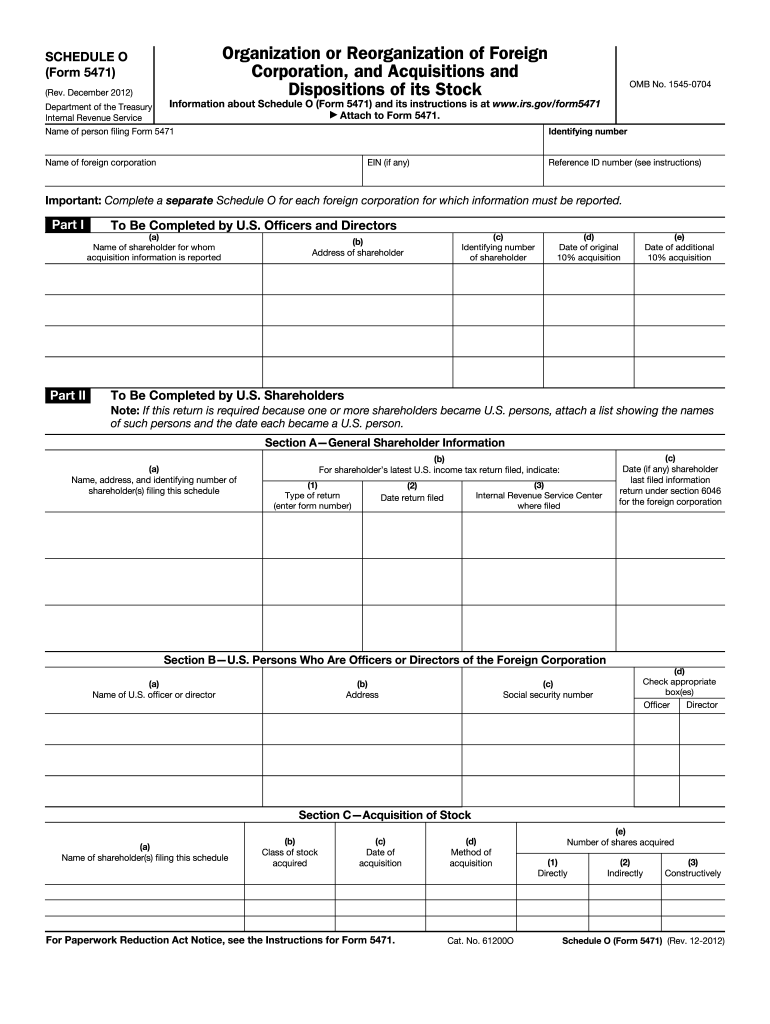

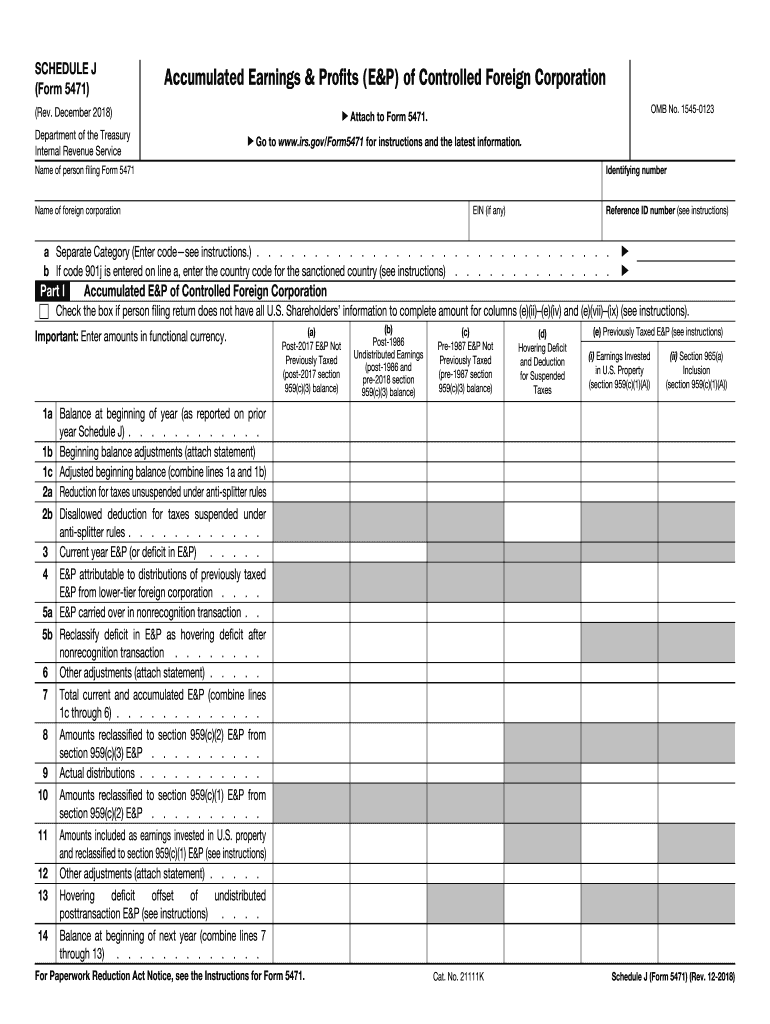

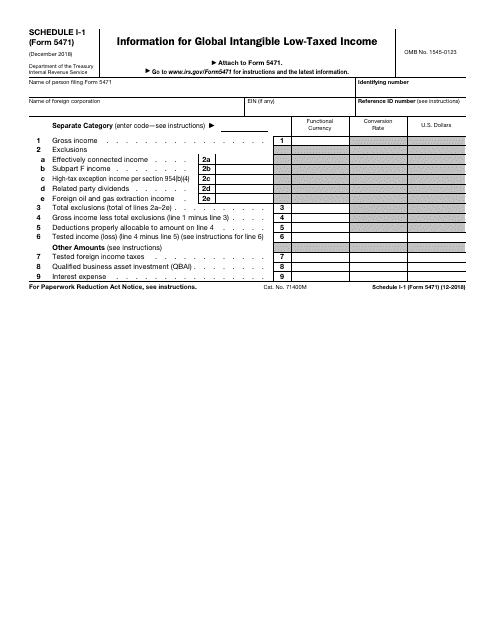

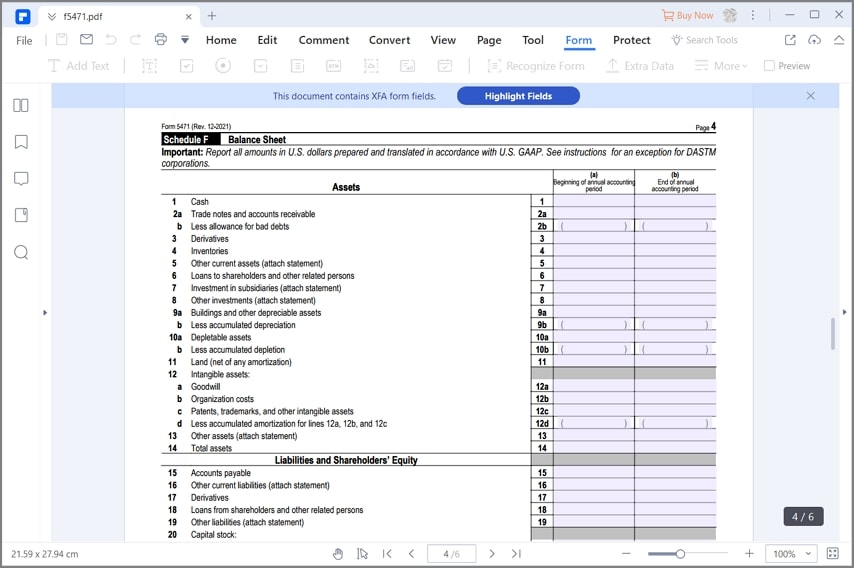

Form 5471 Schedule I-1

Form 5471 Schedule I-1 - Persons with respect to certain foreign corporations 0122 02/11/2022 form 5471 (schedule m) transactions. Shareholder’s pro rata share of income subpart f income from a controlled foreign corporation (“cfc”). Web the form 5471 schedules are: January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Subpart f the subpart f tax regime is used to ensure that certain passive. Ad living outside the usa? Need to file your taxes? Ad download or email irs 5471 & more fillable forms, register and subscribe now! Ad living outside the usa? Web check the box if this form 5471 has been completed using “alternative information” under rev. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation. Need to file your taxes? Web instructions for form 5471(rev. Web schedule i is. This is the tenth of a series of. If the answer to question 7 is “yes,” complete. Ad living outside the usa? Web changes to separate schedule e (form 5471). Instructions for form 5471, information return of u.s. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Instructions for form 5471, information return of u.s. This is the tenth of a series of. Web how do i produce form 5471 schedule i in individual tax using interview forms? Web schedule. Ad living outside the usa? Web the form 5471 schedules are: January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Persons with respect to certain foreign corporations 0122 02/11/2022 form 5471 (schedule m) transactions. The december 2021 revision of separate. Ad register and subscribe now to work on your irs 5471 & more fillable forms. Web check the box if this form 5471 has been completed using “alternative information” under rev. New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation. Ad download or email irs 5471 & more fillable forms,. Need to file your taxes? Instructions for form 5471, information return of u.s. Web changes to separate schedule e (form 5471). Web instructions for form 5471(rev. Persons with respect to certain foreign corporations 0122 02/11/2022 form 5471 (schedule m) transactions. Shareholder’s pro rata share of income subpart f income from a controlled foreign corporation (“cfc”). Web instructions for form 5471(rev. Web schedule i is designed to disclose a u.s. We also have attached rev. Web how do i produce form 5471 schedule i in individual tax using interview forms? Hsa, archer msa, or medicare advantage msa information 2023 11/02/2022 form 5471 (schedule e) income, war profits, and excess profits taxes. Subpart f the subpart f tax regime is used to ensure that certain passive. Web on page 6 of form 5471, schedule i, line 9 is new. New line 9 requests the sum of the hybrid deduction accounts with. Web schedule i is designed to disclose a u.s. Hsa, archer msa, or medicare advantage msa information 2023 11/02/2022 form 5471 (schedule e) income, war profits, and excess profits taxes. Web changes to separate schedule e (form 5471). Instructions for form 5471, information return of u.s. Web the form 5471 schedules are: Subpart f the subpart f tax regime is used to ensure that certain passive. The december 2021 revision of separate. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Ad register and subscribe now to work on your irs 5471 & more fillable forms. New line 9 requests the sum of the hybrid deduction. Instructions for form 5471, information return of u.s. Need to file your taxes? Subpart f the subpart f tax regime is used to ensure that certain passive. December 2022) department of the treasury internal revenue service. If the answer to question 7 is “yes,” complete. Need to file your taxes? Web the form 5471 schedules are: Web schedule i is designed to disclose a u.s. Web on page 6 of form 5471, schedule i, line 9 is new. Persons with respect to certain foreign corporations. Ad living outside the usa? Shareholder’s pro rata share of income subpart f income from a controlled foreign corporation (“cfc”). Ad living outside the usa? Persons with respect to certain foreign corporations 0122 02/11/2022 form 5471 (schedule m) transactions. Web instructions for form 5471(rev. New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation. Ad register and subscribe now to work on your irs 5471 & more fillable forms. We also have attached rev. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; The december 2021 revision of separate.Form 5471 Schedule Form Fill Out and Sign Printable PDF Template

Do You Own A Foreign Corporation? Have You Filed IRS Form 5471? RJS

IRS Issues Updated New Form 5471 What's New?

Schedule C Statement IRS Form 5471 YouTube

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

5471 Schedule I Worksheet Activities Gettrip24

Instructions for Form 5471 (01/2022) Internal Revenue Service

2018 Form IRS 5471 Schedule J Fill Online, Printable, Fillable, Blank

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

Comment remplir le formulaire 5471 de l'IRS (saison fiscale 2020)

Related Post: