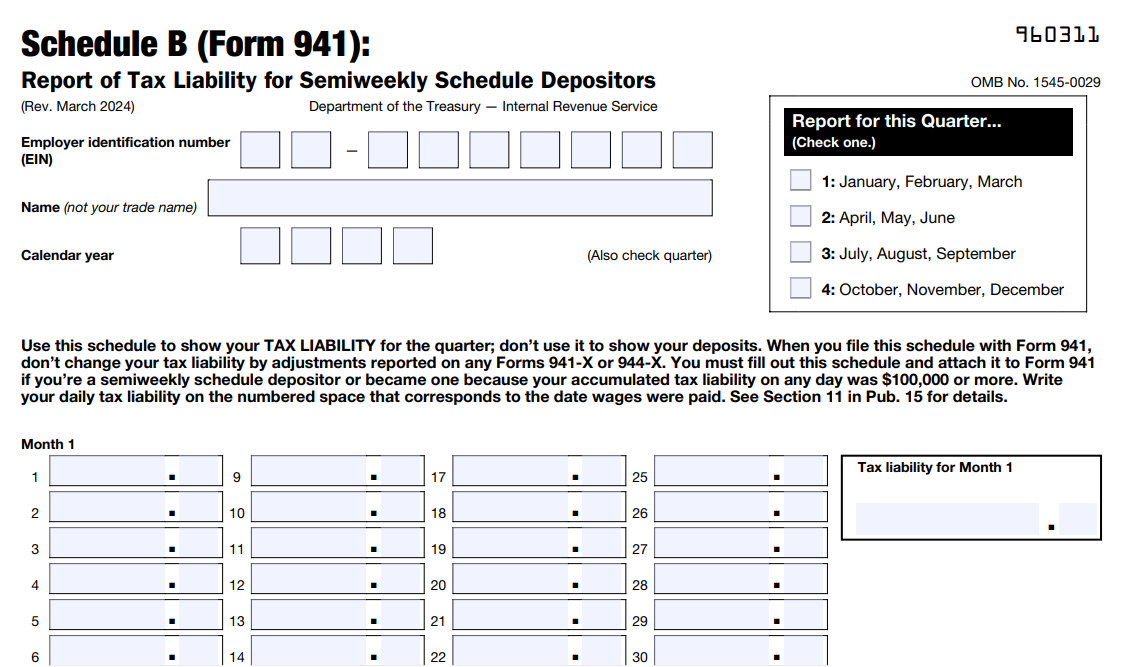

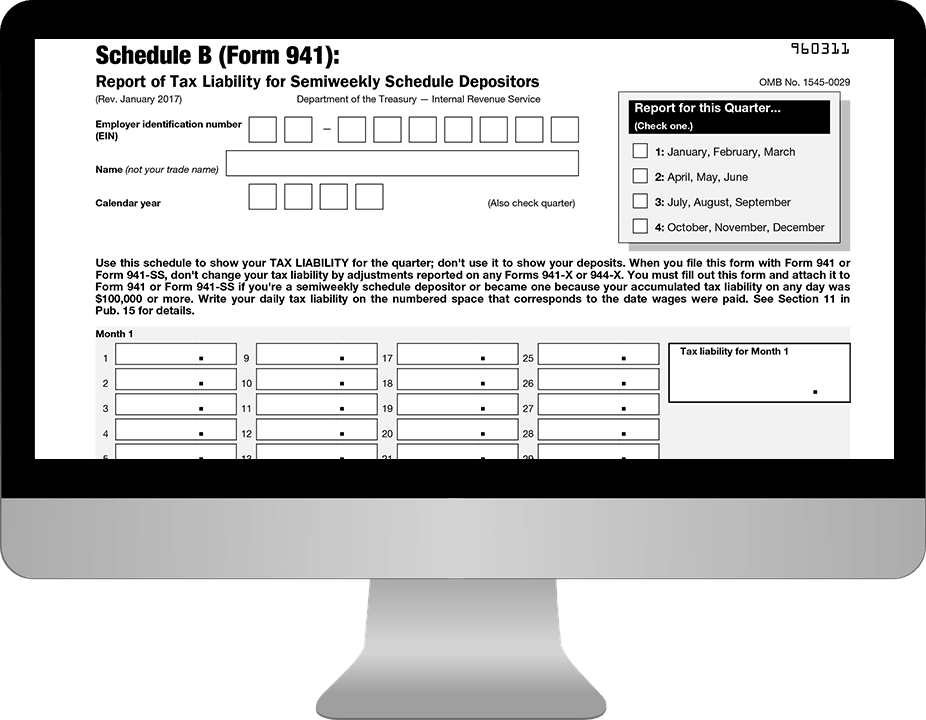

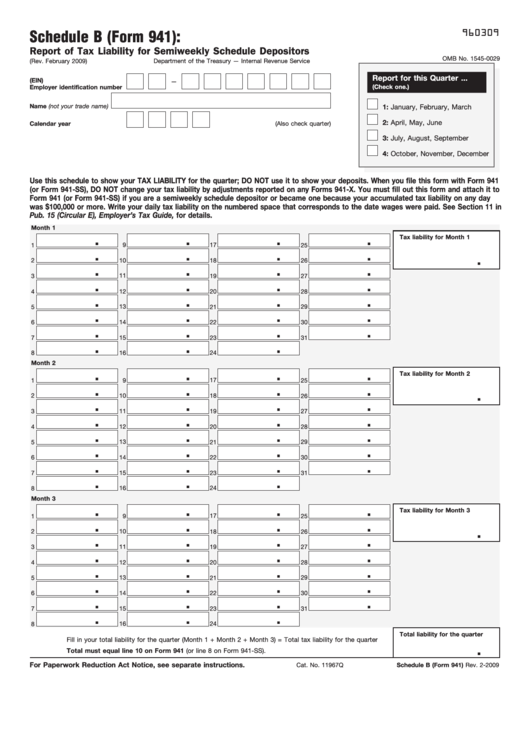

Federal Schedule B Form 941

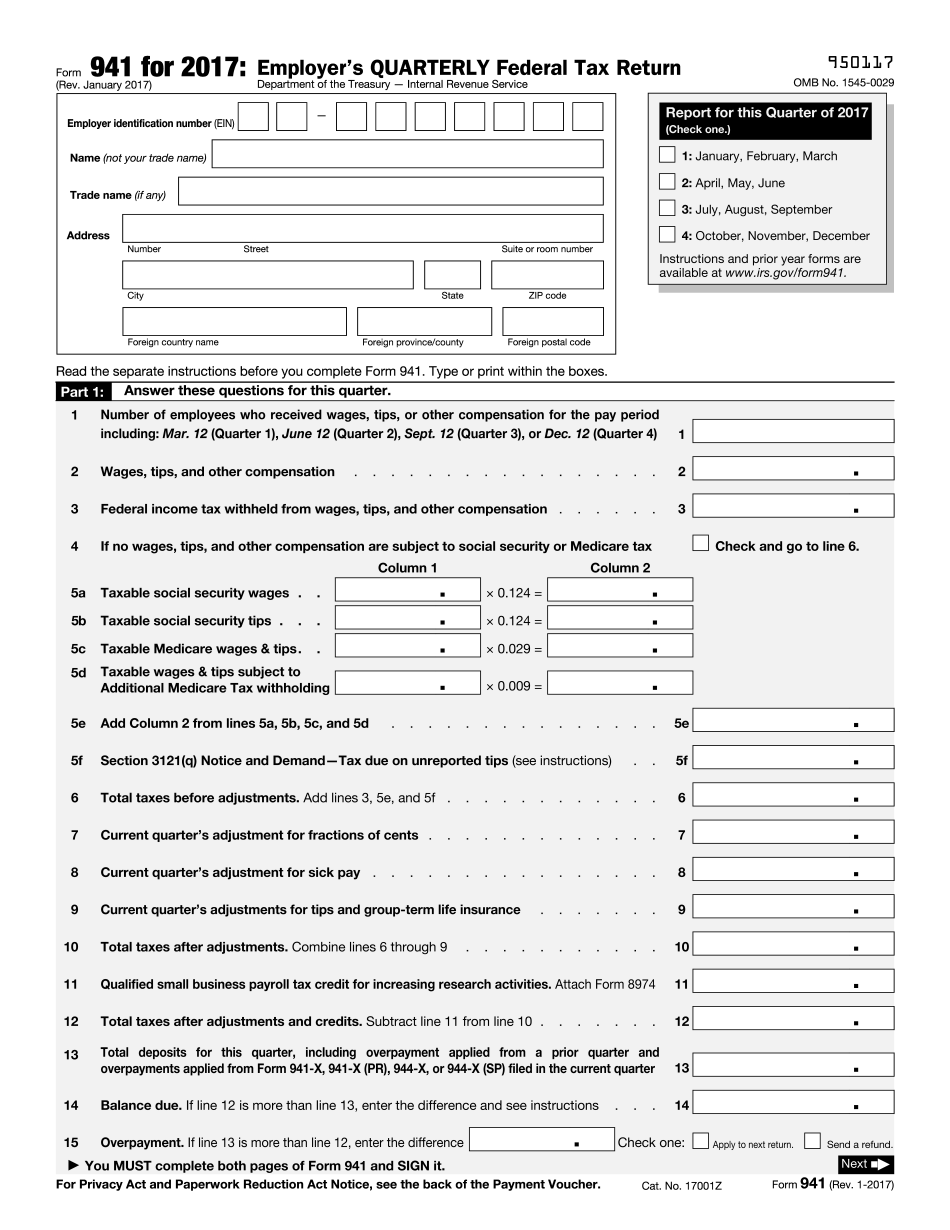

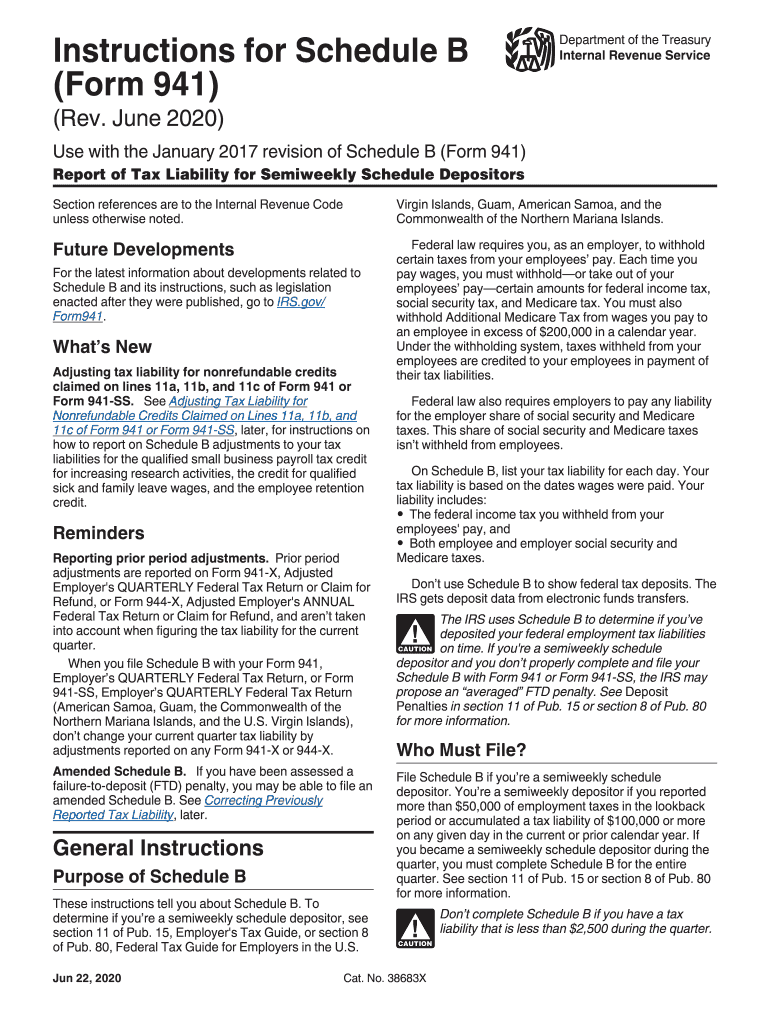

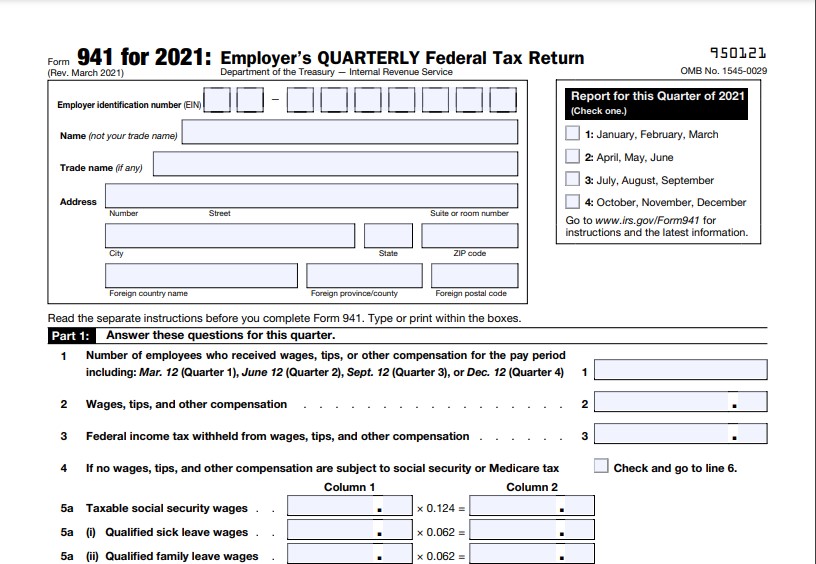

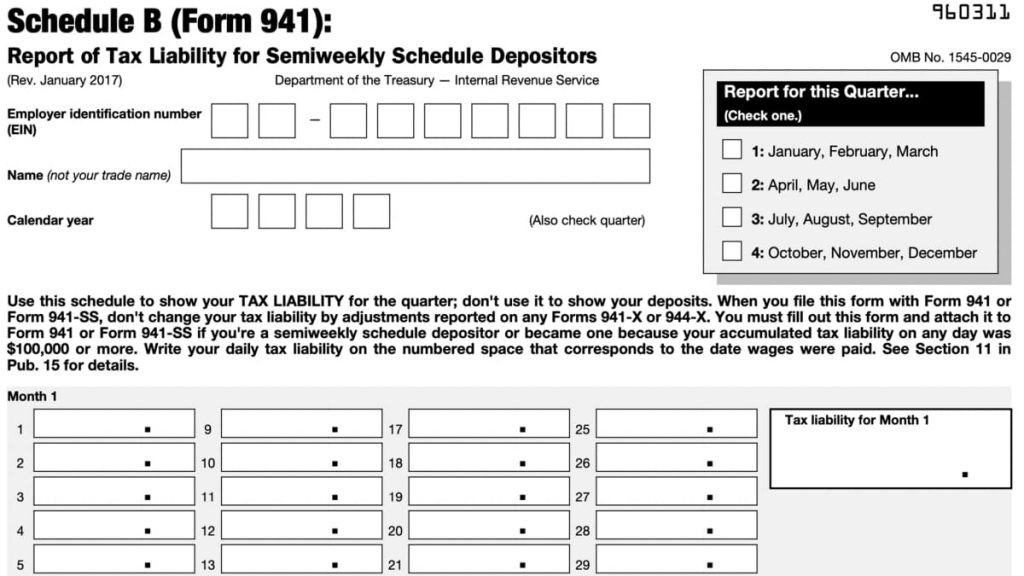

Federal Schedule B Form 941 - Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from. Use this schedule to show your tax liability for the quarter;. Web page last reviewed or updated: Don't report federal income tax withholding from wages on form 945. Web form 941 employer's quarterly federal tax return. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Report for this quarter of 2022. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Ein shown on the attached. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions. Web form 941 employer's quarterly federal tax return. Web jun 23, 2021. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. October, november, december go to www.irs.gov/form941 for instructions and the latest. All federal income tax withholding and. Web in completing line 16 or schedule b (form 941), you take into account the entire quarter's nonrefundable portion of the credit for qualified sick and family leave. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and. Web purpose of schedule b. All federal income tax withholding and. Web on schedule b (form 941), list your tax liability for each assigned to your business and also agree with the name and day. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to. Web tax form 941 fill in and calculate online. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web in completing line 16 or schedule b (form 941), you take into account the entire quarter's nonrefundable portion of the credit for qualified sick and family leave. Report for this. These instructions tell you about schedule b. Web updated schedule b instructions were released. Web the irs has updated form 8974, qualified small business payroll tax credit for increasing research activities, to allow small businesses to claim up to $250,000 in credit against. Web page last reviewed or updated: Use this schedule to show your tax liability for the quarter;. Report for this quarter of 2022. Web tax form 941 fill in and calculate online. Ein shown on the attached. Use this schedule to show your tax liability for the quarter;. These instructions tell you about schedule b. Use this schedule to show your tax liability for the quarter;. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web purpose of schedule b. Web tax form 941 fill in and calculate online. If you're a semiweekly schedule depositor and you don’t properly. Web gambling winnings, must be reported on form 945. October, november, december go to www.irs.gov/form941 for instructions and the latest. Employer's quarterly federal tax return as a. Web updated schedule b instructions were released. Don't report federal income tax withholding from wages on form 945. Report for this quarter of 2022. Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web on schedule b (form 941), list your tax liability for each assigned to your business and also agree with the name and day. For. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. These instructions tell you about schedule b. To determine if you’re a semiweekly schedule depositor, see section 11 of pub. Web on schedule b (form 941), list your tax liability for each assigned to your business and also agree with the name and day.. Web form 941 employer's quarterly federal tax return. For tax years beginning before january 1, 2023, a qualified small business may elect to. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web on schedule b (form 941), list your tax liability for each assigned to your business and also agree with the name and day. Web page last reviewed or updated: To determine if you’re a semiweekly schedule depositor, see section 11 of pub. All federal income tax withholding and. Information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions. Web purpose of schedule b. Web jun 23, 2021. October, november, december go to www.irs.gov/form941 for instructions and the latest. Web tax form 941 fill in and calculate online. Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Web updated schedule b instructions were released. Web in completing line 16 or schedule b (form 941), you take into account the entire quarter's nonrefundable portion of the credit for qualified sick and family leave. The instructions are to continue to be used with the january 2017 version of schedule b. Web gambling winnings, must be reported on form 945. Employer's quarterly federal tax return. Employer's quarterly federal tax return as a. Don't report federal income tax withholding from wages on form 945.File 941 Online How to File 2023 Form 941 electronically

Form 941 Schedule B Edit, Fill, Sign Online Handypdf

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Fillable Schedule B (Form 941) Report Of Tax Liability For Semiweekly

Printable 941 Form For 2020 Printable World Holiday

Schedule B Form 941 Semiweekly Tax Liability Report for Employers DocHub

Get IRS 941 Schedule B 20172023 US Legal Forms Fill Online

IRS Instructions 941 Schedule B 2020 Fill and Sign Printable

Form 941 Printable & Fillable Per Diem Rates 2021

IRS Fillable Form 941 2023

Related Post: