Beneficiary Instructions For Schedule K 1 Form 1041

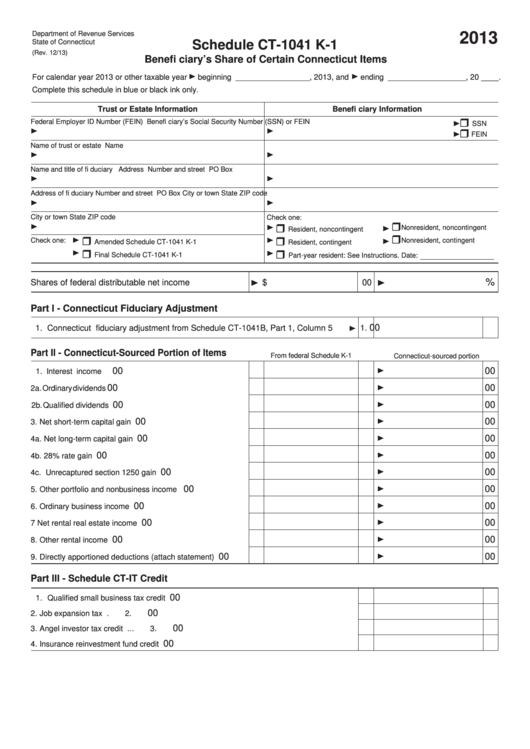

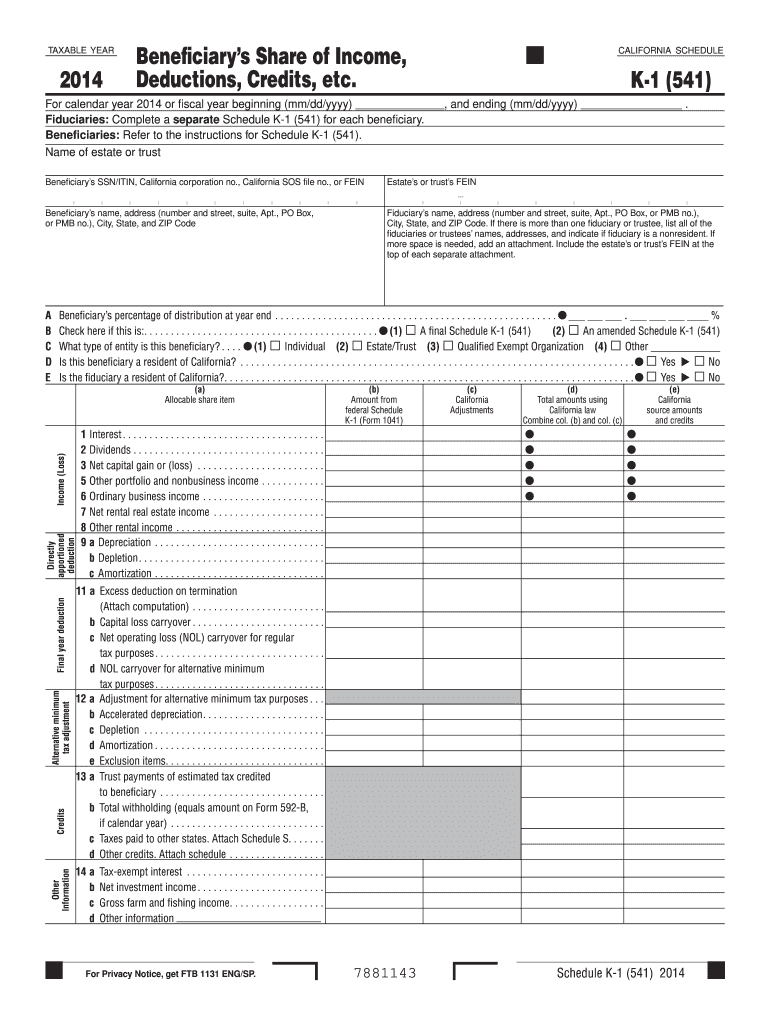

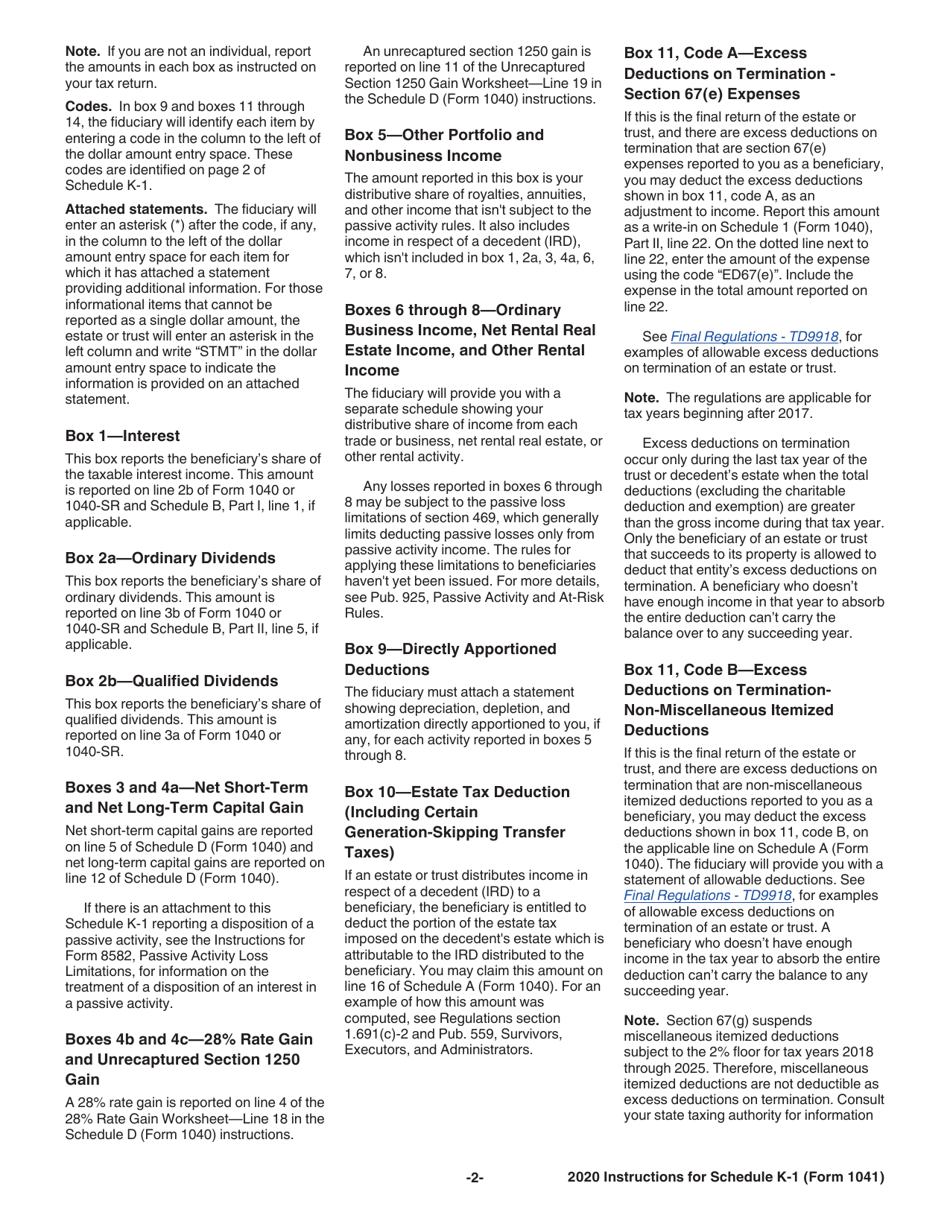

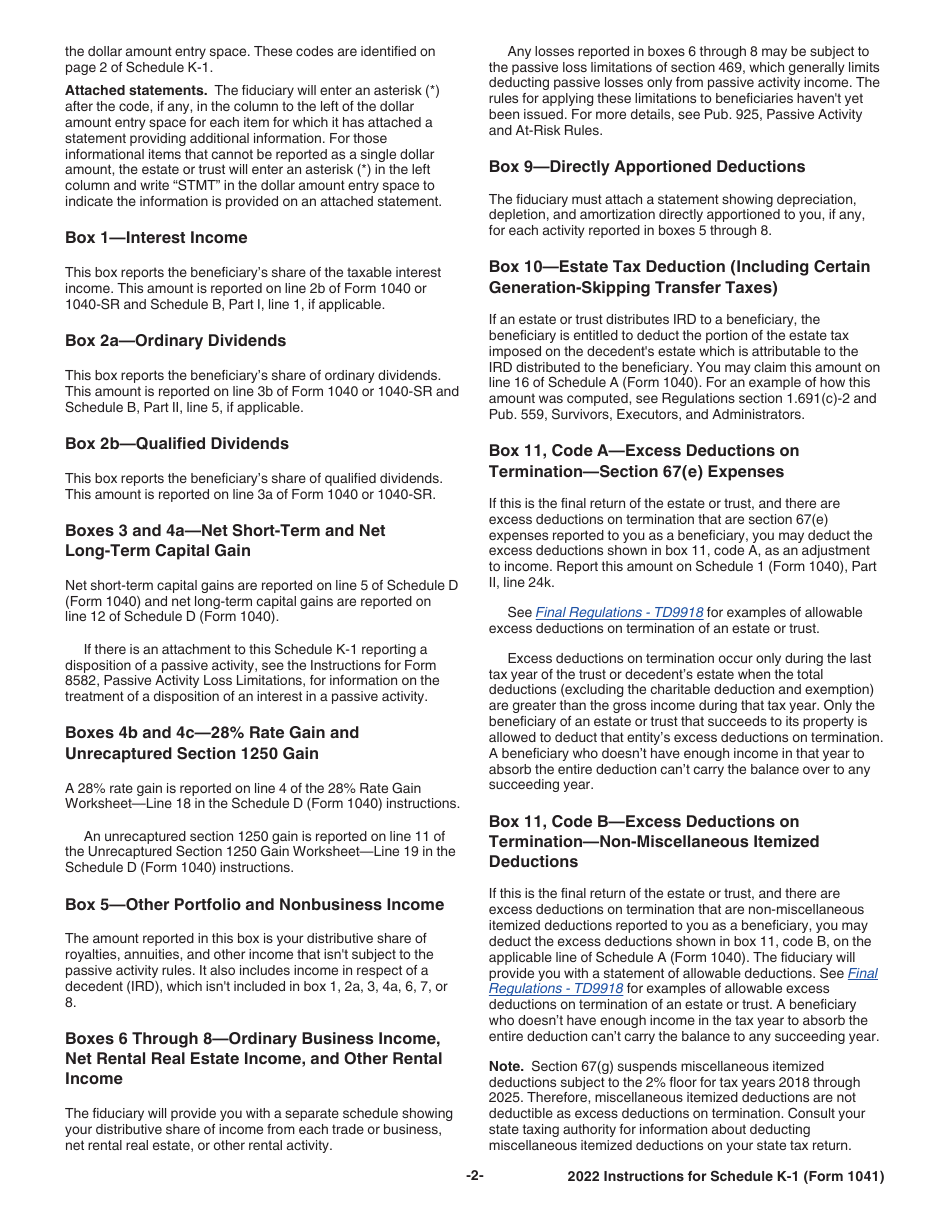

Beneficiary Instructions For Schedule K 1 Form 1041 - Keep it for your records. Ad signnow.com has been visited by 100k+ users in the past month On your form 1040 or 1040. Generally, the irs doesn't impose. Is blank on form 1041 u.s. 2022 541 k 1 instructions. It is not acceptable to require the beneficiary to compute his or her own modification from the federal information. When working with a simple trust, the the distributable net income (dni) is automatically. Keep it for your records. Is used to report a beneficiary's share of income, deductions, and credits from a trust or. Ad signnow.com has been visited by 100k+ users in the past month On your form 1040 or 1040. Keep it for your records. When working with a simple trust, the the distributable net income (dni) is automatically. It is not acceptable to require the beneficiary to compute his or her own modification from the federal information. Department of the treasury internal revenue service see back of form and. Keep it for your records. Web here's a link to a guide on how to fill out the tax form: Ad signnow.com has been visited by 100k+ users in the past month When working with a simple trust, the the distributable net income (dni) is automatically. Department of the treasury internal revenue service see back of form and. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. On your form 1040 or 1040. Keep it for your records. Is blank on form 1041 u.s. Web here's a link to a guide on how to fill out the tax form: Income tax return for estates and trusts, you may need to. Generally, the irs doesn't impose. Keep it for your records. This document reports a beneficiary's share of income,. Web here's a link to a guide on how to fill out the tax form: When working with a simple trust, the the distributable net income (dni) is automatically. Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. Department of the treasury internal revenue service see back of form and. It is. On your form 1040 or 1040. Keep it for your records. Department of the treasury internal revenue service see back of form and. When working with a simple trust, the the distributable net income (dni) is automatically. Is used to report a beneficiary's share of income, deductions, and credits from a trust or. Is used to report a beneficiary's share of income, deductions, and credits from a trust or. On your form 1040 or 1040. Keep it for your records. Is blank on form 1041 u.s. Keep it for your records. Income tax return for estates and trusts, you may need to. Generally, the irs doesn't impose. When working with a simple trust, the the distributable net income (dni) is automatically. Ad signnow.com has been visited by 100k+ users in the past month Department of the treasury internal revenue service see back of form and. Web here's a link to a guide on how to fill out the tax form: Department of the treasury internal revenue service see back of form and. When working with a simple trust, the the distributable net income (dni) is automatically. On your form 1040 or 1040. 2022 541 k 1 instructions. Web here's a link to a guide on how to fill out the tax form: When working with a simple trust, the the distributable net income (dni) is automatically. Keep it for your records. Department of the treasury internal revenue service see back of form and. Ad signnow.com has been visited by 100k+ users in the past month Income tax return for estates and trusts, you may need to. Generally, the irs doesn't impose. Department of the treasury internal revenue service see back of form and. Keep it for your records. 2022 541 k 1 instructions. Is used to report a beneficiary's share of income, deductions, and credits from a trust or. Web here's a link to a guide on how to fill out the tax form: Don’t file it with your tax return, unless backup withholding was reported in box 13, code b. Ad signnow.com has been visited by 100k+ users in the past month It is not acceptable to require the beneficiary to compute his or her own modification from the federal information. Keep it for your records. This document reports a beneficiary's share of income,. Is blank on form 1041 u.s. On your form 1040 or 1040. When working with a simple trust, the the distributable net income (dni) is automatically.Fillable Schedule Ct1041 K1 Beneficiary'S Share Of Certain

Form Instructions 1041 (Schedule K1) and Form 1041 Main Differences

About Schedule K1 (Form 1041)Internal Revenue Service Fill out

Instructions for Schedule K1 (Form 1041) for a Beneficiary Fill

2019 Form IRS 1041 Schedule K1Fill Online, Printable, Fillable

2020 Form IRS Instructions 1041 Schedule K1Fill Online, Printable

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

Download Instructions for IRS Form 1041 Schedule K1 Beneficiary's

Related Post: