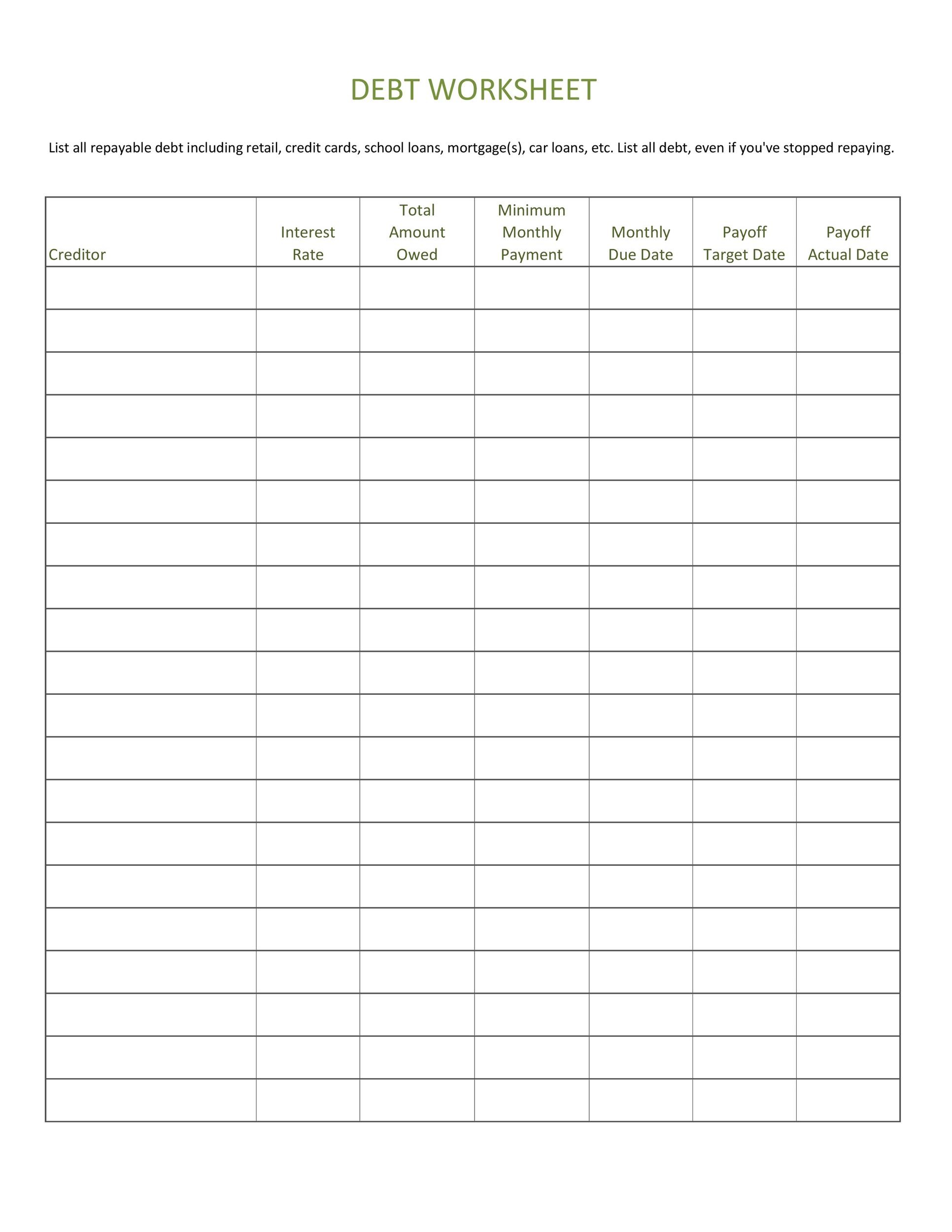

Debt Snowball Form - Put any extra dollar amount into your smallest debt until it is paid off. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Access our free debt snowball calculator today! It indicates a way to close an interaction, or dismiss a notification. Repeat until each debt is paid in full. List the balance, interest rate, and minimum payment. List the starting balance owed on each debt at the top of each column. What is the debt snowball method? Web write each one of your debts down on this form in order from smallest to largest. Like most of the other worksheets, you’ll list your debts, balances, and payments every month and there’s even a section to jot down some notes. You can even create a payment schedule and payoff summary. The smallest debt will be the one that will be getting the snowball payment. Get your debt snowball rolling. Debt #1 should be the smallest debt, and debt #4 should be the largest debt. Managing debt is a normal part of the modern financial journey. Download doc version (free) download pdf version (free) download the entire collection for only $199. Web figure out what you owe on each debt. Web simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. This form collects information we will use. Web with the debt snowball method, you reward yourself for wins along your debt payoff journey. Pay as much as possible on your smallest debt. You can unsubscribe at any. It works by concentrating on paying off the smallest amount of debt first, then. Write down the amount you plan to pay on that debt each month. Now, before you start arguing about the interest rates, hear us out. This is the exact debt snowball form that we used to get out debt in that short period of time. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan #1”, “student loan #2” etc. Make minimum. Repeat until each debt is paid in full. Below is more information about the debt snowball plan to help you break free of the debt monster. These worksheets make it easy to pay off debt. Get your debt snowball rolling. This debtbuster worksheet works best if you put the smallest debt at the top of the list and the biggest. Pay as much as possible on your smallest debt. Web track your monthly payments and debt payoff progress with these free debt snowball printable worksheets. This is the exact debt snowball form that we used to get out debt in that short period of time. This debtbuster worksheet works best if you put the smallest debt at the top of. This form collects information we will use to send you updates about promotions, special offers, and news. Download doc version (free) download pdf version (free) download the entire collection for only $199. Pay as much as possible on your smallest debt. List your debts from smallest to largest regardless of interest rate. This is the exact debt snowball form that. Managing debt is a normal part of the modern financial journey. Web this debt snowball form is for setting up a debt snowball payment system, where debts with a smaller balance are paid off first. List your debts from smallest to largest regardless of interest rate. Make minimum payments on all your debts except the smallest. The approach involves paying. List all of your debts smallest to largest, and use this sheet to mark them off one by one. How to use this as a debt. Web crown's debt snowball calculator has been used by thousands of people to help them get out of debt! List your debts from smallest to largest regardless of interest rate. Web you can grab. Pay as much as possible on your smallest debt. You can unsubscribe at any. Web in order to keep track of the payments you’re making, you can use a debt snowball form or a debt payoff spreadsheet. How to create a debt reduction plan. Remember it is okay to pay even more if it is possible. The smallest debt will be the one that will be getting the snowball payment. Pay as much as possible on your smallest debt. Web here’s how the debt snowball works: We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. Once you’ve paid that one off, you move on to the next smallest. Like most of the other worksheets, you’ll list your debts, balances, and payments every month and there’s even a section to jot down some notes. Repeat until each debt is paid in full. Web 1 day agotwo crossed lines that form an 'x'. Decide how much you are going to pay towards your debt each. You can unsubscribe at any. Then you can plan out how much you’ll set aside per month for your debts. How to use this as a debt. Web track your monthly payments and debt payoff progress with these free debt snowball printable worksheets. Do the same for the second smallest debt untill that one is paid off as well. You can even create a payment schedule and payoff summary. This form collects information we will use to send you updates about promotions, special offers, and news. What is the debt snowball method? Learn how the debt snowball method works to decide if it’s right for you. Web write each one of your debts down on this form in order from smallest to largest. List the starting balance owed on each debt at the top of each column.Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Etsy

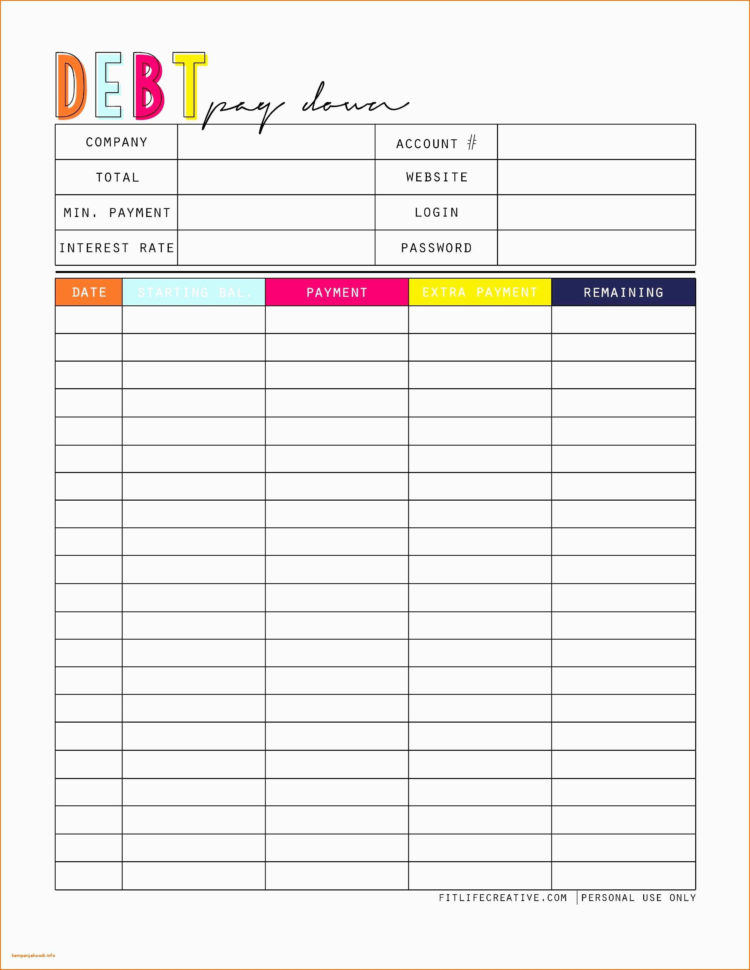

Printable Debt Snowball Tracker Printable Blank World

Debt Snowball Spreadsheet inside 12+ Debt Snowball Spreadsheet Credit

38 Debt Snowball Spreadsheets, Forms & Calculators Free Printable

Snowball Spreadsheet with Debt Snowball Form Unique Debt Snowball

Dave Ramsey Debt Snowball Worksheets —

38 Debt Snowball Spreadsheets, Forms & Calculators

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Etsy

Free Debt Snowball Method Worksheet Simply Unscripted

Related Post: