What Is Form 3804-Cr

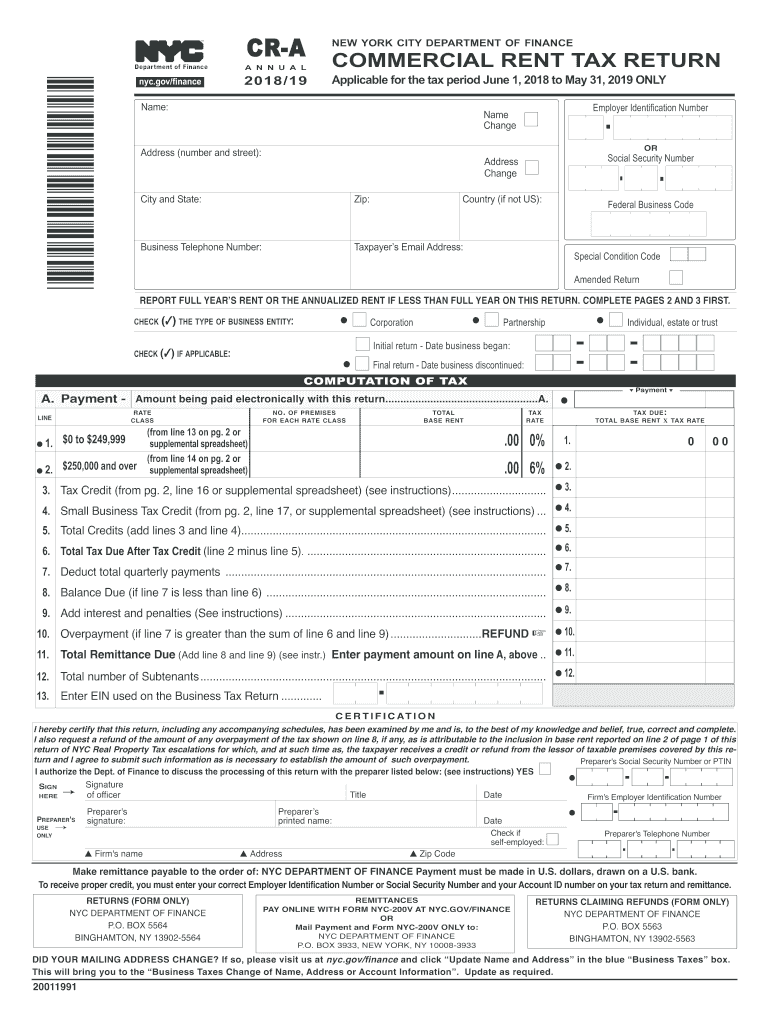

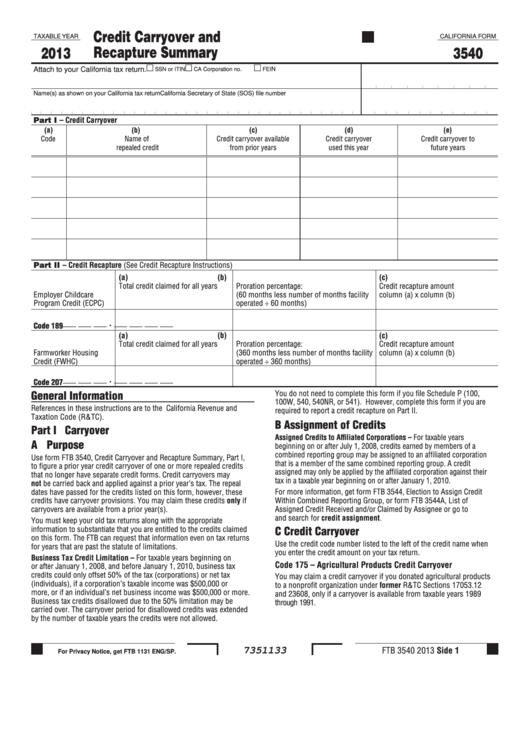

What Is Form 3804-Cr - Attach to your california tax return. Attach to your california tax return. I am working on an s corp return for. Name(s) as shown on your california tax return. Commanders will interview the recr u iter in order to validate the information and submit. When will the elective tax expire? I elective tax credit amount. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. I am working on an s corp return for. When will the elective tax expire? In general, for taxable years beginning on or after january 1, 2015, california law conforms. Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. Commanders will interview the recr u iter in order to validate the. Commanders will interview the recr u iter in order to validate the information and submit. When will the elective tax expire? I elective tax credit amount. I am working on an s corp return for. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. Attach to your california tax return. Name(s) as shown on your california tax return. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. Commanders will. When will the elective tax expire? For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. Name(s) as shown on your california tax return. I am working on an s corp return for. Prepare and populate california form 3804 and / or form 3893. I elective tax credit amount. In general, for taxable years beginning on or after january 1, 2015, california law conforms. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. Prepare and populate california form 3804 and / or form 3893 in a partnership. Name(s) as shown on your california tax return. Attach to your california tax return. I elective tax credit amount. When will the elective tax expire? For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. Commanders will interview the recr u iter in order to validate the information and submit. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Attach to your california tax return. The balance due, including any related. Attach to your california tax return. The balance due, including any related. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Name(s) as shown on your california tax return. When will the elective tax expire? Attach to your california tax return. Attach to your california tax return. Commanders will interview the recr u iter in order to validate the information and submit. The balance due, including any related. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. I elective tax credit amount. Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. Attach to your california tax return. Attach to your california tax return. In general, for taxable years beginning on or after january 1, 2015, california law conforms. Commanders will interview the recr u iter in order to validate the information and submit. In general, for taxable years beginning on or after january 1, 2015, california law conforms. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. I elective tax credit amount. Prepare and populate california form 3804 and / or form 3893 in an s corporation return using worksheet. Prepare and populate california form 3804 and / or form 3893 in a partnership return using worksheet view. Name(s) as shown on your california tax return. Commanders will interview the recr u iter in order to validate the information and submit. Attach to your california tax return. Attach to your california tax return. The balance due, including any related. When will the elective tax expire? I am working on an s corp return for.NYC DoF CRA 2019 Fill out Tax Template Online US Legal Forms

Car Form Cr Fill Online, Printable, Fillable, Blank PDFfiller

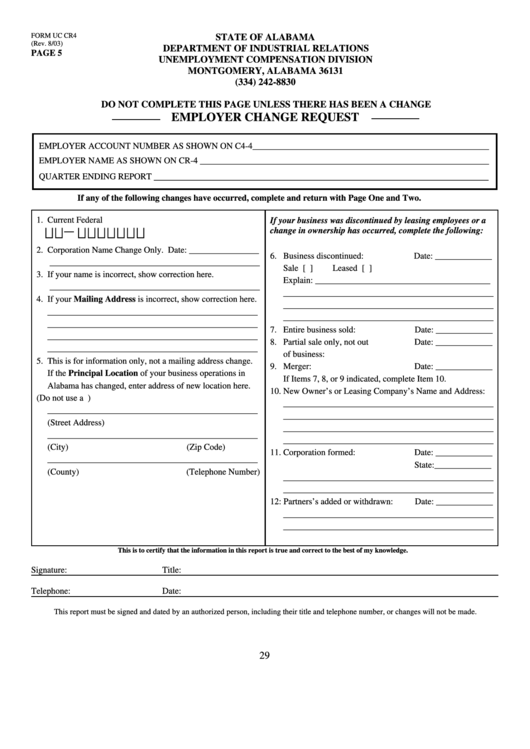

Form Uc Cr4 Employer Change Request Alabama Department Of

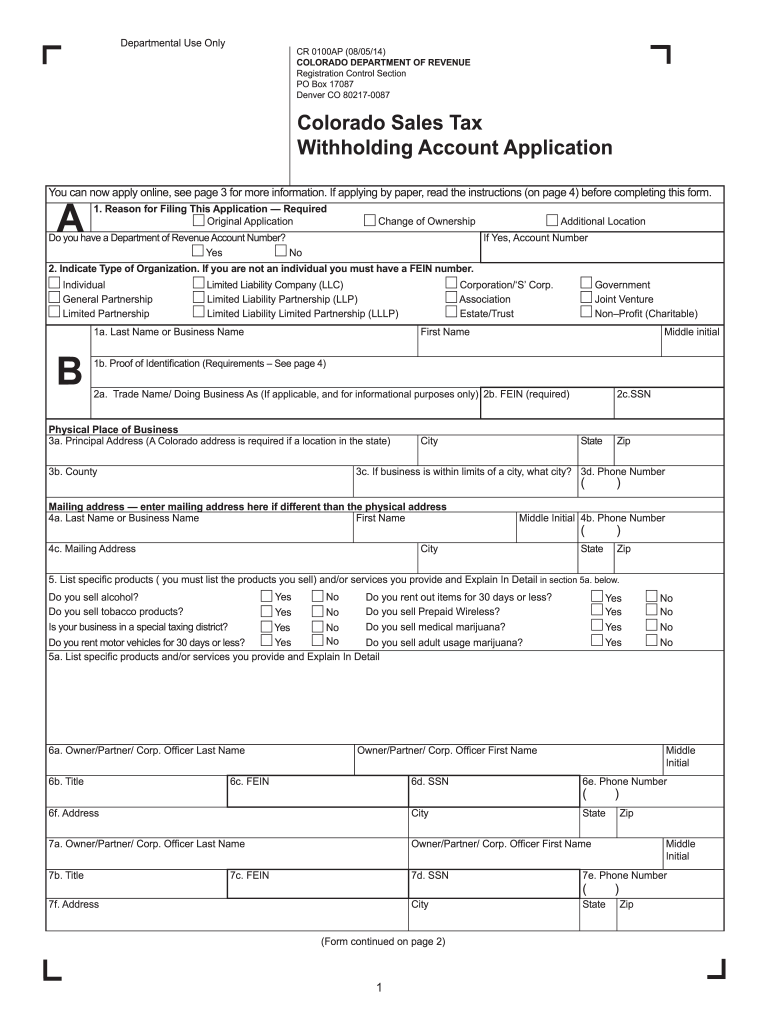

Cr 0100ap Form Fill Out and Sign Printable PDF Template signNow

Fillable California Form 3540 Credit Carryover And Recapture Summary

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

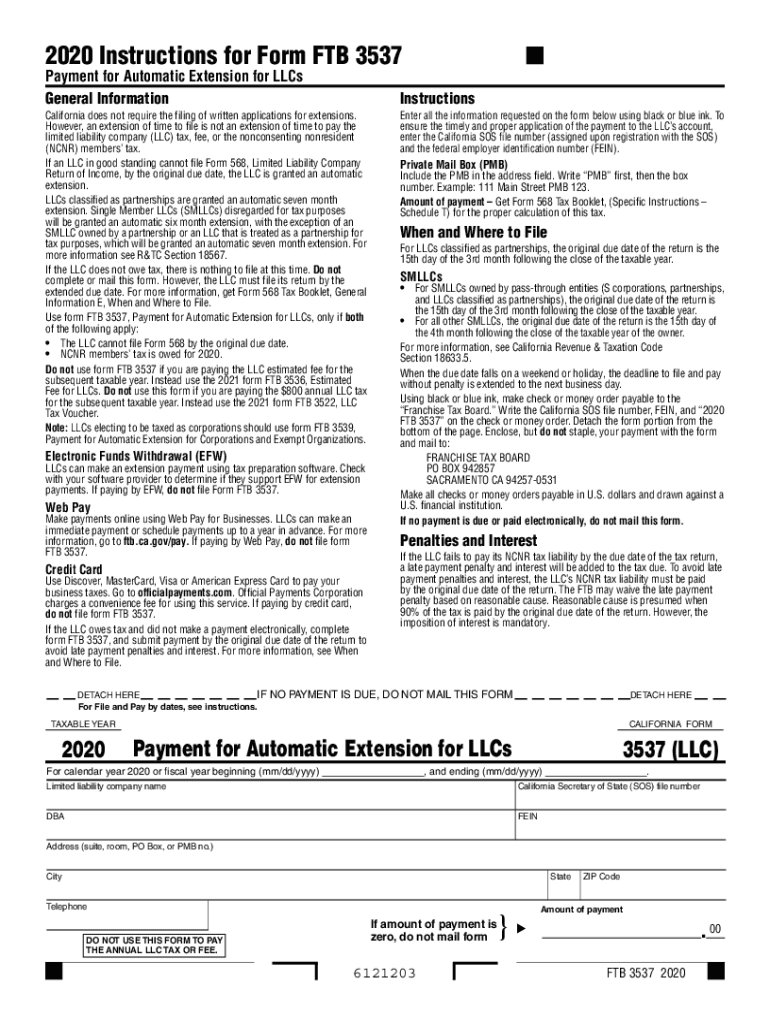

Ftb 3537 Fill out & sign online DocHub

Form cr 3 2010 Fill out & sign online DocHub

What is Form 3804CR (California) and why will I be getting one? r/tax

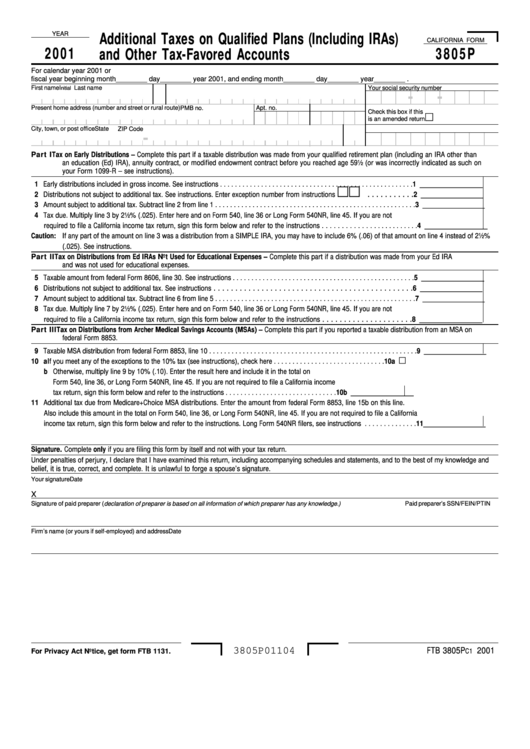

California Form 3805p Additional Taxes On Qualified Plans (Including

Related Post: