Can You Deduct Funeral Expenses On Form 1041

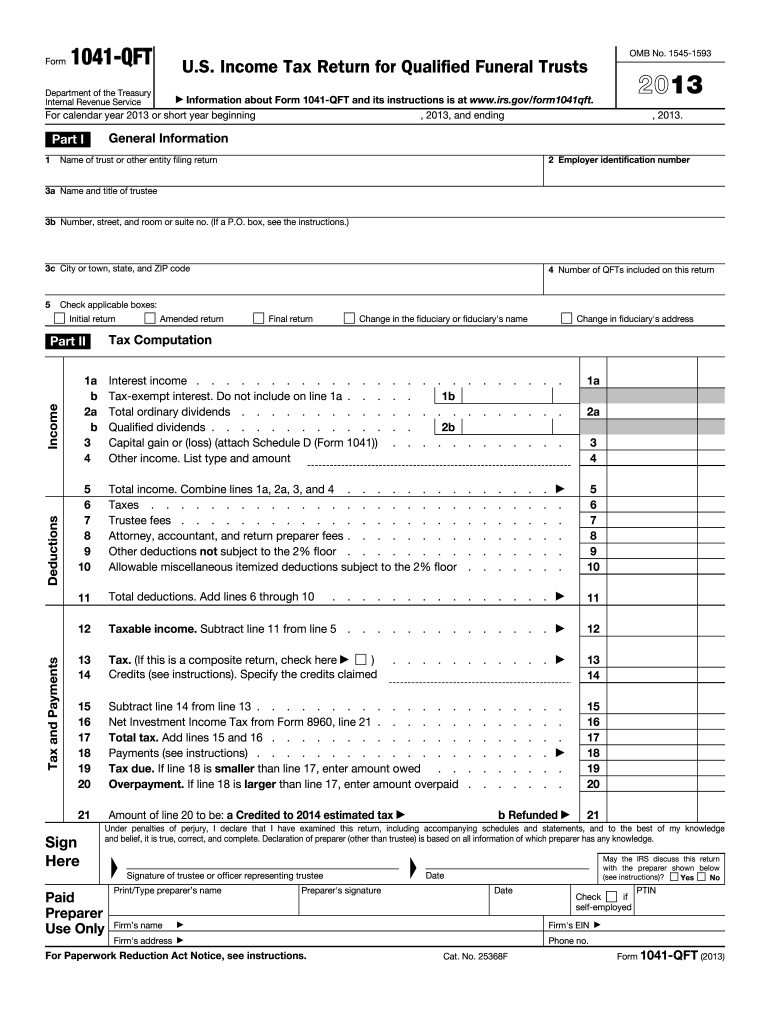

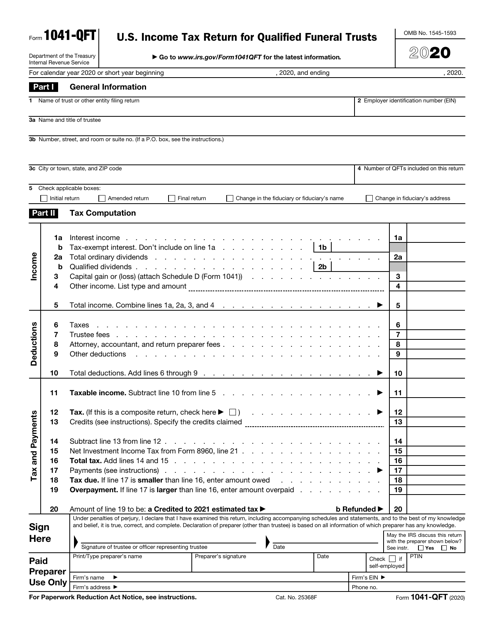

Can You Deduct Funeral Expenses On Form 1041 - Are you in charge of funeral. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Medical expenses of the decedent paid by the estate may be deductible on. Placement of the cremains in a cremation urn or cremation burial plot. You can’t take the deductions. Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or more of gross income during the tax year. In short, these expenses are not eligible to be. The irs deducts qualified medical expenses. Web it is not possible to deduct funeral expenses from form 1041, according to the irs. Executors and trustees are responsible for filing form 1041. The irs deducts qualified medical expenses. No, funeral costs can only be deducted using the estate tax return, on schedule j of form 706. While the irs allows deductions for medical expenses, funeral costs are not included. Form 1041 is not used to report estate tax, which is filed through form 706. Web are funeral expenses deductible on form 1041? While the irs allows deductions for medical expenses, funeral costs are not included. Web individual taxpayers cannot deduct funeral expenses on their tax return. In short, these expenses are not eligible to be. Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or. Form 1041 is not used to report estate tax, which is filed through form 706. The irs deducts qualified medical expenses. Web no, you are not able to claim deductions for funeral expenses on form 1041. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Medical expenses of the decedent paid by the estate. Are you in charge of funeral. The income, deductions, gains, losses, etc. Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or more of gross income during the tax year. Individual taxpayers cannot deduct funeral expenses on their tax return. Qualified medical expenses. While the irs allows deductions for medical expenses, funeral costs are not included. Web if the irs requires the decedent's estate to file an estate tax return, the estate's representative may be able to include funeral expenses as a deduction. Web no, never can funeral expenses be claimed on taxes as a deduction. The income, deductions, gains, losses, etc. Web. Web it is not possible to deduct funeral expenses from form 1041, according to the irs. You can’t take the deductions. Web funeral and burial expenses are only tax deductible if they’re paid for by the estate of the deceased person. The irs deducts qualified medical expenses. Executors and trustees are responsible for filing form 1041. Of the estate or trust. Form 1041 is not used to report estate tax, which is filed through form 706. Web transfer tax return for distributions, you can deduct the gst tax paid on income distributions on schedule a (form 1040), line 6. Web it is not possible to deduct funeral expenses from form 1041, according to the irs. Individual. Web you are required to file a fiduciary return (using irs form 1041) about 11 months after the month of death if the estate generated $600 or more of gross income during the tax year. Of the estate or trust. Web yes, except for medical and funeral expenses, which you do not deduct on form 1041. Web can i deduct. No, you are not able to claim deductions for funeral expenses on form 1041. The income, deductions, gains, losses, etc. In short, these expenses are not eligible to be. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: The irs deducts qualified medical expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Web no, never can funeral expenses be claimed on taxes as a deduction. Web it is not possible to deduct funeral expenses from form 1041, according to the irs. Funeral expenses are recognized as legitimate estate tax deductions under. Schedule g—tax computation and payments. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Funeral expenses are not tax deductible because they are. Schedule g—tax computation and payments. The irs deducts qualified medical expenses. Many of these expenses can be spent on. Web no, never can funeral expenses be claimed on taxes as a deduction. Are you in charge of funeral. The cost of a funeral and burial can be deducted on a form 1041, which is the final income tax return filed for a. This is a significant decision, especially given the fact that. In short, these expenses are not eligible to be. Find out when the agency requires this form and what details it includes. Executors and trustees are responsible for filing form 1041. Web can i deduct funeral expenses on form 1041? While the irs allows deductions for medical expenses, funeral costs are not included. Web no, you are not able to claim deductions for funeral expenses on form 1041. No, funeral costs can only be deducted using the estate tax return, on schedule j of form 706. Of the estate or trust. Web if the irs requires the decedent's estate to file an estate tax return, the estate's representative may be able to include funeral expenses as a deduction. What expenses are deductible on estate tax return? Medical expenses of the decedent paid by the estate may be deductible on.IRS Form 1041QFT Download Fillable PDF or Fill Online U.S. Tax

Can You Deduct Funeral Expenses On Your Tax Tax Walls

Form 1041 QFT U S Tax Return for Qualified Funeral Trusts Fill

Funeral Expenses How to Pay

HOW YOU CAN SAVE ON FUNERAL EXPENSES PART II Your BackUp Plan

Sss Affidavit Of Funeral Expenses Form

Form 1041QFT U.S. Tax Return Form for Qualified Funeral

Tax Deductions for Funeral Expenses Tax deductions, Funeral expenses

What Expenses Are Deductible On Form 1041 Why Is

Are Funeral Expenses Tax Deductable

Related Post:

/GettyImages-514211407-7890c9f9232844d1863ab073895a7c6f.jpg)