1031 Exchange Form 8824 Example

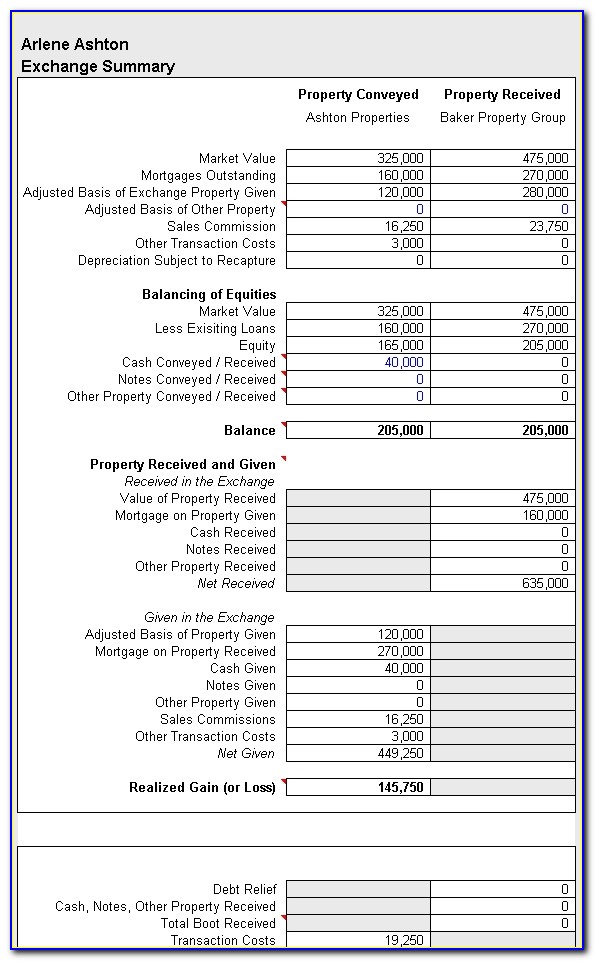

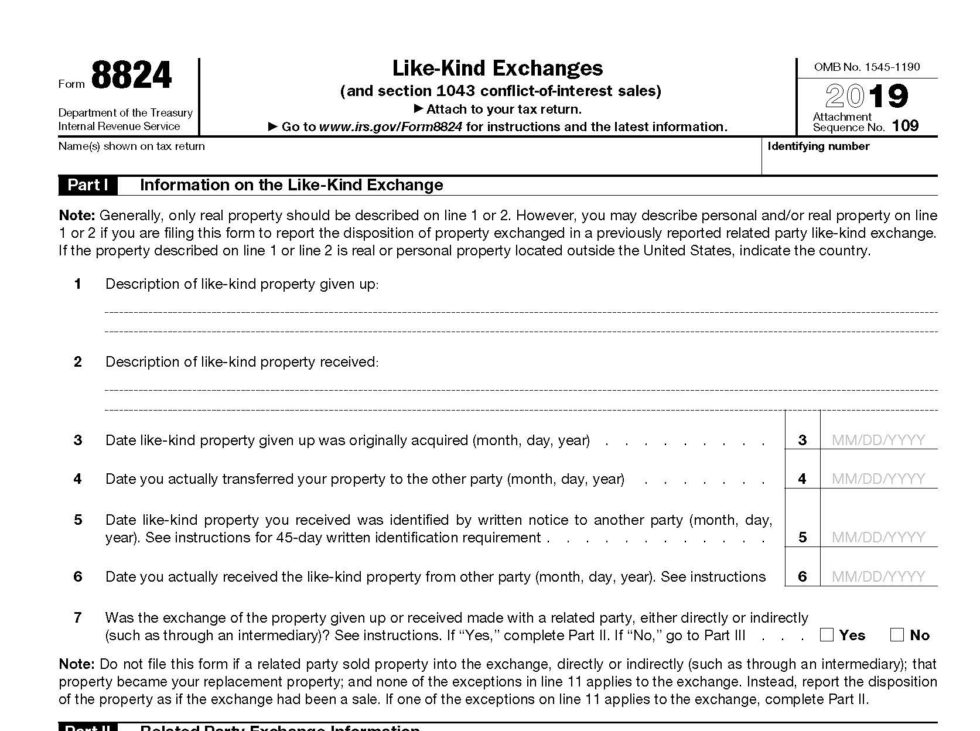

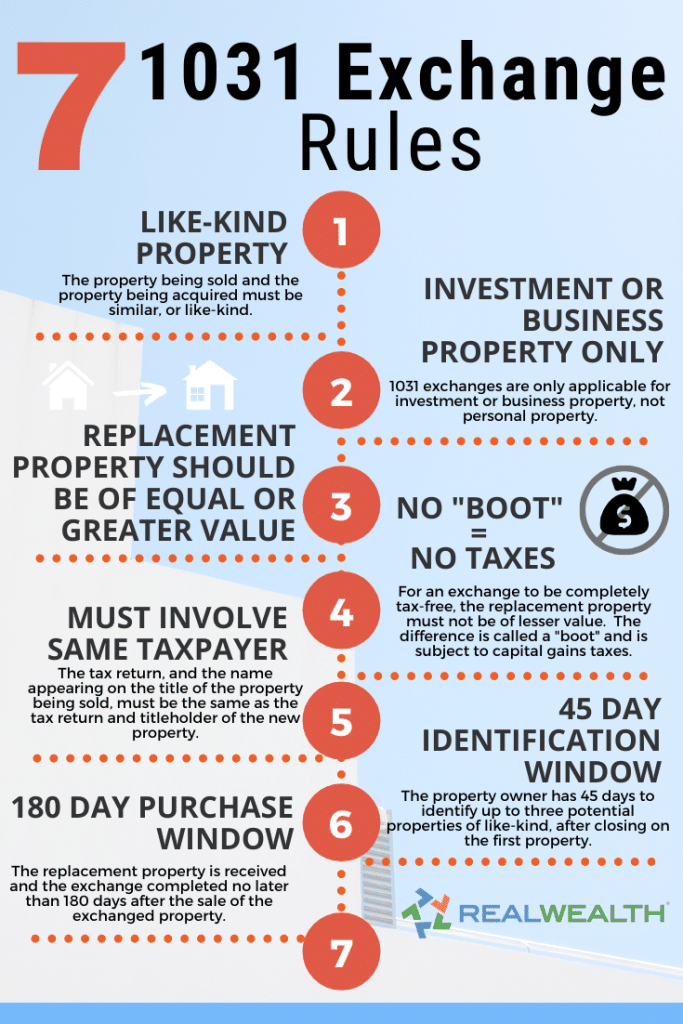

1031 Exchange Form 8824 Example - Web type of section 1031 exchange is a simultaneous swap of one property for another. Web you have to know the basis in each property for purposes of depreciation and for purposes of disposal even through another 1031 exchange. Beginning the 1031 exchange process? Ad start a 1031 exchange today or contact an expert. Contact the most experienced 1031 exchange experts Ad start a 1031 exchange today or contact an expert. Ad own real estate without dealing with the tenants, toilets and trash. Web use of the §1031 exchange. Use part iii to figure the amount of gain required to be reported on the tax return in the. Try it for free now! Ad need a 1031 exchange accommodator? Ad start a 1031 exchange today or contact an expert. Include your name and tax id number at the top of each page of the. Use part iii to figure the amount of gain required to be reported on the tax return in the. Web form 8824 worksheet worksheet 1 tax deferred exchanges under. Learn more about qualified intermediaries. And none of the exceptions on line 11 applies to the exchange. Click below to download the form 8824 worksheets. Ad start a 1031 exchange today or contact an expert. Learn how a qualified intermediary can help. Instead, report the disposition of the property as if the exchange had. Click below to download the form 8824 worksheets. Beginning the 1031 exchange process? And none of the exceptions on line 11 applies to the exchange. Form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Ad need a 1031 exchange accommodator? Beginning the 1031 exchange process? Instead, report the disposition of the property as if the exchange had. Ad start a 1031 exchange today or contact an expert. Contact the most experienced 1031 exchange experts Ad own real estate without dealing with the tenants, toilets and trash. Learn more about qualified intermediaries. Form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Ad start a 1031 exchange today or contact an expert. Contact the most experienced 1031 exchange experts And none of the exceptions on line 11 applies to the exchange. Web use of the §1031 exchange. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Beginning the 1031 exchange process? Ad start a 1031 exchange today or contact an expert. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Beginning the 1031 exchange process? Web form 8824 worksheet worksheet 1 tax deferred exchanges under irc § 1031 date closed taxpayer exchange property replacement property form 8824 line 15 cash. Web type of section 1031 exchange is a simultaneous swap of one property for another. Ad. Ad start a 1031 exchange today or contact an expert. Our experienced team is ready to help. Web the information provided in irs form 8824 makes it easy for the irs to review a taxpayer's prior 8824 forms to verify that the appropriate amount of taxable gain is calculated and. Web type of section 1031 exchange is a simultaneous swap. Ad need a 1031 exchange accommodator? Web property became your replacement property; Contact the most experienced 1031 exchange experts Ad own real estate without dealing with the tenants, toilets and trash. Web and attach your own statement showing all the information requested on form 8824 for each exchange. Web property became your replacement property; Try it for free now! Ad start a 1031 exchange today or contact an expert. Web you have to know the basis in each property for purposes of depreciation and for purposes of disposal even through another 1031 exchange. Web use of the §1031 exchange. Web use of the §1031 exchange. Click below to download the form 8824 worksheets. Try it for free now! Ad need a 1031 exchange accommodator? Contact the most experienced 1031 exchange experts Our experienced team is ready to help. Web form 8824 worksheet worksheet 1 tax deferred exchanges under irc § 1031 date closed taxpayer exchange property replacement property form 8824 line 15 cash. Learn how a qualified intermediary can help. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Include your name and tax id number at the top of each page of the. Instead, report the disposition of the property as if the exchange had. Form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Web the information provided in irs form 8824 makes it easy for the irs to review a taxpayer's prior 8824 forms to verify that the appropriate amount of taxable gain is calculated and. Upload, modify or create forms. Web type of section 1031 exchange is a simultaneous swap of one property for another. You can find instructions to the form 8824 worksheets in the paragraphs following. Learn more about qualified intermediaries. Contact the most experienced 1031 exchange experts Use part iii to figure the amount of gain required to be reported on the tax return in the. Web property became your replacement property;Irs 1031 Exchange Form Form Resume Examples EpDLaMr5xR

Form 8824 LikeKind Exchanges (2015) Free Download

1031 Exchange Order Form

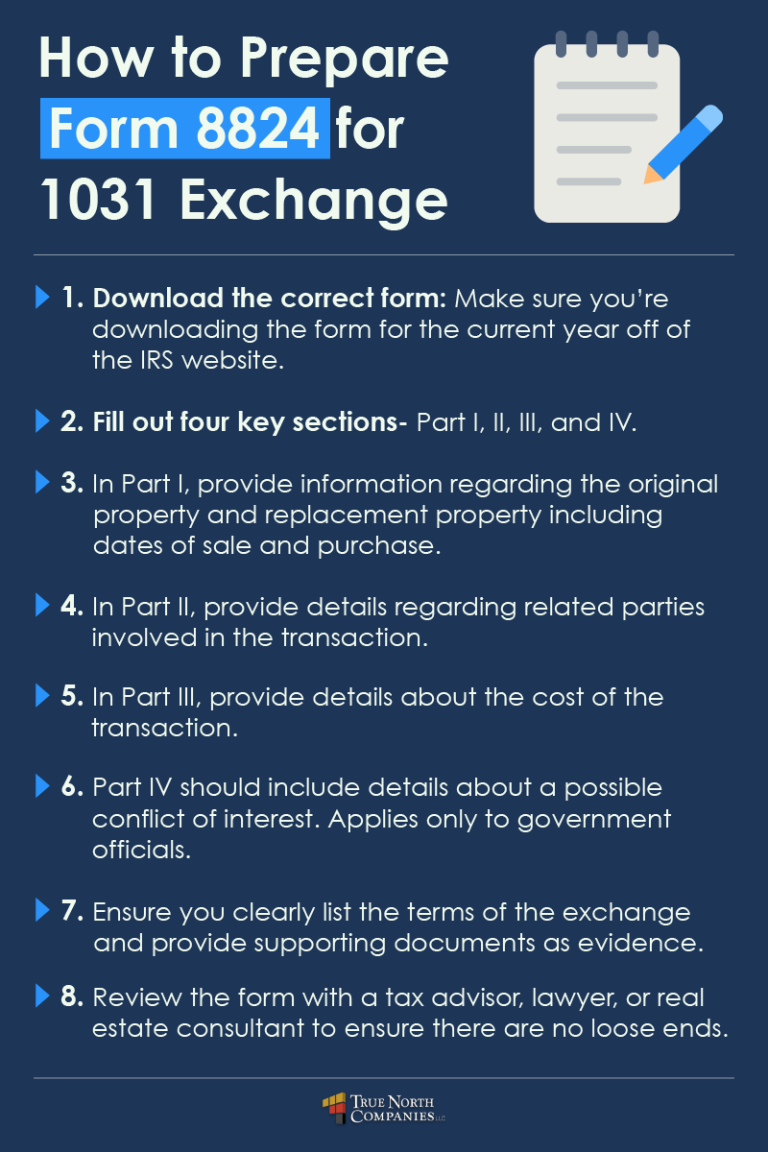

1031 Exchange All You Need to Know About Completing IRS Form 8824

turbotax entering 1031 exchange Fill Online, Printable, Fillable

1031 Exchange Calculation Worksheet CALCULATORVGW

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Steps to a 1031 Exchange Realty Exchange Corporation 1031 Qualified

Basic 1031 Exchange Rules 1031 Exchange Rules 2021

Irs Form 8824 Simple Worksheet herofinstant

Related Post: