California Individual - Form 3804-Cr

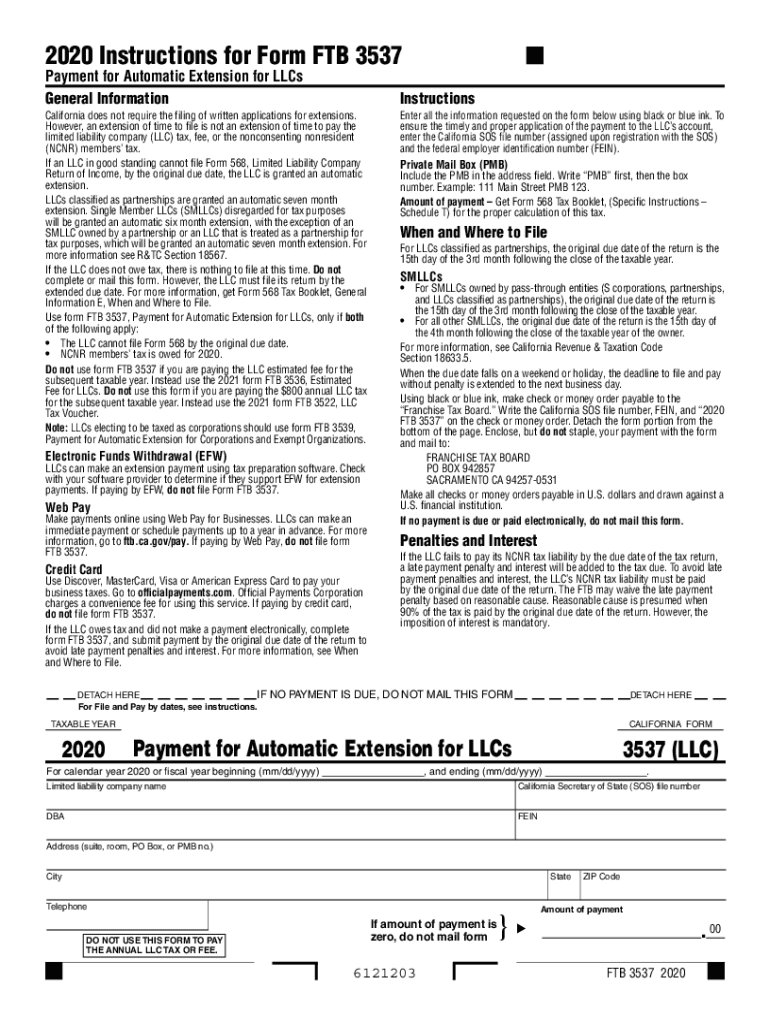

California Individual - Form 3804-Cr - 20, 2023, 10:00 pm pdt. Attach to your california tax return. When will the elective tax expire? Web california form 3504 your frst name. Attach to your california tax return. Name(s) as shown on your california tax return (smllcs see instructions). What is a pending audit tax deposit payment? For each taxable year beginning on or after january 1, 2021, and before january 1, 2026, the electing qualified. In general, for taxable years beginning on or after january 1, 2015, california law. I elective tax credit amount. For each taxable year beginning on or after january 1, 2021, and before january 1, 2026, the electing qualified. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. 20, 2023, 10:00 pm pdt. What is a pending audit tax deposit payment? Web california. For each taxable year beginning on or after january 1, 2021, and before january 1, 2026, the electing qualified. Go to california > other information worksheet. Attach to your california tax return. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. 20, 2023,. When will the elective tax expire? 20, 2023, 10:00 pm pdt. Go to california > other information worksheet. Web what is form 3834 used for? Attach to your california tax return. What is a pending audit tax deposit payment? Name(s) as shown on your california tax return (smllcs see instructions). Attach to your california tax return. For each taxable year beginning on or after january 1, 2021, and before january 1, 2026, the electing qualified. Go to california > other information worksheet. Web what is form 3834 used for? Go to california > other information worksheet. Name(s) as shown on your california tax return (smllcs see instructions). Attach to your california tax return. Attach to your california tax return. Physical address (not a po box) city state. When will the elective tax expire? Web what is form 3834 used for? You can obtain a copy here: Web california form 3504 your frst name. Attach to your california tax return. Web daily tax report: For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. When will the elective tax expire? Name(s) as shown on your california tax return (smllcs see instructions). 20, 2023, 10:00 pm pdt. Go to california > other information worksheet. Web california form 3504 your frst name. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. Name(s) as shown on your california tax return (smllcs see instructions). You can obtain a copy here: Go to california > other information worksheet. When will the elective tax expire? Physical address (not a po box) city state. I elective tax credit amount. Physical address (not a po box) city state. 20, 2023, 10:00 pm pdt. When will the elective tax expire? Web what is form 3834 used for? Go to california > other information worksheet. You can obtain a copy here: Name(s) as shown on your california tax return (smllcs see instructions). Attach to your california tax return. Web daily tax report: What is a pending audit tax deposit payment? When will the elective tax expire? 20, 2023, 10:00 pm pdt. Web california form 3504 your frst name. Web what is form 3834 used for? I am working on an s corp. Go to california > other information worksheet. Attach to your california tax return. For more information, see california revenue and tax code (r&tc) section 17039.3 and get schedule p (540, 540nr, or 541), alternative minimum tax and credit limitations. Physical address (not a po box) city state. For each taxable year beginning on or after january 1, 2021, and before january 1, 2026, the electing qualified. In general, for taxable years beginning on or after january 1, 2015, california law. I elective tax credit amount.Ftb 3537 Fill out & sign online DocHub

Jfs intearn report fill out on line 2010 form Fill out & sign online

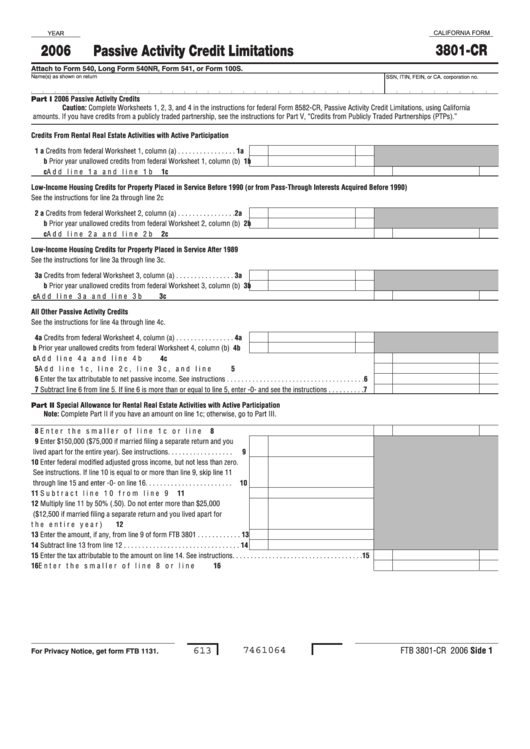

California Form 3801Cr Passive Activity Credit Limitations 2006

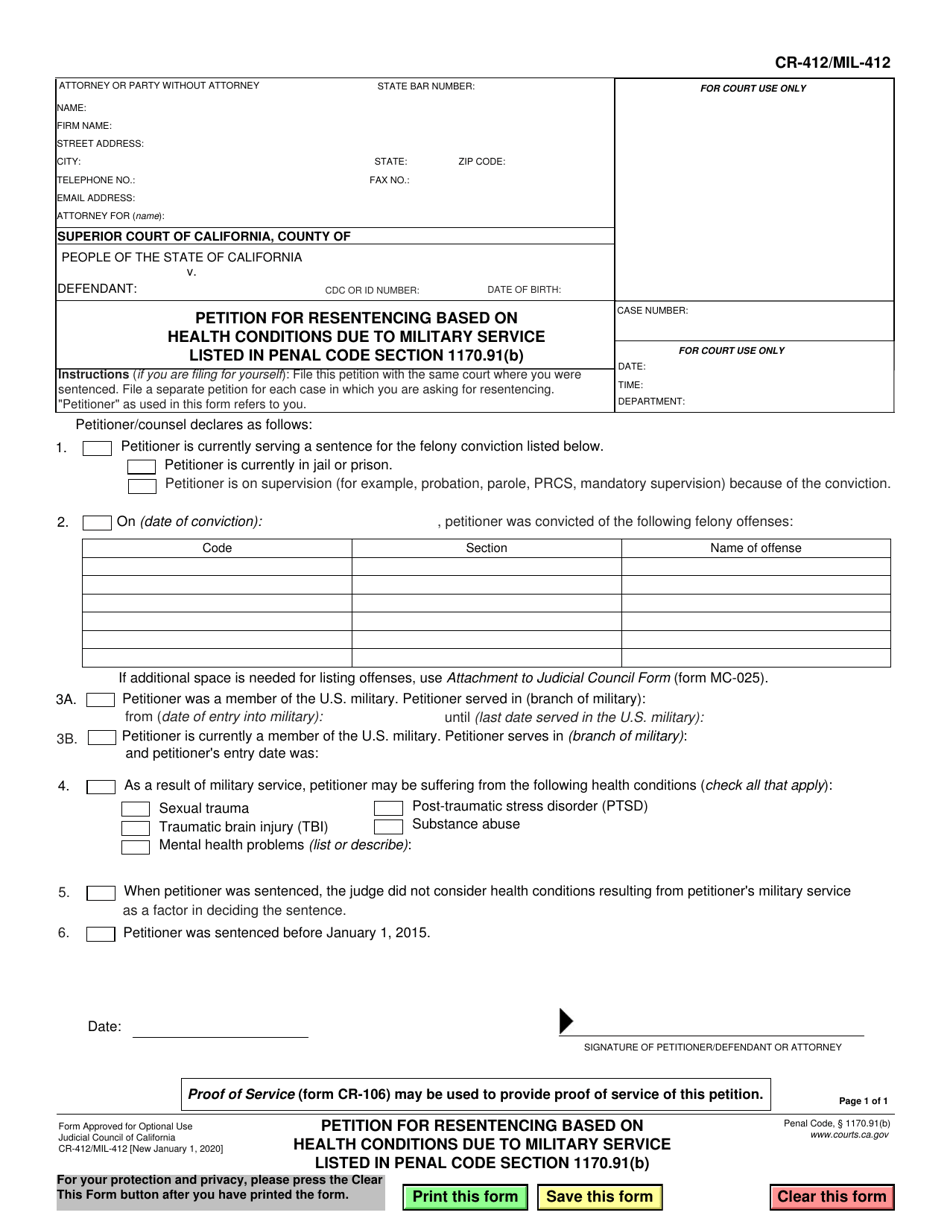

Form CR412 (MIL412) Fill Out, Sign Online and Download Fillable PDF

California FTB Releases 2022 Instructions for Form FTB 3804CR, Pass

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

Form CR101 Download Fillable PDF or Fill Online Plea Form, With

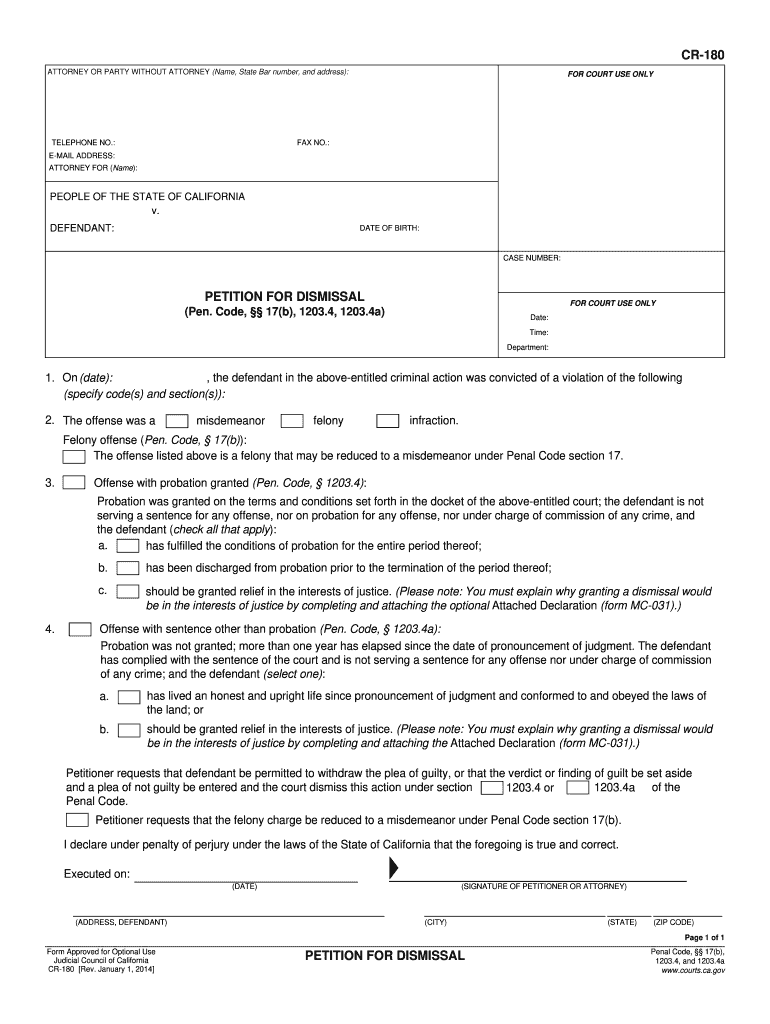

2014 Form CA CR180 Fill Online, Printable, Fillable, Blank pdfFiller

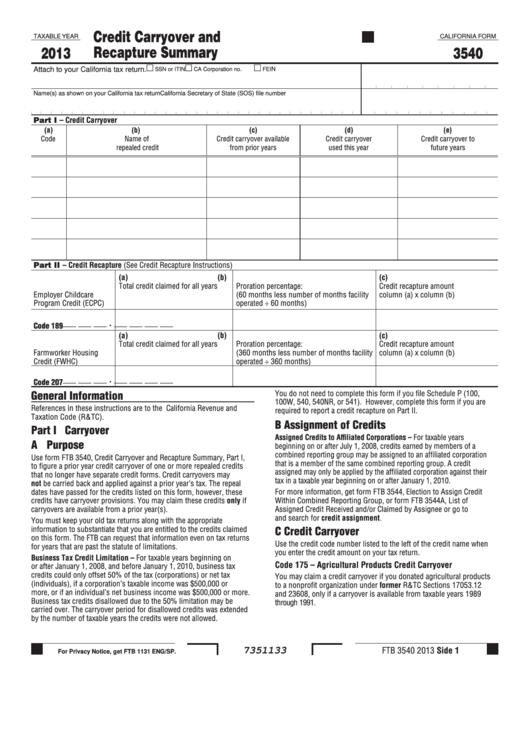

Fillable California Form 3540 Credit Carryover And Recapture Summary

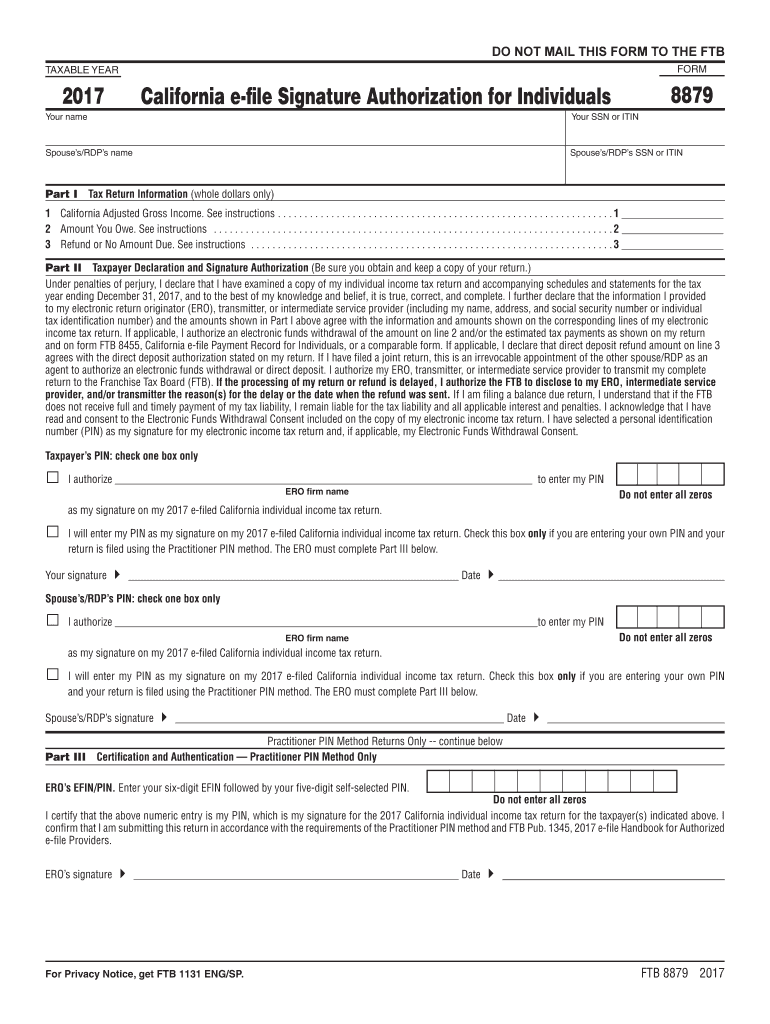

California Tax Form 8879 Fill Out and Sign Printable PDF Template

Related Post: