8915-F Form

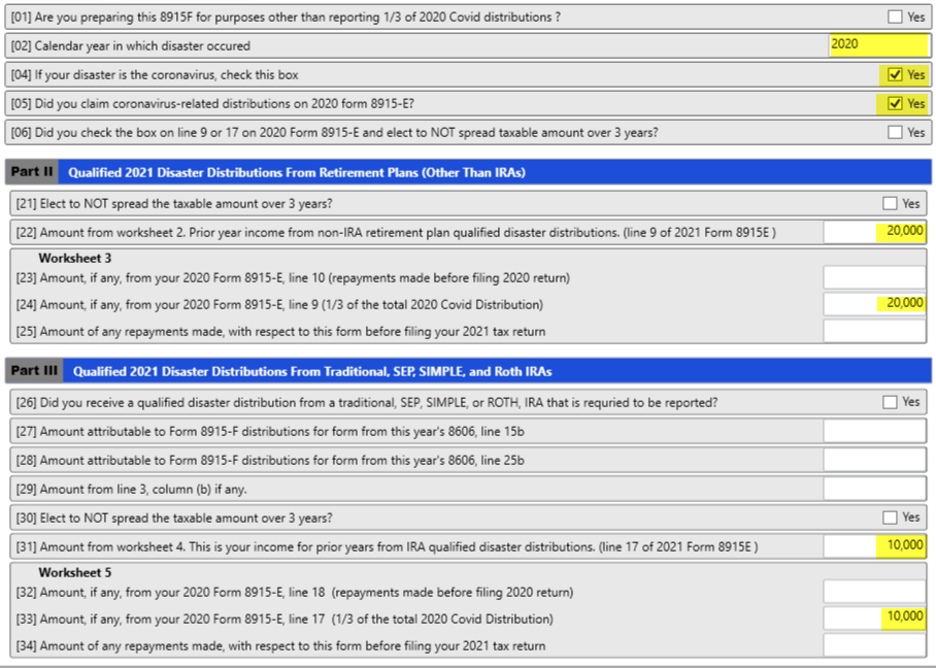

8915-F Form - There were no disaster distributions allowed in 2021. Screens for these forms can be. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web solved•by intuit•598•updated january 17, 2023. (january 2022) qualified disaster retirement plan distributions and repayments. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? It also allows you to spread the taxable portion of the. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. Web please download the february 2022 revision of the instructions pdf for the revised text. Web about form 8915, qualified disaster retirement plan distributions and repayments. Web about form 8915, qualified disaster retirement plan distributions and repayments. Web solved•by intuit•598•updated january 17, 2023. (january 2022) qualified disaster retirement plan distributions and repayments. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so. Web about form 8915, qualified disaster retirement plan distributions and repayments. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? Web solved•by intuit•598•updated january 17, 2023. You can choose to use worksheet 1b even if you are not required to do so. Web please download the february 2022 revision of the instructions pdf for. See worksheet 1b, later, to determine whether you must use worksheet 1b. (january 2022) qualified disaster retirement plan distributions and repayments. There were no disaster distributions allowed in 2021. It also allows you to spread the taxable portion of the. .2 qualified disaster distribution.2 qualified distribution for. You can choose to use worksheet 1b even if you are not required to do so. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. (january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to. Web solved•by intuit•598•updated january 17, 2023. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? There were no disaster distributions allowed in 2021. You can choose to use worksheet 1b even if you are not required to do so. Web when and where to file. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? Web about form 8915, qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. .2 qualified disaster distribution.2 qualified distribution for. See worksheet 1b, later, to determine whether you must use worksheet. Screens for these forms can be. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? Page last reviewed or updated: (january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web when and where to file. Starting in tax year 2022,. There were no disaster distributions allowed in 2021. Web about form 8915, qualified disaster retirement plan distributions and repayments. It also allows you to spread the taxable portion of the. (january 2022) qualified disaster retirement plan distributions and repayments. Starting in tax year 2022,. You can choose to use worksheet 1b even if you are not required to do so. Page last reviewed or updated: .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. There were no disaster distributions allowed in 2021. Page last reviewed or updated: Web when and where to file. Web please download the february 2022 revision of the instructions pdf for the revised text. (january 2022) qualified disaster retirement plan distributions and repayments. .2 qualified disaster distribution.2 qualified distribution for. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? Web about form 8915, qualified disaster retirement plan distributions and repayments. See worksheet 1b, later, to determine whether you must use worksheet 1b. Page last reviewed or updated: You can choose to use worksheet 1b even if you are not required to do so. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so. There were no disaster distributions allowed in 2021. Web solved•by intuit•598•updated january 17, 2023. Starting in tax year 2022,. There are instances when the projected availability date gets pushed back to ensure we've accurately incorporated the form into the turbotax. Screens for these forms can be. Web this takes some time. Web when and where to file. It also allows you to spread the taxable portion of the.Basic 8915F Instructions for 2021 Taxware Systems

8915e tax form instructions Somer Langley

8915 d form Fill out & sign online DocHub

About Form 8915F, Qualified Disaster Retirement Plan Distributions and

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

Where can I find the 8915 F form on the TurboTax app?

How To Report 2021 COVID Distribution On Taxes Update! Form 8915F

Form 8915 Qualified Hurricane Retirement Plan Distributions and

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

Related Post: