8582 Form Instructions

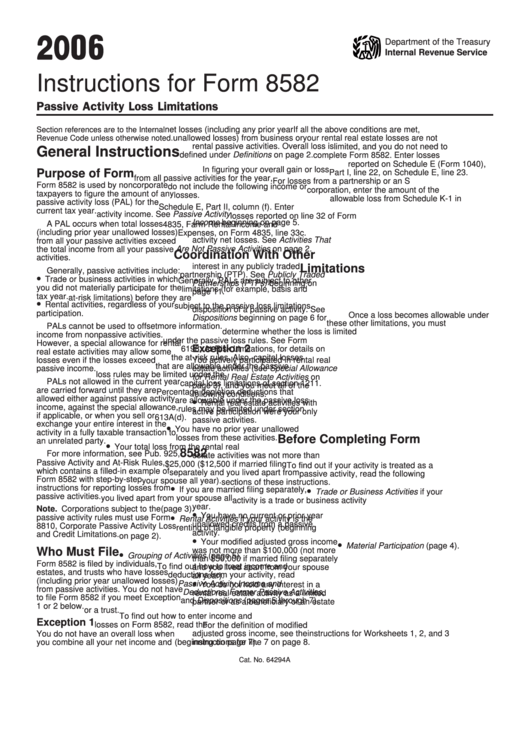

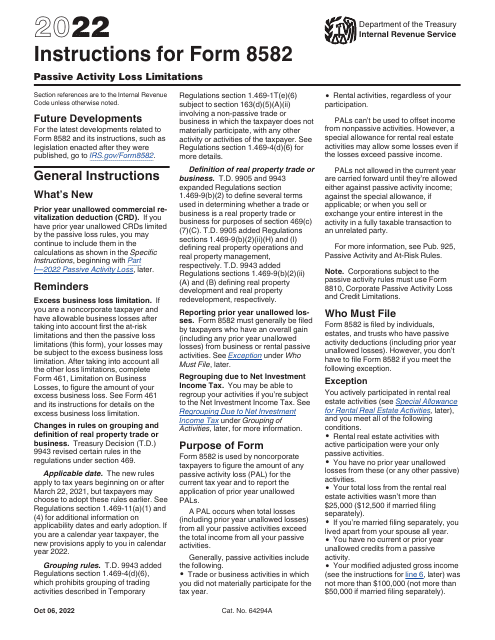

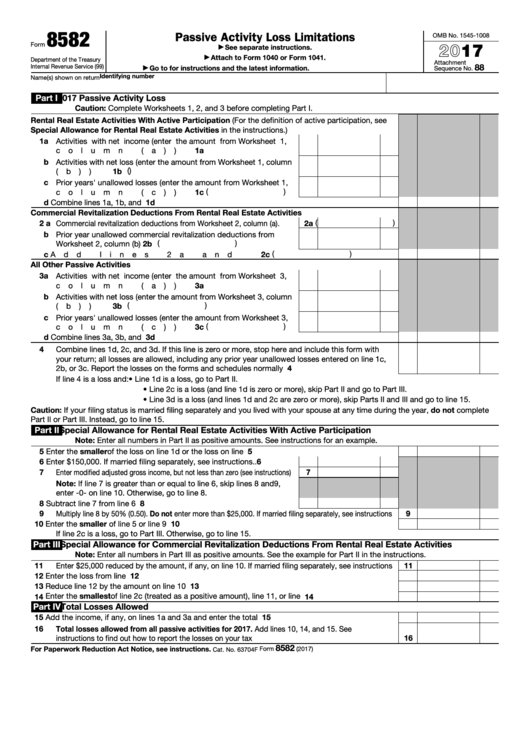

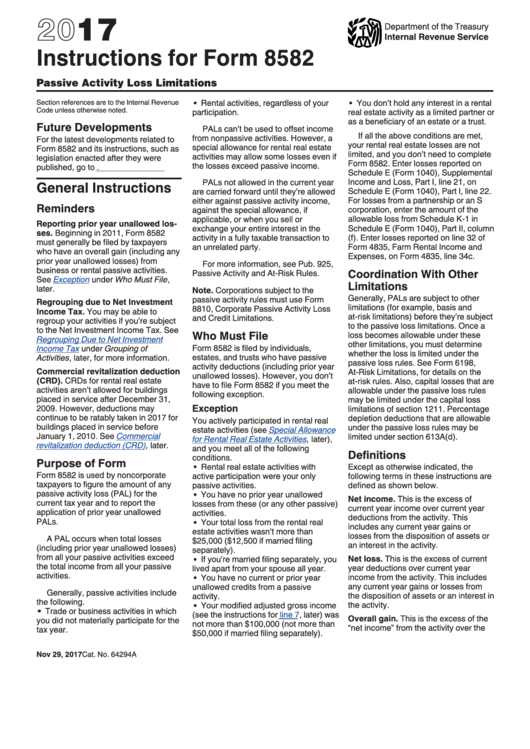

8582 Form Instructions - Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. If you actively participated in a passive rental real estate activity, you. If you actively participated in a passive rental real estate activity, you may. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Taxpayer with an ownership interest in a partnership, s corporation, or. Web 2010 instructions for form 8582 passive activity loss limitations section references are to the internal8810, corporate passive activity loss•your modified adjusted gross. Web per irs instructions for form 8582 passive activity loss limitations, on page 3: 858 name(s) shown on return identifying number part i 2022 passive. Get ready for tax season deadlines by completing any required tax forms today. Web if you paper file your tax return, you would mail form 8582 along with your tax return to the address found in your tax return’s instructions. 14 minutes watch video get the form! If you actively participated in a passive rental real estate activity, you may. Web intuit help intuit common questions about form 8582 in proseries solved • by intuit • 35 • updated july 17, 2023 what is the purpose of the 8582: Web form 8283 contains more than one item, this exception applies. 858 name(s) shown on return identifying number part i 2022 passive. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. If you actively participated in a passive rental real estate activity, you. Complete, edit or print tax forms instantly. Web the instructions. However, for purposes of the donor’s. Web for instructions and the latest information. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Web keep a copy for your records. Web form 8282 is used by donee organizations to report information. If you actively participated in a passive rental real estate activity, you. Web 2010 instructions for form 8582 passive activity loss limitations section references are to the internal8810, corporate passive activity loss•your modified adjusted gross. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after. Web per irs instructions for form 8582 passive activity loss limitations, starting page 3: Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. Web per irs instructions for form 8582 passive activity loss limitations, on page 3: Web 2010 instructions for form 8582. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a. Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions) 2 current year prior years net income (b) net loss (c) unallowed (line 1a). An irs tax form used by organizations to report the sale. Web form 8282 is used by donee organizations to report information to irs about dispositions of certain charitable deduction property made within three years after the. 858 name(s) shown on return identifying number part i 2022 passive. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in. 14 minutes watch video get the form! Ad access irs tax forms. Complete, edit or print tax forms instantly. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. Get ready for tax season deadlines by completing any required tax forms today. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. Web 2010 instructions for form 8582 passive activity loss limitations section references are to the internal8810, corporate passive activity loss•your modified adjusted gross. If you actively participated in a passive rental real estate activity, you may. Worksheet 1—for form. However, for purposes of the donor’s. Web the instructions provided with california tax forms are a summary of california tax law and are only intended to aid taxpayers in preparing their state income tax returns. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a. 858. Web per irs instructions for form 8582 passive activity loss limitations, on page 3: 858 name(s) shown on return identifying number part i 2022 passive. Web intuit help intuit common questions about form 8582 in proseries solved • by intuit • 35 • updated july 17, 2023 what is the purpose of the 8582: Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Web for instructions and the latest information. You can download or print current. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. Complete, edit or print tax forms instantly. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. How to file form 8582. However, for purposes of the donor’s. Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions) 2 current year prior years net income (b) net loss (c) unallowed (line 1a). If you actively participated in a passive rental real estate activity, you may. Web if you paper file your tax return, you would mail form 8582 along with your tax return to the address found in your tax return’s instructions. Get ready for tax season deadlines by completing any required tax forms today. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. 14 minutes watch video get the form! Web 2010 instructions for form 8582 passive activity loss limitations section references are to the internal8810, corporate passive activity loss•your modified adjusted gross. 858 name(s) shown on return identifying number part i 2021 passive. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a.Instructions For Form 8582 Passive Activity Loss Limitations 2006

Download Instructions for IRS Form 8582 Passive Activity Loss

Fillable Form 8582 Passive Activity Loss Limitations 2017 printable

Instructions For Form 8582 Passive Activity Loss Limitations 2017

IRS Form 8582 Instructions A Guide to Passive Activity Losses

IRS 8582 Form PAL Blanks to Fill out and Download in PDF

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Instructions for Form 8582CR, Passive Activity Credit Limitations

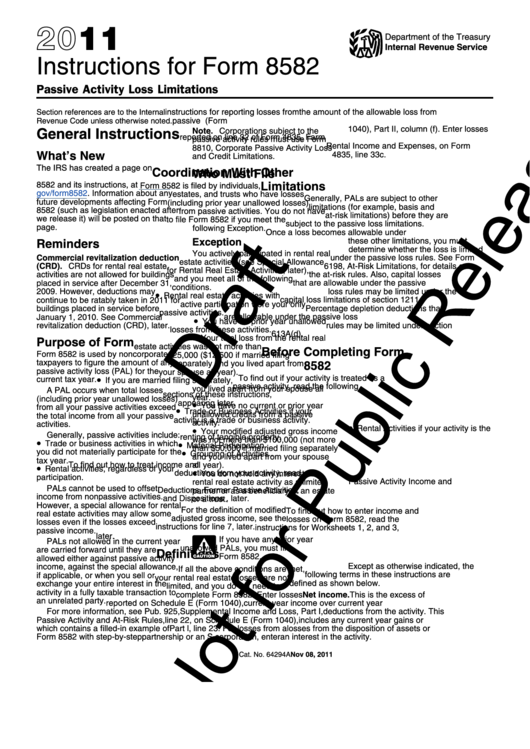

Instructions For Form 8582 Draft 2011 printable pdf download

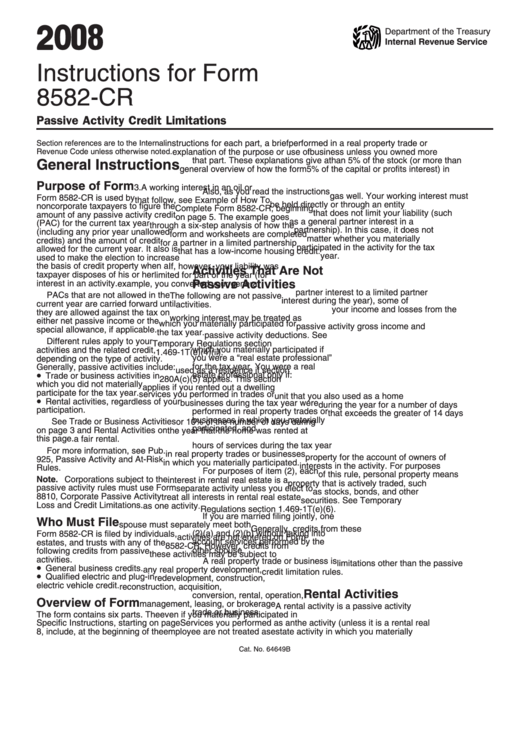

Instructions For Form 8582Cr Passive Activity Credit Limitations

Related Post: