8862 Form Turbotax

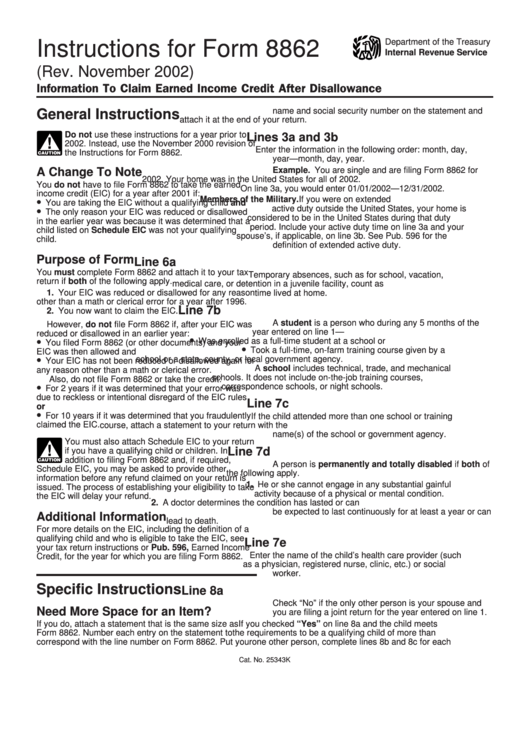

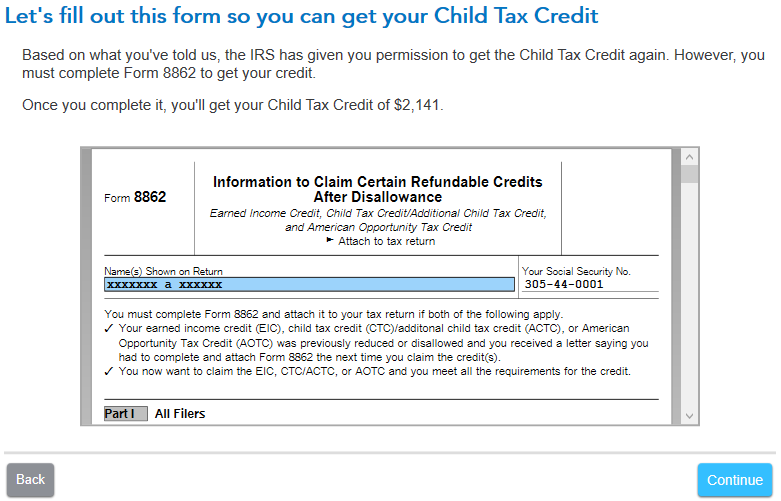

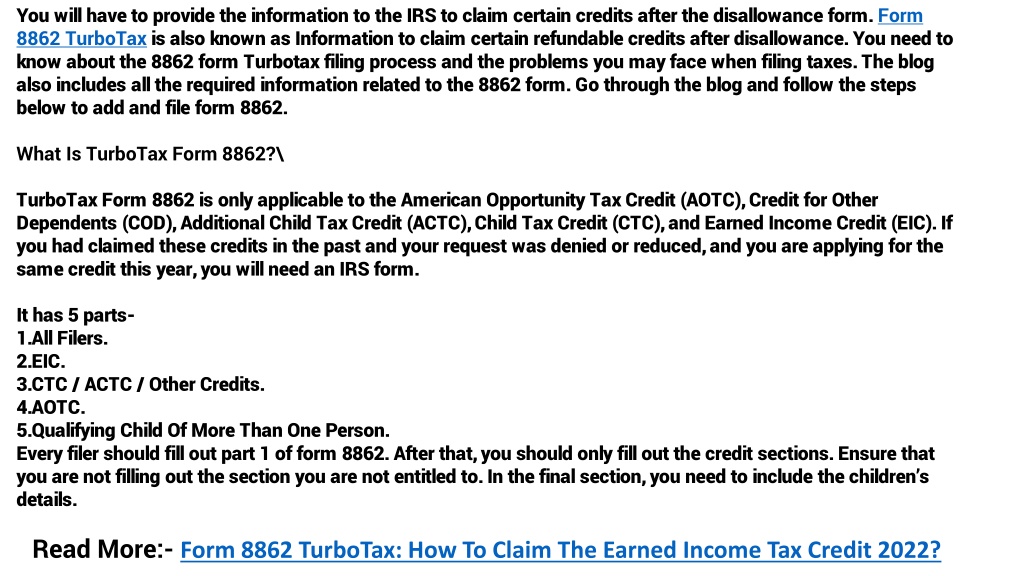

8862 Form Turbotax - Go to the input returntab. Turbotax can help you fill out your. Please see the faq link. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web to resolve this rejection, you'll need to add form 8862: Web 1 best answer. Web file form 8862. Child tax credit/additional child tax credit/credit for other dependents;. Web you'll need to add form 8862: Turbotax can help you fill out your. Web to resolve this rejection, you'll need to add form 8862: Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published,. Information to claim earned income credit after disallowance to your return. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web to resolve this rejection, you'll need to add form 8862: Web form 8862 is the form the irs requires. Enjoy smart fillable fields and interactivity. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Web you can use the steps below to help you get to where to fill out information for form 8862to add it to your tax return. Web to resolve this rejection, you'll need to. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Click on eic/ctc/aoc after disallowances. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Web how to fill out and sign form 8862. Web here's how to file form 8862 in turbotax. Enjoy smart fillable fields and interactivity. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web 1 best answer. Web how to fill out and sign form 8862 turbotax online? Turbotax can help you fill out your. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web to resolve this rejection, you'll need to add form 8862: Web how do i complete irs form 8862? Information to claim earned income credit after disallowance. Web you'll need to add form 8862: Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Web you can use the steps below to help you get to where to fill out information for form 8862to add it to your tax return. Web if. Web you can use the steps below to help you get to where to fill out information for form 8862to add it to your tax return. Web here's how to file form 8862 in turbotax. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior. Get your online template and fill it in using progressive features. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Web you'll need to add form 8862: In the earned income credit section when you see do. Child tax credit/additional child tax credit/credit for other dependents;. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical. Taxpayers complete form 8862 and attach it to their tax return if: Get your online template and fill it in using progressive features. Watch this turbotax guide to learn more.turbotax home:. Please see. In the earned income credit section when you see do. Enjoy smart fillable fields and interactivity. Web file form 8862. Web you'll need to add form 8862: Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Please see the faq link. Watch this turbotax guide to learn more.turbotax home:. Web 1,511 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Taxpayers complete form 8862 and attach it to their tax return if: Web 1 best answer. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Turbotax can help you fill out your. Click on eic/ctc/aoc after disallowances. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search,. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Go to the input returntab. Web here's how to file form 8862 in turbotax. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web how do i complete irs form 8862?Printable Irs Form 8862 Printable Forms Free Online

Form 8862 Pdf Fillable Printable Forms Free Online

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

how do i add form 8862 TurboTax® Support

PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

IRS Form 8962 Understanding Your Form 8962

Form 8862Information to Claim Earned Credit for Disallowance

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/04/file-08april-2-1024x536.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)