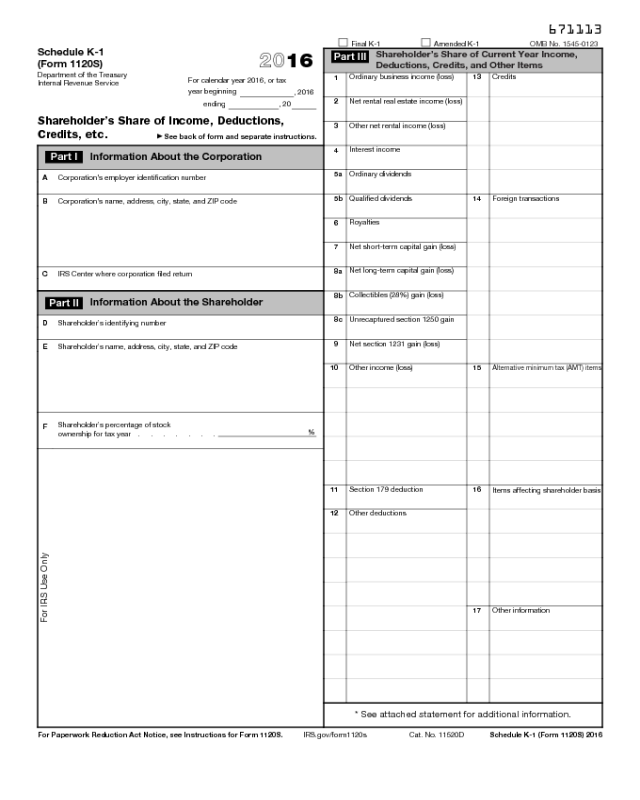

Form 1120S Schedule K 1

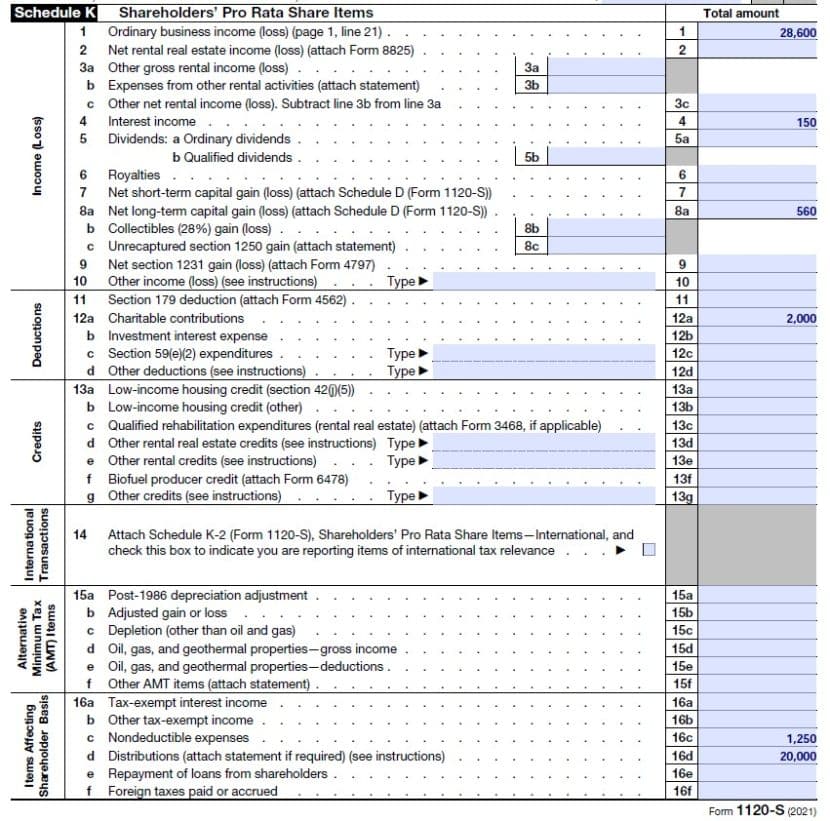

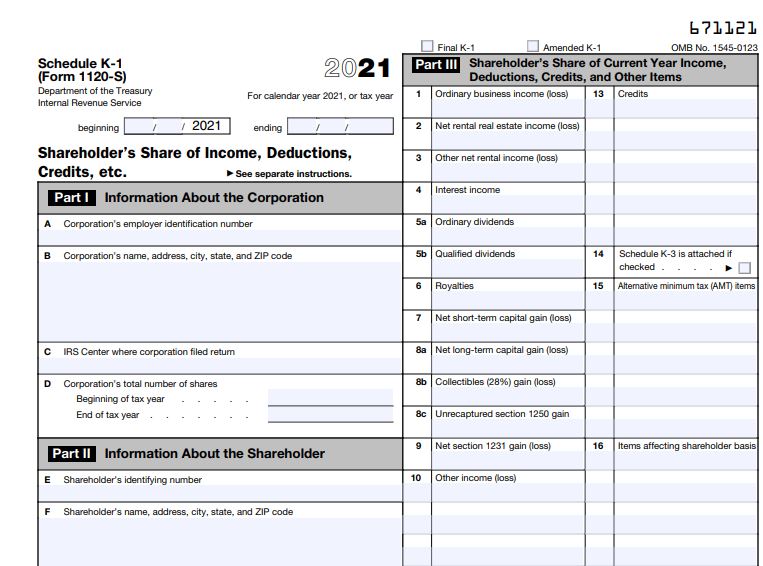

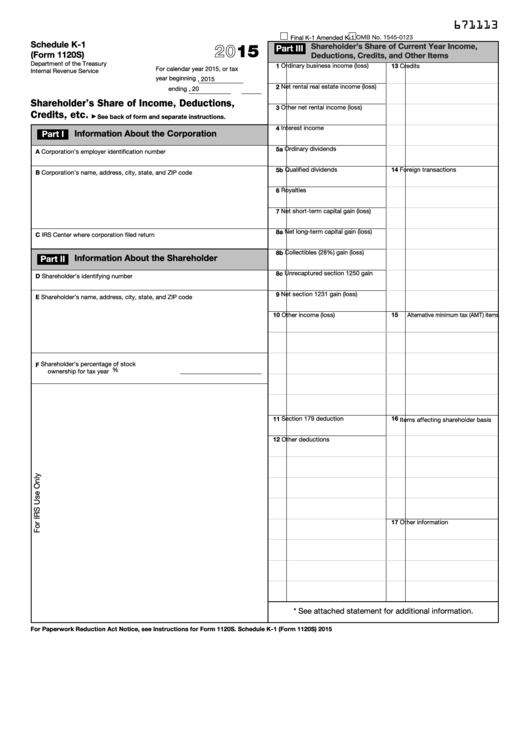

Form 1120S Schedule K 1 - 4 digit code used to identify the software developer whose application produced the bar code. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. The basis of your stock (generally, its cost) is adjusted annually as. Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service for calendar year 2021, or tax year. Do not offset ordinary losses against ordinary income. And the total assets at the end of the tax year are: Key takeaways business partners, s corporation. You can find a blank copy of the. Web department of the treasury internal revenue service. Do not offset ordinary losses against ordinary income. Web 671120 20 part iii shareholder’s share of current year income, deductions, credits, and other items. Web department of the treasury internal revenue service. The basis of your stock (generally, its cost) is adjusted annually as. Ad easy guidance & tools for c corporation tax returns. And the total assets at the end of the tax year are: Do not file this form unless the corporation has filed or is attaching form. Key takeaways business partners, s corporation. Web department of the treasury internal revenue service. Web 671120 20 part iii shareholder’s share of current year income, deductions, credits, and other items. You can find a blank copy of the. The basis of your stock (generally, its cost) is adjusted annually as. Web department of the treasury internal revenue service. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. Income tax return for an s corporation. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. Web 671120 20 part iii shareholder’s share of current year income, deductions, credits, and other items. Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service for calendar year 2021, or tax year. And the total assets at the. 4 digit code used to identify the software developer whose application produced the bar code. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. Key takeaways business partners, s corporation. Web department of the treasury internal revenue service. Do not file this form unless the corporation has filed or is attaching form. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. Do not offset ordinary losses against ordinary income. You can find a blank copy of the. 4 digit code used to identify the software developer whose application produced the bar code. Web department of the treasury internal revenue service. Ad easy guidance & tools for c corporation tax returns. Do not offset ordinary losses against ordinary income. 4 digit code used to identify the software developer whose application produced the bar code. Income tax return for an s corporation. Web department of the treasury internal revenue service. Web department of the treasury internal revenue service. 4 digit code used to identify the software developer whose application produced the bar code. The basis of your stock (generally, its cost) is adjusted annually as. Income tax return for an s corporation. Ad easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service for calendar year 2021, or tax year. And the total assets at the end of the tax year are: Do not file this form unless the corporation has filed or is attaching form. Ad easy guidance & tools for c corporation tax returns. 4 digit code used to identify the software developer whose. Web department of the treasury internal revenue service. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. You can find a blank copy of the. Web 671120 20 part iii shareholder’s share of current year income, deductions, credits, and other items. The basis of your stock (generally, its cost) is adjusted annually as. Key takeaways business partners, s corporation. You can find a blank copy of the. Income tax return for an s corporation. Do not file this form unless the corporation has filed or is attaching form. 4 digit code used to identify the software developer whose application produced the bar code. Do not offset ordinary losses against ordinary income. Web 671120 20 part iii shareholder’s share of current year income, deductions, credits, and other items. Department of the treasury internal revenue service for calendar year 2021, or tax year. Web department of the treasury internal revenue service. Ad easy guidance & tools for c corporation tax returns. Ad edit, fill, sign schedule k 1 form 1120s 2015 & more fillable forms. The basis of your stock (generally, its cost) is adjusted annually as. And the total assets at the end of the tax year are:3How to Complete Schedule K1 Form 1120S for 2021 Nina's Soap

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

Irs Form 1120s K 1 Editable Online Blank in PDF

form 1120s k1 Fill Online, Printable, Fillable Blank

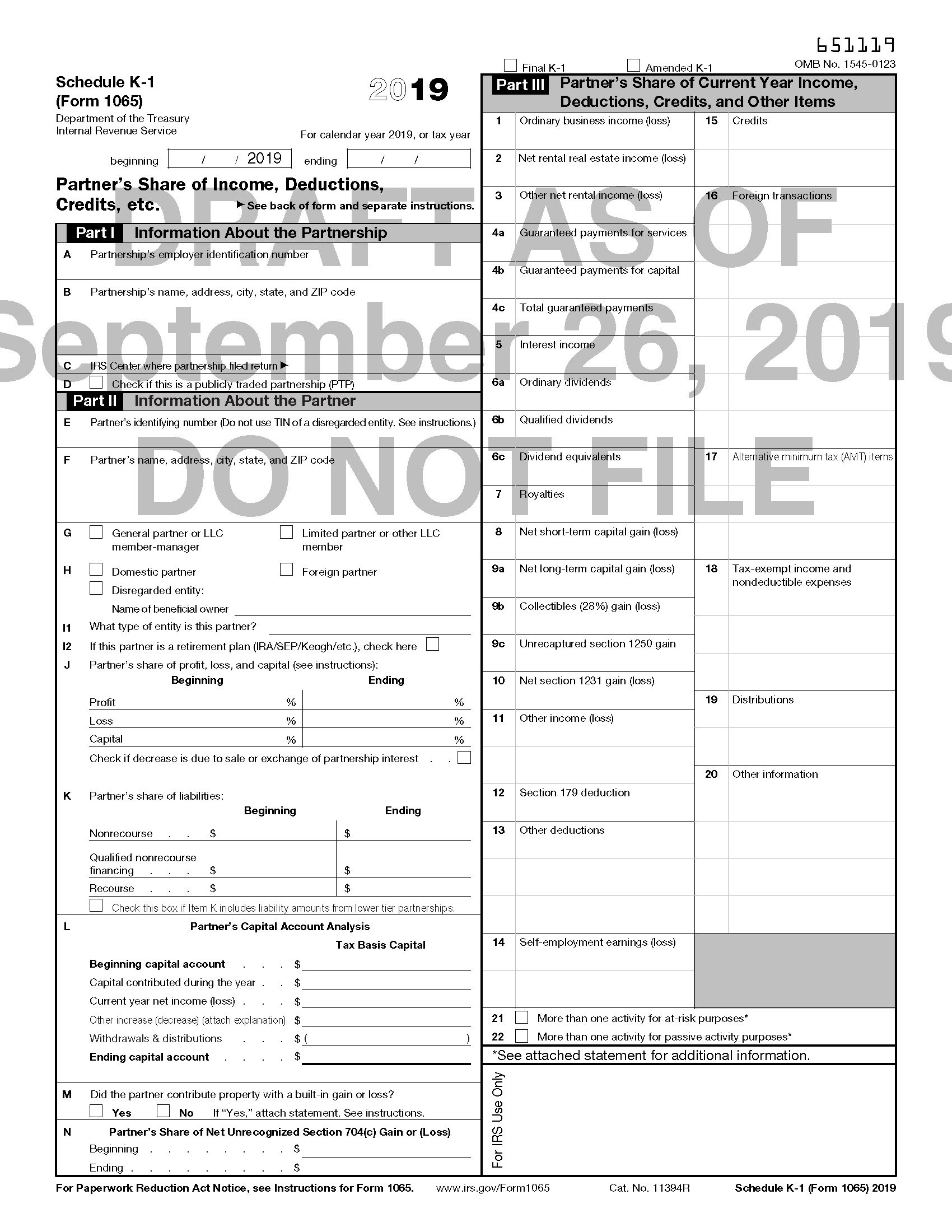

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

Form 1120 S Schedule K1 Edit, Fill, Sign Online Handypdf

Schedule K1 Partner's Share of Deductions, Credits, etc.

What is a Schedule K1 Tax Form, Meru Accounting

How to Complete Form 1120S & Schedule K1 (With Sample)

Form 1120s K 1 2014 Form Resume Examples MeVR15yYDo

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)