Colorado Form 106 Schedule K-1

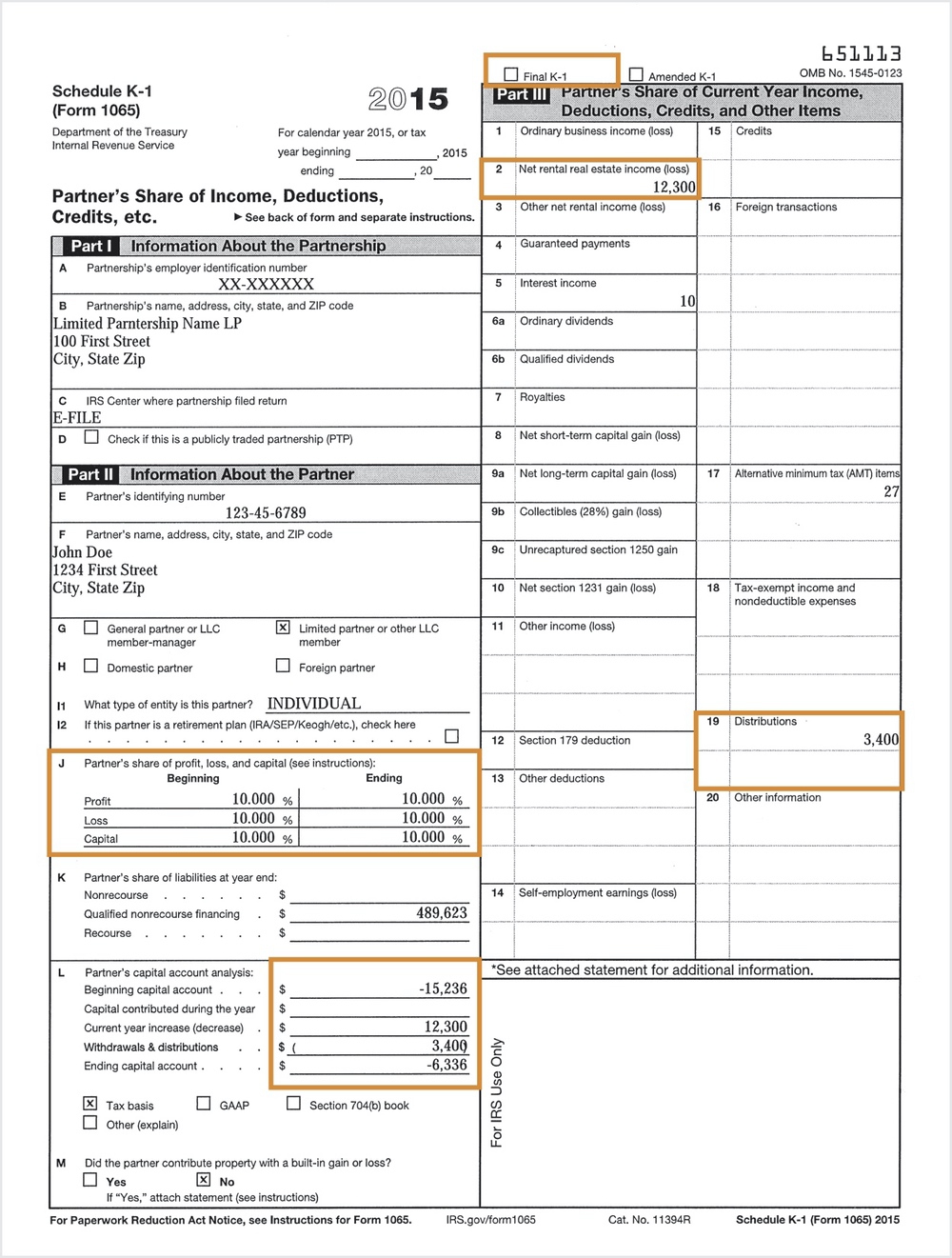

Colorado Form 106 Schedule K-1 - Web who must file form 106 any partnership, joint venture, common trust fund, limited association, pool or working agreement, limited liability company or any other. Get ready for tax season deadlines by completing any required tax forms today. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Easily fill out pdf blank, edit, and sign them. Web line 1 — report the total income from federal schedule k. Web provided exactly as it appears from colorado form 106. Ad register and subscribe now to work on form 106 & more fillable forms. Modifications may be sourced to colorado. Save or instantly send your ready documents. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Modifications may be sourced to colorado only to the extent that the. Ad register and subscribe now to work on form 106 & more fillable forms. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Line 2 — allowable deduction from federal schedule k.. Colorado form 106 for any year that. Line 3 — report the amount of tax reported on colorado. Get ready for tax season deadlines by completing any required tax forms today. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web see the instructions for nonresident partners and shareholders in the 106 book. Line 3 — report the amount of tax reported on colorado. Identification of partners or shareholders part iii must be. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Ad register and subscribe now to work on form 106 & more fillable forms. Easily. Identification of partners or shareholders part iii must be. Web line 1 — report the total income from federal schedule k. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Modifications may be sourced to colorado. Modifications may be sourced to colorado. Web who must file form 106 any partnership, joint venture, common trust fund, limited association, pool or working agreement, limited liability company or any other. Modifications may be sourced to colorado only to the extent that the. Easily fill out pdf blank, edit, and sign them. Modifications may be sourced to colorado. Modifications may be sourced to colorado. Line 2 — allowable deduction from federal schedule k. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information. Web web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Modifications may be sourced to colorado only to the. Get ready for tax season deadlines by completing any required tax forms today. Modifications may be sourced to colorado. Web partnerships may also enter the data manually at colorado.gov/revenueonline. Web provided exactly as it appears from colorado form 106. Save or instantly send your ready documents. Save or instantly send your ready documents. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Web line 1 — report the total income from federal schedule k. Modifications may be sourced to colorado only to the extent that the. Web partnerships may also enter the data manually at colorado.gov/revenueonline. Modifications may be sourced to colorado. Line 2 — allowable deduction from federal schedule k. Colorado form 106 for any year that. Download past year versions of this tax form as. Web provided exactly as it appears from colorado form 106. Line 2 — allowable deduction from federal schedule k. Web complete co form 106 ep pdf online with us legal forms. Web partnerships may also enter the data manually at colorado.gov/revenueonline. Web line 1 — report the total income from federal schedule k. Download past year versions of this tax form as. Modifications may be sourced to colorado only to the extent that the. Line 2 — allowable deduction from federal schedule k. Get ready for tax season deadlines by completing any required tax forms today. Web partnerships may also enter the data manually at colorado.gov/revenueonline. Download past year versions of this tax form as. Modifications may be sourced to colorado. Save or instantly send your ready documents. Identification of partners or shareholders part iii must be. Web complete co form 106 ep pdf online with us legal forms. Ad register and subscribe now to work on form 106 & more fillable forms. Web line 1 — report the total income from federal schedule k. Web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Modifications may be sourced to colorado. Easily fill out pdf blank, edit, and sign them. Web web colorado uses part ii of form 106 to prepare a composite return for nonresident shareholders. Colorado form 106 for any year that. Web line 1 — report the total income from federal schedule k. Modifications may be sourced to colorado. Line 3 — report the amount of tax reported on colorado. Web see the instructions for nonresident partners and shareholders in the 106 book and the income tax guidance publications available at tax.colorado.gov for more information.Schedule K1

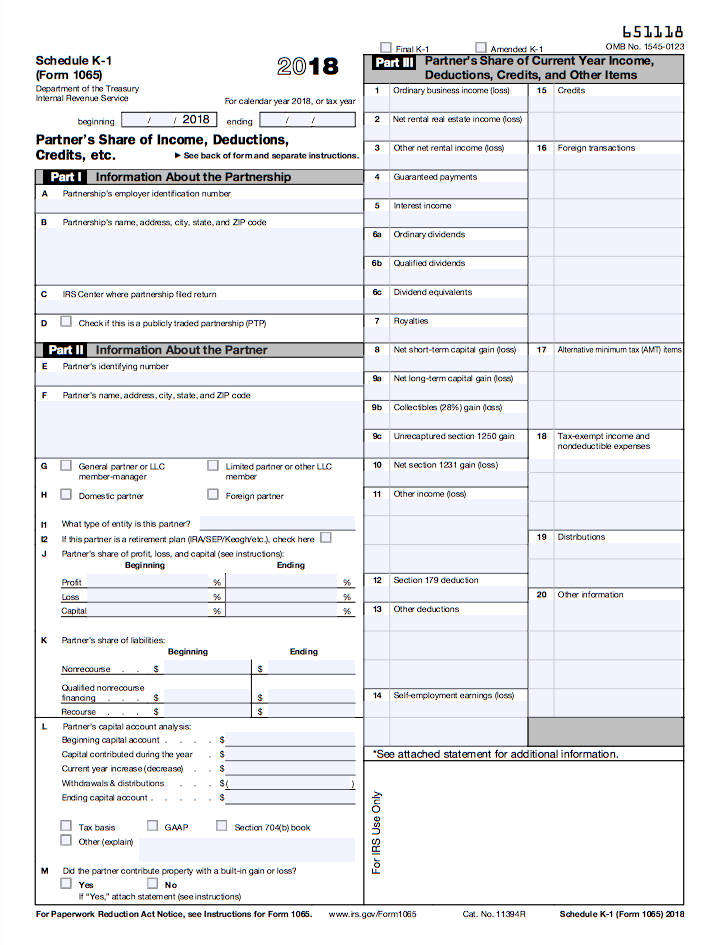

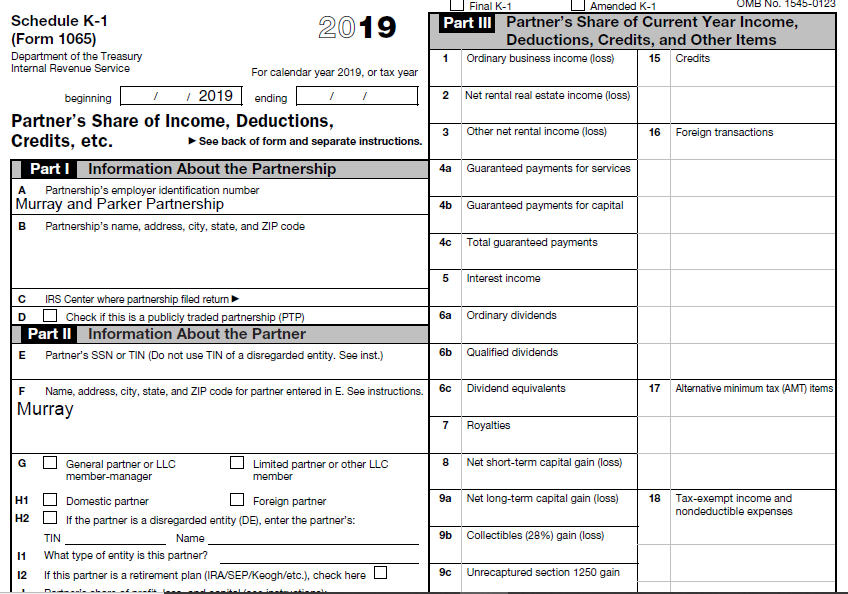

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

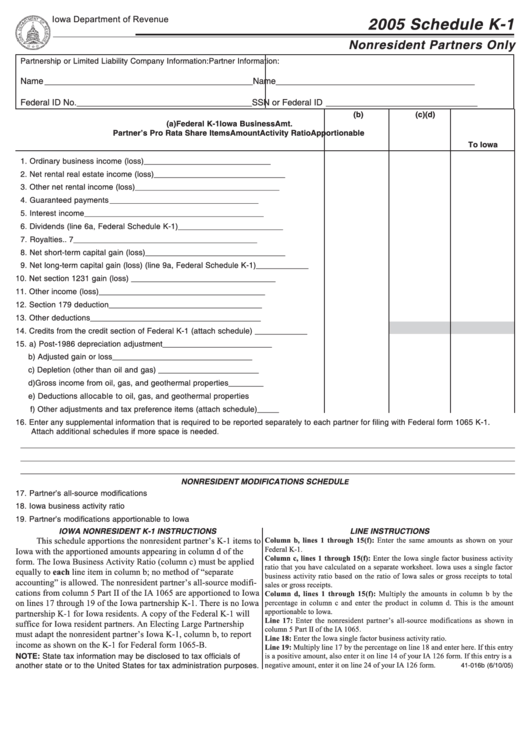

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

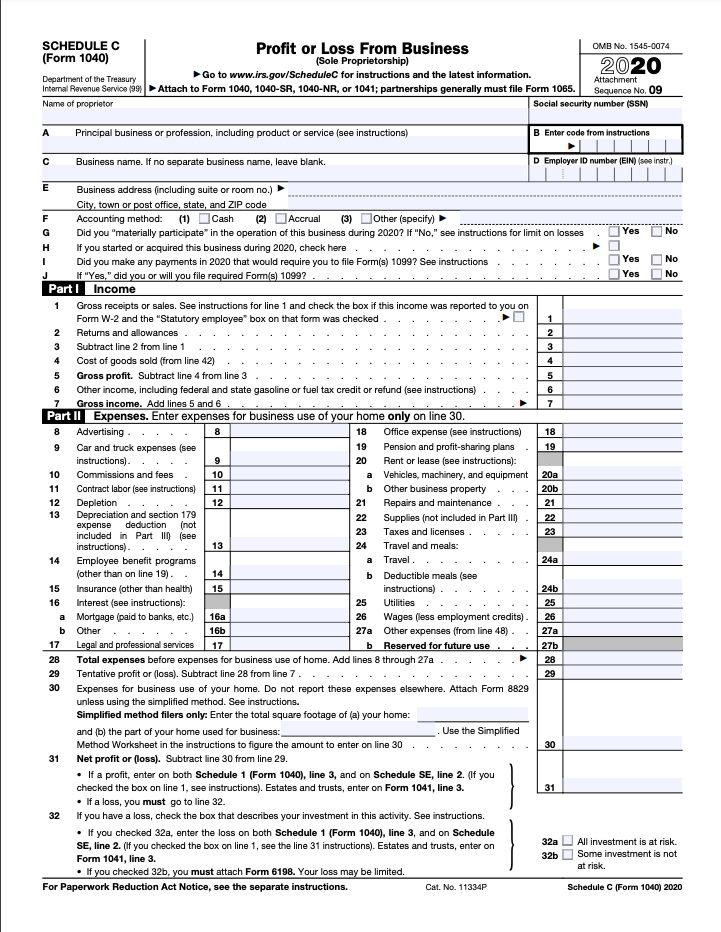

Sample k1 tax form fansver

Publication 541 Partnerships; Form 1065 Example

A Simple Guide to the Schedule K1 Tax Form Bench Accounting

Do I Need To File Schedule K1 With Form 1065 Leah Beachum's Template

À quoi servent les documents de l'annexe K1

Schedule K1 / 1065 Tax Form Guide LP Equity

Schedule K1 Tax Form Here’s What You Need to Know LendingTree

Related Post:

:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)