Ca Withholding Form

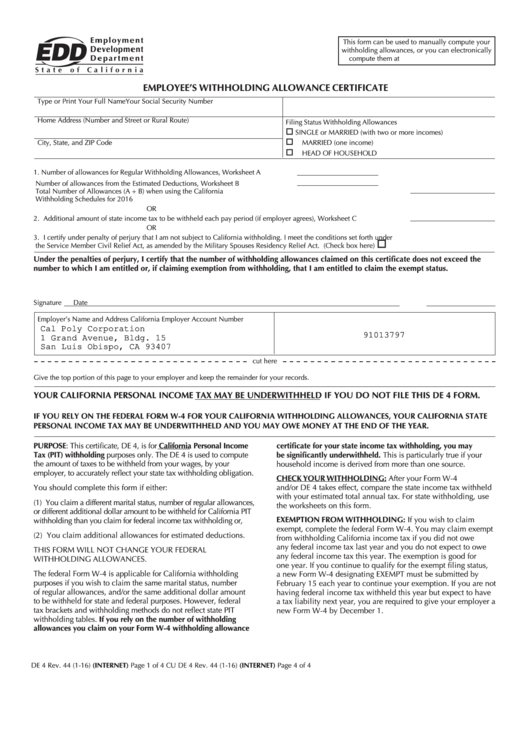

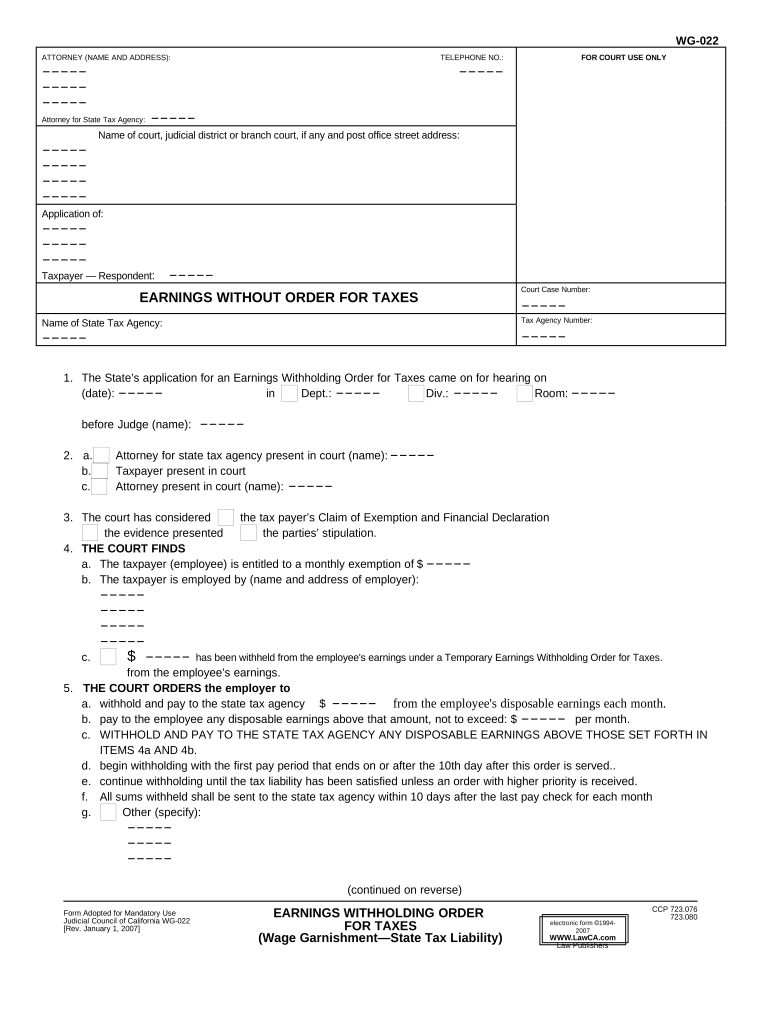

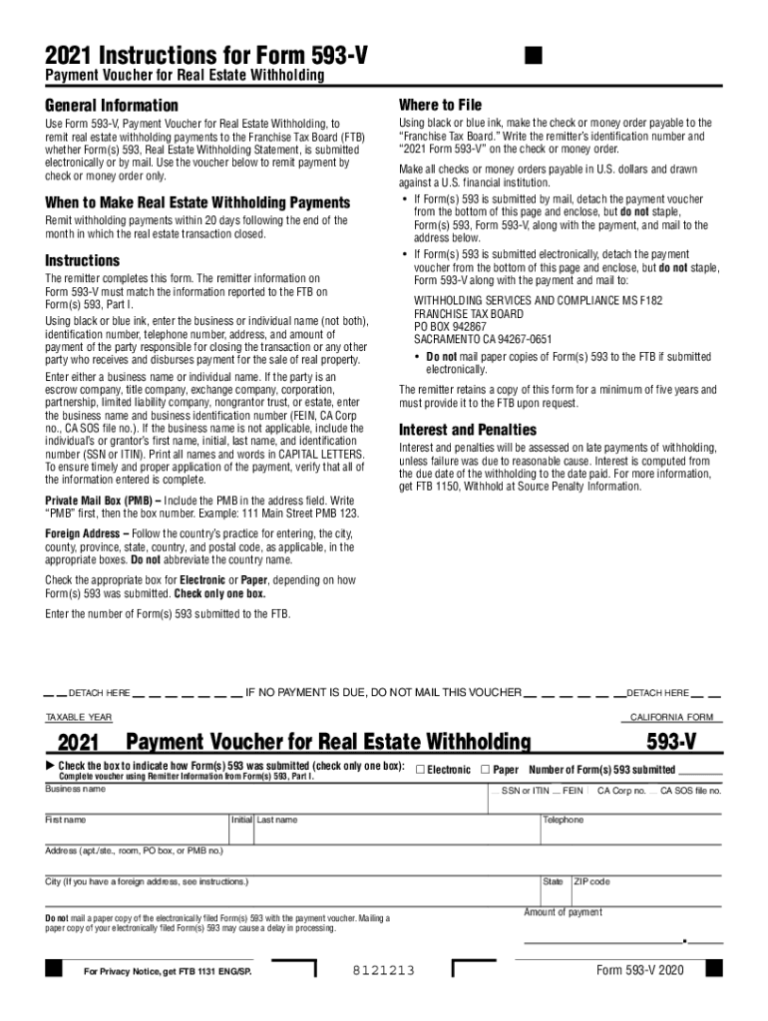

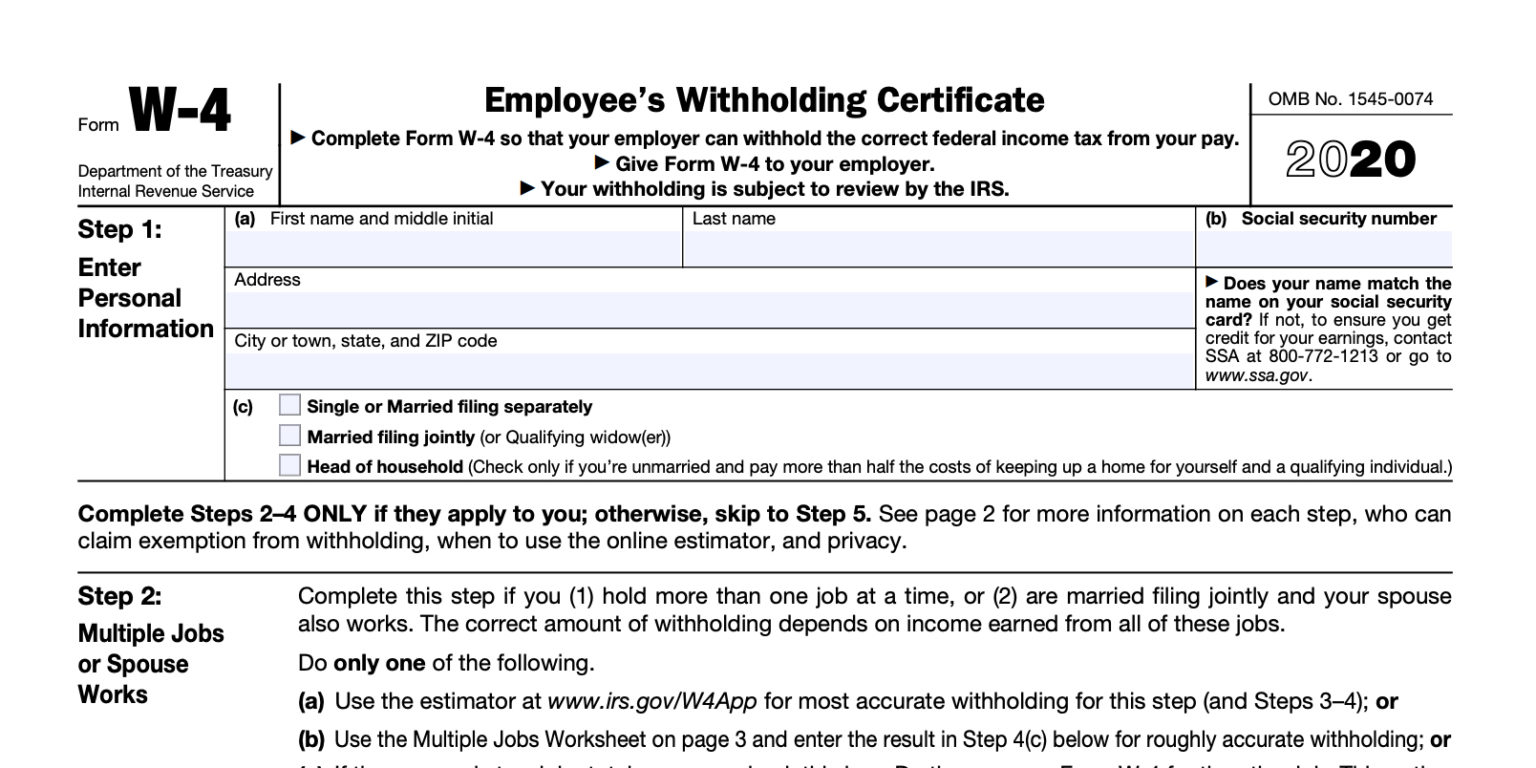

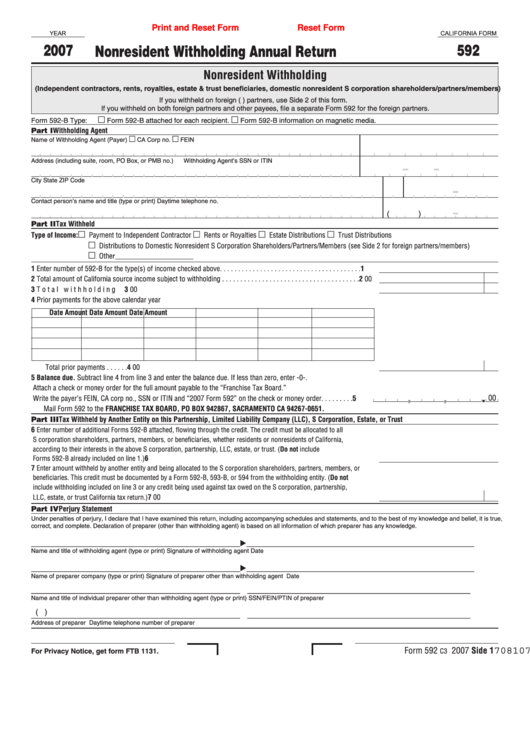

Ca Withholding Form - The de 4p allows you to: Employment training tax (ett) y the 2023 ett rate is 0.1 percent (.001) on the first $7,000 of each employee’s wages. The low income exemption amount for married with 0 or 1 allowance. Best tool to create, edit & share pdfs. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web the income tax withholdings formula for the state of california includes the following changes: Arizona, california, massachusetts and new. Employee's withholding certificate form 941; Total number of allowances you’re claiming (use worksheet a. (1) claim a different number of allowances. The de 4 is used to compute the amount of taxes to be withheld from. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Arizona, california, massachusetts and new. Choose avalara sales tax rate tables by state or look up individual rates by address. (1) claim a different number of allowances. Use the calculator or worksheet to determine the number of. Choose avalara sales tax rate tables by state or look up individual rates by address. Form 590 does not apply to payments of backup withholding. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web filling out the california withholding. Best tool to create, edit & share pdfs. Arizona, california, massachusetts and new. Web employers and licensed health professionals: The de 4 is used to compute the amount of taxes to be withheld from. Ad state withholding form ca. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Ad vast library of fillable legal documents. Web employers and. Use this form to certify exemption from withholding; Web employee to show the correct california income tax withholding. Arizona, california, massachusetts and new. Employee's withholding certificate form 941; Web ftb.ca.gov/forms and search for 1131. Web ftb.ca.gov/forms and search for 1131. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Items of income that are subject to withholding are. Use the calculator or worksheet to determine the number of. Web complete this form so that your employer can withhold. The form helps your employer. Ad vast library of fillable legal documents. Web the income tax withholdings formula for the state of california includes the following changes: Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The de 4 is used to compute the amount of taxes to be withheld from. Web simplified income, payroll, sales and use tax information for you and your business Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web the. Ad state withholding form ca. The de 4p allows you to: Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Use the calculator or worksheet. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Ad approve payroll when you're ready, access employee services & manage it all in one. Best tool to create, edit & share pdfs. Withholding exemption certificate (form 590) submit form 590 to your withholding agent; Employment training tax (ett) y the 2023 ett rate is 0.1 percent (.001) on the first $7,000 of each employee’s wages. Web complete this form so that your employer can withhold the correct california state income tax from your paycheck. The low income exemption amount for married with 0 or 1 allowance. The form helps your employer. Web employers and licensed health professionals: Use the calculator or worksheet to determine the number of. Web employee to show the correct california income tax withholding. Web simplified income, payroll, sales and use tax information for you and your business The de 4 is used to compute the amount of taxes to be withheld from. Arizona, california, massachusetts and new. Use this form to certify exemption from withholding; (1) claim a different number of allowances. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Ad state withholding form ca. Items of income that are subject to withholding are. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Please allow two to four weeks for orders to arrive.Fillable Employee Development Department State Of California Employee

Ca De 4 Printable Form California Employee's Withholding Allowance

ca withholding Doc Template pdfFiller

1+ California State Tax Withholding Forms Free Download

Ftb 589 Fill out & sign online DocHub

California Employee Withholding Form 2022 2023

California Tax Withholding Worksheet A And B Forms Gettrip24

Ca State Withholding Form 2021 Federal Witholding Tables 2021

Form De4 California Employee Withholding

California Withholding Tax Form 592

Related Post: