8885 Form Irs

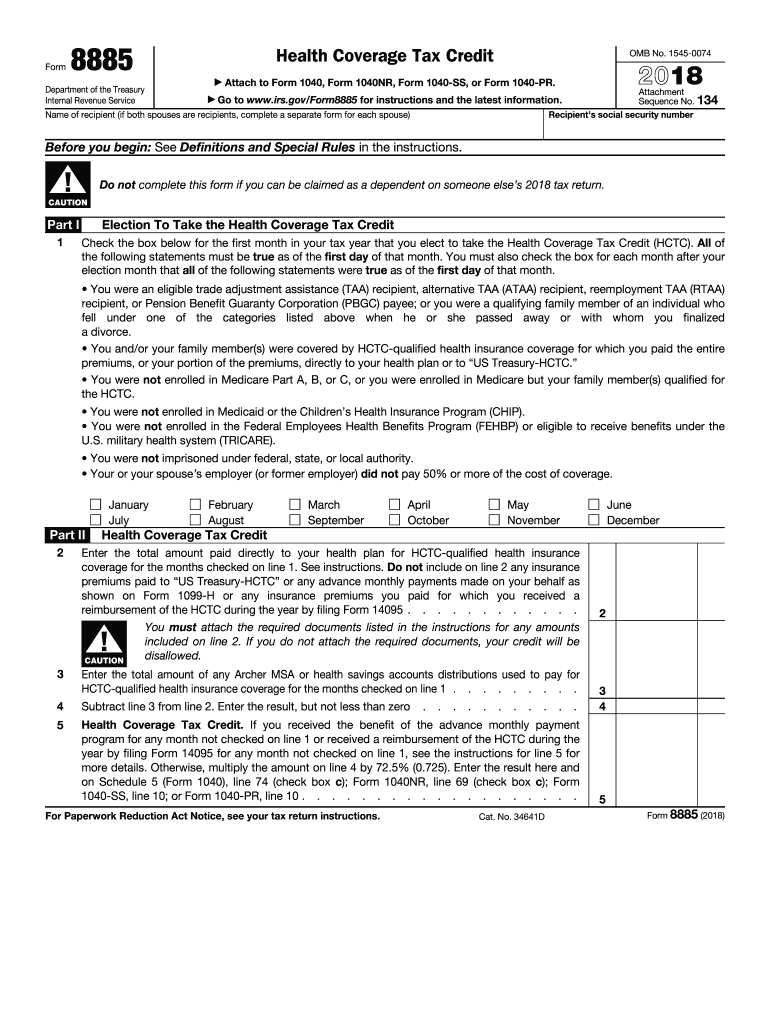

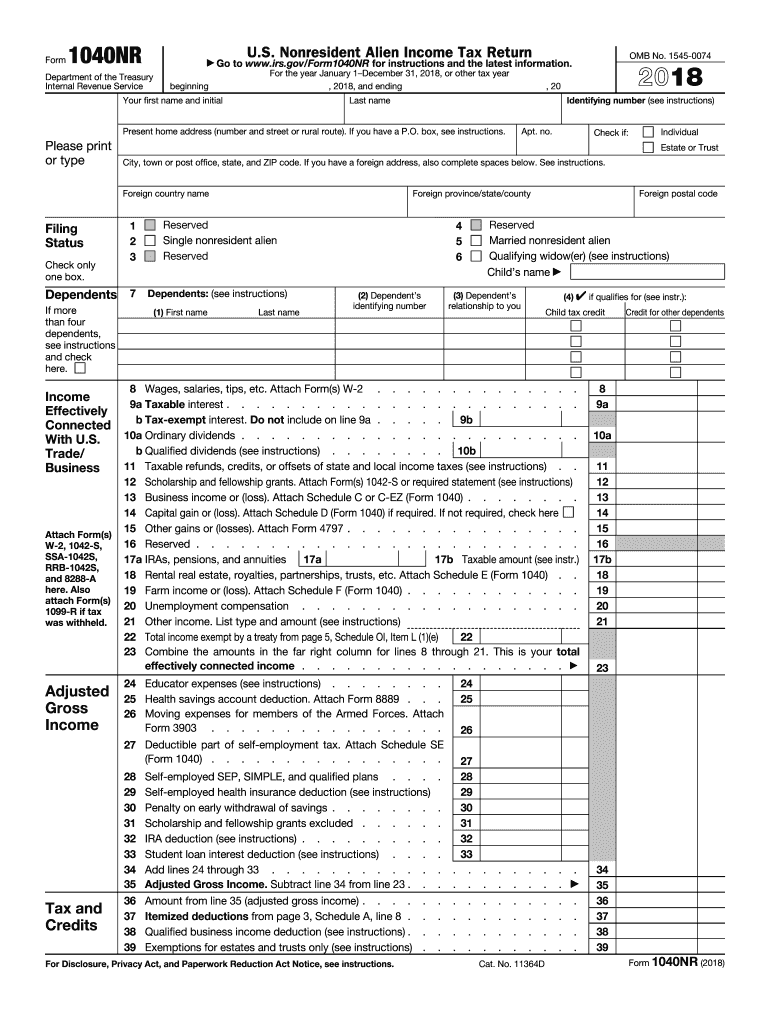

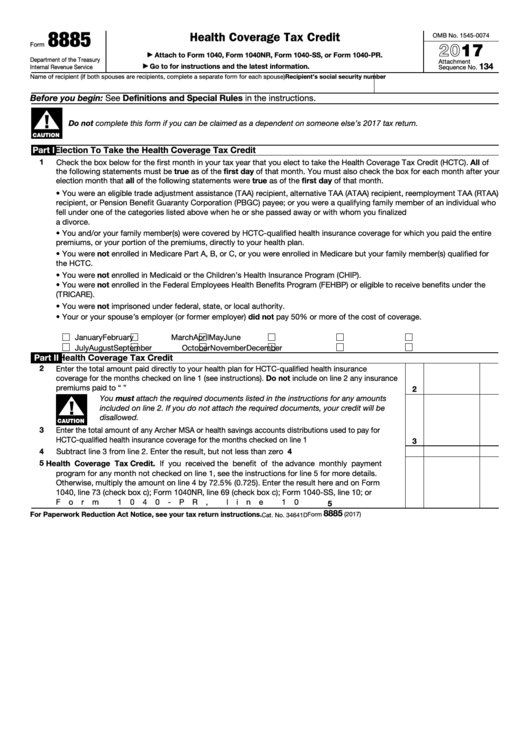

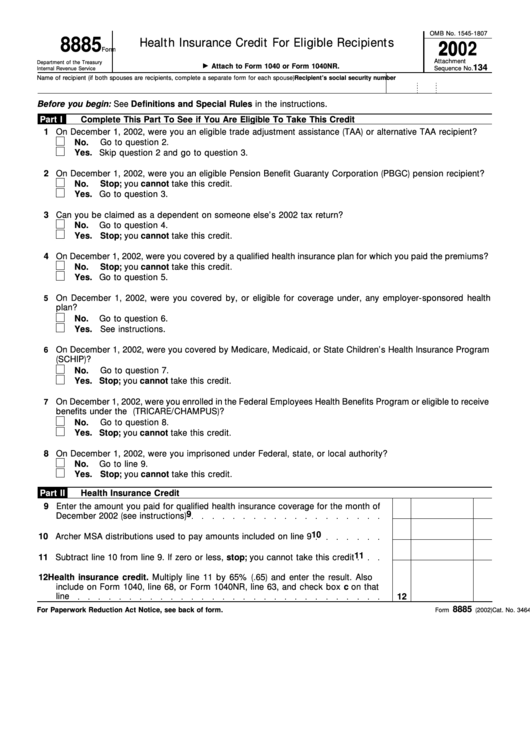

8885 Form Irs - Web what is the health coverage tax credit? When figuring the amount to enter on line 1 of the worksheet, do not include: To qualify for hctc, and have your form 8885 irs approved, you must meet at least the following criteria: Web use the 8885 screen in the health care folder to complete form 8885, health care coverage tax credit. In part ii you declare the total amount you paid directly to your qualified health. Enter x for each month the taxpayer and/or spouse qualify for the. Health savings accounts (hsas) 2022 10/31/2022 form 8888: Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Easily fill out pdf blank, edit, and sign them. Get ready for tax season deadlines by completing any required tax forms today. Almost every form and publication has a page on irs.gov with a friendly shortcut. Web what is the health coverage tax credit? In part ii you declare the total amount you paid directly to your qualified health. Health savings accounts (hsas) 2022 10/31/2022 form 8888: To qualify for hctc, and have your form 8885 irs approved, you must meet at. Web form 8885 instructions require supplement reflecting extension of health coverage tax credit under the further consolidated appropriations act, 2019, the irs. Web 3 add lines and 2. Web the 8885 tax form is the document used to claim this tax credit. Web do not complete this form if you can be claimed as a dependent on someone else’s 2018. Web part i of form 8885 establishes which months in the tax year you claim the hctc. Get ready for tax season deadlines by completing any required tax forms today. Web what is the health coverage tax credit? Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or. Part i election to take the health coverage tax credit. Complete, edit or print tax forms instantly. Ad we help get taxpayers relief from owed irs back taxes. Estimate how much you could potentially save in just a matter of minutes. Web what is form 8885 and how to use it? To access the form, you will need to open a 1040 return on the online/desktop and then go to add form/display and type 8885. Web instructions, and pubs is at irs.gov/forms. Health savings accounts (hsas) 2022 10/31/2022 form 8888: • any amounts you included on form 8885,. Web complete form 8885 before completing that worksheet. In part ii you declare the total amount you paid directly to your qualified health. The health coverage tax credit (hctc) was a refundable tax credit that paid 72.5% of qualified health insurance premiums for eligible. Web what is the health coverage tax credit? Web general instructions purpose of form use form 8885 to elect and figure the amount, if. Web use the 8885 screen in the health care folder to complete form 8885, health care coverage tax credit. Web use form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or. Get ready for tax season deadlines by completing. Enter x for each month the taxpayer and/or spouse qualify for the. Health savings accounts (hsas) 2022 10/31/2022 form 8888: Web they can’t be claimed as a dependent on someone else’s tax return for the year; Web the 8885 tax form is the document used to claim this tax credit. For example, the form 1040 page is at. Web 3 add lines and 2. • any amounts you included on form 8885,. Easily fill out pdf blank, edit, and sign them. Estimate how much you could potentially save in just a matter of minutes. Web the 8885 tax form is the document used to claim this tax credit. To qualify for hctc, and have your form 8885 irs approved, you must meet at least the following criteria: Web draft instructions for form 8885, health coverage tax credit, released november 17 to reflect that the health coverage tax credit expires after 2020. Save or instantly send your ready documents. When figuring the amount to enter on line 1 of. Web the 8885 tax form is the document used to claim this tax credit. Caution part i election to take the health coverage tax credit check the. Estimate how much you could potentially save in just a matter of minutes. Web draft instructions for form 8885, health coverage tax credit, released november 17 to reflect that the health coverage tax credit expires after 2020. Web what is the health coverage tax credit? • any amounts you included on form 8885,. For example, the form 1040 page is at. Enter x for each month the taxpayer and/or spouse qualify for the. Web instructions, and pubs is at irs.gov/forms. The health coverage tax credit (hctc) was a refundable tax credit that paid 72.5% of qualified health insurance premiums for eligible. Ad we help get taxpayers relief from owed irs back taxes. Web how to access the form: Web use the 8885 screen in the health care folder to complete form 8885, health care coverage tax credit. Web they can’t be claimed as a dependent on someone else’s tax return for the year; When figuring the amount to enter on line 1 of the worksheet, do not include: The main purpose of this tax form is to elect and figure the amount of your health coverage tax credit if there is any. Web complete form 8885 before completing that worksheet. To access the form, you will need to open a 1040 return on the online/desktop and then go to add form/display and type 8885. Web part i of form 8885 establishes which months in the tax year you claim the hctc. Easily fill out pdf blank, edit, and sign them.Form 8885 Health Coverage Tax Credit (2013) Free Download

Form 8885 Health Coverage Tax Credit (2013) Free Download

Fillable Online irs Form 8885 OMB No Fax Email Print pdfFiller

3.11.3 Individual Tax Returns Internal Revenue Service

20182022 Treasury Form 8885 Fill Online, Printable, Fillable, Blank

2018 Form IRS 1040NRFill Online, Printable, Fillable, Blank pdfFiller

Top 9 Irs Form 8885 Templates free to download in PDF format

Financial Concept Meaning Form 8885 Health Coverage Tax Credit with

Form 8885 Health Insurance Credit For Eligible Recipients 2002

Form 8885 Health Coverage Tax Credit (2013) Free Download

Related Post: