Form Or-40-V Instructions

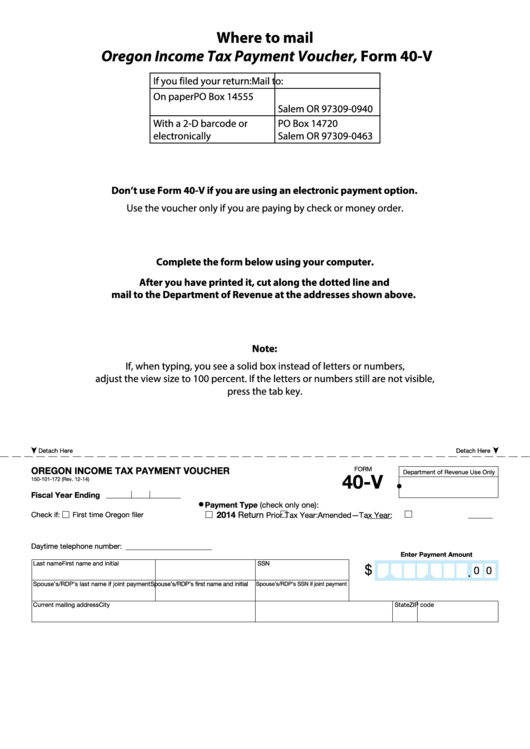

Form Or-40-V Instructions - This form is for income earned in tax year 2022, with tax returns due in april. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. If more than three, check this box and. If you owe oregon tax for 2019 and need more time to file your oregon return, use the tax payment worksheet on page 1 to calculate your extension. For tax year 2022, enter: Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. For more information about the. Web how it works the form with your finger filled & signed form or save how to fill out and sign oregon form v online? For most filers this will be. Enter your social security number (ssn). Web page last reviewed or updated: Make your check, money order, or cashier’s check payable to the oregon department of revenue. Web regular severely disabled someone else can claim you as a dependent. For tax year 2022, enter: Get your online template and fill it in using progressive features. List your dependents in order from youngest to oldest. This form is for income earned in tax year 2022, with tax returns due in april. For tax year 2022, enter: Web page last reviewed or updated: If you owe oregon tax for 2019 and need more time to file your oregon return, use the tax payment worksheet on page 1. If you are filling out a joint return, then you will enter the first ssn listed on your form 1040. Web page last reviewed or updated: You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Web regular severely disabled someone else can claim you as a dependent. For tax year 2022, enter: For more information about the. If you are filling out a joint return, then you will enter the first ssn listed on your form 1040. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. List your dependents in order from youngest to oldest. For tax year 2022, enter: This form is for income earned in tax year 2022, with tax returns due in april. For most filers this will be. Web regular severely disabled someone else can claim you as a dependent. If more than three, check this box and. Revenue online www.oregon.godorv/ (click on revenue online) • securely communicate with us. Enter the month, day, and year for the beginning and end date of the tax year you are submitting the payment for. Make your check, money order, or cashier’s check payable to the oregon department of revenue. If you are filling out a joint return, then you will enter the first ssn listed on your form 1040. Enter the month,. Enter your social security number (ssn). Web page last reviewed or updated: Enter the month, day, and year for the beginning and end date of the tax year for this payment. Enter the month, day, and year for the beginning and end date of the tax year you are submitting the payment for. Enter the month, day, and year for. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. Enter the month, day, and year for the beginning and end date of the tax year for this payment. • make or schedule payments. Web page last reviewed or updated: Get your online template and fill it in using progressive. Revenue online www.oregon.godorv/ (click on revenue online) • securely communicate with us. Web how it works the form with your finger filled & signed form or save how to fill out and sign oregon form v online? For tax year 2022, enter: If you are filling out a joint return, then you will enter the first ssn listed on your. Enter the month, day, and year for the beginning and end date of the tax year for this payment. List your dependents in order from youngest to oldest. For more information about the. Enter your social security number (ssn). If more than three, check this box and. If you are filling out a joint return, then you will enter the first ssn listed on your form 1040. Make your check, money order, or cashier’s check payable to the oregon department of revenue. If more than three, check this box and. This form is for income earned in tax year 2022, with tax returns due in april. List your dependents in order from youngest to oldest. • make or schedule payments. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Web regular severely disabled someone else can claim you as a dependent. Enter your social security number (ssn). Enter the month, day, and year for the beginning and end date of the tax year for this payment. Use this payment voucher to file any payments that you need to make with your oregon income taxes. • check your refund status. For tax year 2022, enter: Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. Enter the month, day, and year for the beginning and end date of the tax year you are submitting the payment for. If you owe oregon tax for 2019 and need more time to file your oregon return, use the tax payment worksheet on page 1 to calculate your extension. Enter the month, day, and year for the beginning and end date of the tax year for this payment. Get your online template and fill it in using progressive features. For more information about the. Revenue online www.oregon.godorv/ (click on revenue online) • securely communicate with us.Alabama Form 40 Instructions

OR OR40V 20202021 Fill out Tax Template Online US Legal Forms

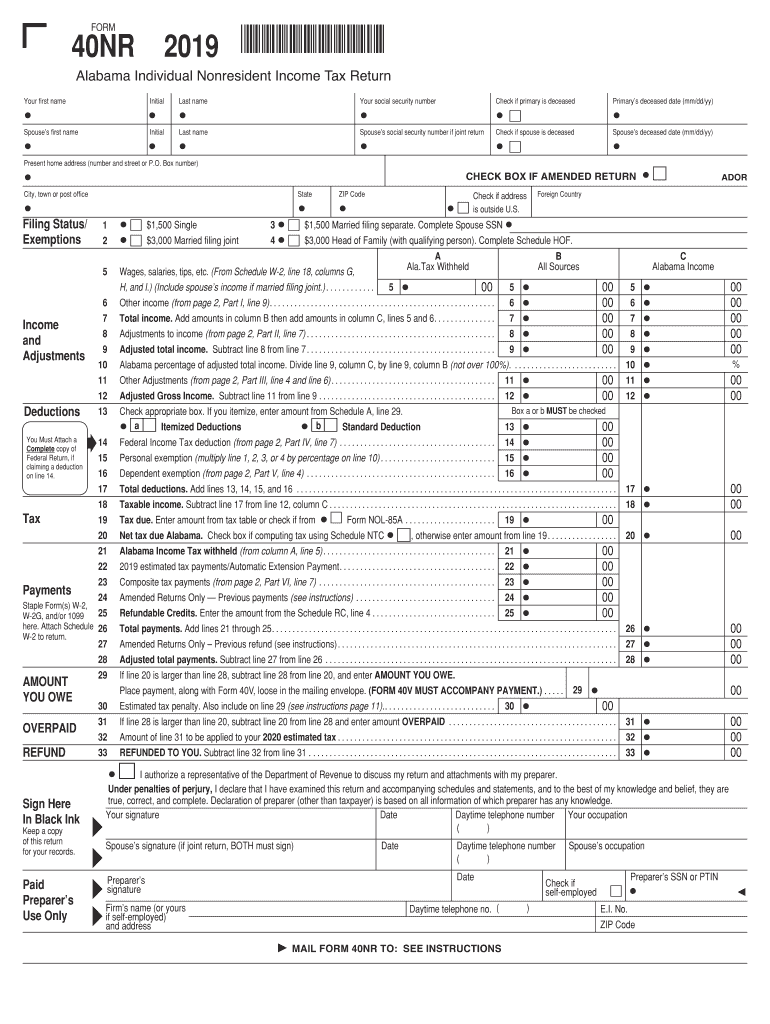

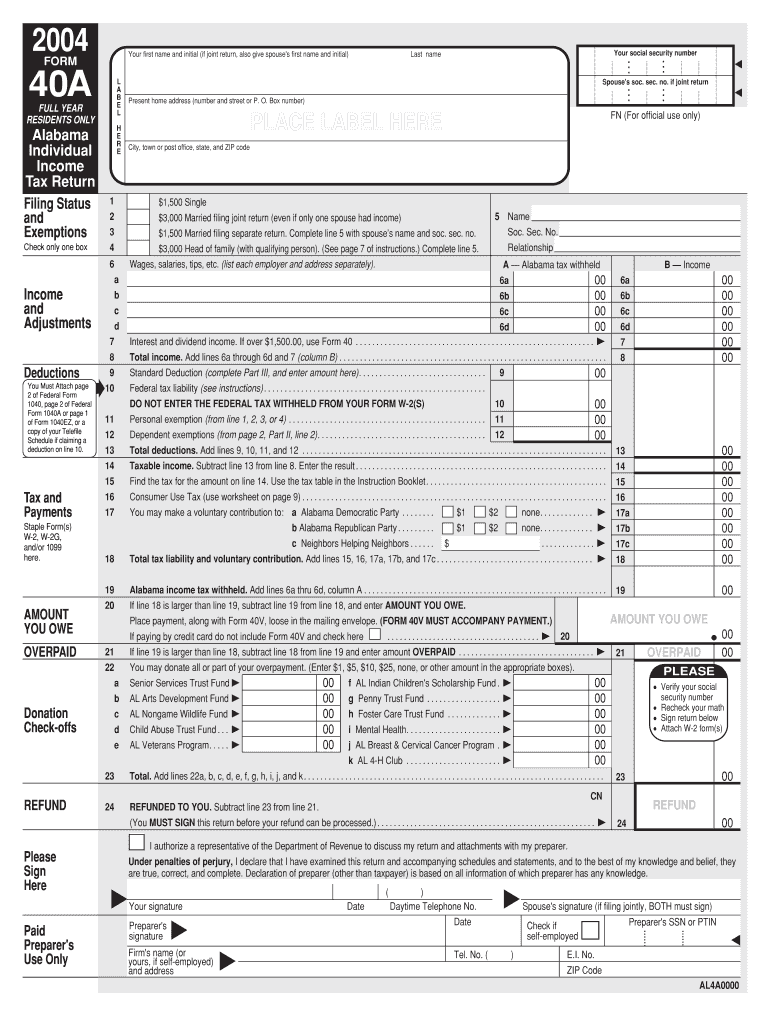

2016 alabama form 40 Fill out & sign online DocHub

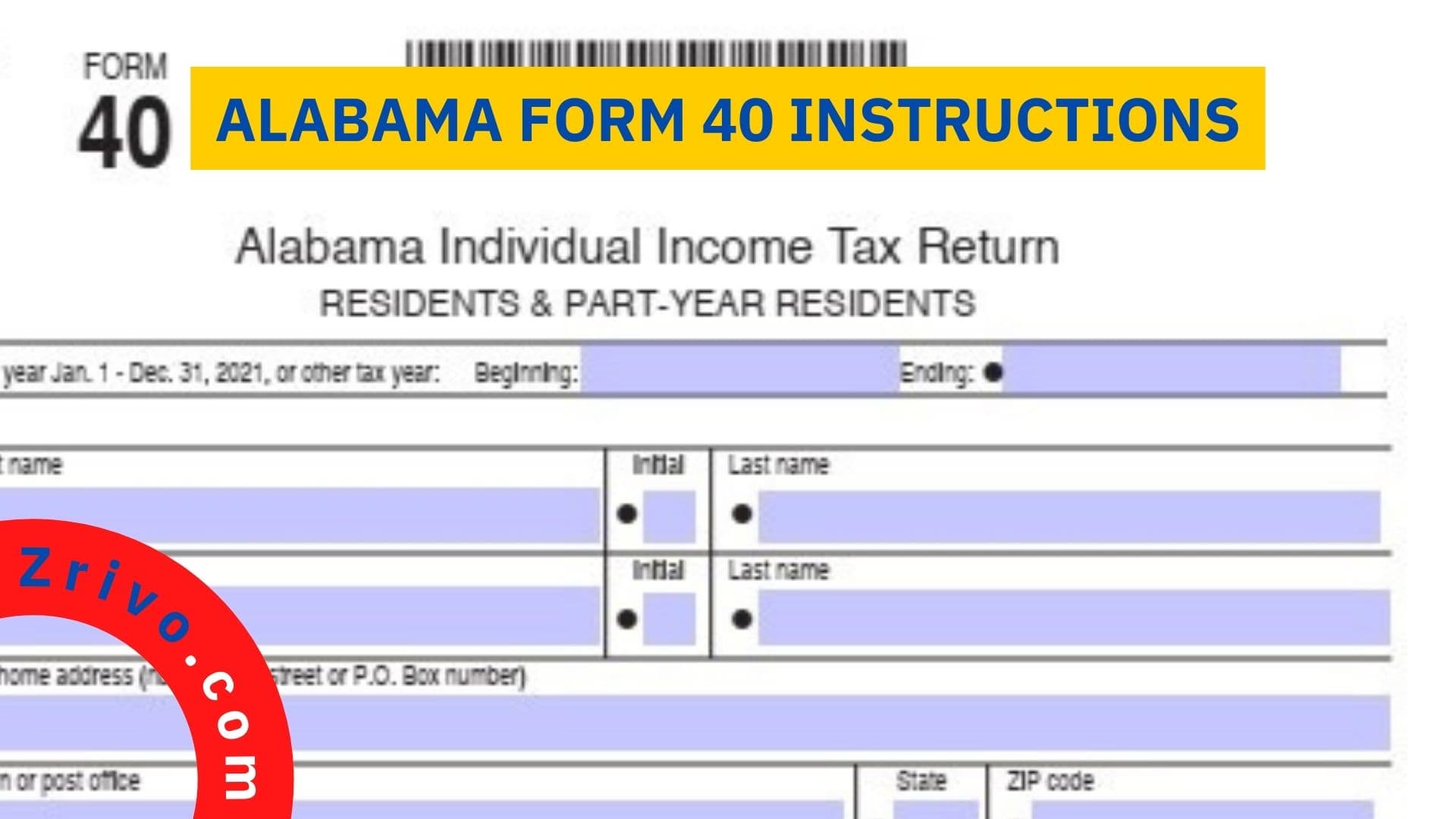

Alabama Form 40 Instructions 2023 Printable Forms Free Online

Fillable Form 40V Oregon Tax Payment Voucher printable pdf

Oregon form 40 v Fill out & sign online DocHub

Oregon Form 40 Instructions 2018 slidesharedocs

IL DoR IL1040V 20202022 Fill and Sign Printable Template Online

Fillable Online Alabama Form 40v 2000 Individual State

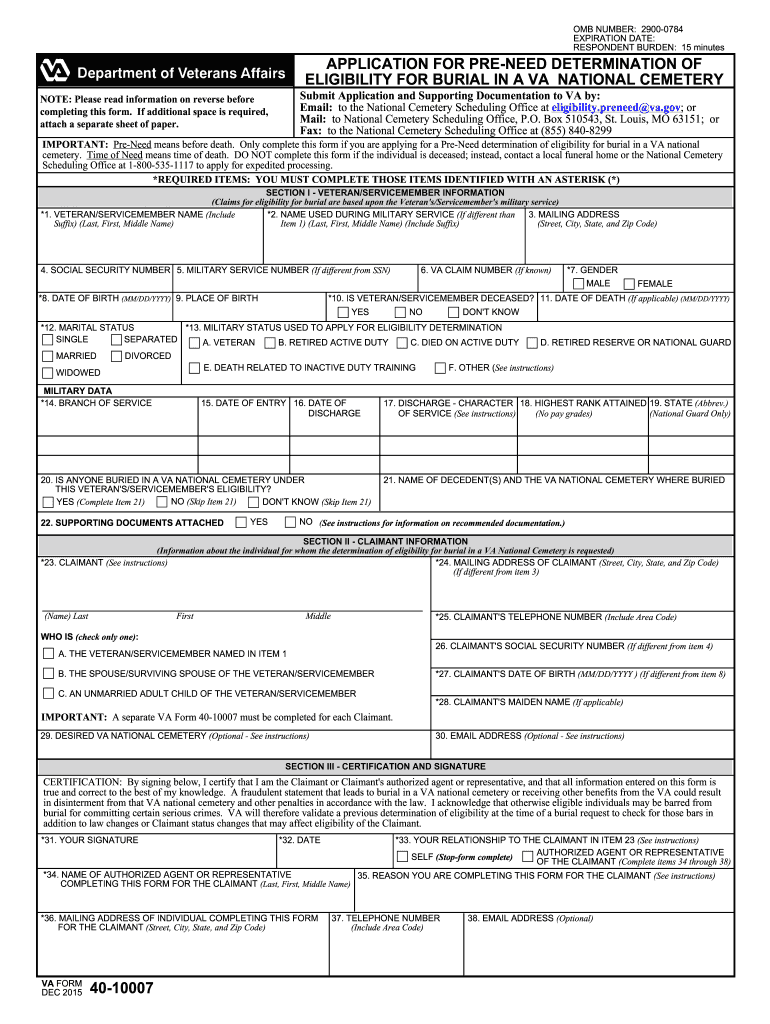

Va form 40 10007 Fill out & sign online DocHub

Related Post: