6198 Form Instructions

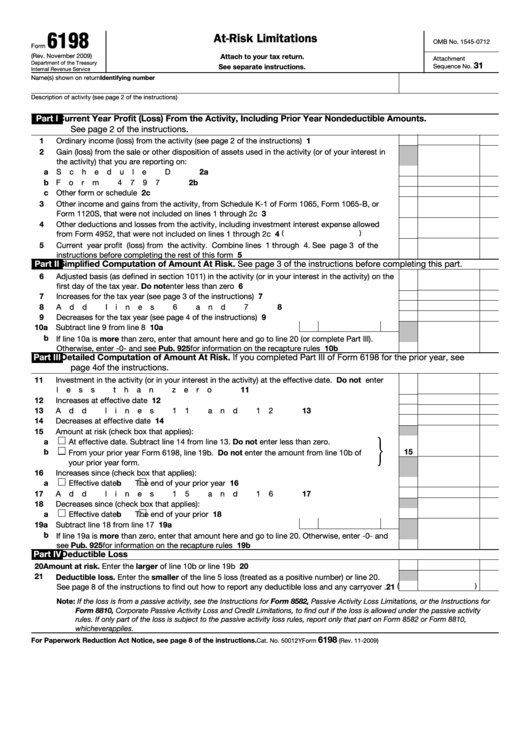

6198 Form Instructions - The amount at risk for the current year (part ii. Web adjust your basis on form 6198 by the gain on the sale of the qualified small business stock. Form 6198 should be filed when a taxpayer has a loss in a business. Web table of contents guide on how to write a form 6198 download irs form 6198 template components of a standard form 6198 best strategies when drafting a form 6198. Attach to your tax return. There are 4 parts to irs form 6198, which we’ll go. Form 6198 must be completed if there is an entry on line 19 above. Form 6198 should be filed separately for each activity related to. You can manually enter the gain, if any, on line 3 of form 6198. First, the adjusted tax basis of the partnership interest under sec. Department of the treasury internal revenue service attachment sequence no.31 ' see separate instructions. Form 6198 must be completed if there is an entry on line 19 above. You can manually enter the gain, if any, on line 3 of form 6198. Form 6198 should be filed when a taxpayer has a loss in a business. Fortunately, this tax form. You can manually enter the gain, if any, on line 3 of form 6198. I am trying to input the following scenario into. Find the template you need from the library of legal form samples. Web how do i complete irs form 6198? Web the form 6198 instructions will help you in filling out the 21 lines with all the. There are 4 parts to irs form 6198, which we’ll go. (part i), the amount at risk for the current year (part ii or part iii), and. Web use form 6198 to figure: Web these rules and the order in which they apply are: December 2020) department of the treasury internal revenue service. Web use form 6198 to figure: Web how do i complete irs form 6198? Department of the treasury internal revenue service attachment sequence no.31 ' see separate instructions. December 2020) department of the treasury internal revenue service. Attach to your tax return. December 2020) department of the treasury internal revenue service. There are 4 parts to irs form 6198, which we’ll go. Generally, any loss from an activity (such as a rental). Find the template you need from the library of legal form samples. Form 6198 should be filed when a taxpayer has a loss in a business. Web the form 6198 instructions will help you in filling out the 21 lines with all the necessary data. Web table of contents guide on how to write a form 6198 download irs form 6198 template components of a standard form 6198 best strategies when drafting a form 6198. Fortunately, this tax form is only one page long, so it’s. You can manually enter the gain, if any, on line 3 of form 6198. Attach to your tax return. Web how do i complete irs form 6198? Form 6198 should be filed when a taxpayer has a loss in a business. Web general instructions purpose of form use form 6198 to figure: Fortunately, this tax form is only one page long, so it’s not terribly long. The amount at risk for the current year (part ii. You can manually enter the gain, if any, on line 3 of form 6198. Form 6198 should be filed when a taxpayer has a loss in a business. Generally, any loss from an activity (such as. Web execute form 6198 instructions in a few moments by using the recommendations below: Attach to your tax return. Web form 6198 parts ii and iii are completed based on the information entered in lines 1 through 24. December 2020) department of the treasury internal revenue service. Form 6198 should be filed separately for each activity related to. Fortunately, this tax form is only one page long, so it’s not terribly long. The amount at risk for the current year (part ii. (part i), the amount at risk for the current year (part ii or part iii), and. Department of the treasury internal revenue service attachment sequence no.31 ' see separate instructions. Form 6198 should be filed separately. Form 6198 must be completed if there is an entry on line 19 above. (part i), the amount at risk for the current year (part ii or part iii), and. Web these rules and the order in which they apply are: Web general instructions purpose of form use form 6198 to figure: Web table of contents guide on how to write a form 6198 download irs form 6198 template components of a standard form 6198 best strategies when drafting a form 6198. There are 4 parts to irs form 6198, which we’ll go. First, the adjusted tax basis of the partnership interest under sec. Find the template you need from the library of legal form samples. Web how do i complete irs form 6198? Form 6198 should be filed when a taxpayer has a loss in a business. Web the form 6198 instructions will help you in filling out the 21 lines with all the necessary data. Attach to your tax return. December 2020) department of the treasury internal revenue service. Web execute form 6198 instructions in a few moments by using the recommendations below: I am trying to input the following scenario into. Generally, any loss from an activity (such as a rental). Department of the treasury internal revenue service attachment sequence no.31 ' see separate instructions. You can manually enter the gain, if any, on line 3 of form 6198. Web form 6198 parts ii and iii are completed based on the information entered in lines 1 through 24. Web adjust your basis on form 6198 by the gain on the sale of the qualified small business stock.Guide to Understanding the AtRisk Basis Rules and Form 6198 (UARB

Fill Free fillable AtRisk Limitations Form 6198 (Rev. November 2009

Instructions For Form 6198 AtRisk Limitations printable pdf download

IRS Form 6198 Instructions AtRisk Limitations

Cms 1500 Claim Form Instructions Form Resume Examples Wk9ynn0Y3D

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

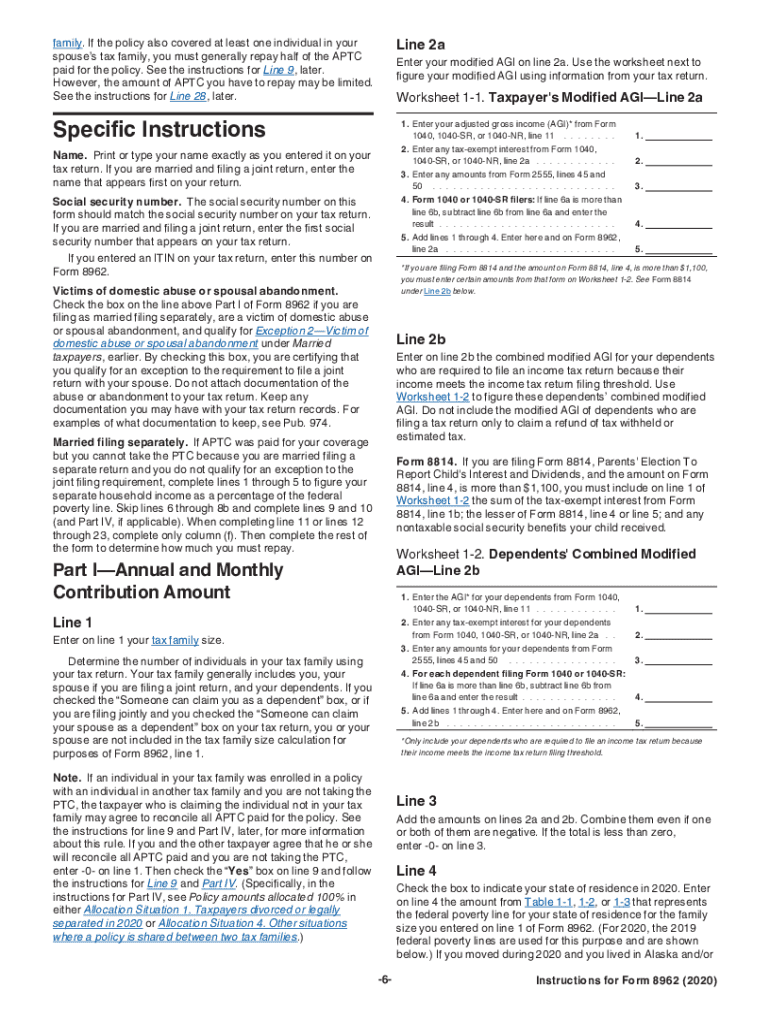

Form 8962 Line Fill Out and Sign Printable PDF Template signNow

Fillable Form 6198 AtRisk Limitations printable pdf download

Ir's 8938 Instructions Form Fill Out and Sign Printable PDF Template

Form 6198 Instructions Fill Out and Sign Printable PDF Template signNow

Related Post: