8615 Form Irs

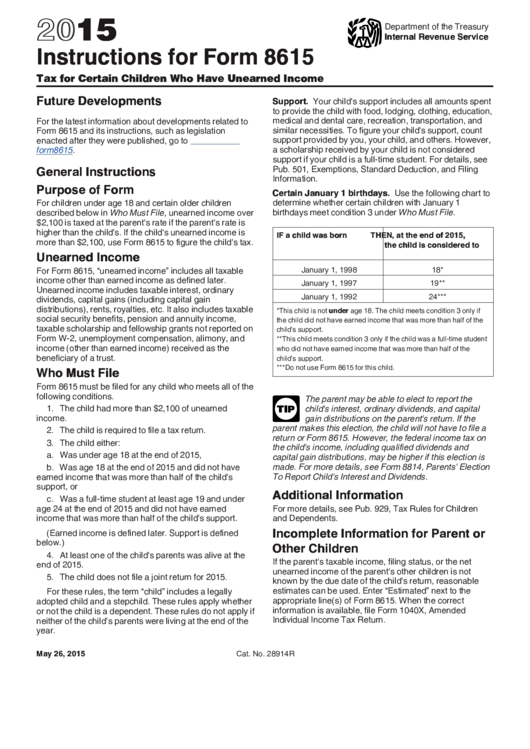

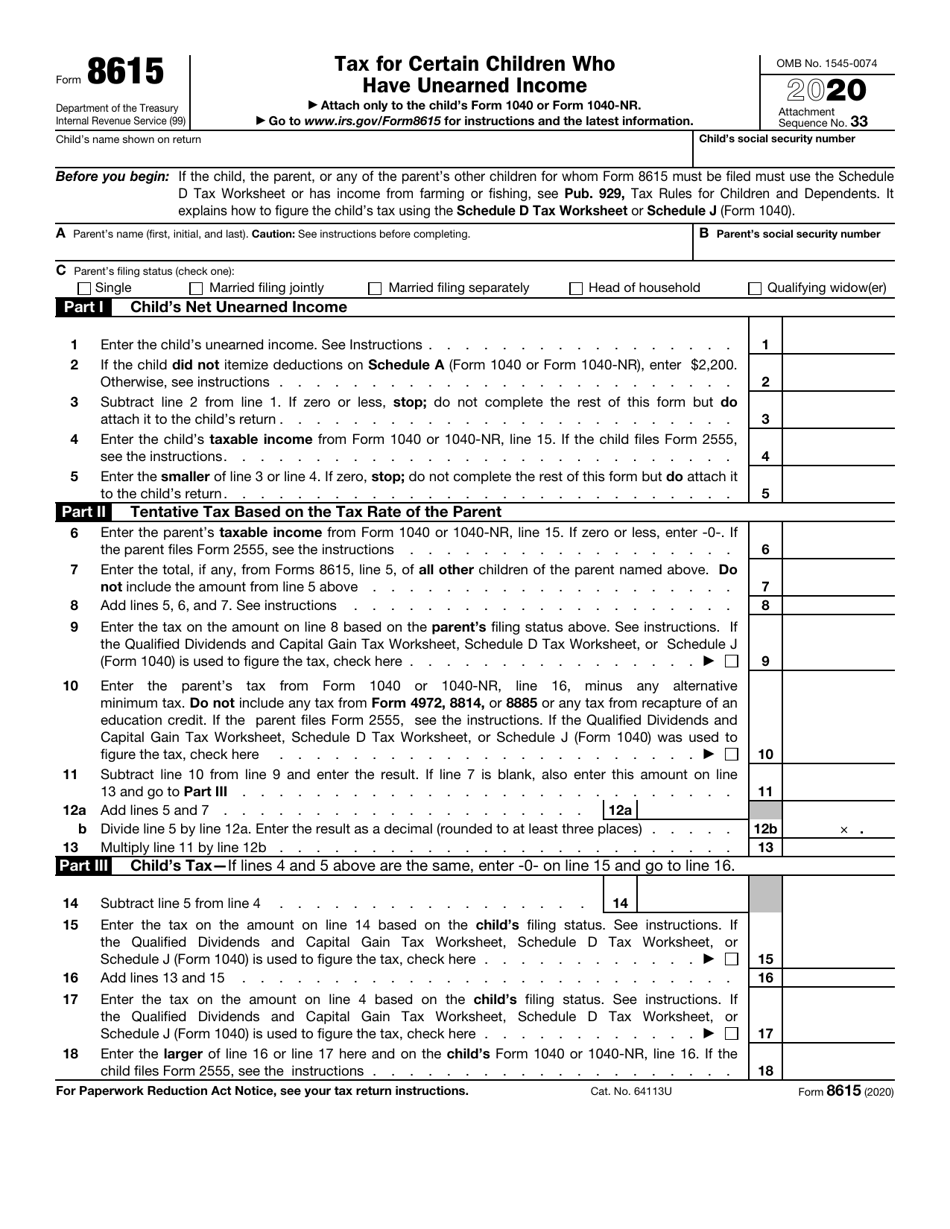

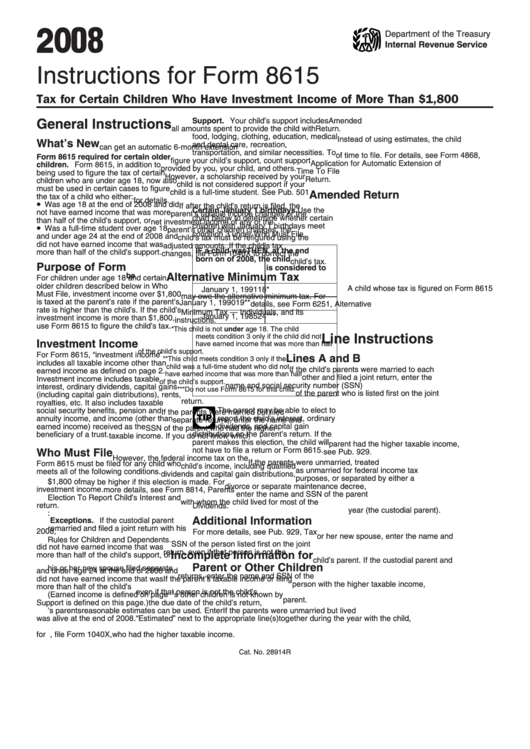

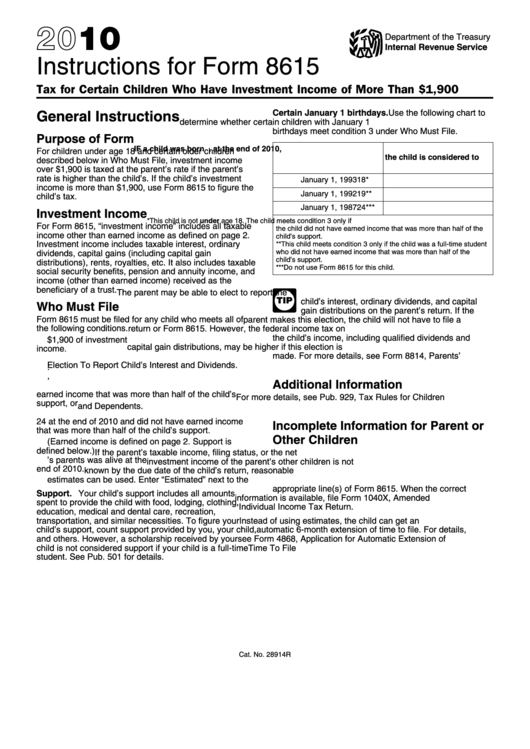

8615 Form Irs - Web for form 8615, “unearned income” includes all taxable income other than earned income. Reporting tax on a child’s unearned income using form 8814 or form 8615. Web for form 8615, “unearned income” includes all taxable income other than earned income. The child is required to file a tax return. Tax relief up to 96% see if you qualify for free. Ad we can solve any tax problem. Web common questions about form 8615 and unearned income. Estimate how much you could potentially save in just a matter of minutes. Take avantage of fresh start options available. Read on this article to learn more about this. Web corrections to the 2020 instructions for form 8615, tax for certain children who have unearned income, that has two incorrect line references to the qualified. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. Web tax for certain children who have unearned income. Pay the lowest amount of taxes possible with strategic planning and preparation Under age 18, age 18 and did. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web corrections to the 2020 instructions for form 8615, tax for certain children who have unearned income, that has two incorrect line references to the qualified. Take avantage of fresh start. Below, you'll find answers to frequently asked. Web tax for certain children who have unearned income before you begin: Do not include any tax from form 4972 or form 8814, or any tax from the. Pay the lowest amount of taxes possible with strategic planning and preparation For children under age 18 and certain older children described below in who. Ad we can solve any tax problem. Web who's required to file form 8615? Unearned income includes taxable interest, ordinary dividends, capital gains (including. Take avantage of fresh start options available. Read on this article to learn more about this. The child is required to file a tax return. The child has more than $2,500 in unearned income;. Ad save time and money with professional tax planning & preparation services. Take avantage of fresh start options available. Video walkthrough where can i find a copy of irs form 8615? Web per irs instructions for form 8615: Web if your child files their own return and the kiddie tax applies, file form 8615 with the child’s return. Web when using form 8615 in proseries, you should enter the child as the taxpayer on the federal information worksheet. Web who's required to file form 8615? Web for form 8615, “unearned income”. Web if your child files their own return and the kiddie tax applies, file form 8615 with the child’s return. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. Who must file irs form 8615? Video walkthrough where can i find a copy of. Ad we can solve any tax problem. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Ad we help get taxpayers relief from owed irs back taxes. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web what is form 8615 used for. Web for form 8615, “unearned income” includes all taxable income other than earned income. When is irs form 8615 due? The child has more than $2,500 in unearned income;. Web when using form 8615 in proseries, you should enter the child as the taxpayer on the federal information worksheet. Ad we can solve any tax problem. Web kiddie tax is reported on form 8615 (tax for certain children who have unearned income), which is attached to the child’s form 1040. When is irs form 8615 due? Take avantage of fresh start options available. Web form 8615, tax for certain children who have unearned income (kiddie tax) children under age. The child is required to file a tax return. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Do not include any tax from form 4972 or form 8814, or any tax from the. Web form 8615 must be filed for any child who meets all of the following conditions. Read on this article to learn more about this. Ad save time and money with professional tax planning & preparation services. Web when using form 8615 in proseries, you should enter the child as the taxpayer on the federal information worksheet. Complete, edit or print tax forms instantly. Web per irs instructions for form 8615: Reporting tax on a child’s unearned income using form 8814 or form 8615. Below, you'll find answers to frequently asked. When is irs form 8615 due? If you must use the schedule d tax worksheet or have income from farming or fishing, see the instructions. Estimate how much you could potentially save in just a matter of minutes. Web for form 8615, “unearned income” includes all taxable income other than earned income. Take avantage of fresh start options available. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. The child has more than $2,500 in unearned income;. For 2023, form 8615 needs to be filed if all of the following conditions apply: Who must file irs form 8615?Form 8615 Instructions (2015) printable pdf download

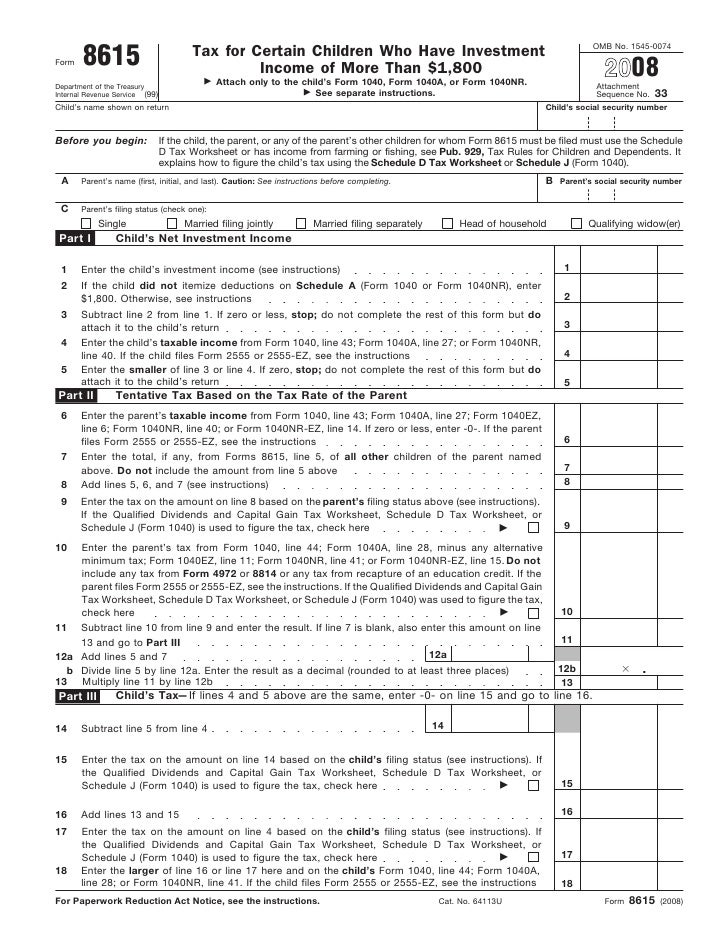

IRS Form 8615 Download Fillable PDF or Fill Online Tax for Certain

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Instructions For Form 8615 Tax For Certain Children Who Have

Fill Free fillable IRS PDF forms

Instructions For Form 8615 Tax For Certain Children Who Have

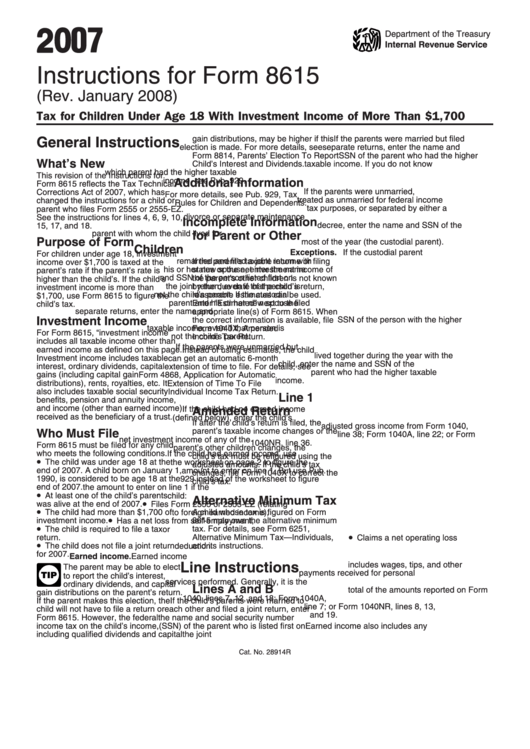

Instructions For Form 8615 Tax For Children Under Age 18 With

Download Form 8615 Tax for Children Who Has Unearned

Form 8615Tax for Children Under Age 14 With Investment of Mor…

Form 8615 Worksheet Math Worksheets 4 Kids

Related Post: