Ca Extension Form

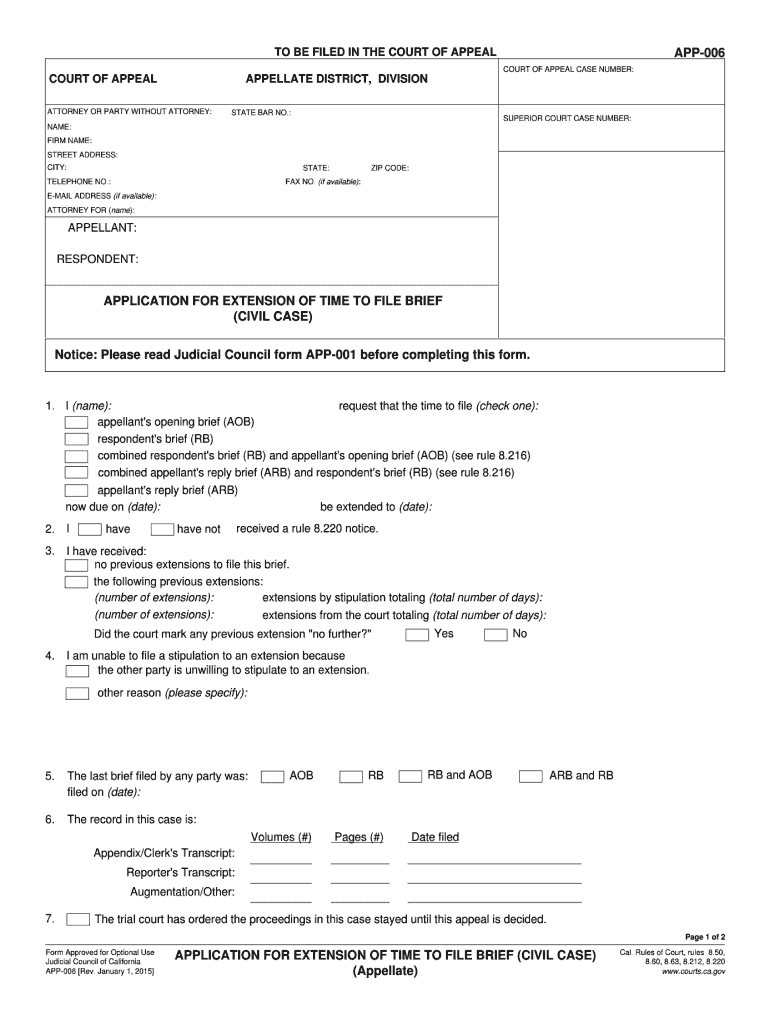

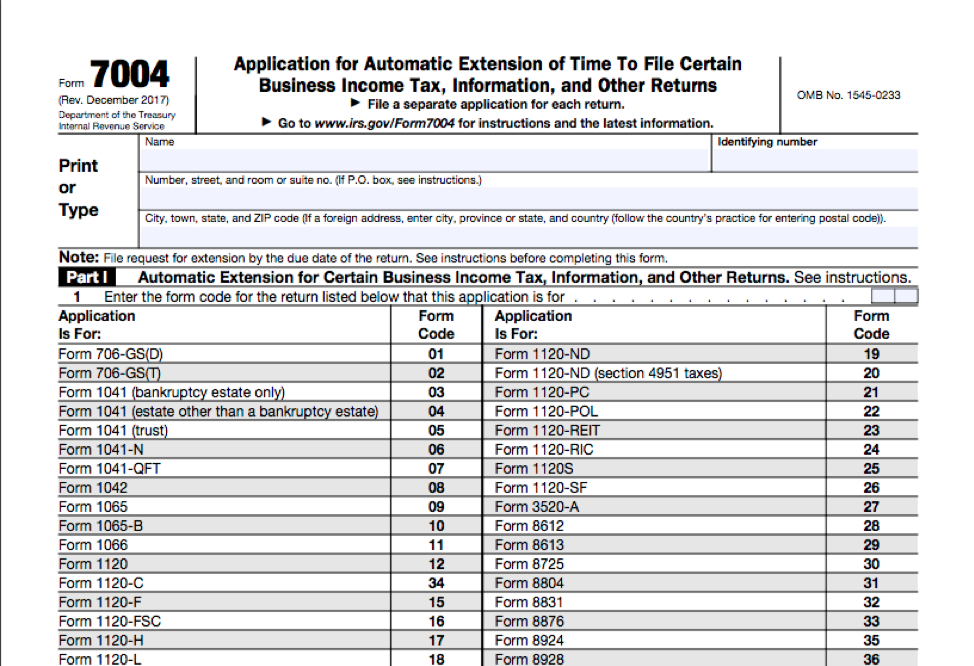

Ca Extension Form - To sunday, october 22, at 3:00 a.m., pacific time, due to scheduled. Web california taxes were supposed to be due. In the wake of last winter’s. The deadline is october 16, 2023. Web in the court of appeal of the state of california. Web federal income tax (internal revenue service) file automatic extension of time to file u.s. Web use this screen to complete form 3519. The irs and the state had extended the tax deadline for 2022 returns to oct. If a partnership cannot file form 565, partnership return of income, by the. Individual income tax return (pdf) (form 4868) on or before the regular due date. If you participate in the california’s. Web federal income tax (internal revenue service) file automatic extension of time to file u.s. Rules of court, rules 8.50, 8.60, 8.63, 8.212, 8.220. To sunday, october 22, at 3:00 a.m., pacific time, due to scheduled. If you cannot file your report or. The federal government does not allow benefit payments to be made for. You must file by the deadline to avoid a late filing penalty. Web credit card services may experience short delays in service on saturday, october 21, from 9:00 p.m. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Web. 540 es estimated tax for individuals. Now, federal filers have another month to file. Individual income tax return (pdf) (form 4868) on or before the regular due date. Web federal income tax (internal revenue service) file automatic extension of time to file u.s. You are required to remit all your payments electronically once you make an estimate or extension payment. The irs and the state had extended the tax deadline for 2022 returns to oct. Web locate the california information section. Web if a foreign corporation (i.e. Use form 3519 to make a payment with extension for individual income tax. If you cannot file your report or. You are required to remit all your payments electronically once you make an estimate or extension payment exceeding. Web simplified income, payroll, sales and use tax information for you and your business Web locate the california information section. But the irs just announced a. Get ready for tax season deadlines by completing any required tax forms today. You cannot file your 2021 tax return, form 540 or 540nr, by april 18,. You are required to remit all your payments electronically once you make an estimate or extension payment exceeding. Web credit card services may experience short delays in service on saturday, october 21, from 9:00 p.m. Web simplified income, payroll, sales and use tax information for you. Web locate the california information section. The irs and the state had extended the tax deadline for 2022 returns to oct. The irs on monday further postponed tax. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. If a partnership cannot file form 565, partnership return of income, by the. Web in the court of appeal of the state of california. 540 es estimated tax for individuals. Taxpayers have until the end of the night monday to meet the irs deadline for filing a late tax return. If you participate in the california’s. California does not require the filing of written applications for extensions. 2022 instructions for schedule ca (540) form. But the irs just announced a. Web if a foreign corporation (i.e. Web 540 2ez california resident income tax return. Web the edd may extend the time for filing a payroll tax report or paying any payroll taxes without penalty for up to 60 days if good cause exists. Individual income tax return (pdf) (form 4868) on or before the regular due date. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. Use this form to make a payment by april 15th if you have requested an extension to file your. Complete the applicable fields with. If a partnership cannot. Check the box to efile california state extension. The federal government does not allow benefit payments to be made for. The irs and the state had extended the tax deadline for 2022 returns to oct. If a partnership cannot file form 565, partnership return of income, by the. The irs on monday further postponed tax. Web use form ftb 3519, payment for automatic extension for individuals, only if both of the following apply: Taxpayers have until the end of the night monday to meet the irs deadline for filing a late tax return. Web the edd may extend the time for filing a payroll tax report or paying any payroll taxes without penalty for up to 60 days if good cause exists. If you participate in the california’s. Web federal income tax (internal revenue service) file automatic extension of time to file u.s. Web the franchise tax board and the irs opted to push the deadline from april 18 to oct. To sunday, october 22, at 3:00 a.m., pacific time, due to scheduled. The deadline is october 16, 2023. Those who miss the deadline. Use this form to make a payment by april 15th if you have requested an extension to file your. If you cannot file your report or. Use form 3519 to make a payment with extension for individual income tax. Web use this screen to complete form 3519. Individual income tax return (pdf) (form 4868) on or before the regular due date. Web in the court of appeal of the state of california.Residential Lease Extension Agreement Form Printable Form, Templates

California Extension Court Form Fill Online, Printable, Fillable

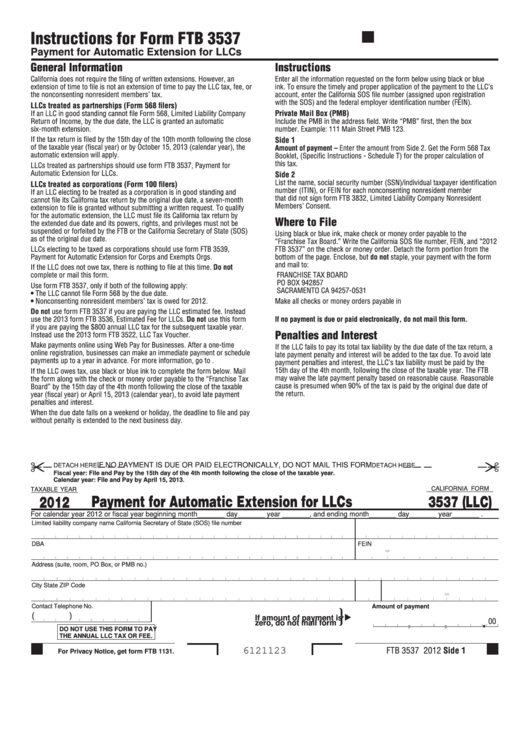

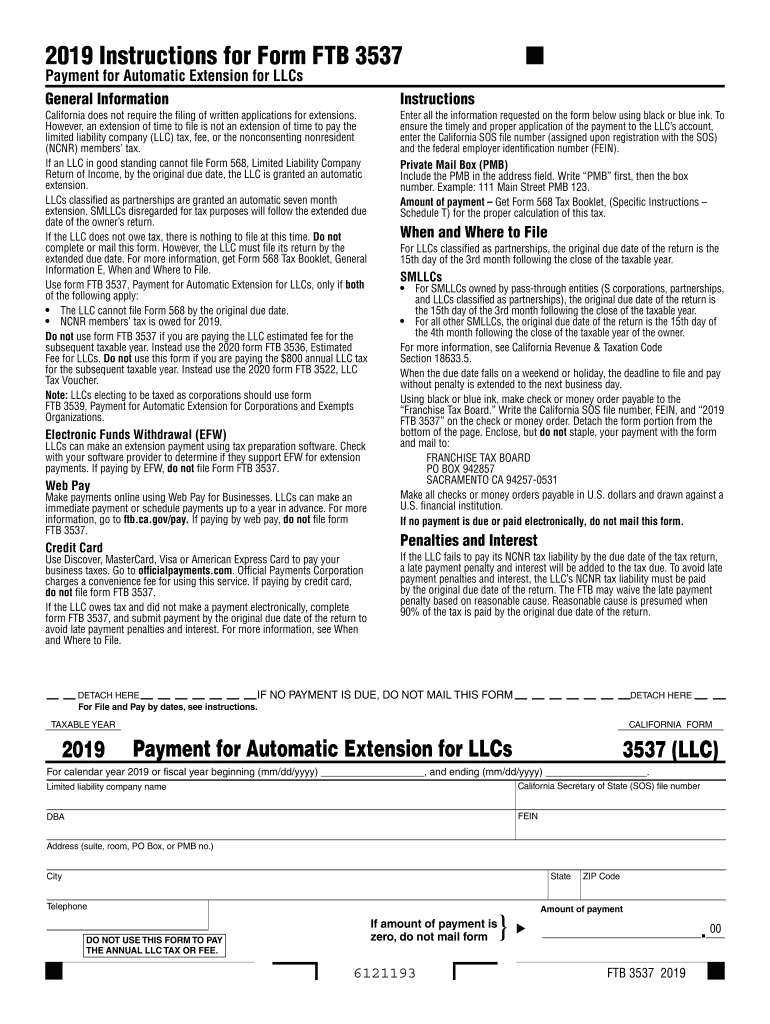

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Ca Form Extension File Fill Online, Printable, Fillable, Blank

Sedgwick physician extension disabiltiy form Fill out & sign online

How to File for a Business Tax Extension (Federal) Bench Accounting

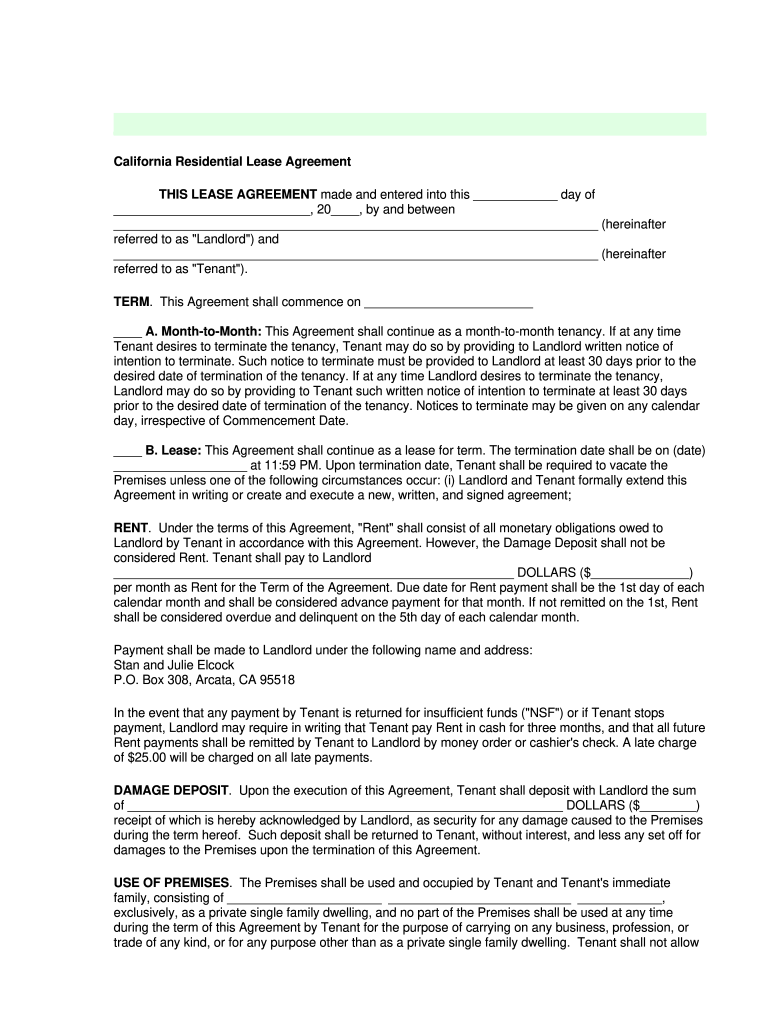

Lease Extension Form California 20202021 Fill and Sign Printable

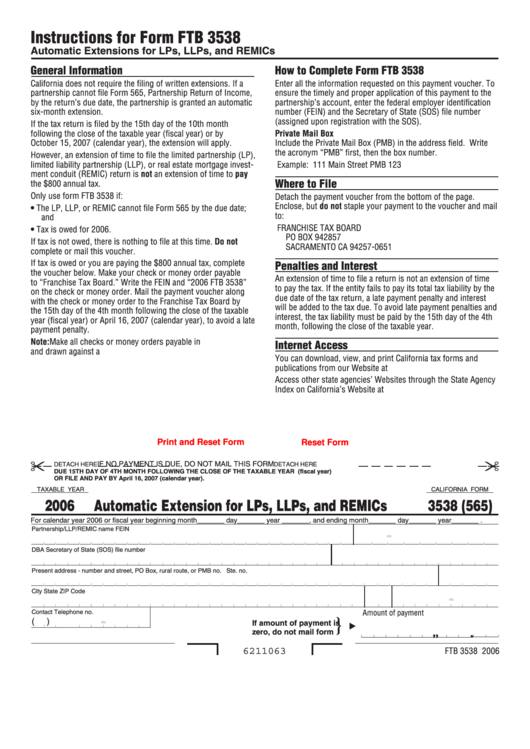

Fillable California Form 3538 (565) Payment For Automatic Extension

California Form 3537 LLC Payment For Automatic Extension For LLCs

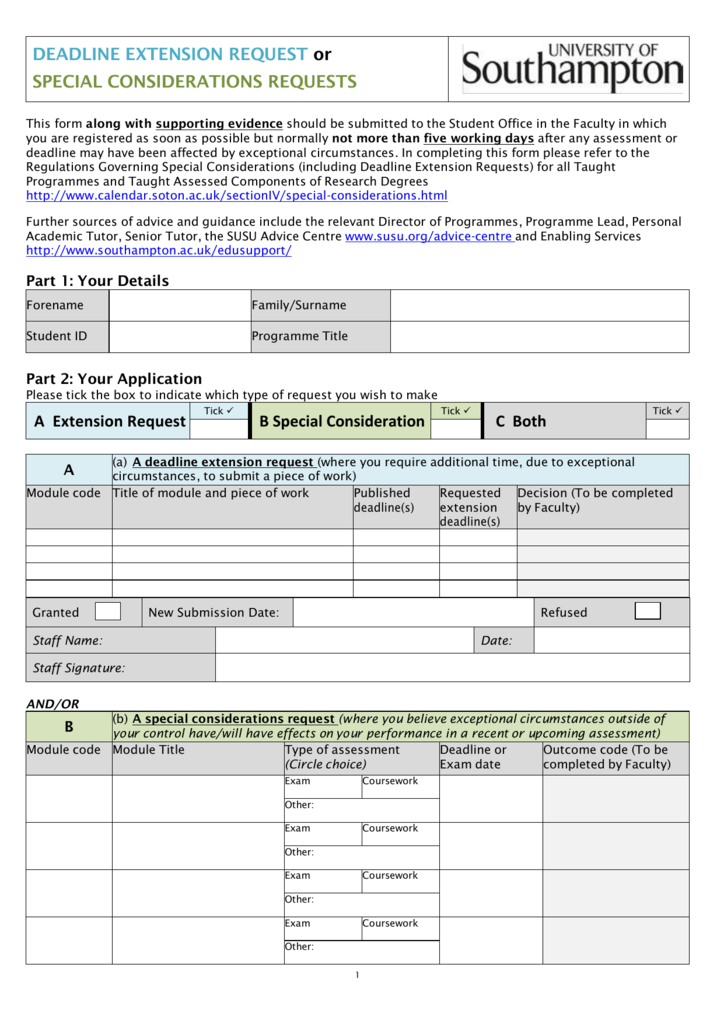

A Extension Request

Related Post: