Ca Form 568 Extension

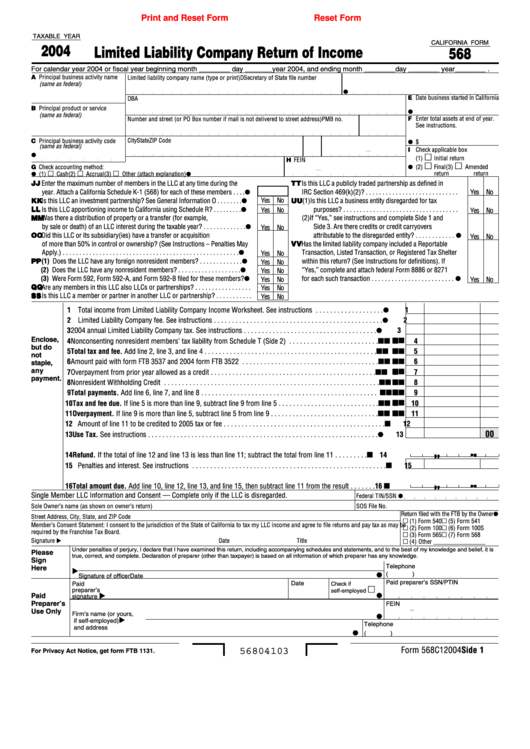

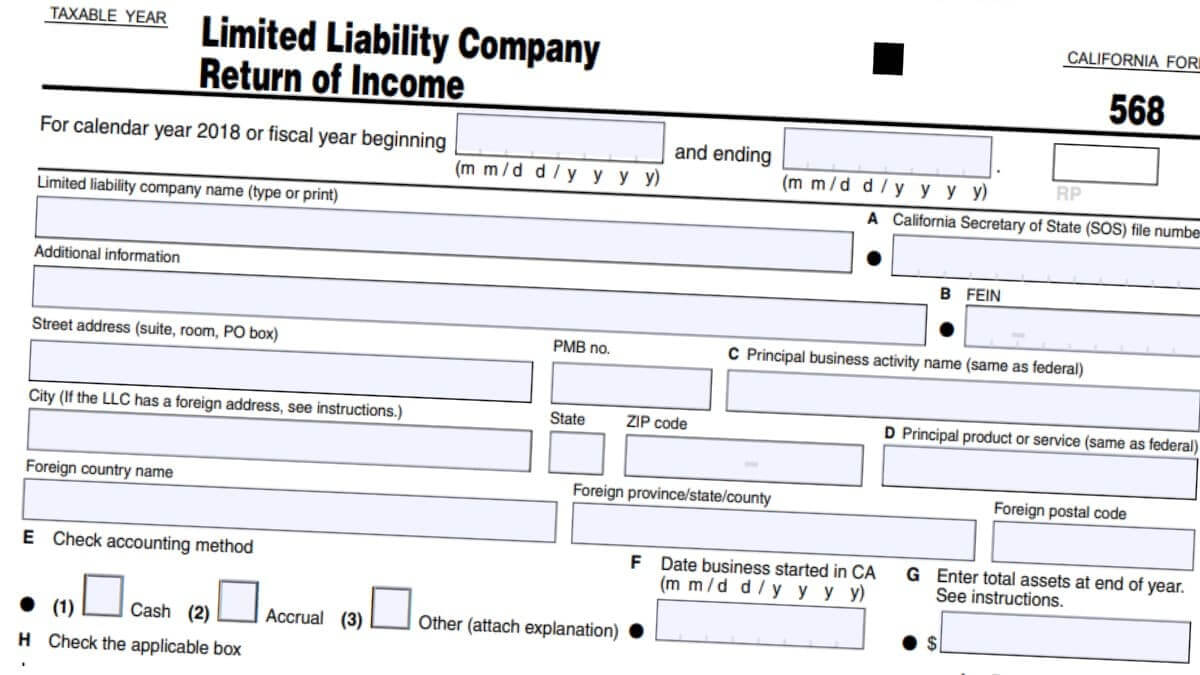

Ca Form 568 Extension - 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. To request this notice by mail, call 800.852.5711. One thing to know about form 568 is that all llcs are required to pay an $800. Web to enter the information for form 568 in the 1040 taxact ® program: Web enter the llc’s “total california income” as computed on line 17 of schedule iw. In addition, the program populates form 3522 for a 2022 tax payment of $800 due on april 15. Web when is form 568 due? Ftb 568, limited liability company return of income. You must file by the deadline to avoid a late filing penalty. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. What is the limited liability company annual tax? Web california limited liability company return of income. Under penalties of perjury, i declare that i have examined this tax return, including. In the wake of last winter’s. It appears you don't have a pdf plugin for this browser. One thing to know about form 568 is that all llcs are required to pay an $800. When is the annual tax due? What is the limited liability company annual tax? You must file by the deadline to avoid a late filing penalty. Web form 3522 is a form used by llcs in california to pay a business's annual tax. Web california forms & instructions members of the franchise tax board betty t. The amount entered on form 568, line 1, may not be a negative number. The deadline is october 16, 2023. An llc must file form 568 by the original tax return due date, unless it files its tax return. Web when is form 568 due? In the wake of last winter’s. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. When are my estimate payments due? When is the annual tax due? 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. In addition, the program populates form 3522 for a 2022 tax payment of $800 due on april 15. Web california extends due date for california state tax returns. You must file by the deadline to avoid a late filing penalty. Web california forms & instructions members of the franchise tax board betty t. Web when is form 568 due? Web file limited liability company return of income (form 568) by the original return due date. From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Accepts returns with these conditions: Web line 3 & 7 on form 568 seem to relate to the 2021 tax of $800. When are my. It isn't included with the regular ca state partnership formset. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Web california form 568 for limited liability company return of income is a. What is the limited liability company annual tax? Web california extends due date for california state tax returns. Irs further postpones tax deadlines for most california. A statement will generate indicating what form (s) the amount (s). California individuals and businesses impacted by the. Solved • by turbotax • 336 • updated january 13, 2023 form 568. A business will have to file form 568 if it has grossed $250,000 or more. A statement will generate indicating what form (s) the amount (s). To request this notice by mail, call 800.852.5711. Web to enter the information for form 568 in the 1040 taxact ®. Accepts returns with these conditions: A statement will generate indicating what form (s) the amount (s). Irs further postpones tax deadlines for most california. Web file limited liability company return of income (form 568) by the original return due date. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. The deadline is october 16, 2023. Web california forms & instructions members of the franchise tax board betty t. 2021, form 568, limited liability company return of income: Registration after the year begins. Web california limited liability company return of income. Web to enter the information for form 568 in the 1040 taxact ® program: When is the annual tax due? Cohen, member joe stephenshaw, member 568 2022 limited liability company tax booklet this booklet contains: Web file limited liability company return of income (form 568) by the original return due date. Accepts returns with these conditions: If your llc files on an extension, refer to payment for automatic extension for llcs. Web up to $40 cash back do whatever you want with a 2021 form 568 limited liability company return of income. An llc must file form 568 by the original tax return due date, unless it files its tax return. It isn't included with the regular ca state partnership formset. Web when is form 568 due? Ftb 568, limited liability company return of income. Web california extends due date for california state tax returns. Web line 3 & 7 on form 568 seem to relate to the 2021 tax of $800. When are my estimate payments due? 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov.Form 568 Download Fillable PDF or Fill Online Limited Liability Company

20202022 Form CA FTB 568 Fill Online, Printable, Fillable, Blank

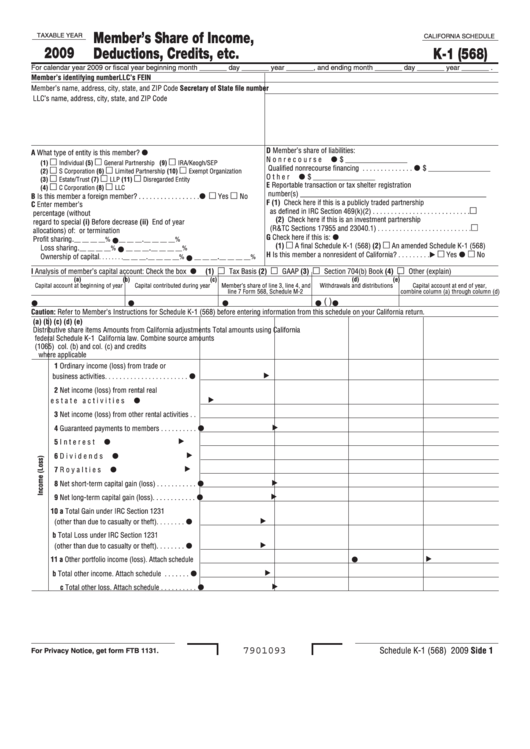

How do I Get Form 568 after I completed my State Taxes in TT Self Employed

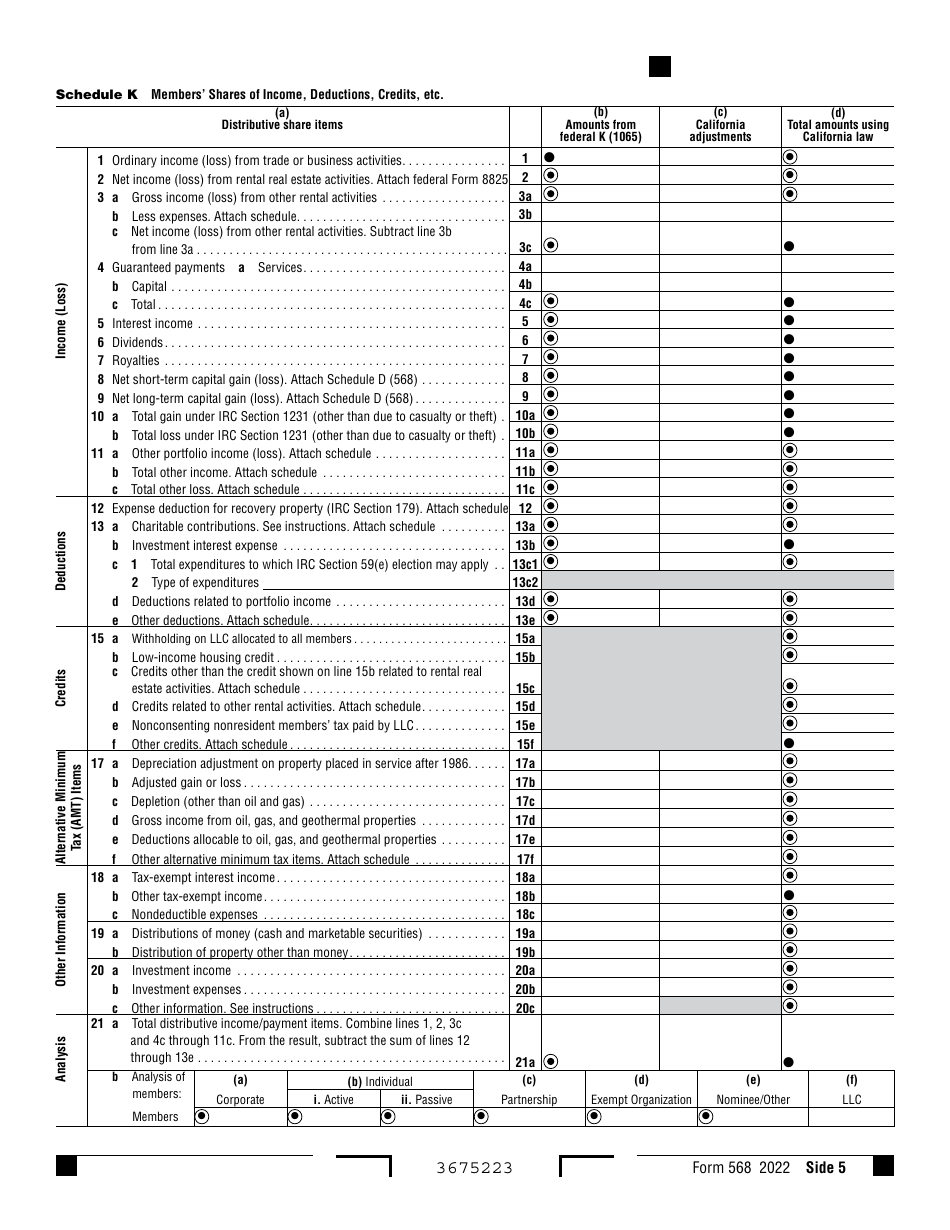

California Schedule K1 (568) Member'S Share Of Deductions

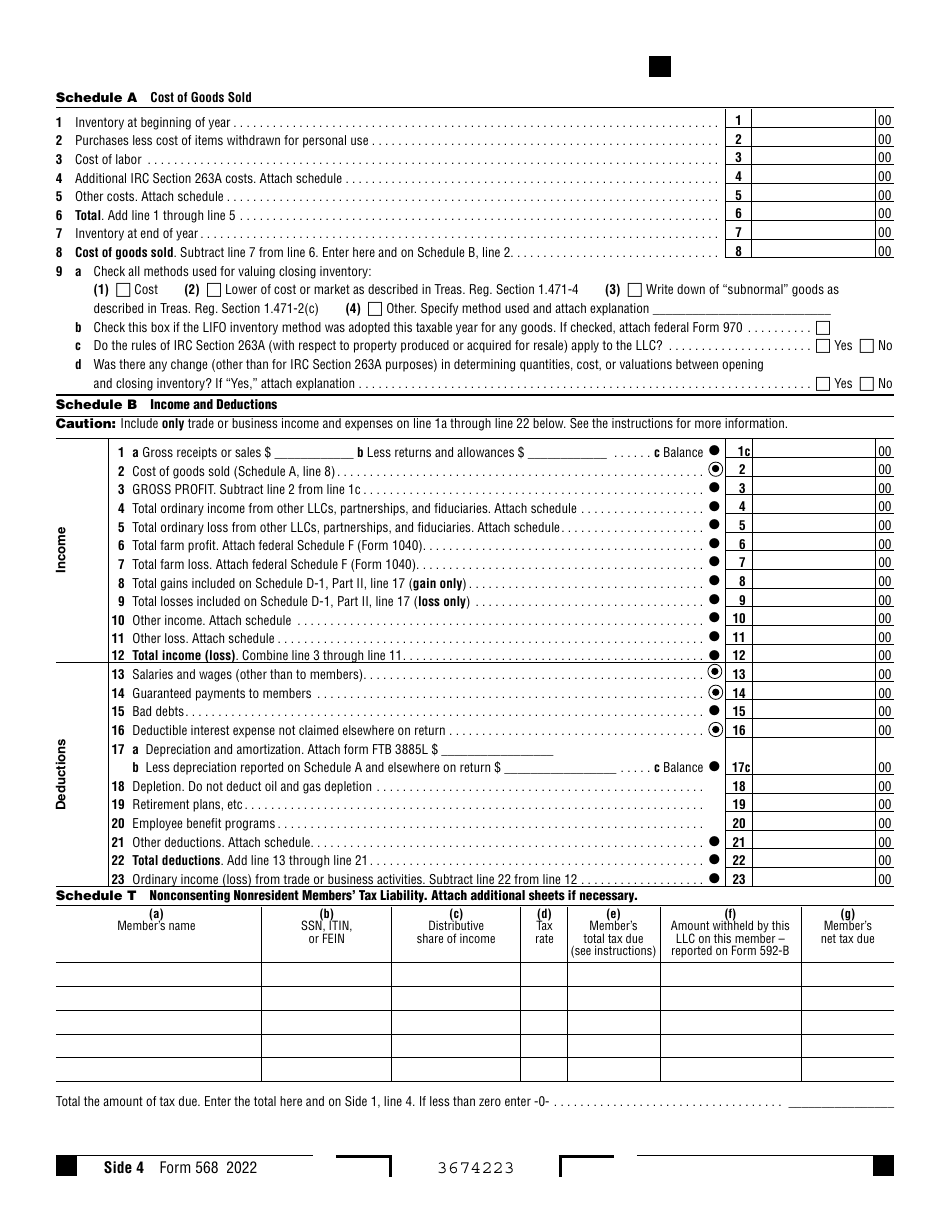

Form 568 Download Fillable PDF or Fill Online Limited Liability Company

Ca Form 568 Fillable Printable Forms Free Online

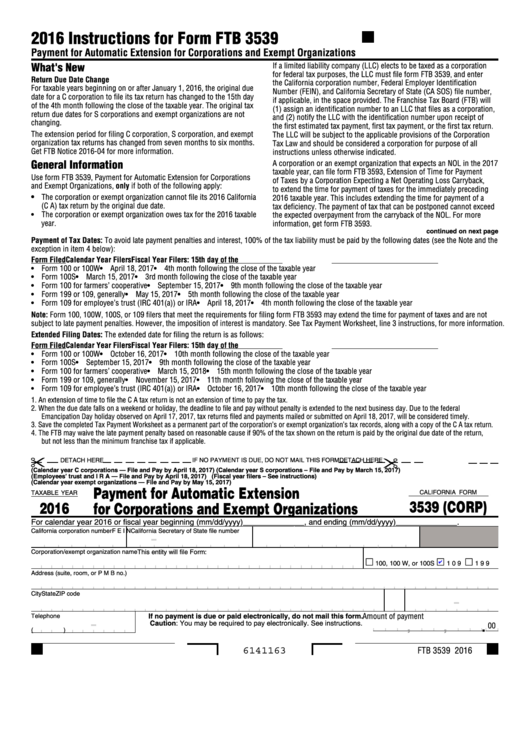

2016 tax extension form corporations dialockq

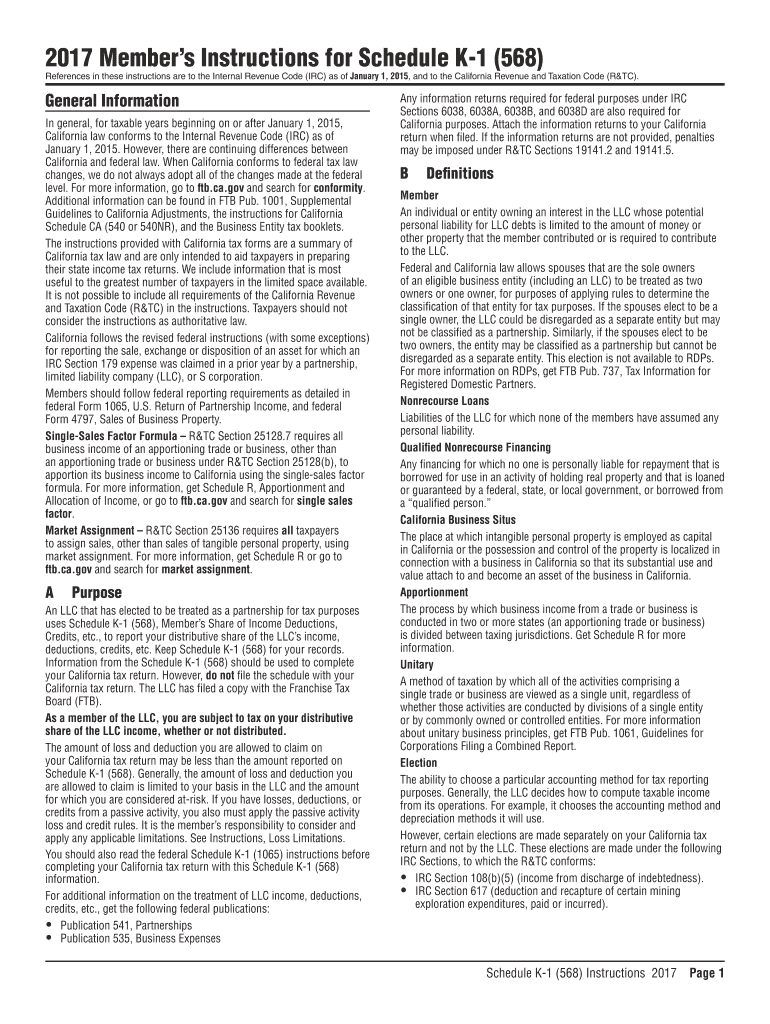

20172022 Form CA FTB Schedule K1 (568) Instructions Fill Online

california form 568 LLC Bible

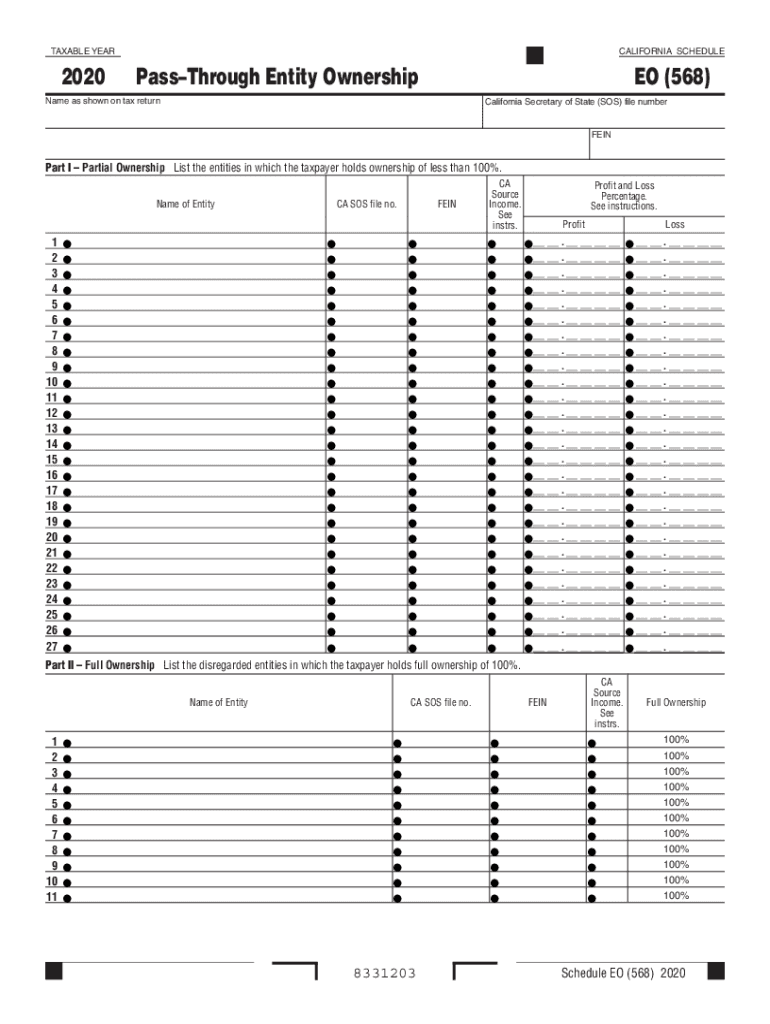

2020 Form CA EO (568) Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: