8944 Irs Form

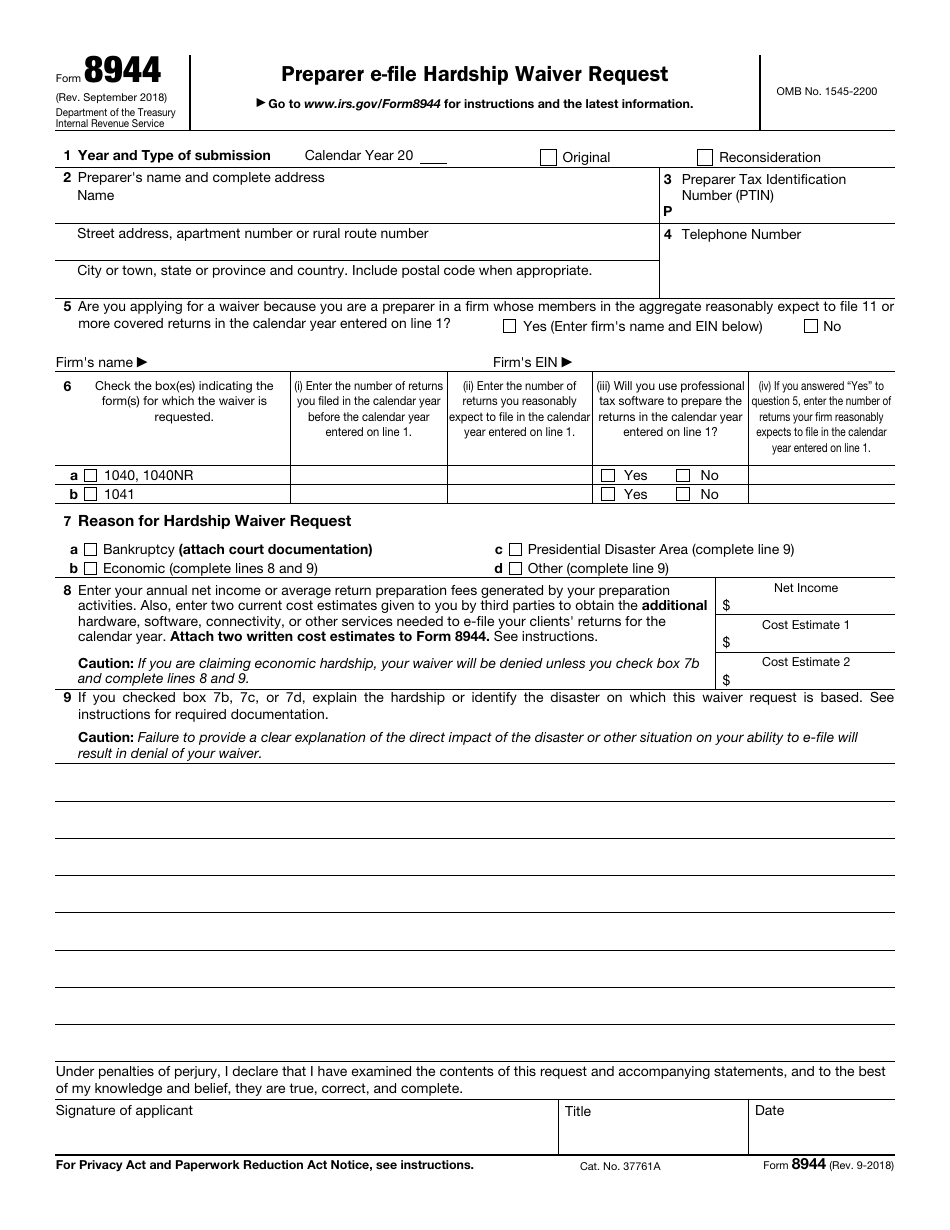

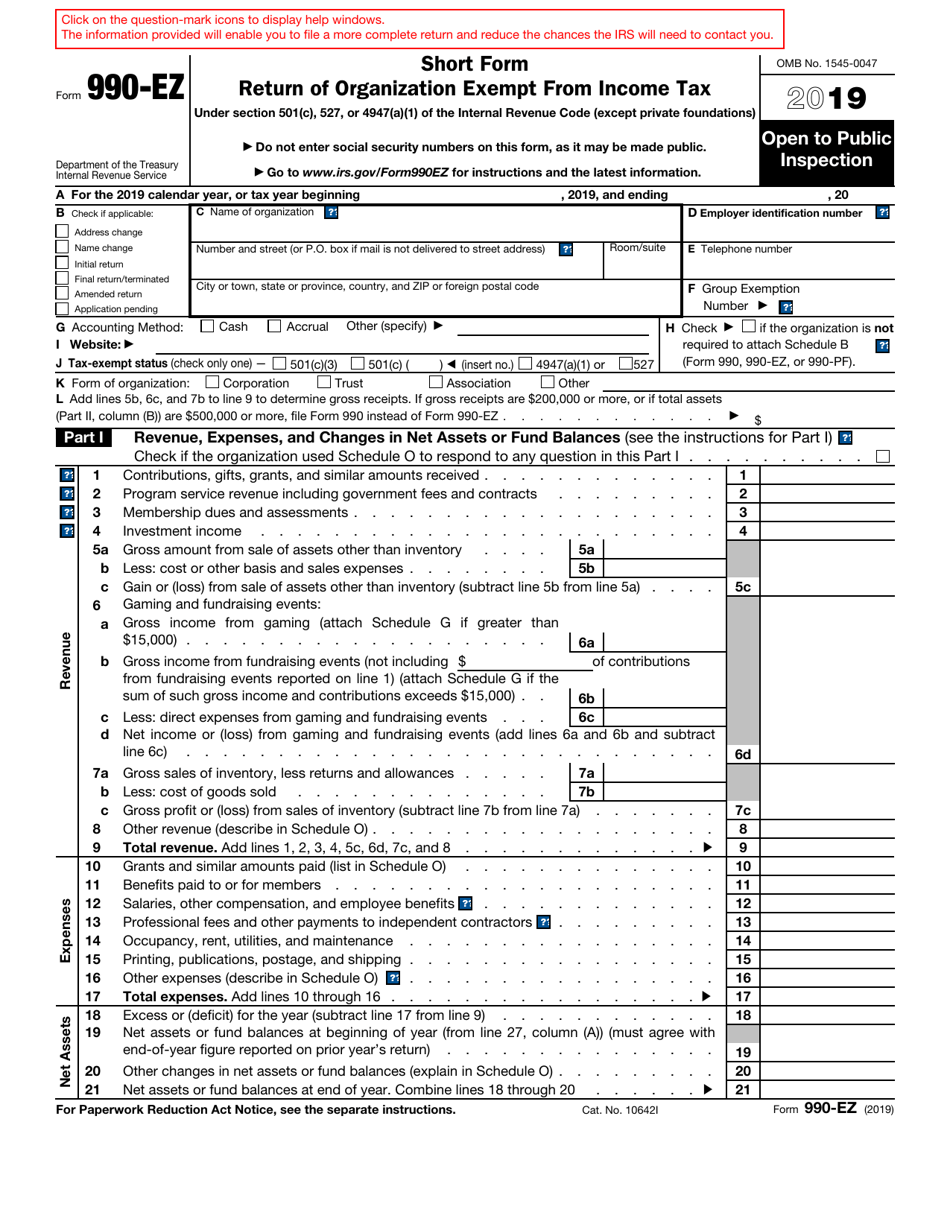

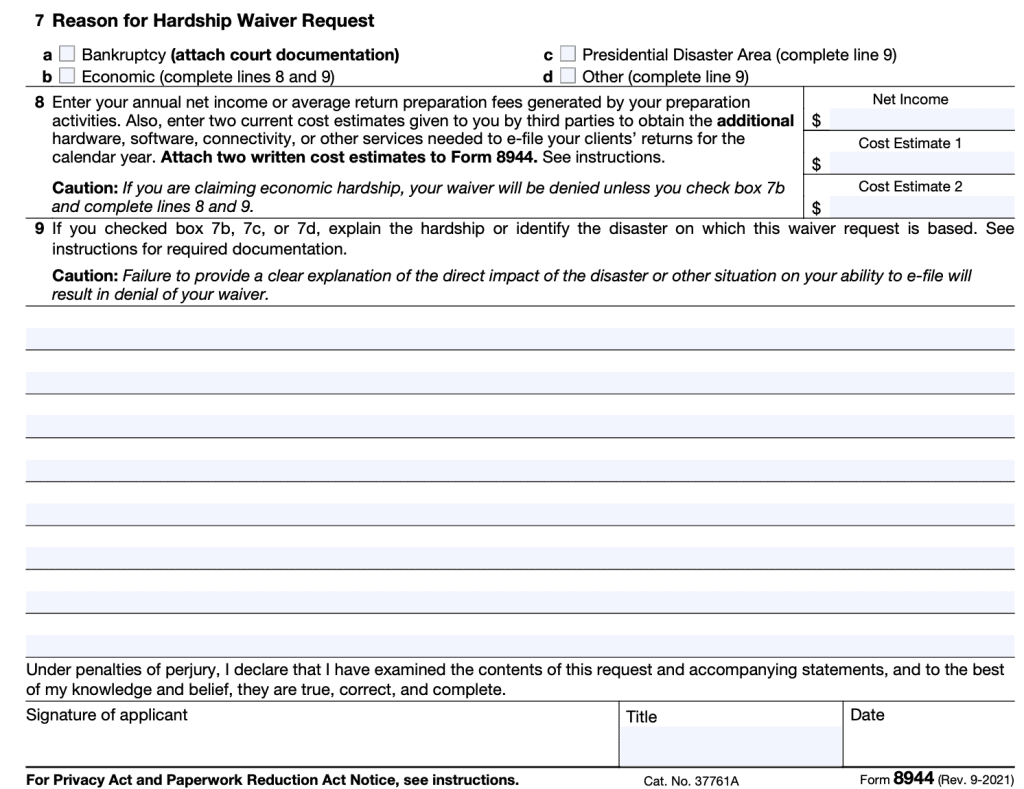

8944 Irs Form - Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Ad download or email irs 1040 & more fillable forms, register and subscribe now! You must file annual form 944 instead of filing quarterly forms 941. When the tax preparer cannot do. How do i prove financial hardship to the irs? Be sure the info you fill in form 8944 is updated and correct. Click the sign icon and create a. Specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of. Specified tax return preparers use this form to request an undue hardship waiver from the section. Ad thecountyoffice.com has been visited by 100k+ users in the past month Click the sign icon and create a. Who must file form 944. Ad iluvenglish.com has been visited by 10k+ users in the past month Web fill out each fillable area. Specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of. What to expect if you hire a tax return preparer who files this form with the irs; Web purpose of form specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of. Web specified tax return preparers use form 8944 to request an undue hardship waiver from the. Web department of the treasury — internal revenue service. You must file annual form 944 instead of filing quarterly forms 941. Click the sign icon and create a. Web department of the treasury — internal revenue service. What to expect if you hire a tax return preparer who files this form with the irs; You must file annual form 944 instead of filing quarterly forms 941. Ad outgrow.us has been visited by 10k+ users in the past month How do i prove a hardship to the irs? Web tax year 2023 940 mef ats scenario 3 crocus company. Ad thecountyoffice.com has been visited by 100k+ users in the past month You must file annual form 944 instead of filing quarterly forms 941. Click the sign icon and create a. What is the hardship form 8944? Web department of the treasury — internal revenue service. Web department of the treasury — internal revenue service. Web purpose of form specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of. Web department of the treasury — internal revenue service. Send filled & signed form or save. Web tax year 2023 940 mef ats scenario 3 crocus company. Web fill out each fillable area. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Be sure the info you fill in form 8944 is updated and correct. Open form follow the instructions. Web specified tax return preparers use form 8944 to. Web department of the treasury — internal revenue service. Send filled & signed form or save. Web instructions for form 944, employer's annual federal tax return 2022 11/16/2022 form 944: Who must file form 944. Web the internal revenue service requires most paid tax return preparers to file their clients’ federal income tax returns electronically. How do i prove a hardship to the irs? Ad download or email irs 1040 & more fillable forms, register and subscribe now! Web information about form 8948, preparer explanation for not filing electronically, including recent updates, related forms and instructions on how to file. Ad iluvenglish.com has been visited by 10k+ users in the past month How do i. Web this form is used to request a hardship waiver from the requirement to file individual (form 1040, form 1040a and form 1040ez), and estate and trust (form 10410) tax. Web information about form 8948, preparer explanation for not filing electronically, including recent updates, related forms and instructions on how to file. Employer's annual federal tax return 2022 11/16/2022 form. Ad download or email irs 1040 & more fillable forms, register and subscribe now! Web information about form 8948, preparer explanation for not filing electronically, including recent updates, related forms and instructions on how to file. Specified tax return preparers use this form to request an undue hardship waiver from the section. You must file annual form 944 instead of filing quarterly forms 941. Specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of. How do i prove a hardship to the irs? Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. When the tax preparer cannot do. You must file annual form 944 instead of filing quarterly forms 941. Web what irs form 8944 is used for; Easily sign the form with your finger. Web specified tax return preparers use form 8944 to request an undue hardship waiver from the section 6011(e)(3) requirement to electronically file returns of income tax imposed by. Click the sign icon and create a. Send filled & signed form or save. Web department of the treasury — internal revenue service. Open form follow the instructions. Ad outgrow.us has been visited by 10k+ users in the past month What a taxpayer should do instead of form. How do i prove financial hardship to the irs? Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form.Irs Form W4V Printable Printable W4v Form Master of

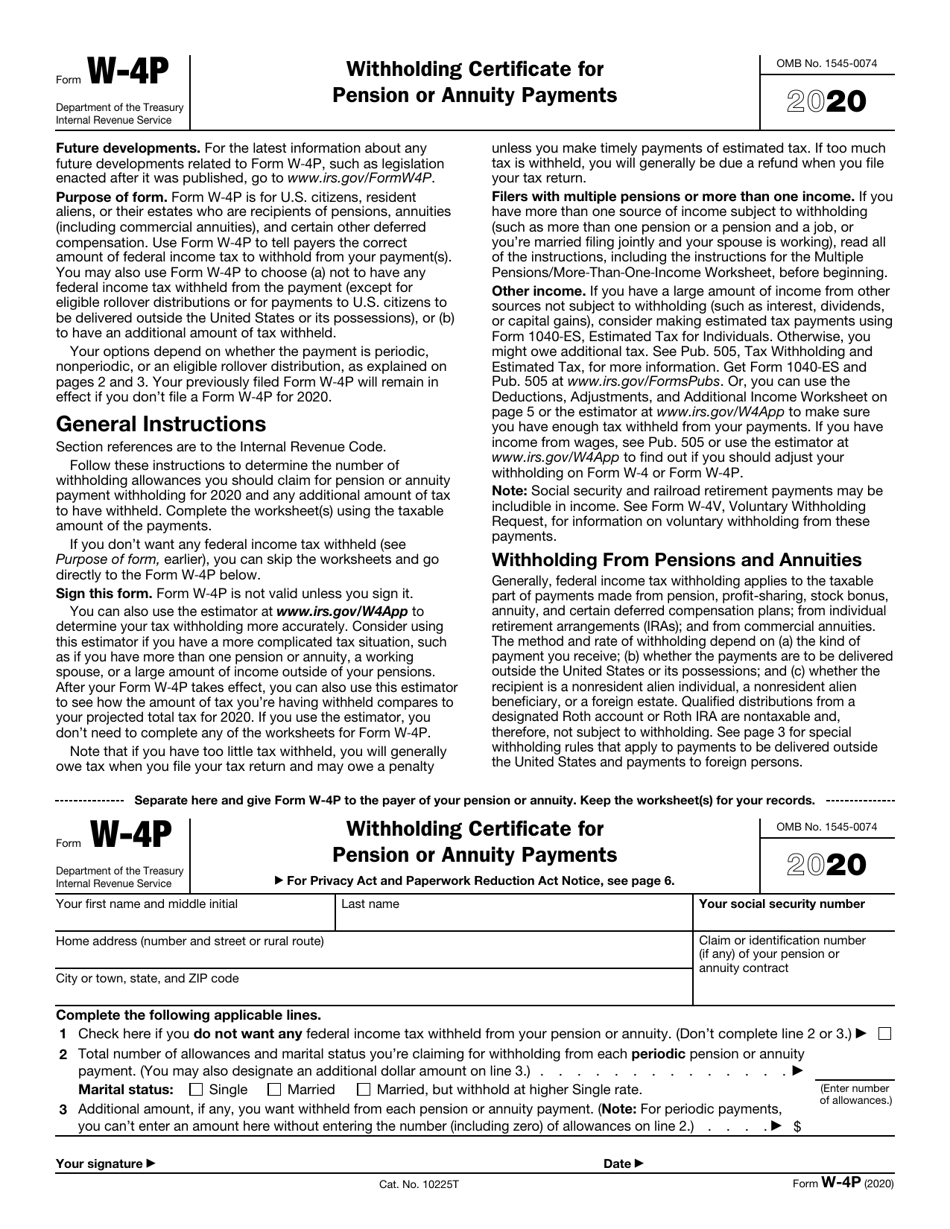

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

Irs Form W4V Printable Irs W 4p Pdffiller

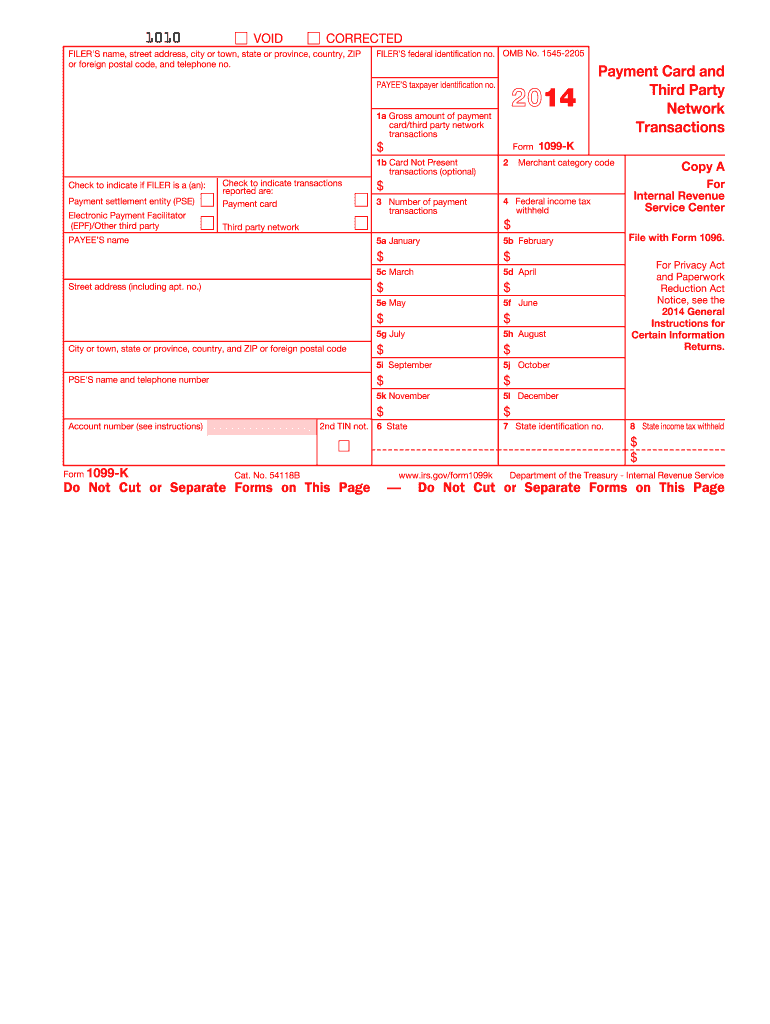

Internal Revenue Fill Online, Printable, Fillable, Blank pdfFiller

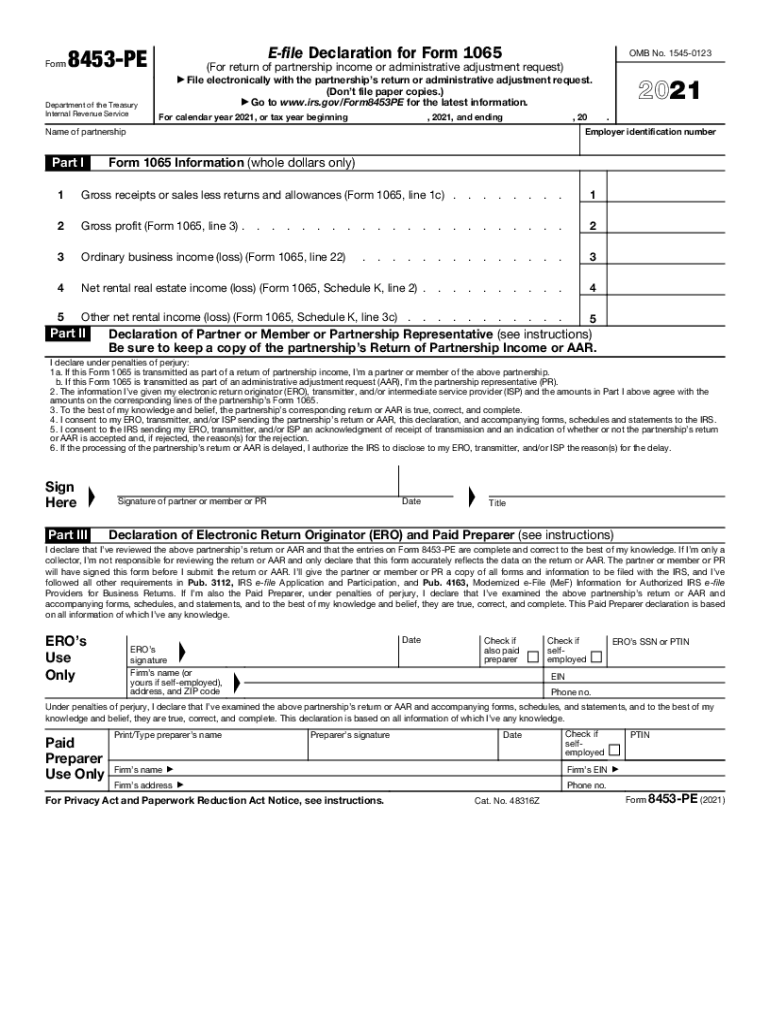

2021 Internal Revenue Service Form Fill Out and Sign Printable PDF

IRS Form 8944 Fill Out, Sign Online and Download Fillable PDF

Irs Form W4V Printable where do i mail my w 4v form for social

Fill Free fillable Form 8944 Preparer efile Hardship Waiver Request

IRS Form 8944 Preparer eFile Hardship Waiver Requests

Form 8944 Preparer efile Hardship Waiver Request (2014) Free Download

Related Post: