Turbotax Form 3115

Turbotax Form 3115 - Select jump to form 3115 4. Set up an irs payment plan. Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or makes. Pay the lowest amount of taxes possible with strategic planning and preparation At the right upper corner, in the search box, type in 3115 and enter 3. Solved•by intuit•24•updated july 27, 2023. Web yes, fax a copy of the form and the statement (separate from your return) to the irs. Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item. Turbotax allows you to complete and print this form in. To get form 8915b to show up in your print. Web common questions about form 3115 and regulation change. Web what is irs form 3115? Ad tax preparation services ordered online in less than 10 minutes. Web department of the treasury internal revenue service application for change in accounting method go to www.irs.gov/form3115 for instructions and the latest information. Until further notice, the irs is implementing the temporary procedure. Yes, that's exactly where it should go. Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web earned income tax credit (eic) child tax credit (ctc) student loan interest deduction situations not. Web taxpayers filing form 3115, application for change in accounting method, should follow new procedure. Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or makes. Pay the lowest amount of taxes possible with strategic planning and preparation At the right upper corner, in the search box,. Web common questions about form 3115 and regulation change. Solved•by intuit•24•updated july 27, 2023. Web in turbo tax basic,it'll come up automatically, depending on how you answer the questions about your ira distribution. At the right upper corner, in the search box, type in 3115 and enter 3. In general, you can only make a change in. Web what is irs form 3115? Web right from the start: Web taxpayers filing form 3115, application for change in accounting method, should follow new procedure. Regardless of the version of form 3115 used,. To get form 8915b to show up in your print. Web yes, fax a copy of the form and the statement (separate from your return) to the irs. Web if i fill out a form 3115 in turbo tax, does turbo tax bring the form 3115 amounts into the tax return to compute the tax? Pay the lowest amount of taxes possible with strategic planning and preparation Select jump to. Web level 15 you will have to purchase a desktop version of turbotax for form 3115 and, basically, start over with that version. Web taxpayers filing form 3115, application for change in accounting method, should follow new procedure. Web yes, fax a copy of the form and the statement (separate from your return) to the irs. Web if i fill. At the right upper corner, in the search box, type in 3115 and enter 3. Irs form 3115 form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Until further notice, the irs is implementing the temporary procedure. Web right from the start: Ad save time and money with professional tax. Solved•by intuit•24•updated july 27, 2023. Until further notice, the irs is implementing the temporary procedure. Yes, that's exactly where it should go. Web to get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. Pay the lowest amount of taxes possible with strategic planning and preparation Until further notice, the irs is implementing the temporary procedure. Web 1 best answer cindy0h new member unfortunately, turbotax does not support this form for efiling. Web earned income tax credit (eic) child tax credit (ctc) student loan interest deduction situations not covered: Also known as application for change in accounting method, irs form 3115 is required for any taxpayer. Solved•by intuit•24•updated july 27, 2023. Taxpayers filing forms 3115 after april 18, 2023, must use the december 2022 form 3115. Web right from the start: After sign into your account, select take me to my return 2. Pay the lowest amount of taxes possible with strategic planning and preparation Web yes, fax a copy of the form and the statement (separate from your return) to the irs. Web to get irs approval to change an accounting method, you'll need to file form 3115, application for change in accounting method. At the right upper corner, in the search box, type in 3115 and enter 3. Web form 3115 is used when you want to change your overall accounting method and also if you need to change the accounting treatment of any particular item. Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or makes. Web in turbo tax basic,it'll come up automatically, depending on how you answer the questions about your ira distribution. Web earned income tax credit (eic) child tax credit (ctc) student loan interest deduction situations not covered: Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. In general, you can only make a change in. Yes, that's exactly where it should go. Set up an irs payment plan. Web 1 best answer cindy0h new member unfortunately, turbotax does not support this form for efiling. Ad save time and money with professional tax planning & preparation services. Itemized deductions unemployment income reported on a 1099. Web common questions about form 3115 and regulation change.Instructions For Form 3115 Application For Change In Accounting

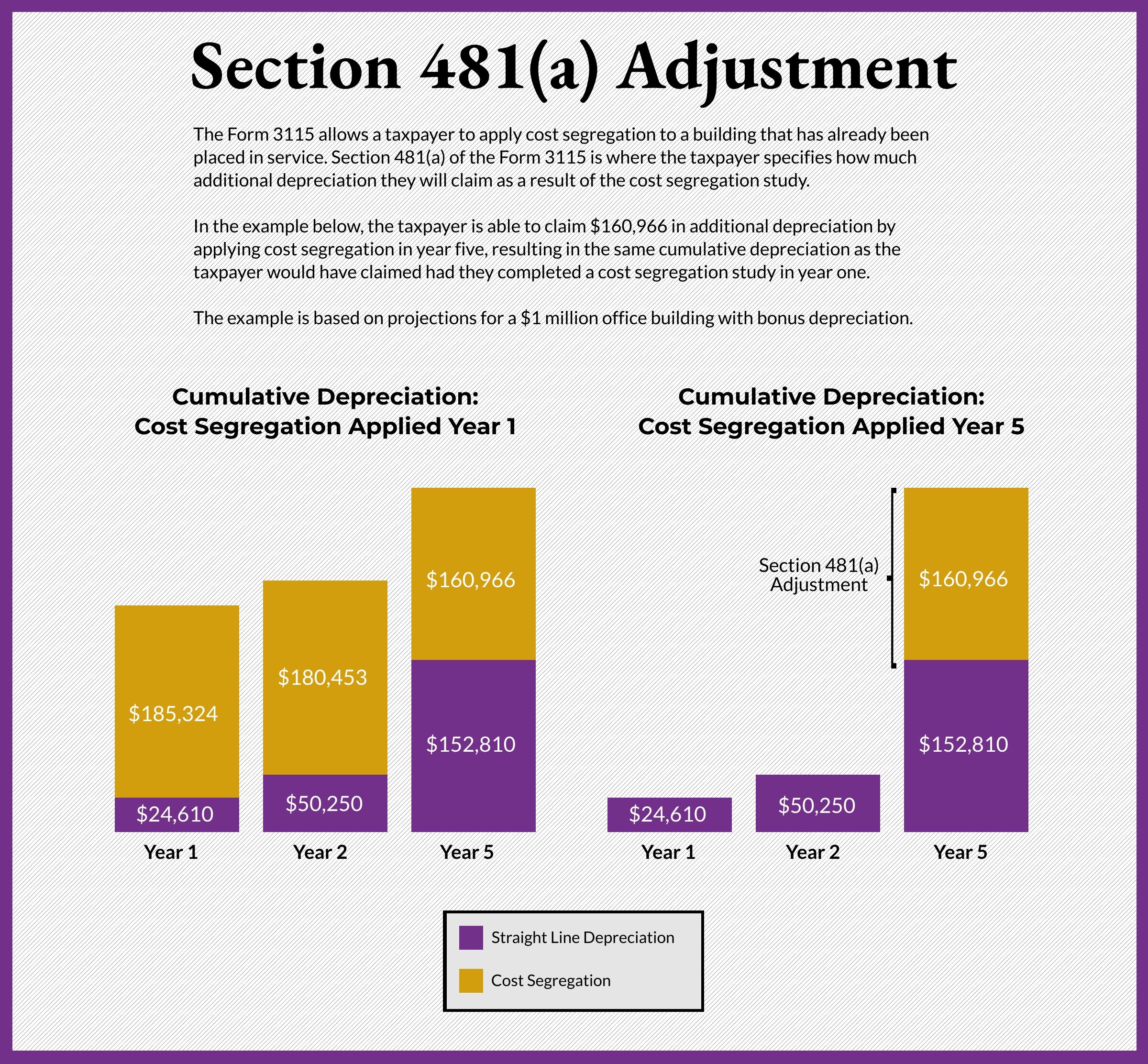

Form 3115 Applying a Cost Segregation Study on a Tax Return The

IRS Form 3115 How to Apply Cost Segregation to Existing Property

Form 3115 Depreciation Guru

Form 3115 Application for Change in Accounting Method(2015) Free Download

Tax Accounting Methods

Form 3115 Edit, Fill, Sign Online Handypdf

Fillable 3115 Form Printable Forms Free Online

Form 3115 Change in accounting method Smart Accountants

Form 3115 Application for Change in Accounting Method(2015) Free Download

Related Post: