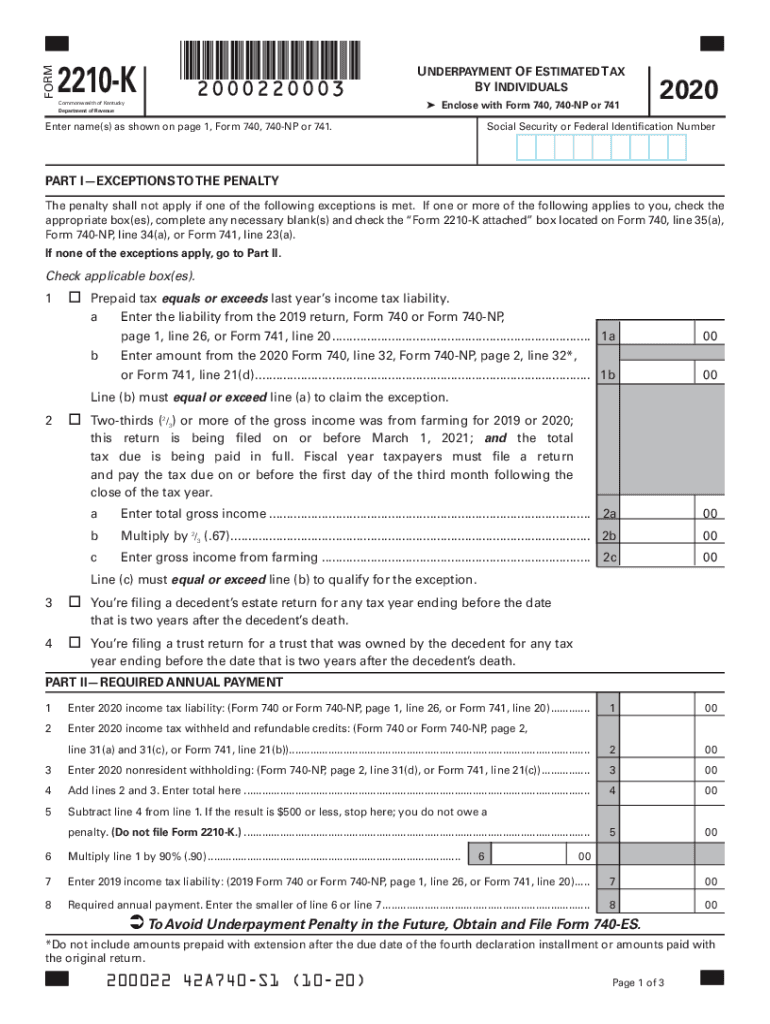

2210 Tax Form

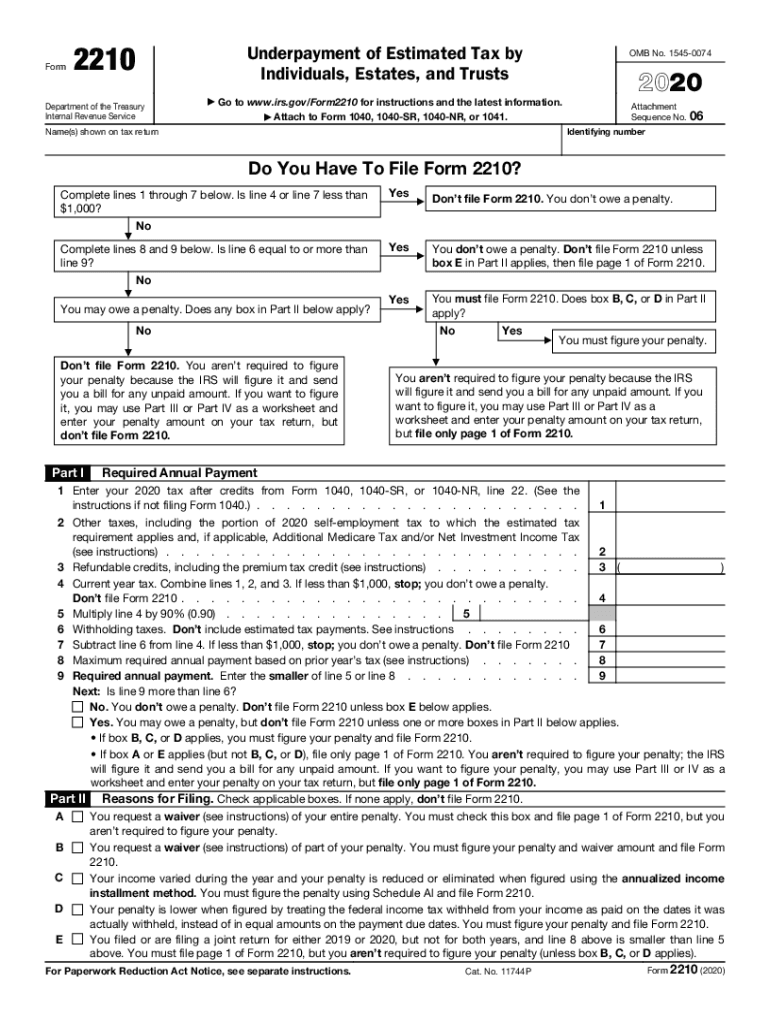

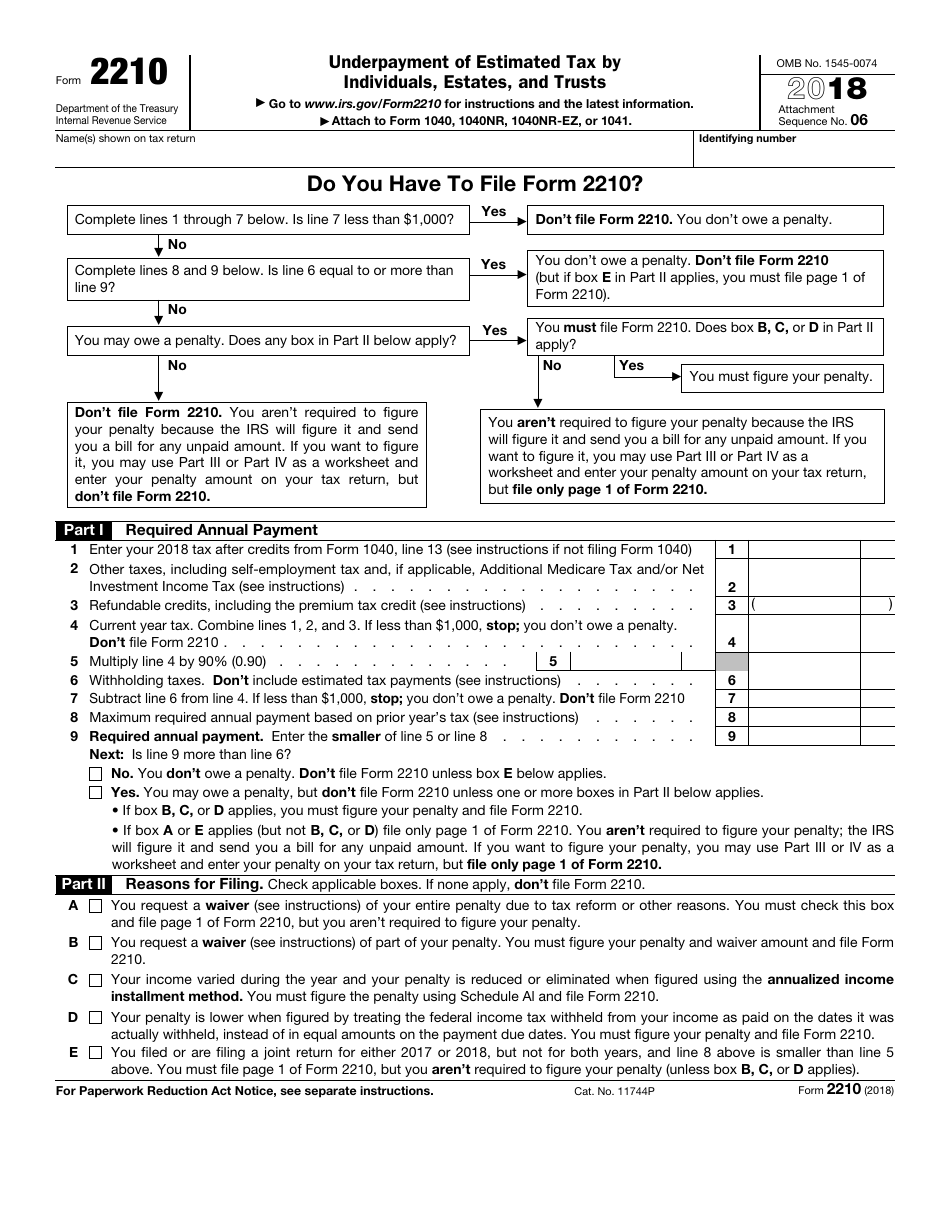

2210 Tax Form - Upload, modify or create forms. Section references are to the internal revenue code unless otherwise noted. Department of the treasury internal revenue service. Web form 2210 is a federal individual income tax form. Solved•by turbotax•2479•updated january 13, 2023. Individual estimated tax payment booklet. Underpayment of estimated tax by individuals, estates, and trusts. Instructions for form 2210 (2022) underpayment of estimated tax by individuals, estates, and trusts. Web tax form 2210 instructions. Web employees who are covered by a special rate schedule are entitled to the applicable special rate within that schedule unless they. Upload, modify or create forms. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web employees who are covered by a special rate schedule are entitled to the applicable special rate within that schedule unless they. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. Tpt forms,. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web yes, you could download the form 2210 from the irs website and use it as a guide to make your entries into turbotax when it is available for. Web what is form 2210? Irs form 2210(underpayment of estimated. Web employees who are covered by a special rate schedule are entitled to the applicable special rate within that schedule unless they. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web. Web form number title; Web employees who are covered by a special rate schedule are entitled to the applicable special rate within that schedule unless they. Irs form 2210(underpayment of estimated. Solved•by turbotax•2479•updated january 13, 2023. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of. Tpt forms, corporate tax forms, withholding forms : Department of the treasury internal revenue service. Try it for free now! Irs form 2210(underpayment of estimated. Web what is the underpayment of estimated tax? The irs will generally figure your penalty for you and you should not file. This is most common with self. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and. Complete, edit or print tax forms instantly. Web form 2210 is a federal individual income tax form. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Try it for free now! Upload, modify or create forms. It appears you don't have a pdf plugin for this. Web employees who are covered by a special rate schedule are entitled to the applicable special rate within that schedule unless they. Tpt forms, corporate tax forms, withholding forms : Web form 2210 is a federal individual income tax form. Upload, modify or create forms. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Department of the treasury internal revenue service. Web form number title; Your income varies during the year. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine. Upload, modify or create forms. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web tax form 2210 instructions. Try it for free now! Your income varies during the year. Underpayment of estimated tax occurs when you don’t pay enough tax during those quarterly estimated tax payments. It appears you don't have a pdf plugin for this. Tpt forms, corporate tax forms, withholding forms : While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. The irs will generally figure your penalty for you and you should not file. Web tax form 2210 instructions. Web what is form 2210? Web employees who are covered by a special rate schedule are entitled to the applicable special rate within that schedule unless they. Web form number title; Web yes, you could download the form 2210 from the irs website and use it as a guide to make your entries into turbotax when it is available for efile after 2/24. How do i complete form 2210 within the program? Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Department of the treasury internal revenue service. Application for automatic extension of time to file corporation, partnership, and exempt organization returns. Irs form 2210(underpayment of estimated. Underpayment of estimated tax by individuals, estates, and trusts. Solved•by turbotax•2479•updated january 13, 2023. Complete, edit or print tax forms instantly. The form doesn't always have to be. Federal — underpayment of estimated tax by individuals, estates, and trusts.Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

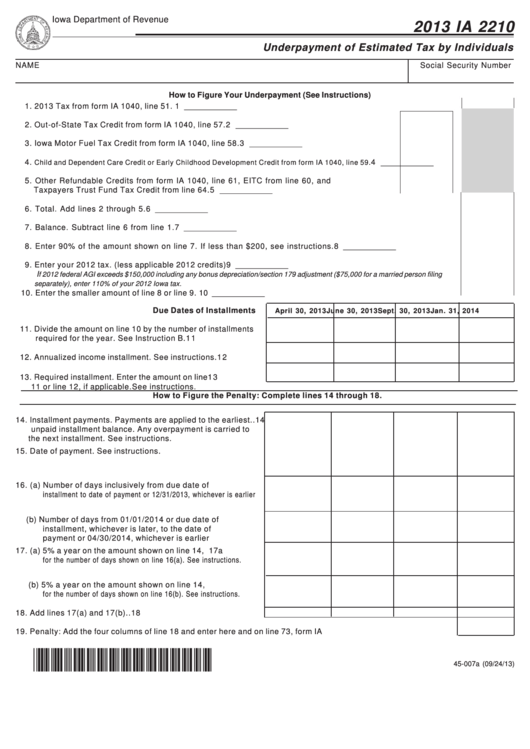

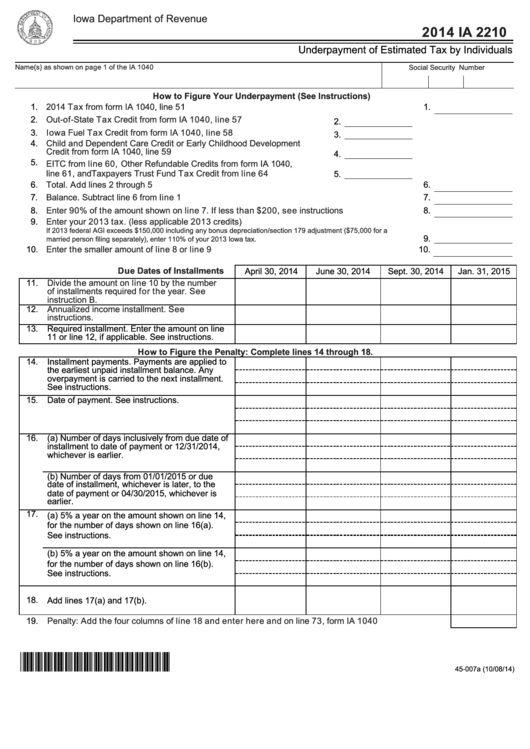

Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

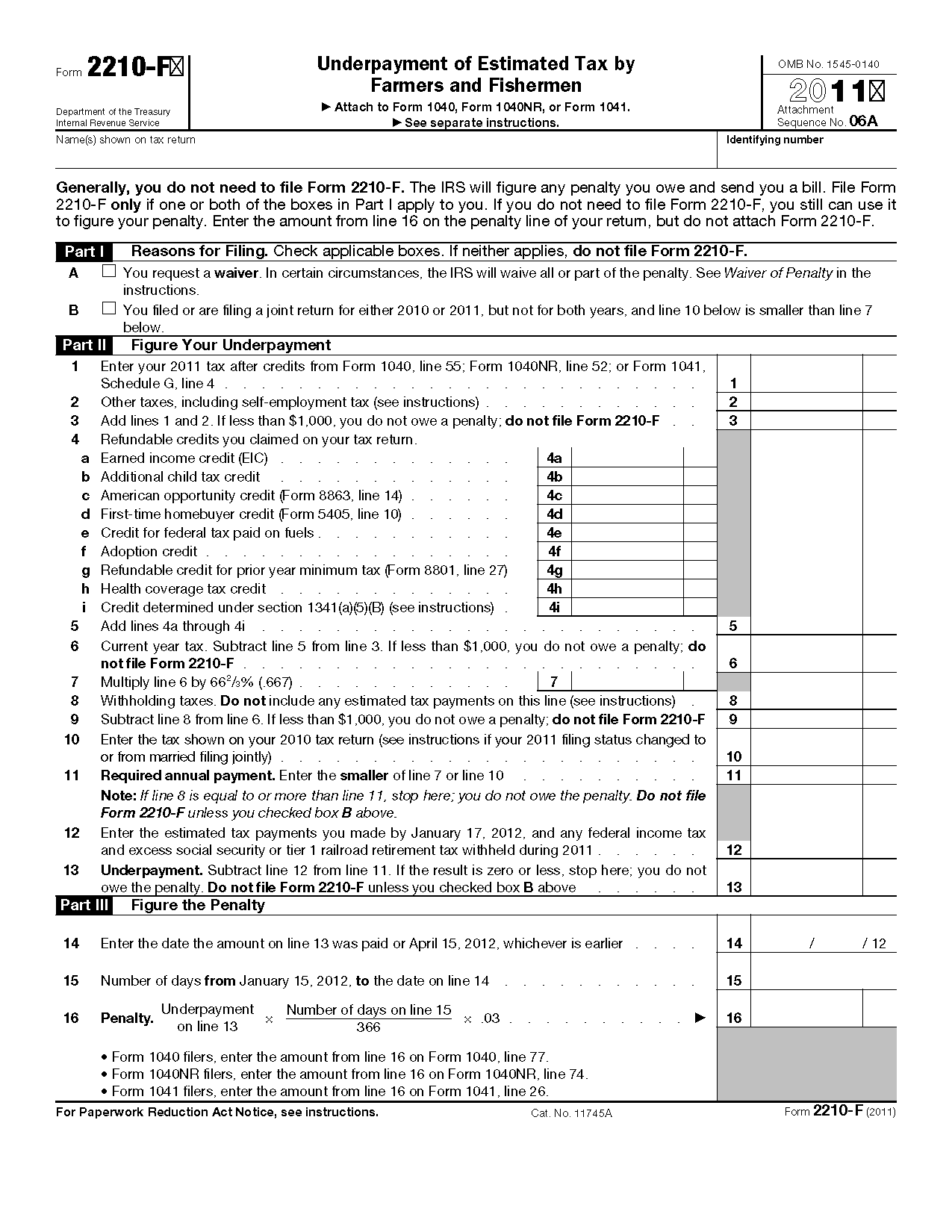

Form 2210 F Underpayment Of Estimated Tax By Farmers And 1040 Form

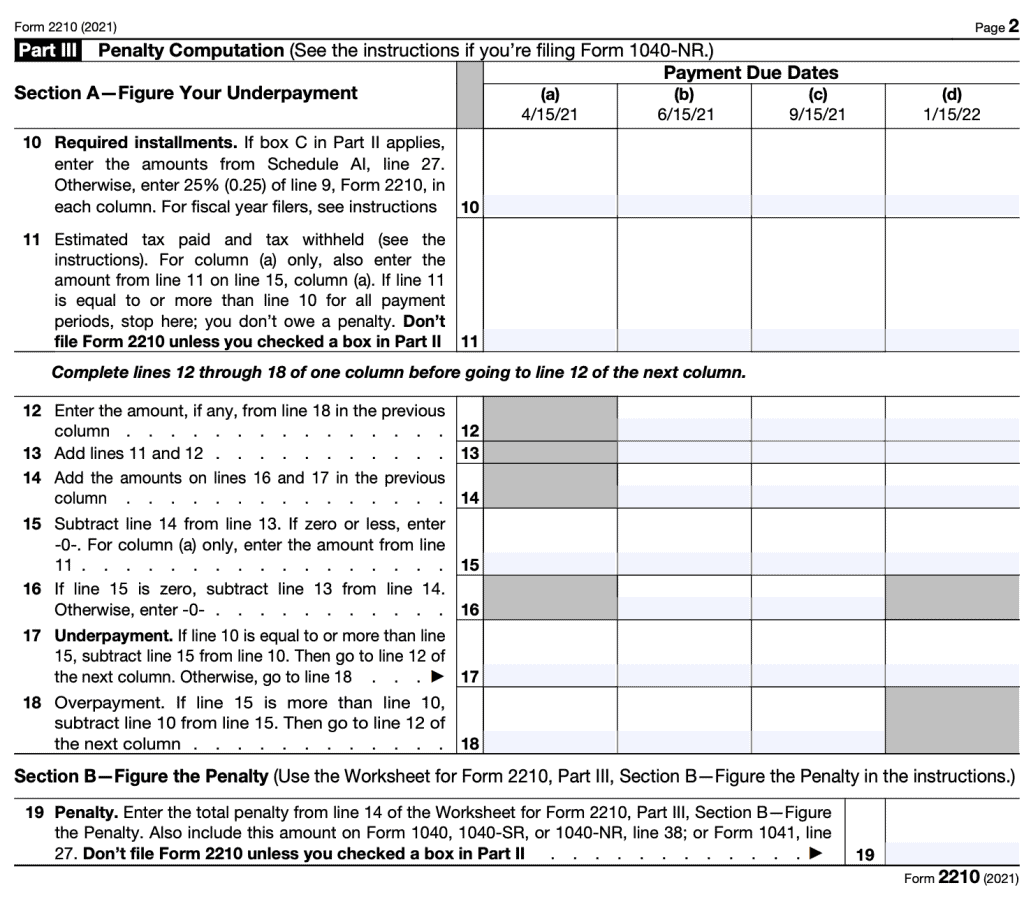

Form 2210Underpayment of Estimated Tax

IRS 2210 2020 Fill out Tax Template Online US Legal Forms

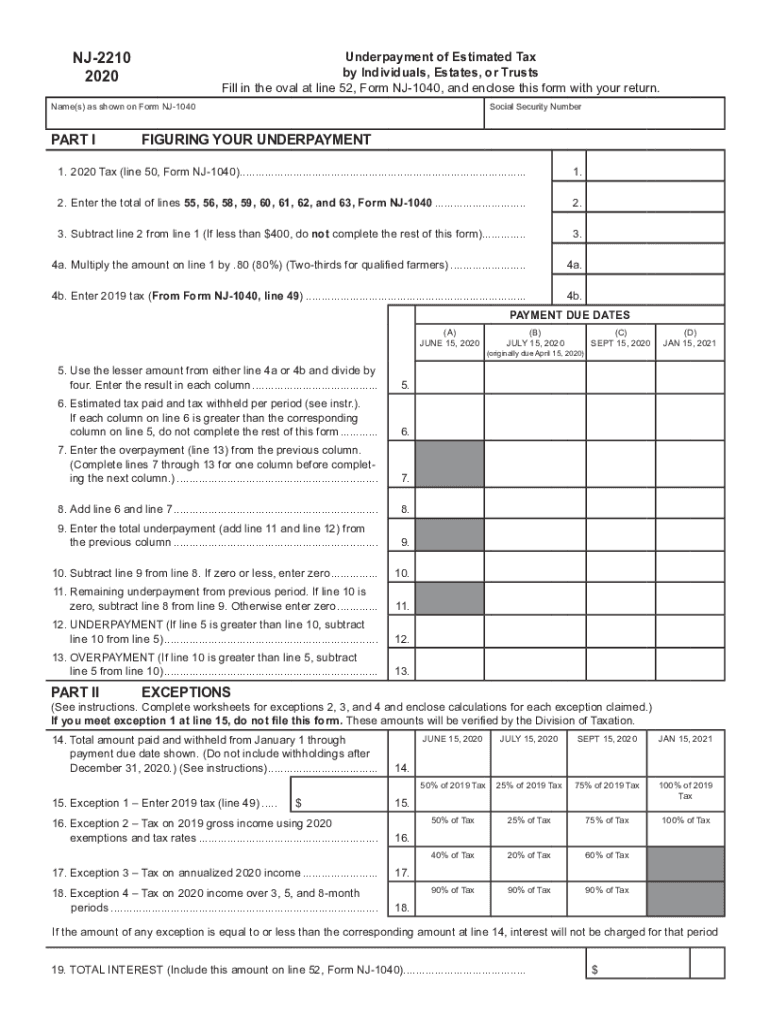

Nj 2210 Form Fill Out and Sign Printable PDF Template signNow

IRS Form 2210 A Guide to Underpayment of Tax

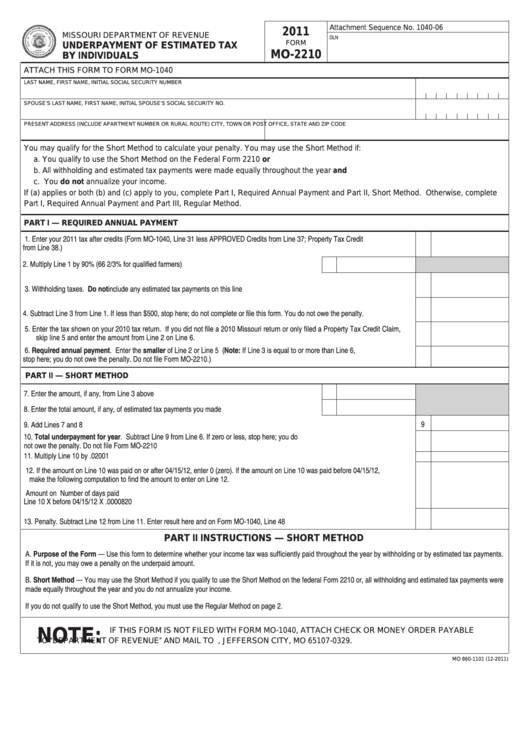

Fillable Form Mo2210 Underpayment Of Estimated Tax By Individuals

IRS Form 2210 Download Fillable PDF or Fill Online Underpayment of

Form 2210 K Fill Out and Sign Printable PDF Template signNow

Related Post: