California Estimated Tax Payment Form

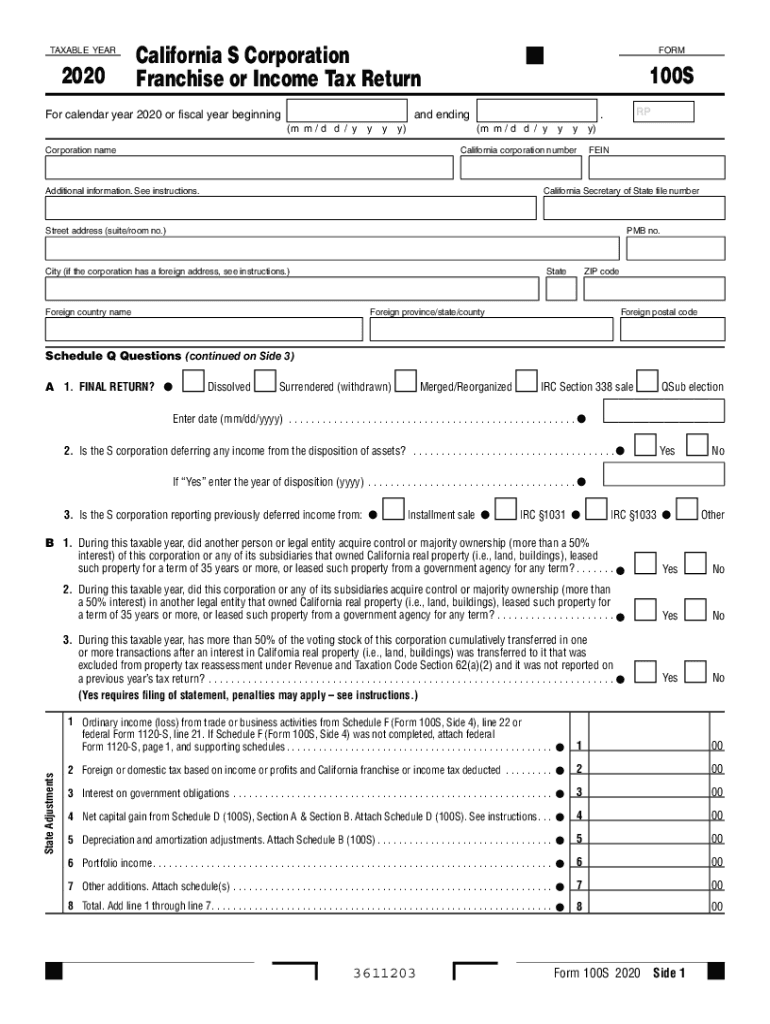

California Estimated Tax Payment Form - Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. 90% of the current year’s tax 2. Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. Most individuals and businesses in california will now have. Fiscal year filers, enter year ending month: Now, the california franchise tax board confirmed that most californians have until november 16, 2023, to file and pay their tax year 2022 state. Web state tax relief. Web quarterly estimated tax payments normally due on april 18, june 15 and sept. Web the irs said monday that californians in 55 of the state's 58 counties would not have to pay their 2022 taxes or 2023 estimated taxes until nov. So, for example, if you had an estimated. Select this quarterly payment type when you do not have tax withheld or not enough tax withheld from wages or income as you earn it (form 540. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. Web california estimated tax payments are due as follows: Fiscal year filers, enter. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps). Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Now, the california franchise tax board confirmed that most californians have until november 16, 2023, to file and pay. Generally, you must make estimated tax payments if in 2022 you expect to owe at least: Complete, edit or print tax forms instantly. Tax may also be withheld from certain other income, including pensions,. California has a state income tax that ranges between 1% and 13.3% , which is administered by the california franchise tax board. Web estimated tax for. Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps). 16 to file their 2022 federal returns and pay any tax due. Web estimated tax for individuals. If you are self employed or do not have. Download or email 540 2ez & more fillable forms,. Web simplified income, payroll, sales and use tax information for you and your business 16 to file their 2022 federal returns and pay any tax due. This calculator does not figure tax for form 540 2ez. Select this quarterly payment type when you do not have tax withheld or not enough tax withheld from wages or income as you earn. Web quarterly estimated tax payments (initially due on april 18, june 15 and sept. This extension covers 55 of. Web estimated tax for individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from. Fiscal year filers, enter year ending month: Web quarterly estimated tax payments normally due on april 18, june 15 and sept. Web the irs tax deadline extension for people in california also applies to 2022 estimated payments of federal income tax. This calculator does not figure tax for form 540 2ez. Most individuals and businesses in california will now have. Web the irs said monday that californians. Web state tax relief. Download or email 540 2ez & more fillable forms, register and subscribe now! Web simplified income, payroll, sales and use tax information for you and your business Web california estimated tax payments are due as follows: Web go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic. If you are self employed or do not have. If you are an employee, your employer probably withholds income tax from your pay. California has a state income tax that ranges between 1% and 13.3% , which is administered by the california franchise tax board. Web state tax relief. Web the following four due dates are imperative to note as. Web california estimated tax payments are due as follows: If you are self employed or do not have. 30% due (january 1 to march 31): Individual tax return form 1040 instructions; This calculator does not figure tax for form 540 2ez. If you are self employed or do not have. Download or email 540 2ez & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web *required field california taxable income enter line 19 of 2022 form 540 or form 540nr. Web form 540es includes four estimated tax payment vouchers for use by individuals who must file quarterly estimated tax payments. California has a state income tax that ranges between 1% and 13.3% , which is administered by the california franchise tax board. Most individuals and businesses in california will now have. Web estimated tax for individuals. Web per the irs, most individuals and businesses in california have until nov. Web state tax relief. Web individuals who are required to make estimated tax payments, and whose 2020 california adjusted gross income is more than $150,000 (or $75,000 if married/rdp filing. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web all corporations incorporated, qualified, or doing business in california, whether active or inactive, must make franchise or income estimated tax payments. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from. If you are an employee, your employer probably withholds income tax from your pay. This calculator does not figure tax for form 540 2ez. Web estimated tax payment select this payment type when paying estimated tax. Web simplified income, payroll, sales and use tax information for you and your business Now, the california franchise tax board confirmed that most californians have until november 16, 2023, to file and pay their tax year 2022 state. Web the following four due dates are imperative to note as a california resident that is required to pay estimated taxes:2020 Form CA FTB 100S Fill Online, Printable, Fillable, Blank pdfFiller

2020 Form OH IT 1040ESFill Online, Printable, Fillable, Blank pdfFiller

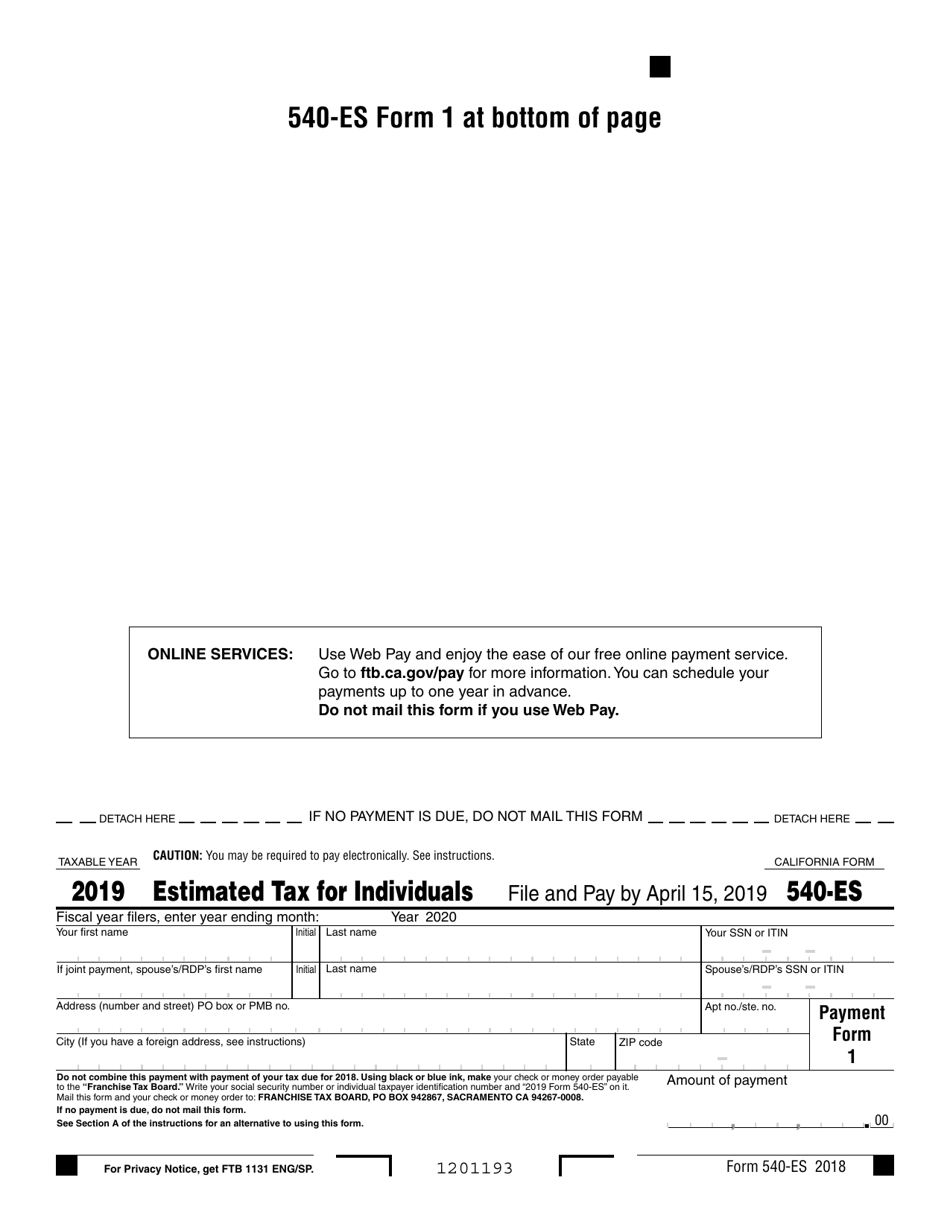

Form 540ES Download Fillable PDF or Fill Online Estimated Tax for

2018 California Resident Tax Return Form 540 Instructions and

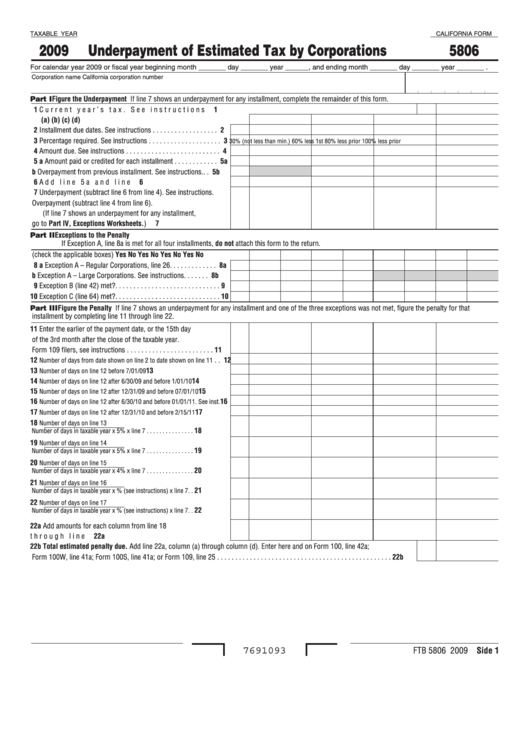

Fillable California Form 5806 Underpayment Of Estimated Tax By

2018 California Resident Tax Return Form 540 Instructions DocHub

California State Tax Fillable Form Printable Forms Free Online

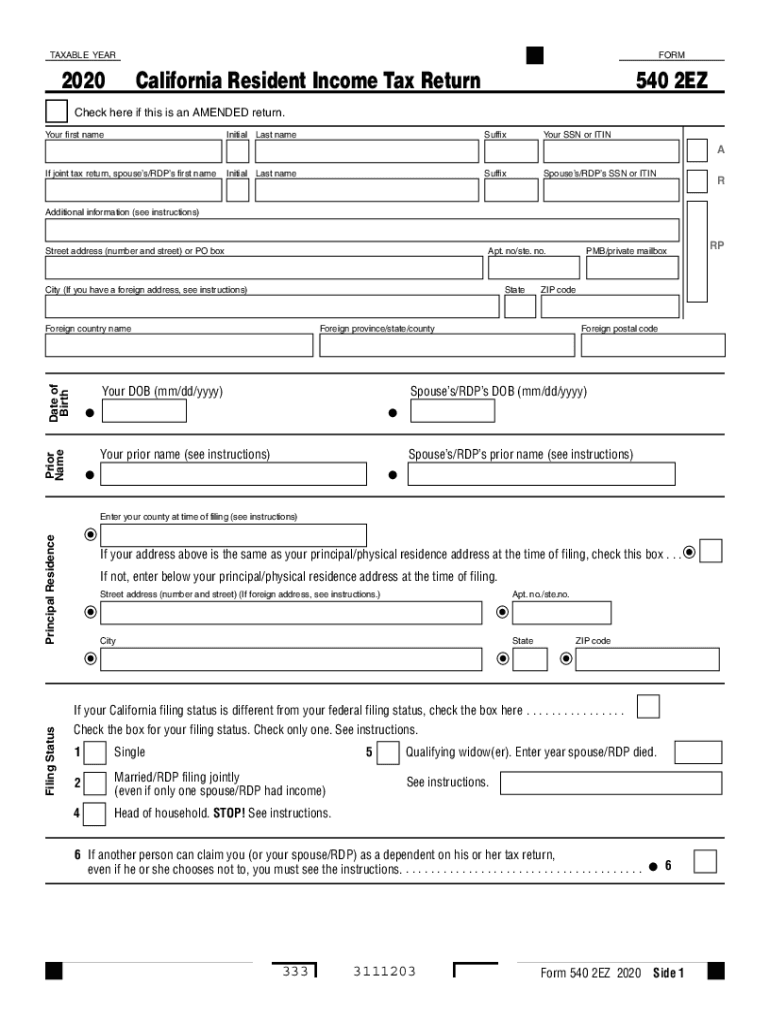

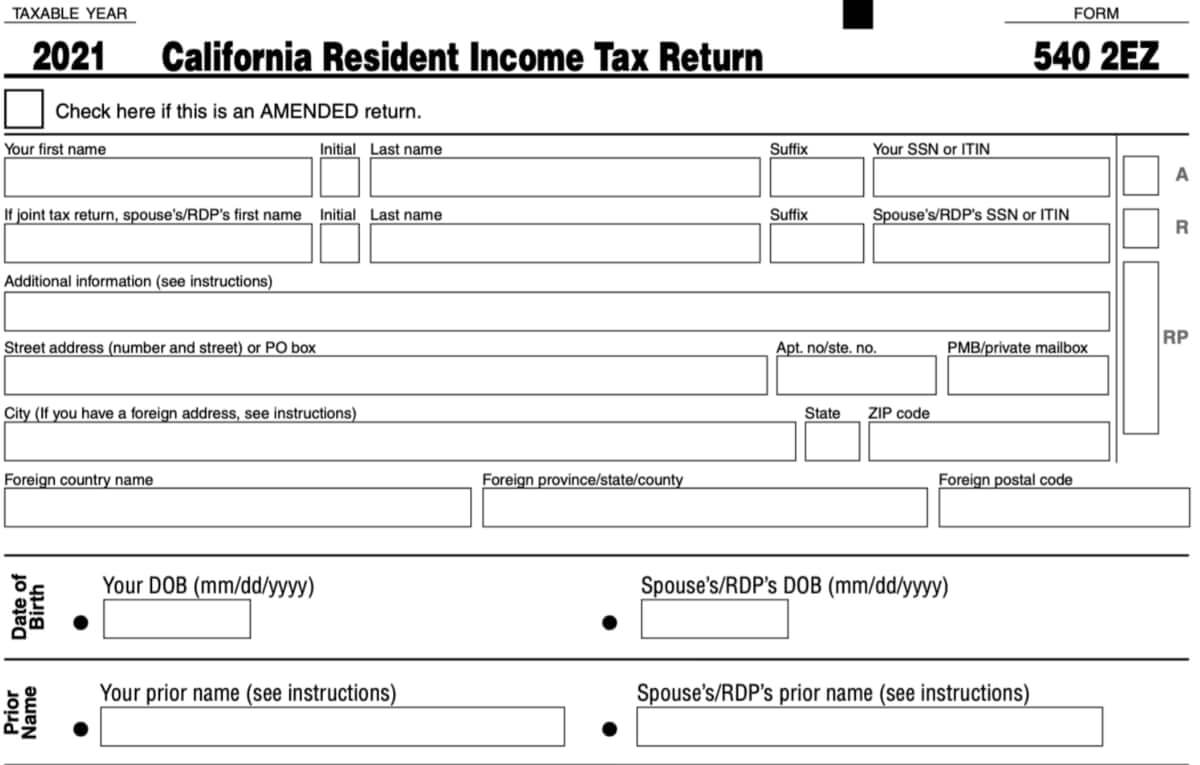

Form 5402EZ California 2022 2023 State And Local Taxes Zrivo

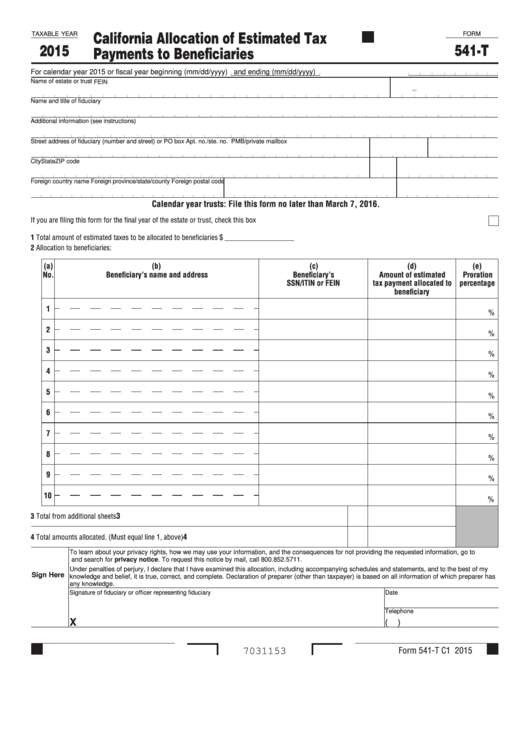

Fillable Form 541T California Allocation Of Estimated Tax Payments

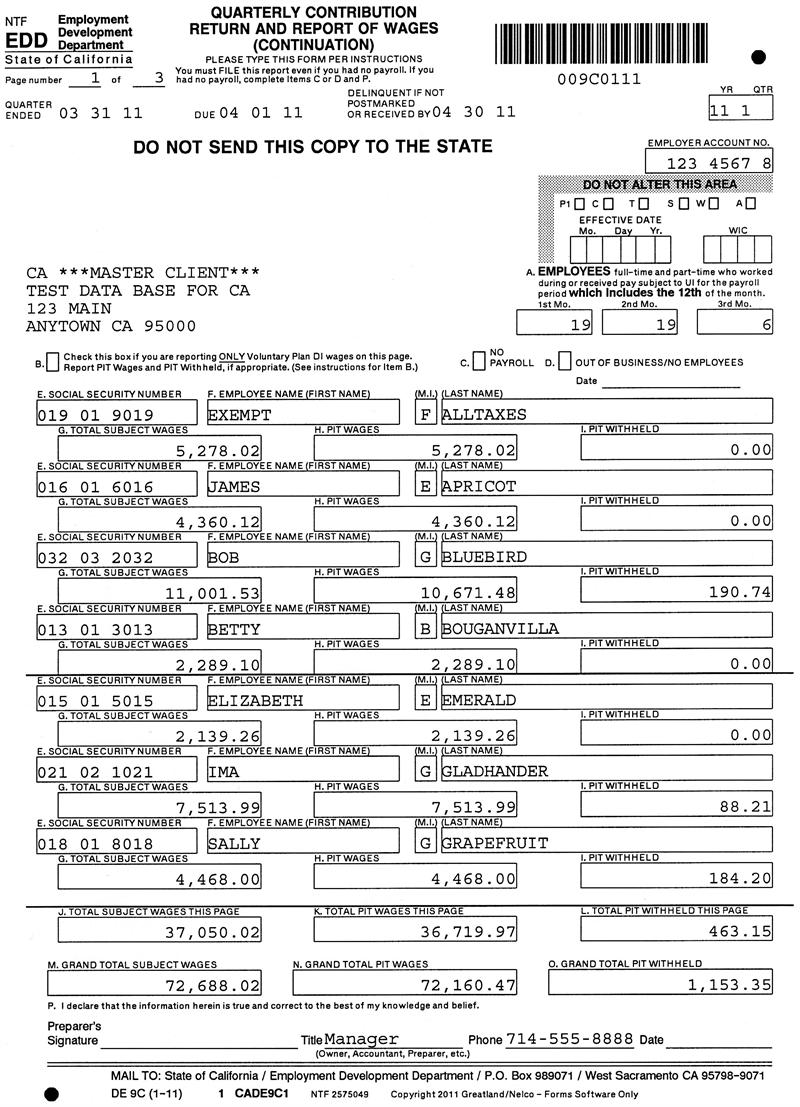

California DE 9 and DE 9C Fileable Reports

Related Post: