Ct Form 1065

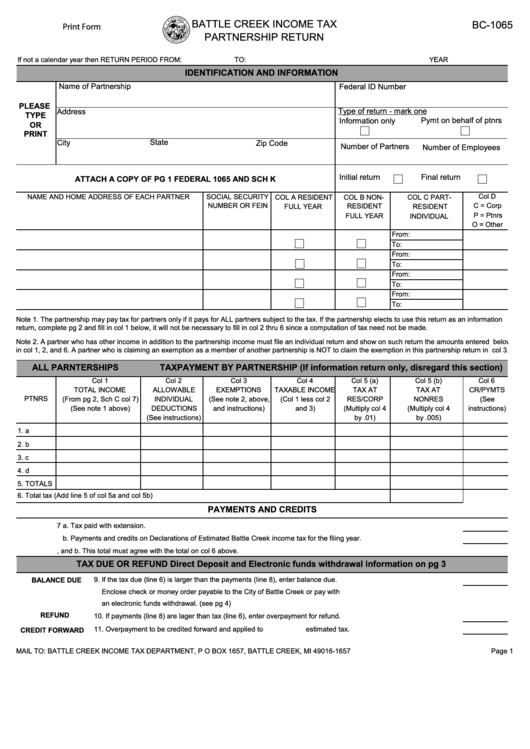

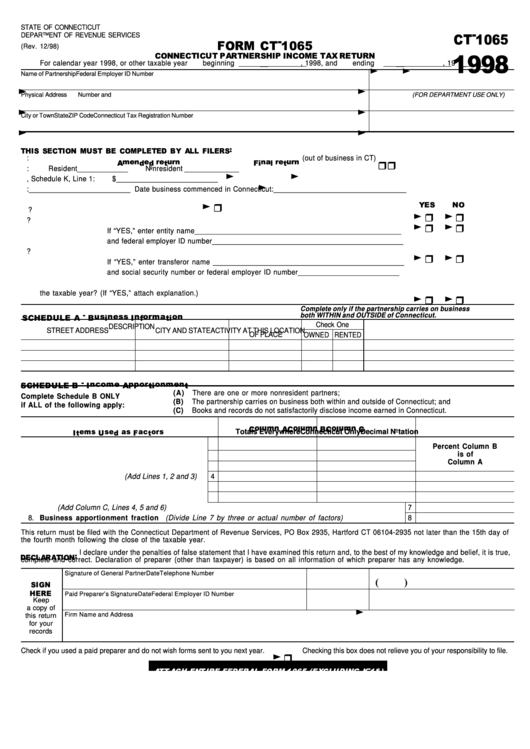

Ct Form 1065 - Amended return final return (out of business in ct) total number of partners during the taxable year:. Complete this form in blue or black ink only. Partnership, including a limited liability partnership and a limited liability company (llc) treated as a partnership for federal purposes, must file. If the partnership's principal business, office, or agency is located in: Complete, edit or print tax forms instantly. Web select a filing method; And the total assets at the end of the. Web welcome to the connecticut department of revenue services (drs) taxpayer service center ( tsc )! Easily fill out pdf blank, edit, and sign them. Pay the lowest amount of taxes possible with strategic planning and preparation The tsc has been retired effective 9/1/2023. Partnership, including a limited liability partnership and a limited liability company (llc) treated as a partnership for federal purposes, must file. Save or instantly send your ready documents. Amended return final return (out of business in ct) total number of partners during the taxable year:. Get ready for tax season deadlines by completing. File partnership and llc form 1065 fed and state taxes with taxact® business. Web select a filing method; Easily fill out pdf blank, edit, and sign them. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. In this booklet, you will find the necessary forms and information to help you meet your connecticut income tax. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. If the due date falls on a saturday,. Web find irs mailing addresses by state to file form 1065. Partnership, including a limited liability partnership and a limited liability company (llc) treated as a partnership for federal purposes, must file. If the partnership's principal business, office, or agency is located in: Web this section must be completed by all filers: Complete this form in blue or black ink only. Web based on the provisions of the new pet legislation,. The tsc has been retired effective 9/1/2023. Web form ct‑1065/ct‑1120si must be filed electronically and payments must be made electronically, unless a taxpayer has received an electronic filing and payment waiver. The state of connecticut and ultratax cs support electronic filing for the following forms: Web based on the provisions of the new pet legislation, calendar year entities would have. Web this section must be completed by all filers: Web form ct‑1065/ct‑1120si must be filed electronically and payments must be made electronically, unless a taxpayer has received an electronic filing and payment waiver. If the due date falls on a saturday,. Get ready for tax season deadlines by completing any required tax forms today. Web select a filing method; If the due date falls on a saturday,. Pay the lowest amount of taxes possible with strategic planning and preparation Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. Save or instantly send your ready documents. Web this section must be completed by all filers: Web select a filing method; Amended return final return (out of business in ct) total number of partners during the taxable year:. File partnership and llc form 1065 fed and state taxes with taxact® business. If the partnership's principal business, office, or agency is located in: Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. The state of connecticut and ultratax cs support electronic filing for the following forms: The tsc has been retired effective 9/1/2023. Ad save time and money with professional tax planning & preparation services. Complete this form in blue or black ink only. 2022 member's share of certain connecticut. Easily fill out pdf blank, edit, and sign them. If the due date falls on a saturday,. Web form ct‑1065/ct‑1120si must be filed electronically and payments must be made electronically, unless a taxpayer has received an electronic filing and payment waiver. The tsc has been retired effective 9/1/2023. Web select a filing method; 2022 member's share of certain connecticut. Web based on the provisions of the new pet legislation, calendar year entities would have an estimated payment due on june 15, 2018. Web this section must be completed by all filers: Pay the lowest amount of taxes possible with strategic planning and preparation Ad save time and money with professional tax planning & preparation services. Amended return final return (out of business in ct) total number of partners during the taxable year:. Partnership, including a limited liability partnership and a limited liability company (llc) treated as a partnership for federal purposes, must file. If the partnership's principal business, office, or agency is located in: The state of connecticut and ultratax cs support electronic filing for the following forms: Web welcome to the connecticut department of revenue services (drs) taxpayer service center ( tsc )! Complete, edit or print tax forms instantly. Web form ct‑1065/ct‑1120si must be filed electronically and payments must be made electronically, unless a taxpayer has received an electronic filing and payment waiver. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. The tsc has been retired effective 9/1/2023. File partnership and llc form 1065 fed and state taxes with taxact® business. And the total assets at the end of the. Easily fill out pdf blank, edit, and sign them. Web find irs mailing addresses by state to file form 1065.Fillable Form Bc1065 Partnership Return Battle Creek Tax

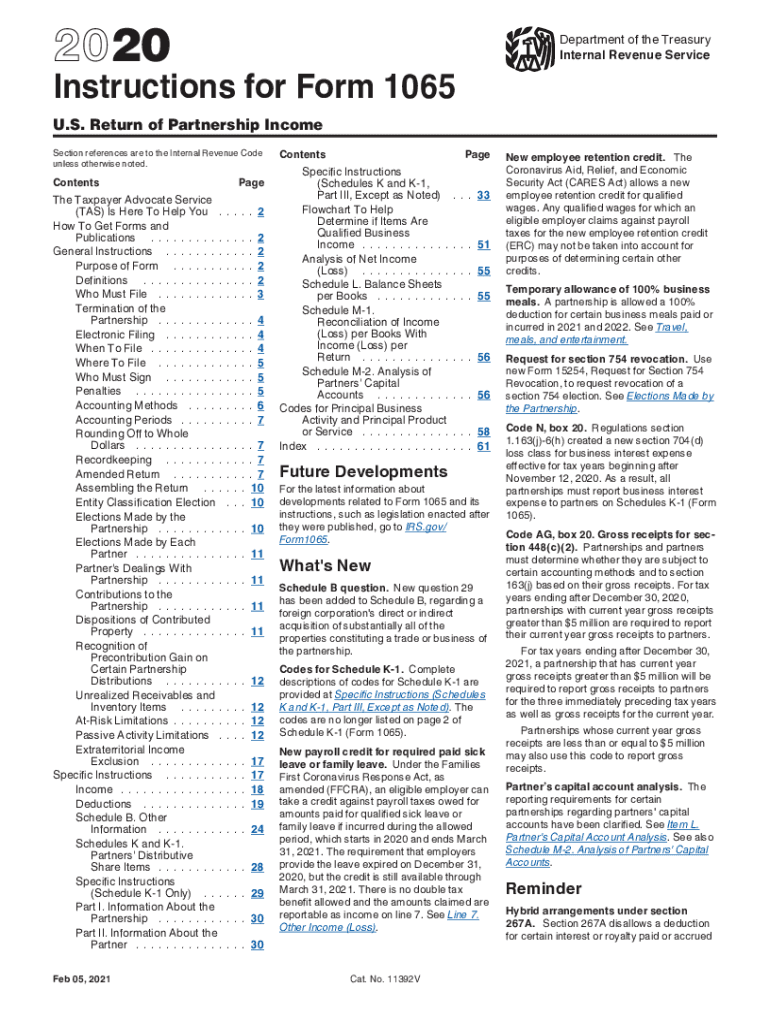

2014 form 1065 instructions

Form 1065 K 1 Instructions 2020 Fill Out and Sign Printable PDF

Fillable Form Ct1065 Connecticut Partnership Tax Return

How To Fill Out Form 1065 Overview and Instructions Bench Accounting

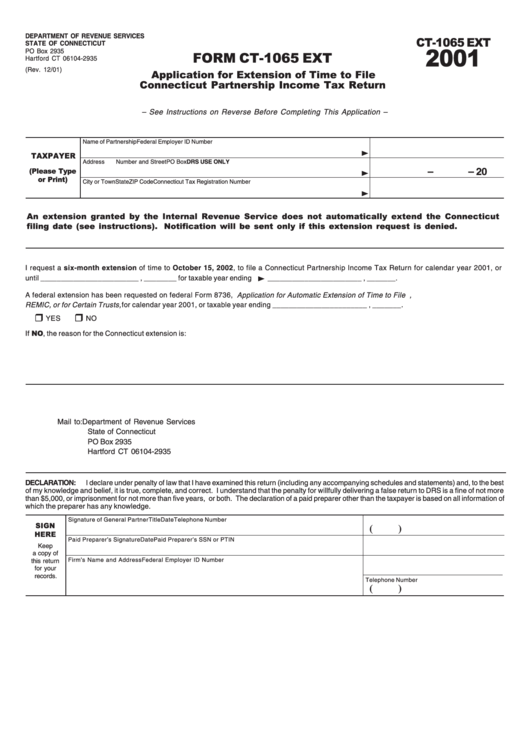

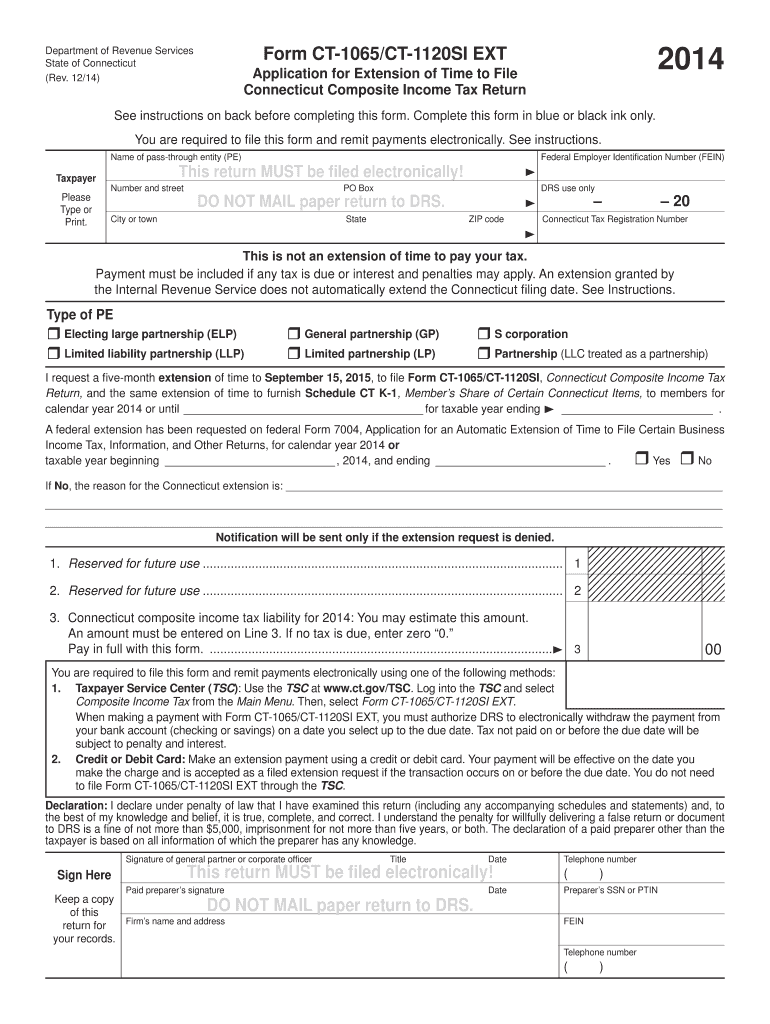

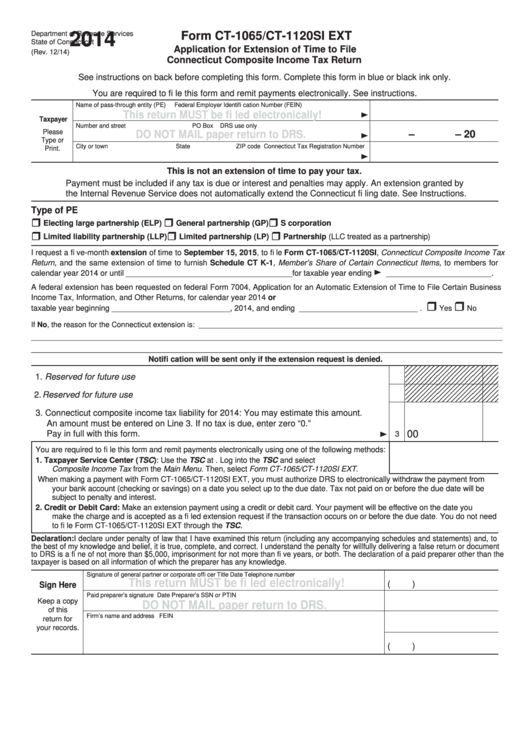

Form Ct1065 Ext Application For Extension Of Time To File

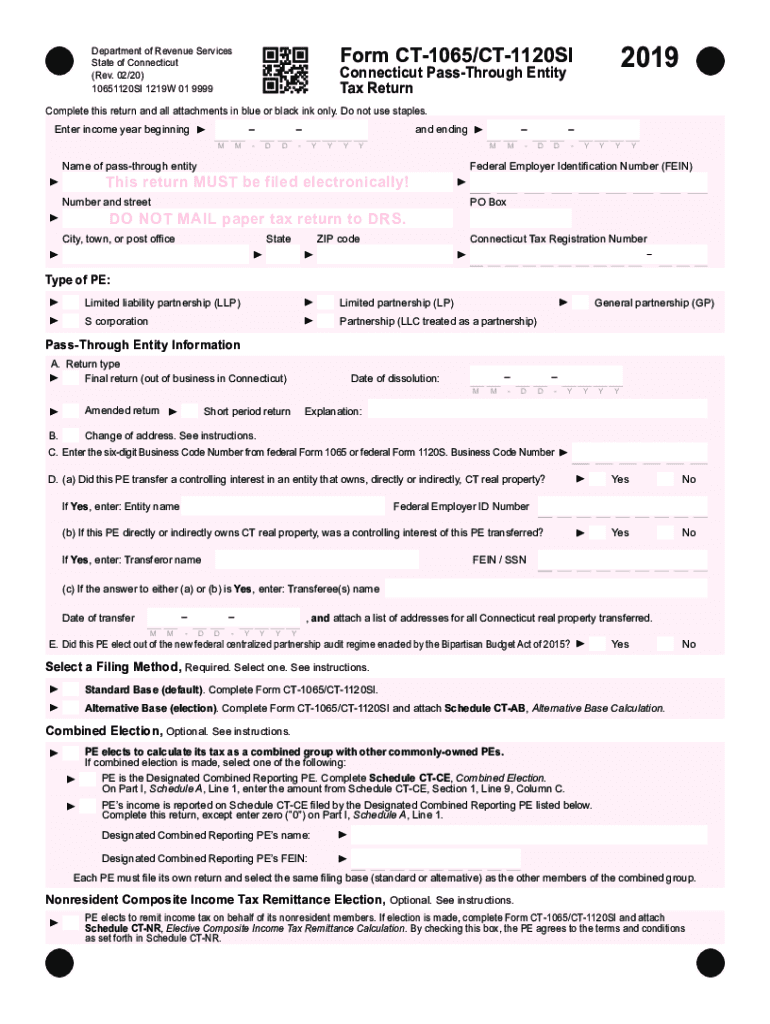

CT DRS CT1065/CT1120SI 20192021 Fill out Tax Template Online US

CT DRS CT1065/CT1120SI EXT 2014 Fill out Tax Template Online US

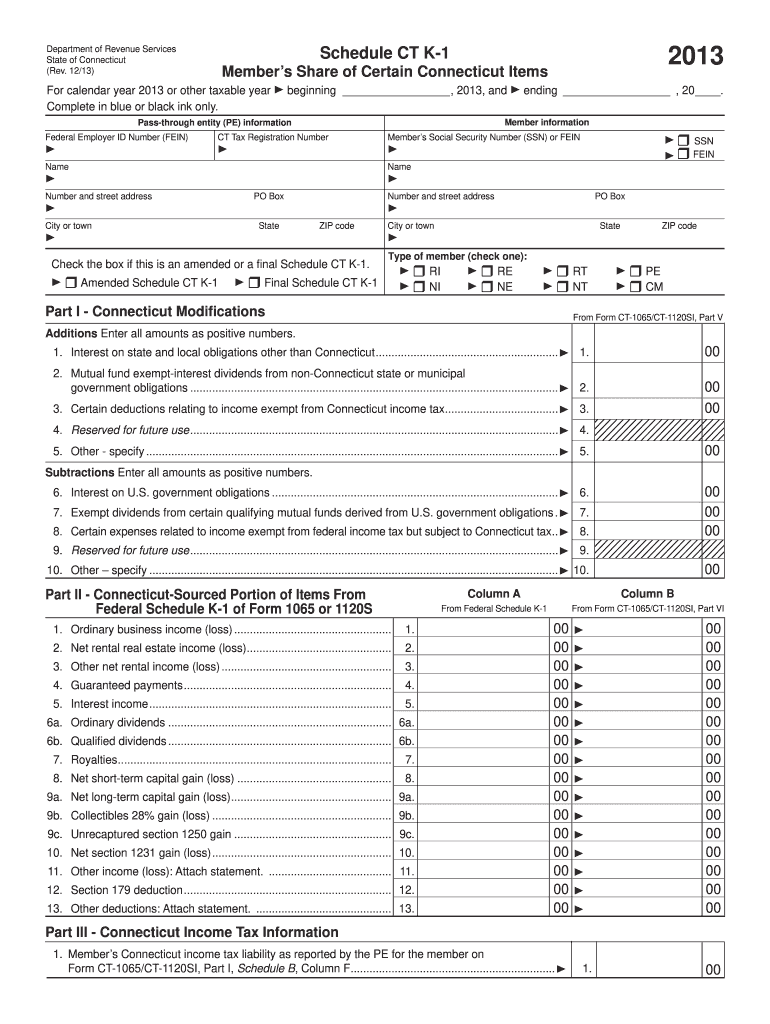

Ct form k1 2013 Fill out & sign online DocHub

Form Ct1065/ct1120si Ext Application For Extension Of Time To File

Related Post: