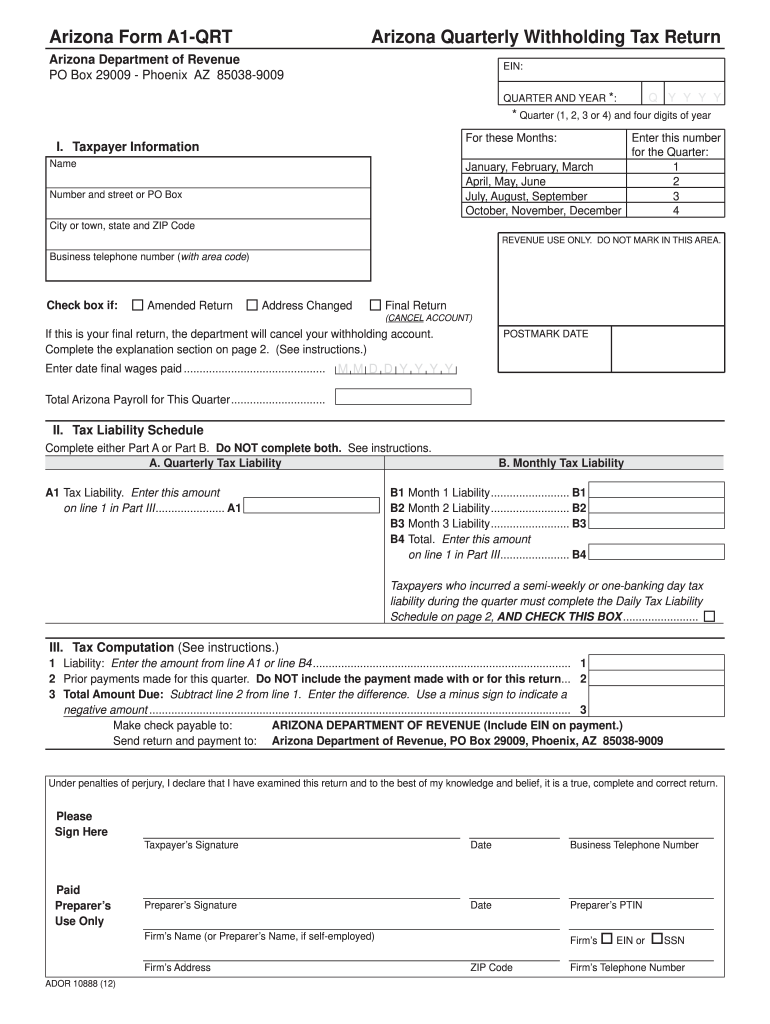

A1-Qrt Form

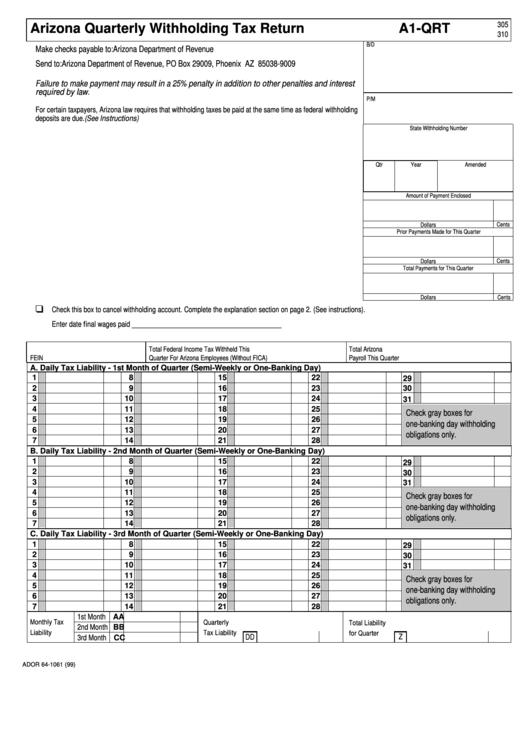

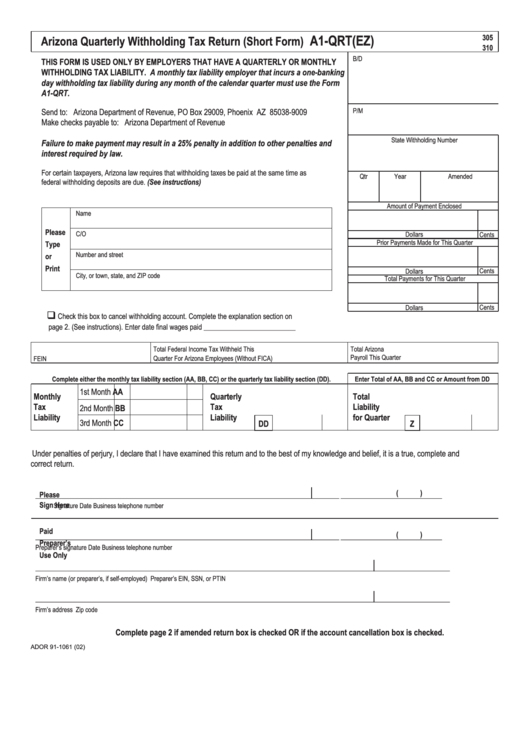

A1-Qrt Form - All withholding returns are required to be filed electronically starting with returns for periods beginning in 2020 or when the department has an. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the. Employers that remit arizona income tax on any of the following. Open form follow the instructions. Payment by eft may be required. An employer must withhold arizona income tax from. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Arizona quarterly withholding tax return. Web arizona quarterly withholding tax return. Arizona quarterly withholding tax return:. It appears you don't have a pdf plugin for this browser. Web handy tips for filling out a1 qrt form online. Arizona quarterly withholding tax return. Easily sign the form with your finger. Q y y y y. Send filled & signed form or. All withholding returns are required to be filed electronically starting with returns for periods beginning in 2020 or when the department has an. Go digital and save time with signnow, the best solution for. Arizona — arizona quarterly withholding tax return. Q y y y y. Web arizona quarterly withholding tax return. Printing and scanning is no longer the best way to manage documents. Web arizona quarterly withholding tax return. An employer must withhold arizona income tax from. Q y y y y. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Employers that remit arizona income tax on any of the following. Payment by eft may be required. Web handy tips for filling out a1 qrt form online. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Payroll service providers registered with arizona can upload electronic files containing. Employers that remit arizona income tax on any of the following. All withholding returns are required to be filed electronically starting with. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. *quarter (1, 2, 3 or 4) and four digits of year. Send filled & signed form or. Web arizona quarterly withholding tax return. Payroll service providers registered with arizona can upload electronic files containing. Go digital and save time with signnow, the best solution for. Easily sign the form with your finger. Web arizona quarterly withholding tax return. Arizona — arizona quarterly withholding tax return. Payment by eft may be required. Payroll service providers registered with arizona can upload electronic files containing. Printing and scanning is no longer the best way to manage documents. Arizona — arizona quarterly withholding tax return. It appears you don't have a pdf plugin for this browser. Open form follow the instructions. Send filled & signed form or. Arizona quarterly withholding tax return:. Employers that remit arizona income tax on any of the following. Web arizona quarterly withholding tax return. Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the. *quarter (1, 2, 3 or 4) and four digits of year. Easily sign the form with your finger. We last updated the arizona quarterly withholding tax return in august 2022, so this is the. Payment by eft may be required. Web arizona quarterly withholding tax return. Web arizona quarterly withholding tax return. Web handy tips for filling out a1 qrt form online. Send filled & signed form or. Easily sign the form with your finger. It appears you don't have a pdf plugin for this browser. Payroll service providers registered with arizona can upload electronic files containing. Go digital and save time with signnow, the best solution for. Web arizona quarterly withholding tax return. Arizona quarterly withholding tax return. Printing and scanning is no longer the best way to manage documents. Updated 10 months ago by greg hatfield. Open form follow the instructions. Arizona quarterly withholding tax return:. Used by employers to reconcile the amount (s) of arizona income tax withheld and deposited with the. All withholding returns are required to be filed electronically starting with returns for periods beginning in 2020 or when the department has an. Arizona — arizona quarterly withholding tax return. Employer identification number (ein) quarter and year*: An employer must withhold arizona income tax from. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Employers that remit arizona income tax on any of the following.Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

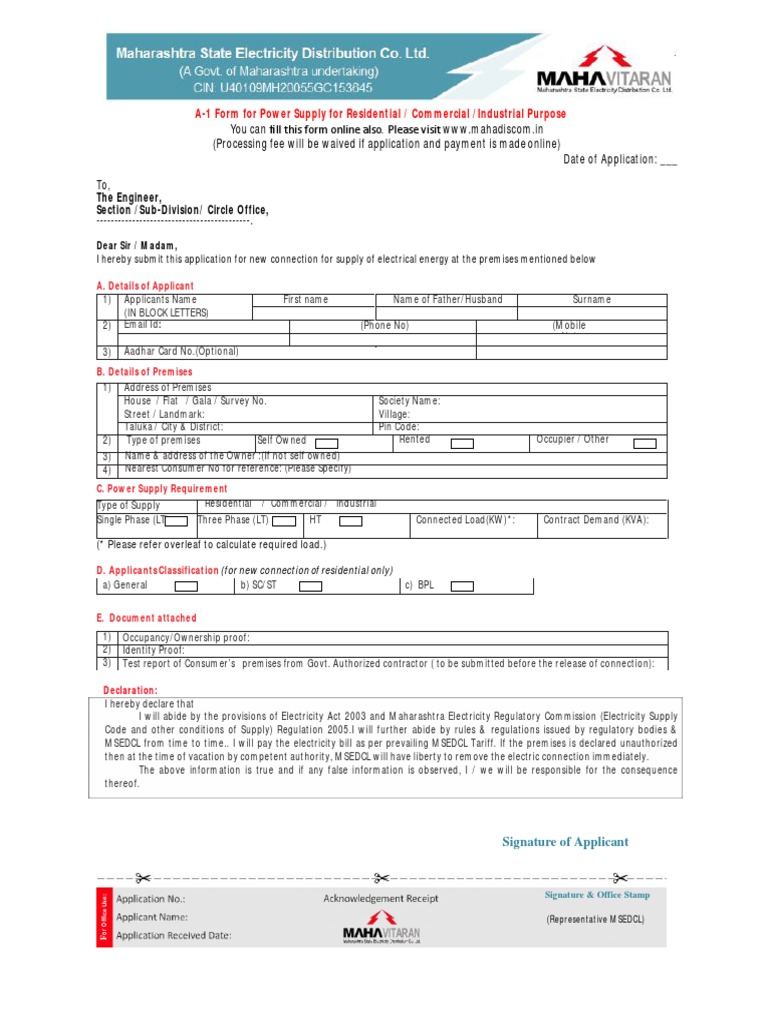

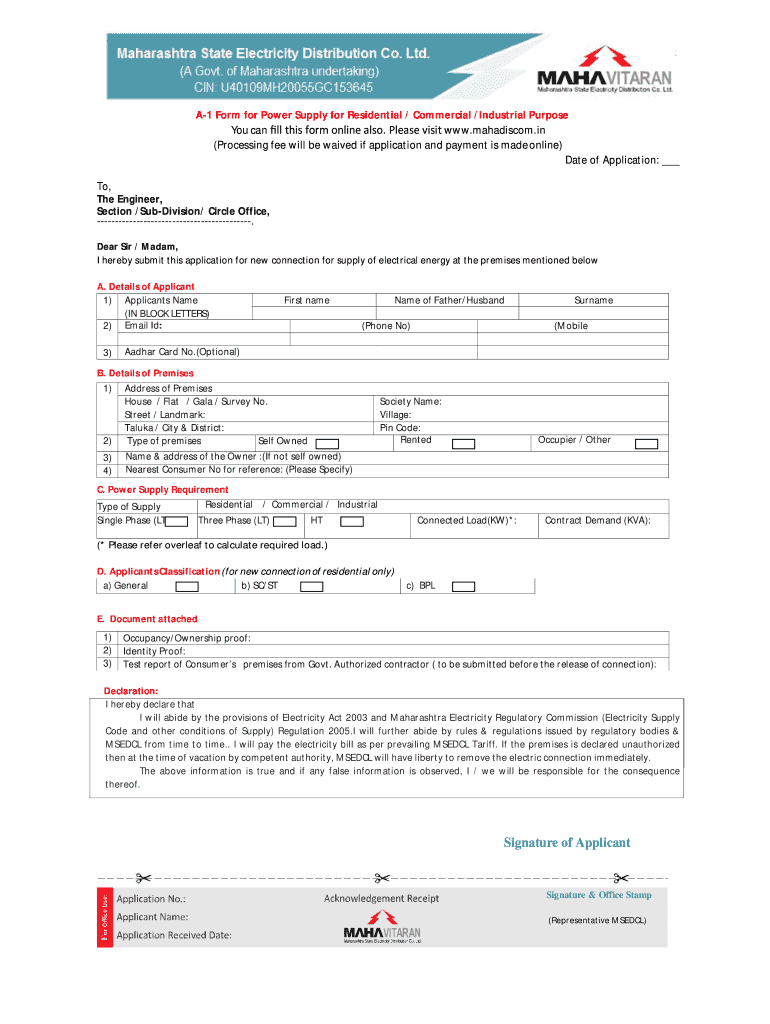

1.a1 Form Rci 21112017 PDF Identity Document Business

Form A1Qrt Arizona Quarterly Withholding Tax Return printable pdf

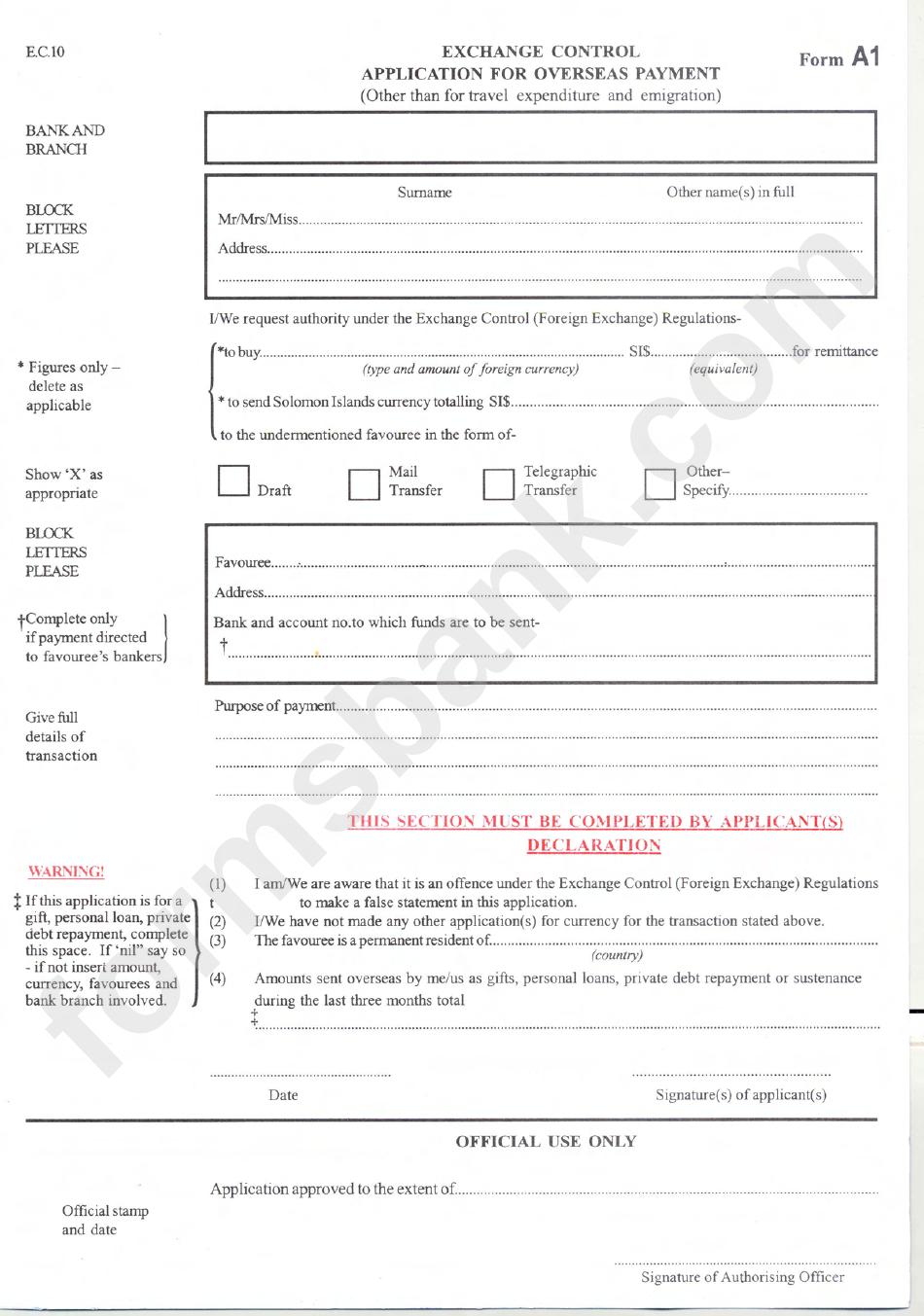

Form A1 Invoice Money

Mseb New Connection A1 Form Pdf 20202022 Fill and Sign Printable

FORM A1 (for Import Payment Only) (Application for Remittance In

Form A1Qrt(Ez) Arizona Quarterly Withholding Tax Return (Short Form

AZ ADOR A1QRT 2012 Fill out Tax Template Online US Legal Forms

Form A1 Application For Overseas Payment Exchange Control printable

Fillable Form A1 Qrt Printable Form, Templates and Letter

Related Post: