Tax Form 941X

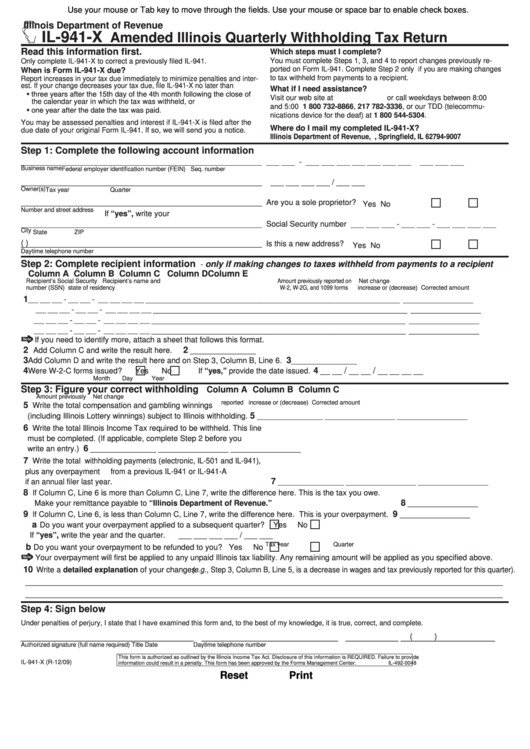

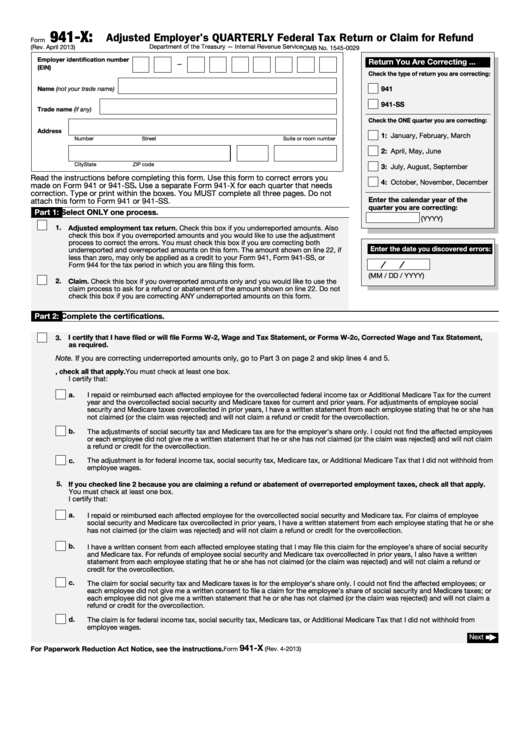

Tax Form 941X - Form 941 requires employers to report the withheld amount in addition to reporting the employer’s share of social security or. Web information from form 941 worksheets. Web amounts, for purposes of the certifications on lines 4 and 5, medicare tax doesn’t include additional medicare tax. There are a lot of concerns and confusion throughout the tax. Web the form is used by all individual taxpayers, regardless of filing status and form type (including partnerships and s corporations that filed a composite nonresident. Click the link to load the. Details about any deposits you made to the irs. Web arizona s corporation income tax return. Web page last reviewed or updated: Part 1 & part 2. Web arizona s corporation income tax return. Web page last reviewed or updated: Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Web amounts,. Web amounts, for purposes of the certifications on lines 4 and 5, medicare tax doesn’t include additional medicare tax. Web this is called tax withholding. Web about form 941, employer's quarterly federal tax return. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web information from form 941 worksheets. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Estimate how much you could potentially save in just a matter of minutes. Ad calculate. Resident shareholder's information schedule form with instructions. Individual estimated tax payment booklet. Web arizona s corporation income tax return. Web amounts, for purposes of the certifications on lines 4 and 5, medicare tax doesn’t include additional medicare tax. Used to file a return with the county treasurer for property subject to the. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. There are a lot of concerns and confusion throughout the tax. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. 13, 2023 — the irs today announced. Resident shareholder's information schedule form with instructions. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web amounts, for purposes of the certifications on lines 4 and 5, medicare tax doesn’t include additional medicare tax. Form 941 requires employers to report the withheld amount in addition to reporting the employer’s share. Individual estimated tax payment booklet. Web page last reviewed or updated: Pay as you go, cancel any time. Report for this quarter of 2023. Web this is called tax withholding. The total tax liability for the quarter. Used to file a return with the county treasurer for property subject to the. Ad a tax advisor will answer you now! There are a lot of concerns and confusion throughout the tax. Part 1 & part 2. Click the link to load the. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Report for this quarter of 2023. Employers use form 941 to: Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web the form is used by all individual taxpayers, regardless of filing status and form type (including partnerships and s corporations that filed a composite nonresident. Web about form 941, employer's quarterly federal tax return. The total tax liability for the quarter. Individual estimated tax payment booklet. Only certain taxpayers are eligible. Estimate how much you could potentially save in just a matter of minutes. The total tax liability for the quarter. Details about any deposits you made to the irs. 13, 2023 — the irs today announced tax relief for individuals and businesses affected by the terrorist attacks in the state of israel. Part 1 & part 2. Web arizona s corporation income tax return. Web form 941 is an information form in the payroll form series which deals with employee pay reports, such as salaries, wages, tips, and taxes. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Pay as you go, cancel any time. Web information from form 941 worksheets. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Ad calculate over 1,500 tax planning strategies automatically and save tens of thousands. Saving clients money is easy. Report income taxes, social security tax, or medicare tax withheld from employee's. Web about form 941, employer's quarterly federal tax return. Employers use form 941 to: There are a lot of concerns and confusion throughout the tax. Know exactly what you'll pay each month. Ad a tax advisor will answer you now! Web page last reviewed or updated:Fillable Form Il941X Amended Illinois Quarterly Withholding Tax

941 X Form Fill Out and Sign Printable PDF Template signNow

How To Fill Out Form 941X For Employee Retention Credit Businesses Go

941X Amended Quarterly Return (DAS)

How to File IRS Form 941X Instructions & ERC Guidelines

IRS Form 941X Complete & Print 941X for 2022

Form 941 X mailing address Fill online, Printable, Fillable Blank

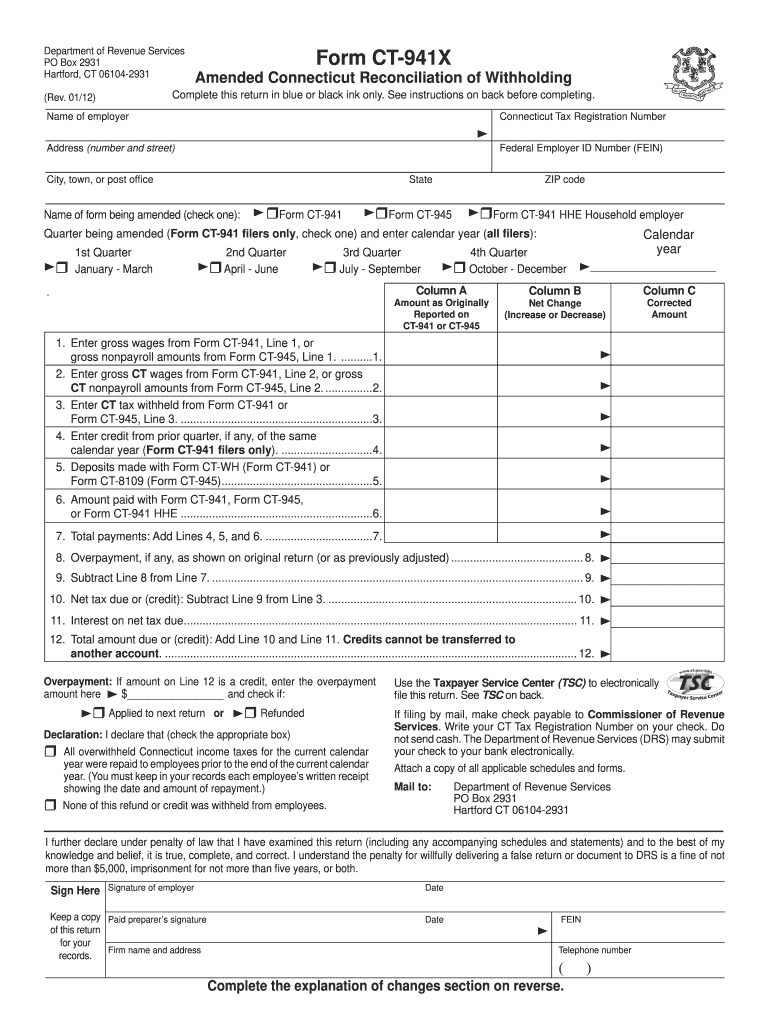

CT DRS CT941X 2012 Fill out Tax Template Online US Legal Forms

How to Complete Form 941 in 5 Simple Steps

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Related Post: