California Form 541

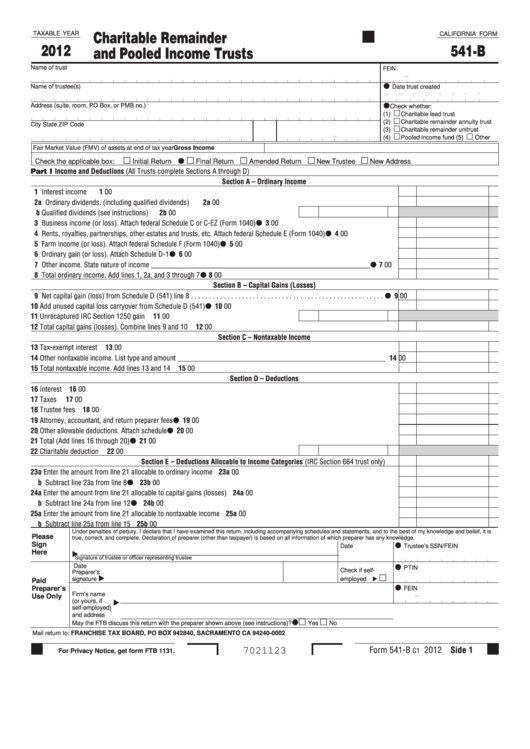

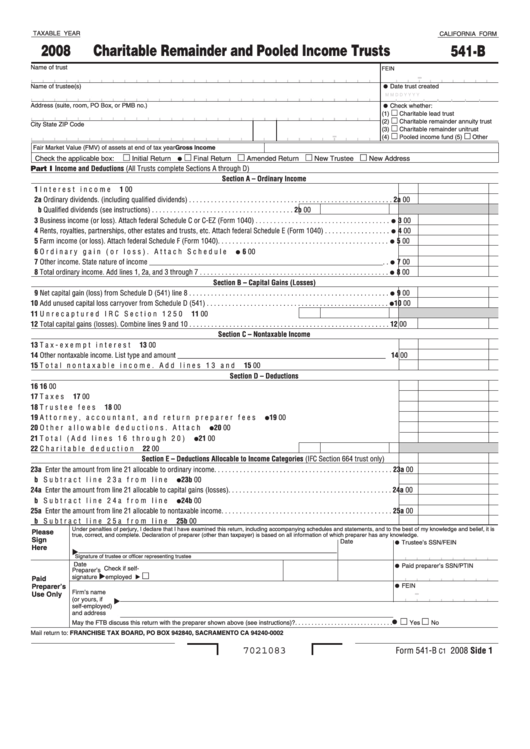

California Form 541 - Schedule g california source income and deduction apportionment. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. If a trust, enter the number of: Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Or form 568, limited liability company return of income. Name of trustee(s) additional information (see instructions) street address (number and street) or po box. Web 2020 california fiduciary income tax return form 541 for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) _____, and ending (mm/dd/yyyy) _____ • type of entity. Complete line 1a through line 1f before. Web schedule p (541) 2022. Attach this schedule to form 541. Printing and scanning is no longer the. Schedule b income distribution deduction. This form is for income earned in tax year 2022, with tax returns due in april. Web form 541, california fiduciary income tax return. Used to report a charitable or other deduction under irc section. Complete line 1a through line 1f before part ii. Attach this schedule to form 541. Web we last updated the beneficiary's share of income, deductions, credits, etc. Enter the amount from form 541,. Web although the california fiduciary income tax return (form 541) and instructions do address the throwback tax, the form and instructions do not fully determine the. Complete line 1a through line 1f before. Web form 541, california fiduciary income tax return. Ad download or email form 541 & more fillable forms, register and subscribe now! Report income received by an estate or trust; Report income distributed to beneficiaries; File form 541 in order to: Ad download or email form 541 & more fillable forms, register and subscribe now! Printing and scanning is no longer the. Web 2020 california fiduciary income tax return form 541 for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) _____, and ending (mm/dd/yyyy) _____ • type of entity. The net taxable income is over. Part i fiduciary’s share of alternative minimum taxable income (amti) 1 adjusted total income (or loss). Report income distributed to beneficiaries; Attach this schedule to form 541. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. File form 541 in order. Part i fiduciary’s share of alternative. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. Report income distributed to beneficiaries; Note, that the trust will be required to file a california form 541. Web simplified income, payroll, sales and use tax. Note, that the trust will be required to file a california form 541. Web the backbone of the tax return for a california trust is the franchise tax board form 541, california fiduciary income tax return. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated. Note, that the trust will be required to file a california form 541. File form 541 in order to: Web simplified income, payroll, sales and use tax information for you and your business Web form 541, california fiduciary income tax return. Web handy tips for filling out form 541 california fiduciary income tax return, form 541, california fiduciary income tax. Ad download or email form 541 & more fillable forms, register and subscribe now! Schedule b income distribution deduction. Part i fiduciary’s share of alternative. Web form without payment with payment other correspondence; Part i fiduciary’s share of alternative minimum taxable income (amti) 1 adjusted total income (or loss). Web simplified income, payroll, sales and use tax information for you and your business Or form 568, limited liability company return of income. Web attach this schedule to form 541. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Web the california franchise tax board (ftb) march 1 released updated 2020 instructions for. Ad download or email form 541 & more fillable forms, register and subscribe now! Form 565, partnership return of income; Schedule g california source income and deduction apportionment. Web we last updated the beneficiary's share of income, deductions, credits, etc. The form, 541 is similar to an individual. You can download or print. Web in sum, $75,000 of the trust's income is allocated to california under the apportionment formula. Web we last updated the california fiduciary income tax return in february 2023, so this is the latest version of form 541, fully updated for tax year 2022. Web attach this schedule to form 541. If a trust, enter the number of: Web the california franchise tax board (ftb) march 1 released updated 2020 instructions for form 541, california fiduciary income tax return, for trust income,. 540 540 2ez 540nr schedule x: Form 541, california fiduciary income tax return; Ad download or email form 541 & more fillable forms, register and subscribe now! Web simplified income, payroll, sales and use tax information for you and your business Web ftb form 541 (california fiduciary income tax return) must be filed for every trust if (rev. Complete line 1a through line 1f before. Complete line 1a through line 1f before part ii. Note, that the trust will be required to file a california form 541. Web schedule p (541) 2022.Fillable California Form 541B Charitable Remainder And Pooled

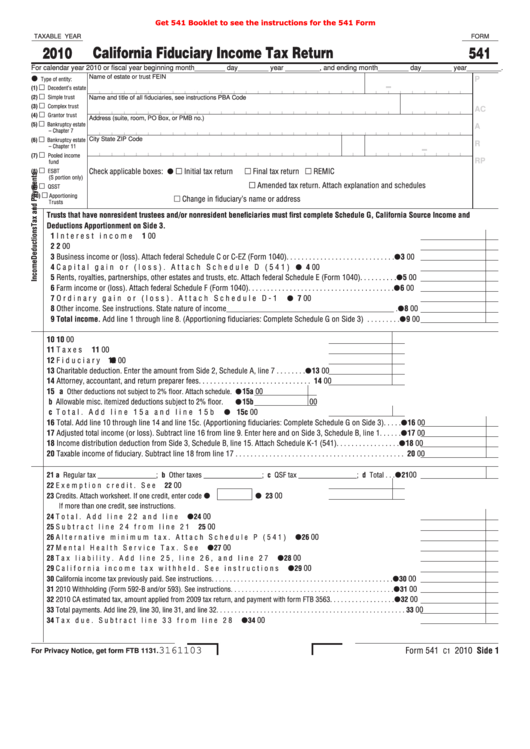

Fillable Form 541 California Fiduciary Tax Return 2010

2015 Form 541 California Fiduciary Tax Return Edit, Fill

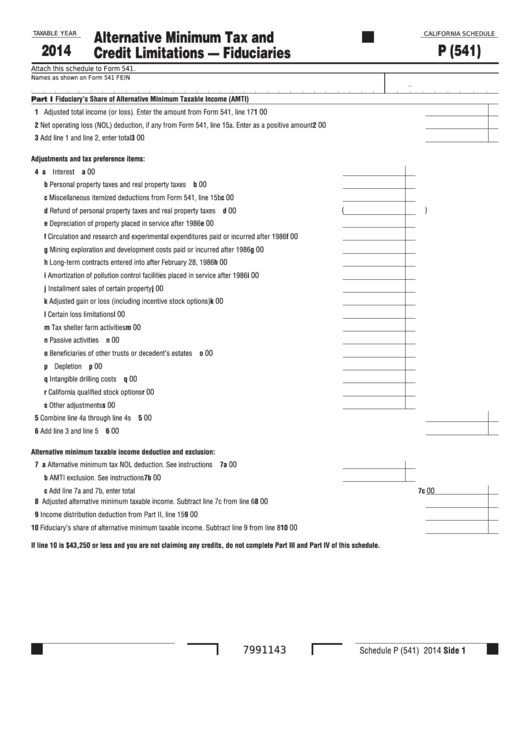

Fillable California Schedule P (541) Attach To Form 541 Alternative

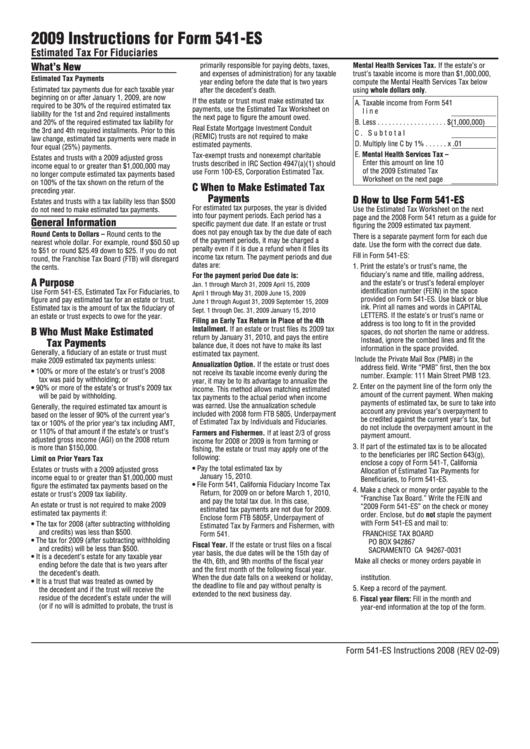

Fillable California Form 541Es Estimated Tax For Fiduciaries 2009

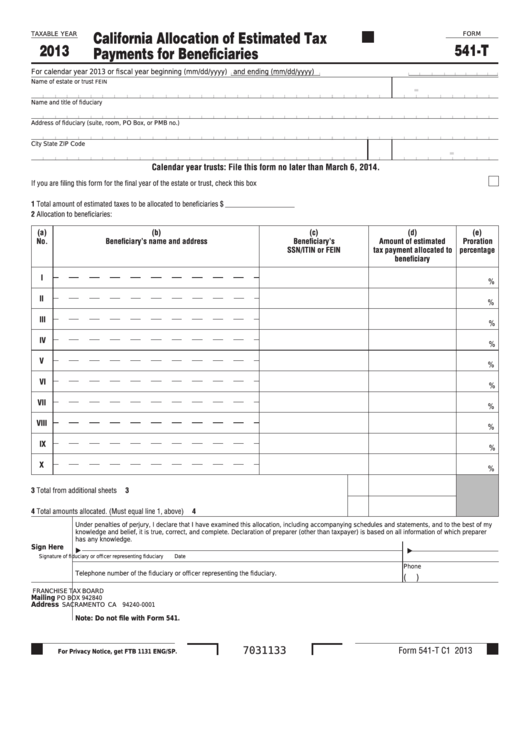

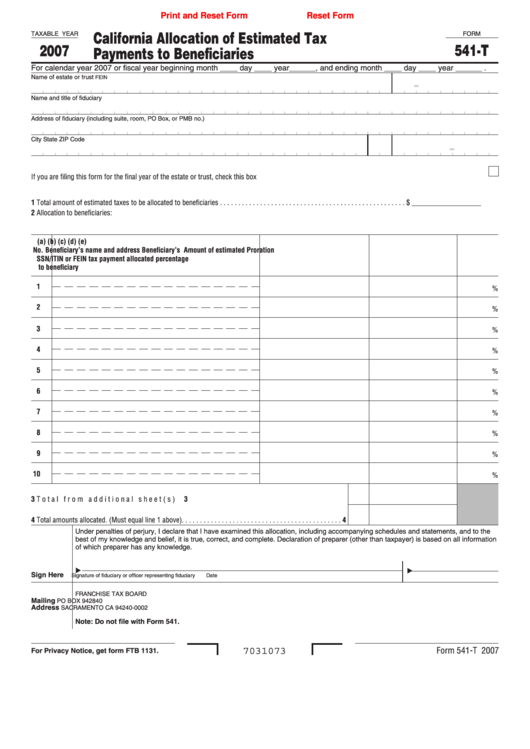

Fillable Form 541T California Allocation Of Estimated Tax Payments

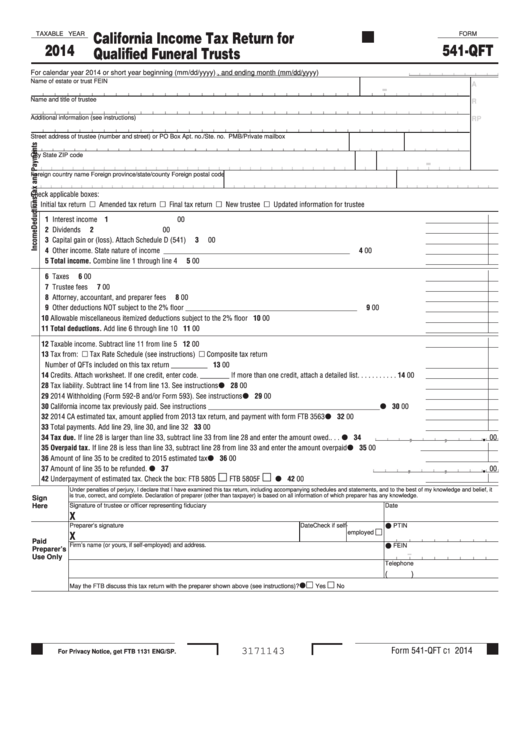

Form 541Qft California Tax Return For Qualified Funeral

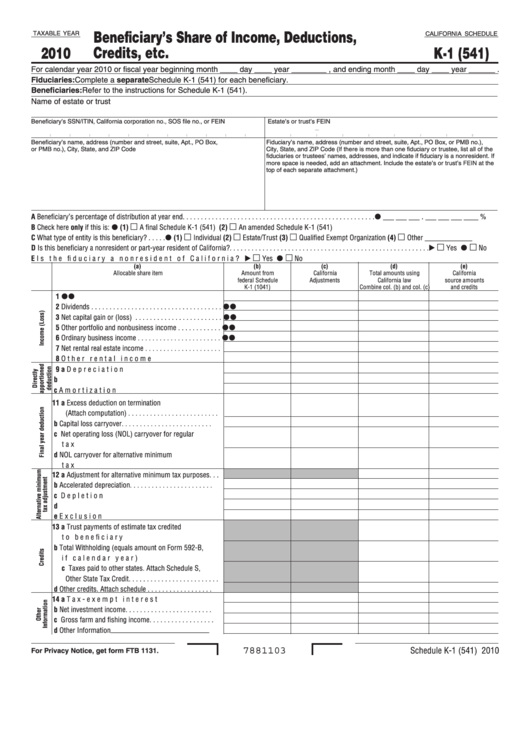

Fillable California Schedule K1 (541) Beneficiary'S Share Of

Fillable Form 541T California Allocation Of Estimated Tax Payments

Fillable California Form 541B Charitable Remainder And Pooled

Related Post: