Form 5500 Schedule R

Form 5500 Schedule R - Web page last reviewed or updated: Information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Web this technical update clarifies the line 14 instructions for the schedule r (form 5500) and provides partial reporting relief for completing line 14 for the 2009 plan. Posting on the web does not constitute acceptance of the. Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. Filings for plan years prior to 2009 are not. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Large plan filers and certain. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Web form 5500, annual return/report of employee benefit plan. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and. Web what is form 5500? Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Large plan filers and certain. Information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related. Web official use only. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Web page last reviewed or updated: Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and. Filings for plan years prior to 2009 are not. Web this technical update clarifies the line 14 instructions for the schedule r (form 5500) and provides partial reporting relief for completing line 14 for the 2009 plan. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa). Web this technical update clarifies the line 14 instructions for the schedule r (form 5500) and provides partial reporting relief for completing line 14 for the 2009 plan. Web schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the adoption of amendments, as well as. The form 5500 series is documentation designed to satisfy. Information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Web the form 5500 is filed annually which reports information to the department of labor (dol) on the plan sponsor, plan provisions and participant counts. Web. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. Filings for plan years. Information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the. Web page last reviewed or updated: This search tool allows you to search for form 5500 series returns/reports filed since january 1,. Web frequently asked questions what is form 5500? Web the form 5500 is filed annually which reports information to the department of labor (dol) on the plan sponsor, plan provisions and participant counts. Web what is form 5500? Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974. Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. Web form 5500, annual return/report of employee benefit plan. Web this technical update clarifies the line 14 instructions for the schedule r (form 5500) and provides partial reporting relief for completing line 14. Web page last reviewed or updated: Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. This search tool allows you to search for form 5500 series returns/reports filed since january 1, 2010. Posting on the web does not constitute acceptance of the. Large plan filers and certain. Web this technical update clarifies the line 14 instructions for the schedule r (form 5500) and provides partial reporting relief for completing line 14 for the 2009 plan. Information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related. Web frequently asked questions what is form 5500? Filings for plan years prior to 2009 are not. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa) and section 6058(a) of the internal. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Web schedule r (form 5500) reports certain information on retirement plan distributions, funding, nondiscrimination, coverage, and the adoption of amendments, as well as. Web this schedule is required to be filed under sections 104 and 4065 of the employee retirement security act of 1974 (erisa) and section 6058(a) of the internal revenue. Web form 5500, annual return/report of employee benefit plan. Web what is form 5500? Web the form 5500 is filed annually which reports information to the department of labor (dol) on the plan sponsor, plan provisions and participant counts. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the. Web the form 5500 series is an important compliance, research, and disclosure tool for the department of labor, a disclosure document for plan participants and beneficiaries, and. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. Schedule r provides information on retirement (e.g., pension) plan distributions, funding, nondiscrimination, coverage, major contributing employers,.Form 5500 Instructions 5 Steps to Filing Correctly (2023)

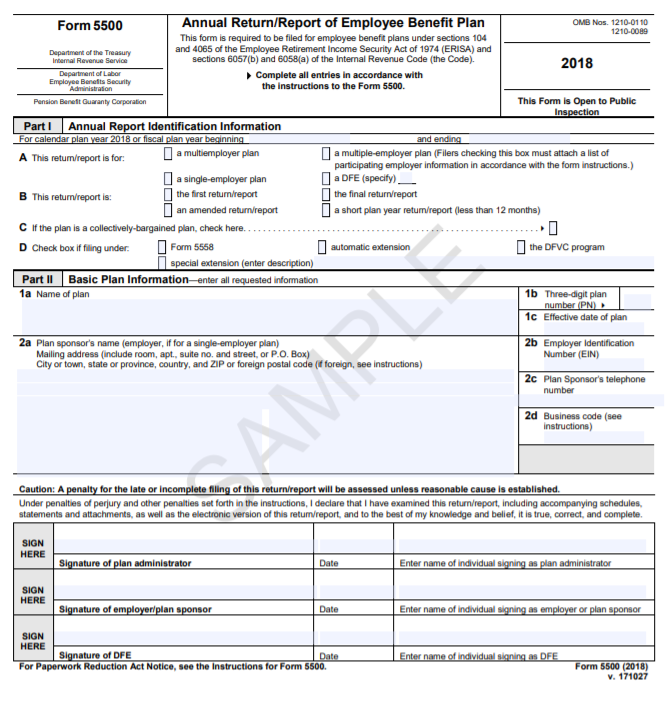

IRS Form 5500 Schedule R 2018 Fill Out, Sign Online and Download

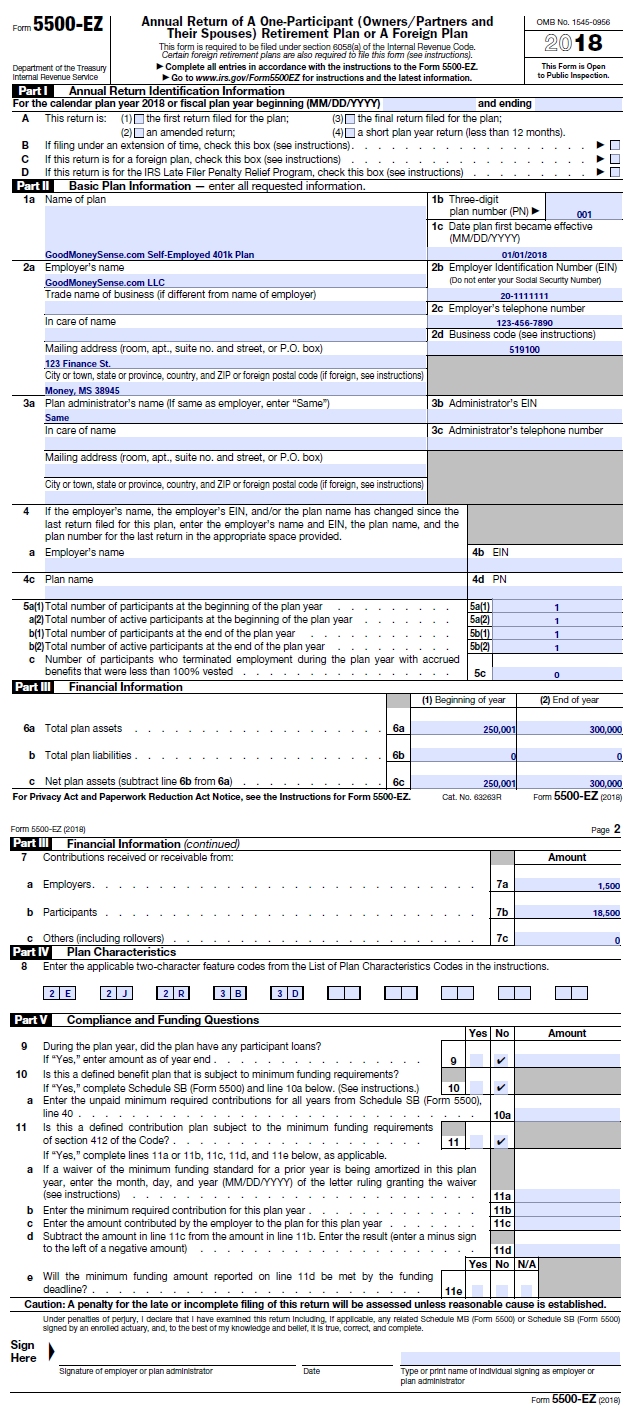

2018 Updated Form 5500EZ Guide Solo 401k

Understanding the Form 5500 for Defined Contribution Plans Fidelity

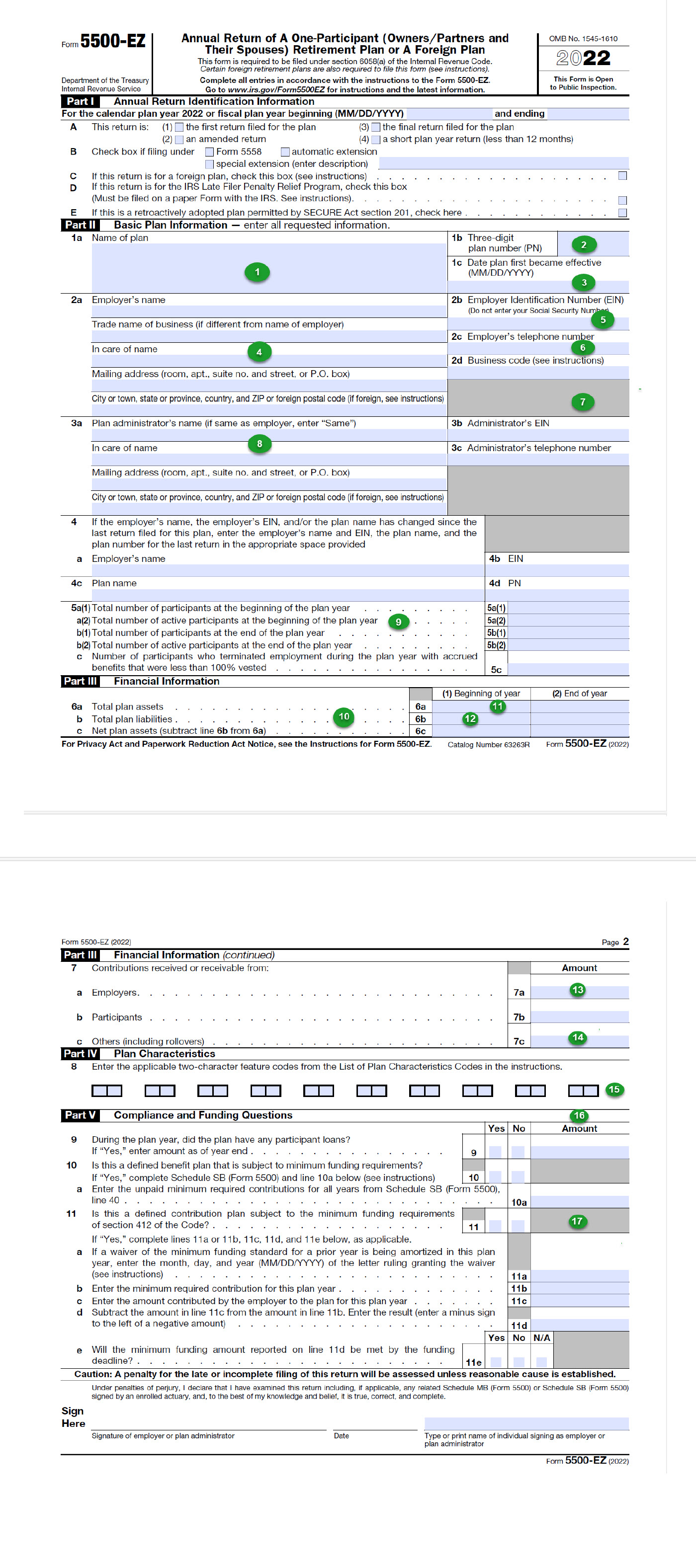

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Form 5500 Instructions 5 Steps to Filing Correctly

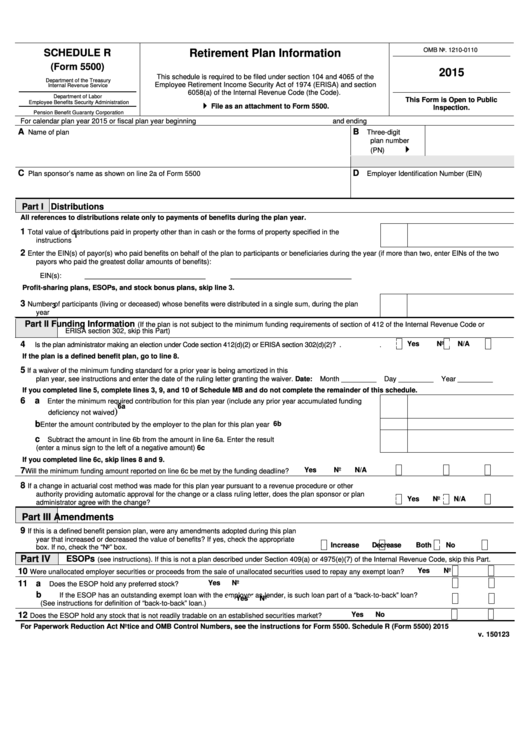

Schedule R (Form 5500) Retirement Plan Information 2015 printable

Form 5500 Is Due by July 31 for Calendar Year Plans

Form 5500 Instructions 5 Steps to Filing Correctly

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

Related Post:

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png)