Form 5329 Turbotax

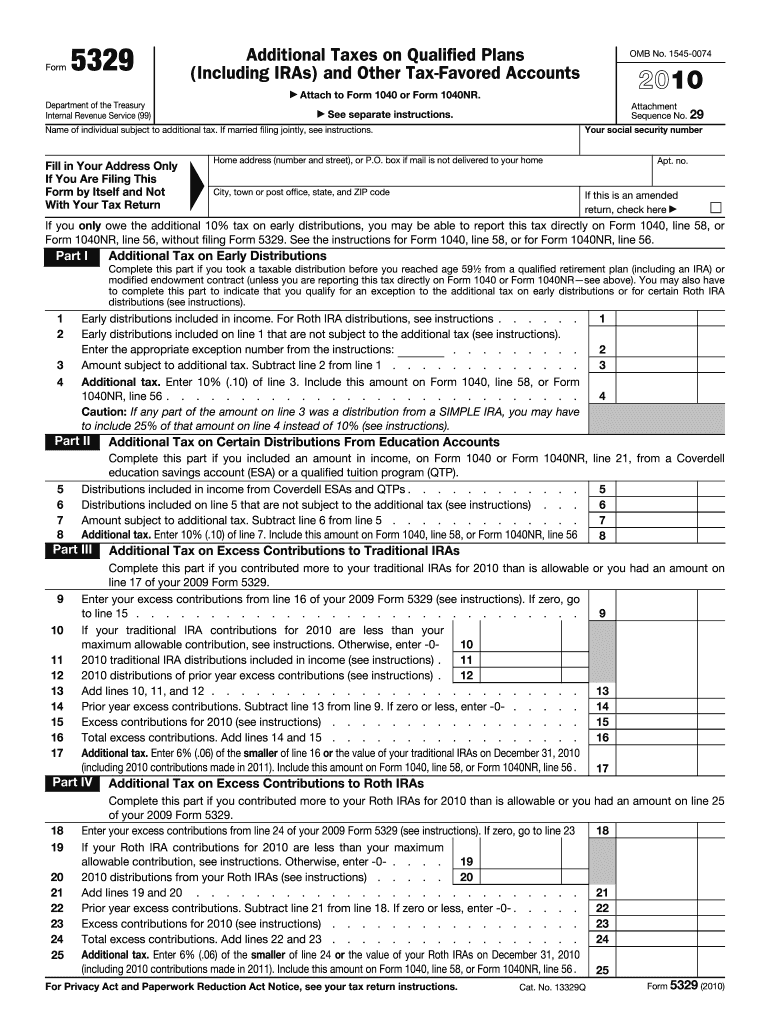

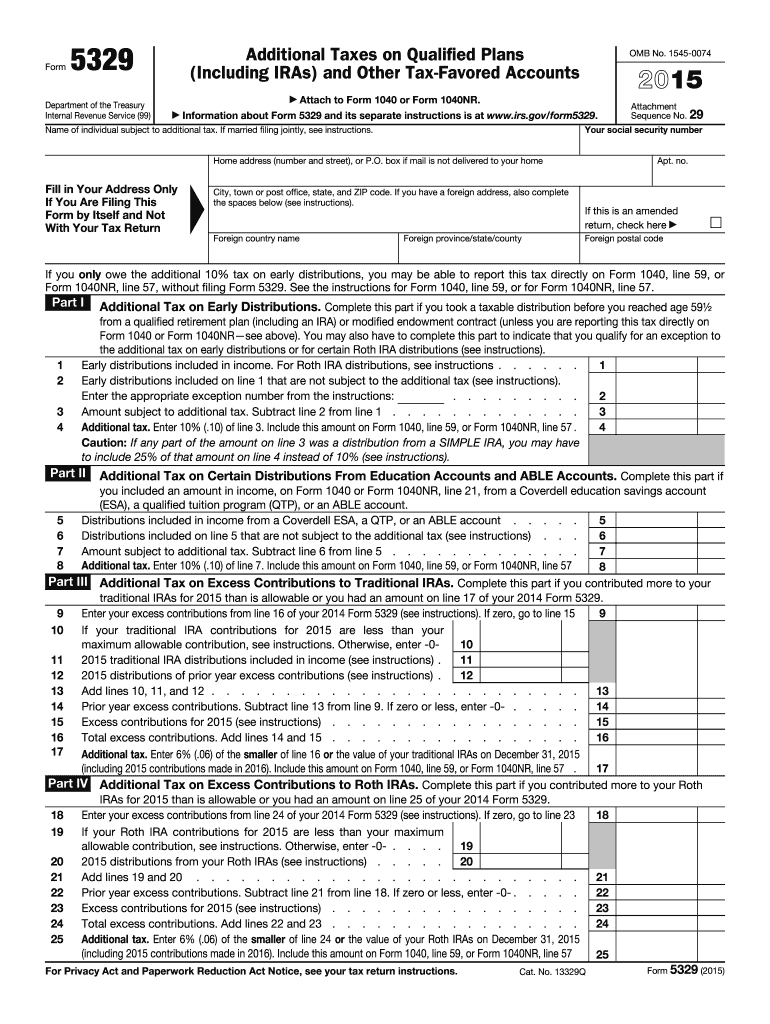

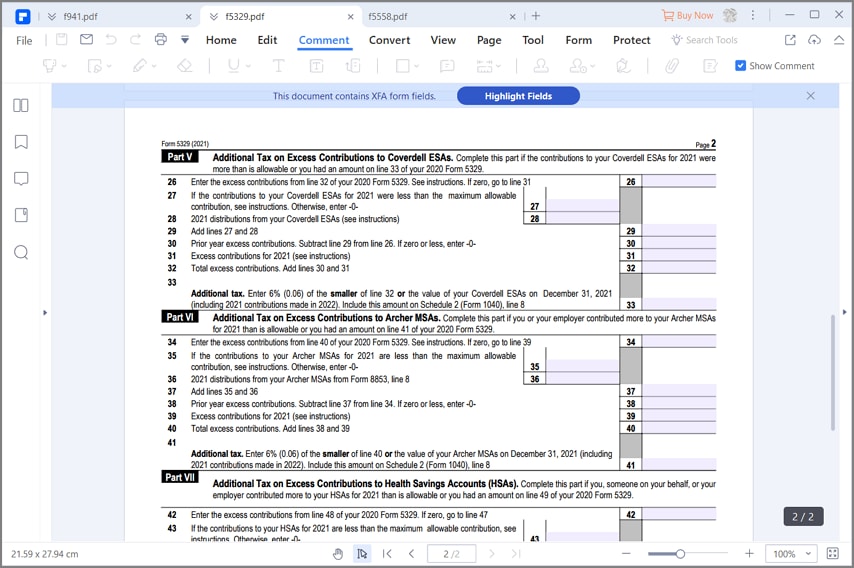

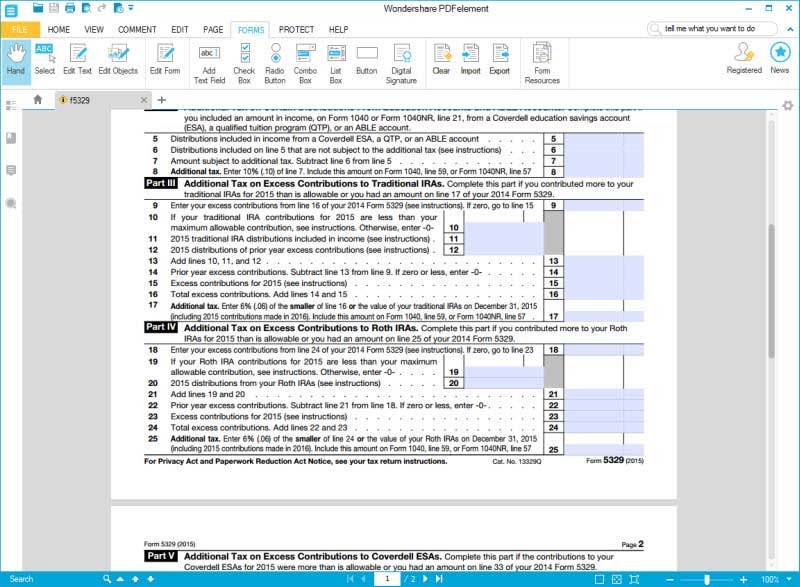

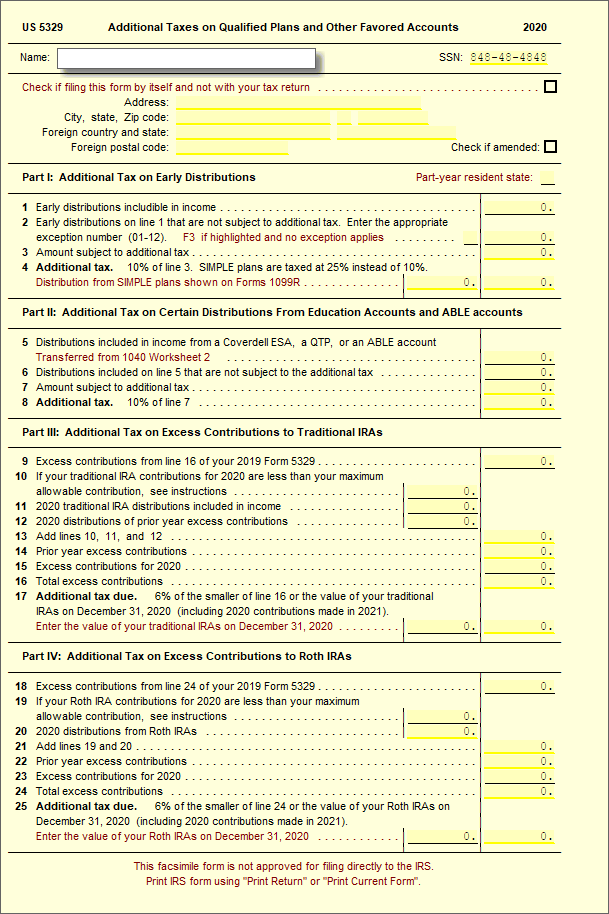

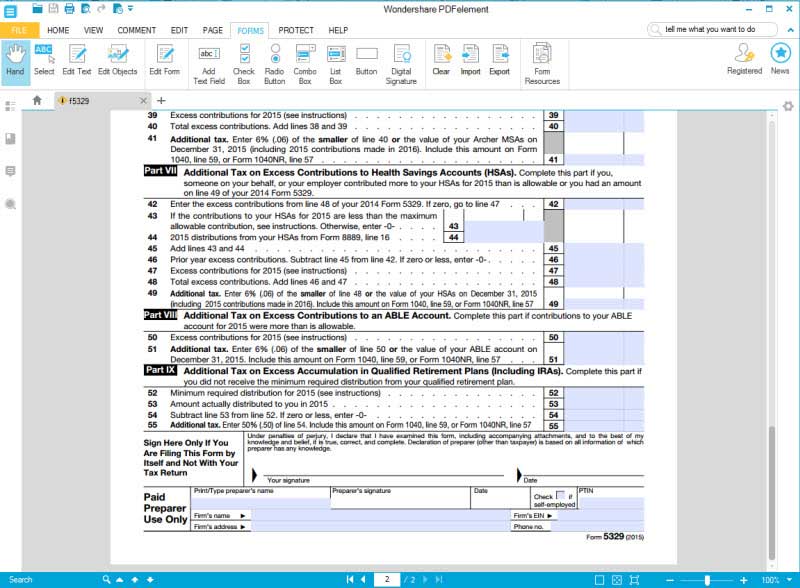

Form 5329 Turbotax - Complete, edit or print tax forms instantly. On the top right corner of your computer. Ad access irs tax forms. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Get ready for tax season deadlines by completing any required tax forms today. Web purpose of form use form 5329 to report additional taxes on: Get ready for tax season deadlines by completing any required tax forms today. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, • qtps, • archer. The additional tax on early distributions doesn't apply to qualified disaster distributions, including 2020 coronavirus. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, • qtps, • archer. In turbotax online, view the form at tax tools / print. Ad access irs tax forms. Web purpose of form use form 5329 to report additional taxes on: Web use form 5329 to report additional taxes on iras, other qualified retirement plans,. Get ready for tax season deadlines by completing any required tax forms today. This form is called “additional taxes on. On the top right corner of your computer. Ad access irs tax forms. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Get ready for tax season deadlines by completing any required tax forms today. On the top right corner of your computer. Ad access irs tax forms. The additional tax on early distributions doesn't apply to qualified disaster distributions, including 2020 coronavirus. Complete, edit or print tax forms instantly. In turbotax online, view the form at tax tools / print. Get ready for tax season deadlines by completing any required tax forms today. February 2021) department of the treasury internal. Web additional taxes on qualified plans and other accounts, reported on form 5329; Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Ad access irs tax forms. Web additional taxes on qualified plans and other accounts, reported on form 5329; Web you can search for the form and the program will take you to it and you can. The additional tax on early distributions doesn't apply to qualified disaster distributions, including 2020 coronavirus. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. On the top right corner of your computer. Get ready for tax season deadlines by completing any required tax forms today.. This form is called “additional taxes on. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, • qtps, • archer. Web irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Form 5329 is the tax form used to calculate possibly irs penalties from the. This form is called “additional taxes on. In turbotax online, view the form at tax tools / print. The additional tax on early distributions doesn't apply to qualified disaster distributions, including 2020 coronavirus. Web additional taxes on qualified plans and other accounts, reported on form 5329; • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas,. February 2021) department of the treasury internal. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, • qtps, • archer. On the top right corner of your computer. Web purpose of form use form 5329 to report additional. Web purpose of form use form 5329 to report additional taxes on: Web irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Web additional taxes on qualified plans and other accounts, reported on form 5329; Get ready for tax season deadlines by completing any required tax forms today. Web. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. • iras, • other qualified retirement plans, • modified endowment contracts, • coverdell esas, • qtps, • archer. Web you can search for the form and the program will take you to it and you can start filling it out. Web general instructions what’s new qualified disaster distributions. The additional tax on early distributions doesn't apply to qualified disaster distributions, including 2020 coronavirus. Complete, edit or print tax forms instantly. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Get ready for tax season deadlines by completing any required tax forms today. Web additional taxes on qualified plans and other accounts, reported on form 5329; Web irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete, edit or print tax forms instantly. On the top right corner of your computer. Get ready for tax season deadlines by completing any required tax forms today. February 2021) department of the treasury internal. Web what is irs form 5329? Form 5329 is the tax form used to calculate possibly irs penalties from the situations listed above and possibly request a penalty waiver. Web form 4868 (extension to file) form 5329 (additional taxes on qualified plans) you can also submit payment through your online tax platform. Ad access irs tax forms. Web purpose of form use form 5329 to report additional taxes on:Form 5329 Instructions Taxes on TaxFavored Accounts Lendstart

5329 Form Fill Out and Sign Printable PDF Template signNow

IRS Form 5329 2018 2019 Printable & Fillable Sample in PDF

Form 5329 Fill Out and Sign Printable PDF Template signNow

How to Fill in IRS Form 5329

Instructions for How to Fill in IRS Form 5329

5329 Additional Taxes on Qualified Plans UltimateTax Solution Center

Instructions for How to Fill in IRS Form 5329

IRS Form 5329A Complete Guide To Additional Taxes

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Related Post: