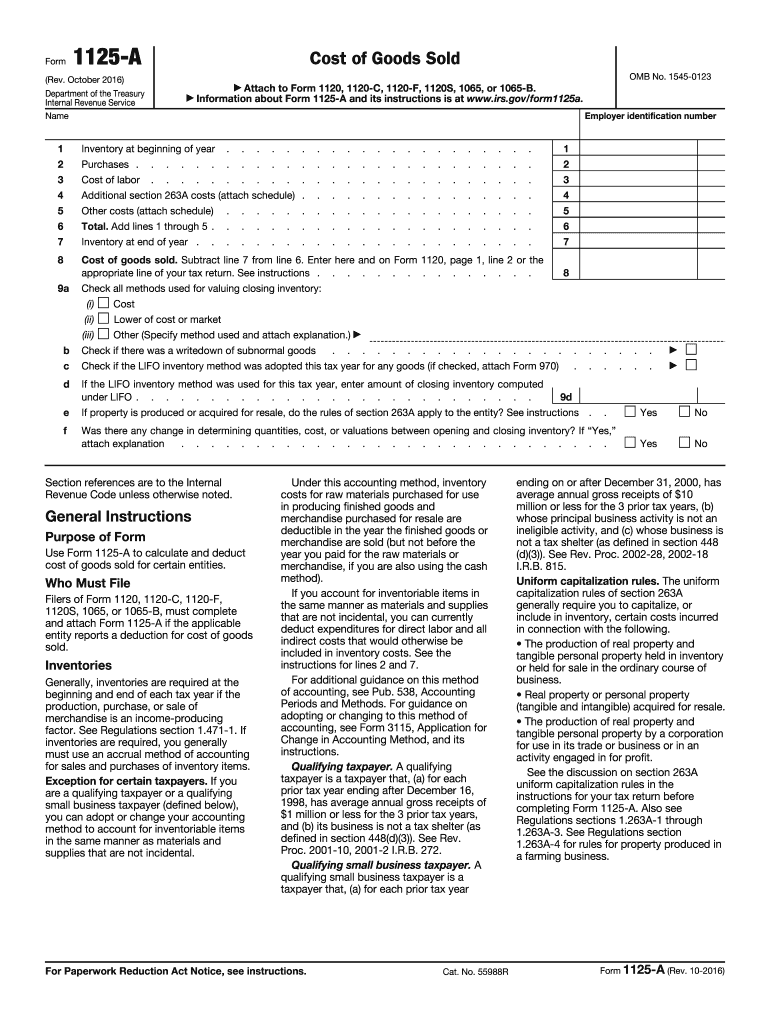

1125A Tax Form

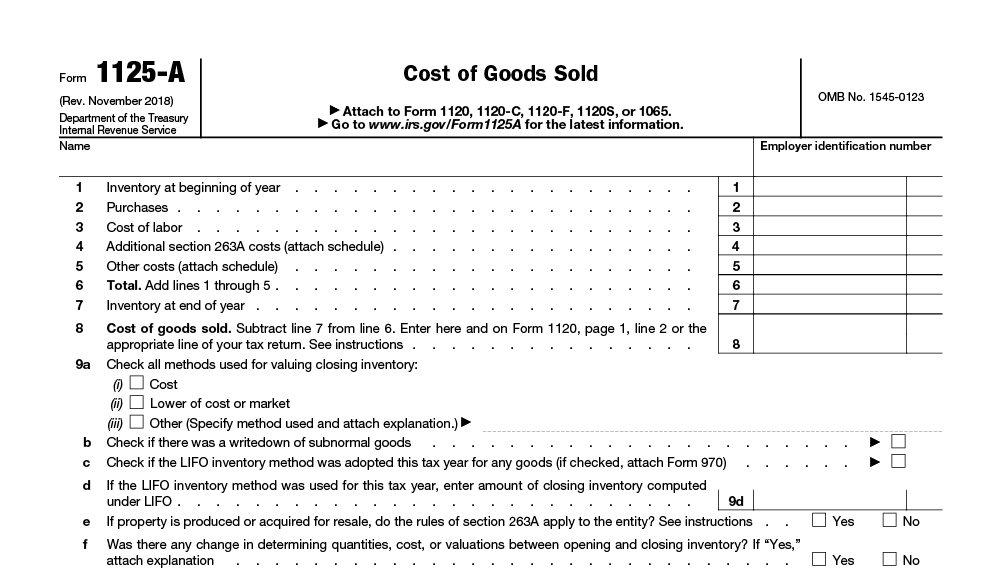

1125A Tax Form - Get ready for tax season deadlines by completing any required tax forms today. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web the 2017 tax return. Web up to $40 cash back fill now. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Resident shareholder's information schedule form with instructions. Estimate how much you could potentially save in just a matter of minutes. Web arizona s corporation income tax return. All forms individual forms information returns fiduciary reporting entity returns transfer taxes. Poa and disclosure forms, withholding forms. Estimate how much you could potentially save in just a matter of minutes. Web the 2017 tax return. Resident shareholder's information schedule form with instructions. All forms individual forms information returns fiduciary reporting entity returns transfer taxes. This form is for income earned in tax year 2022, with tax returns due in april. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web arizona s corporation income tax return. Individual estimated tax payment booklet. You can download or print current or past. Estimate how much you could potentially save in just a matter of minutes. This form is for income earned in tax year 2022, with tax returns due in april. All forms individual forms information returns fiduciary reporting entity returns transfer taxes. Web arizona s corporation income tax return. For contributions made to an umbrella charitable organization, the qualifying charitable organization. You can download or print current or past. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Resident shareholder's information schedule form with instructions. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Ad if you owe more than $5,000 in back taxes tax advocates can. Estimate how much you could potentially save in just a matter of minutes. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. Web the 2017 tax return. Individual estimated tax payment booklet. Ad tax plan at both the federal and state levels with. Cost of goods sold appropriate line (irs) form is 1 page long and contains: You can download or print current or past. Web arizona s corporation income tax return. Poa and disclosure forms, withholding forms. Web up to $40 cash back fill now. All forms individual forms information returns fiduciary reporting entity returns transfer taxes. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. This form is for income earned in tax year 2022, with tax returns due. Cost of goods sold appropriate line (irs) form is 1 page long and contains: Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. This form is for income earned in tax year 2022, with tax returns due in april. Web arizona s corporation. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Cost of goods sold appropriate line (irs) form is 1 page long and contains: Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. Web arizona. Cost of goods sold appropriate line (irs) form is 1 page long and contains: Individual estimated tax payment booklet. Web up to $40 cash back fill now. Web the 2017 tax return. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web arizona s corporation income tax return. Cost of goods sold appropriate line (irs) form is 1 page long and contains: Get ready for tax season deadlines by completing any required tax forms today. Estimate how much you could potentially save in just a matter of minutes. All forms individual forms information returns fiduciary reporting entity returns transfer taxes. Ad tax plan at both the federal and state levels with over 1,500 tax planning strategies. Poa and disclosure forms, withholding forms. You can download or print current or past. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. This form is for income earned in tax year 2022, with tax returns due in april. Calculate over 1,500 tax planning strategies automatically and save tens of thousands Web up to $40 cash back fill now. Resident shareholder's information schedule form with instructions. Individual estimated tax payment booklet. Web the 2017 tax return. Web for businesses that sell inventory to customers, the cost of goods sold (cogs) deduction is likely going to be the largest expense for the expense. Complete, edit or print tax forms instantly.IRS Form 1125E Fill Out, Sign Online and Download Fillable PDF

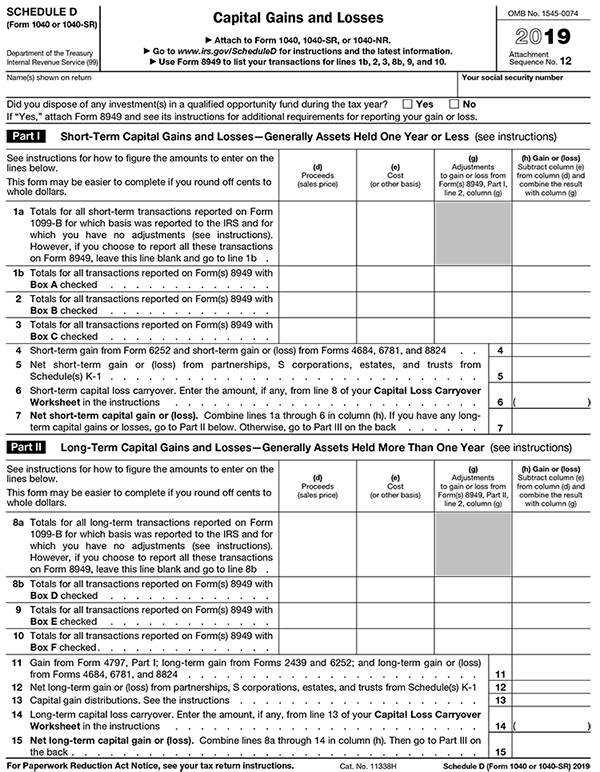

Irs 1040 Form 2019 / The irs introduced a new 1040 form for seniors in

What Does A State Tax Form Look Like Fill and Sign Printable Template

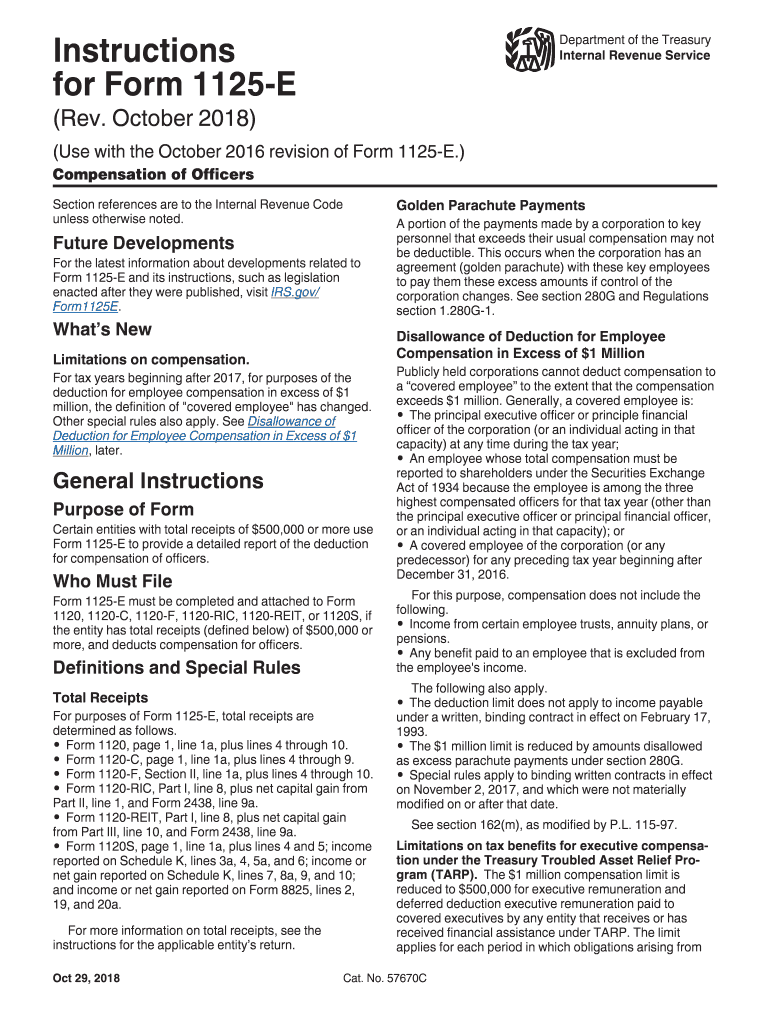

20182022 Form IRS Instruction 1125E Fill Online, Printable, Fillable

IRS 1120W 2021 Fill out Tax Template Online US Legal Forms

Form 1065 Instructions U.S. Return of Partnership

Form 1125 Fill Out and Sign Printable PDF Template signNow

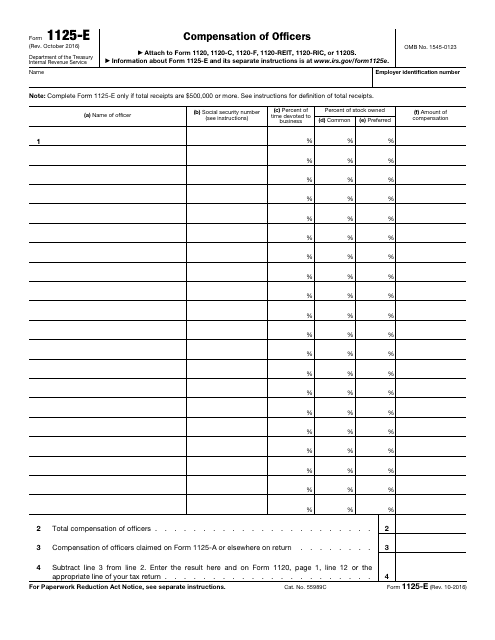

Form 1125A Cost of Goods Sold (2012) Free Download

2016 Form IRS 1125AFill Online, Printable, Fillable, Blank pdfFiller

Publication 17 Your Federal Tax;

Related Post: