Worksheet For Form 2210

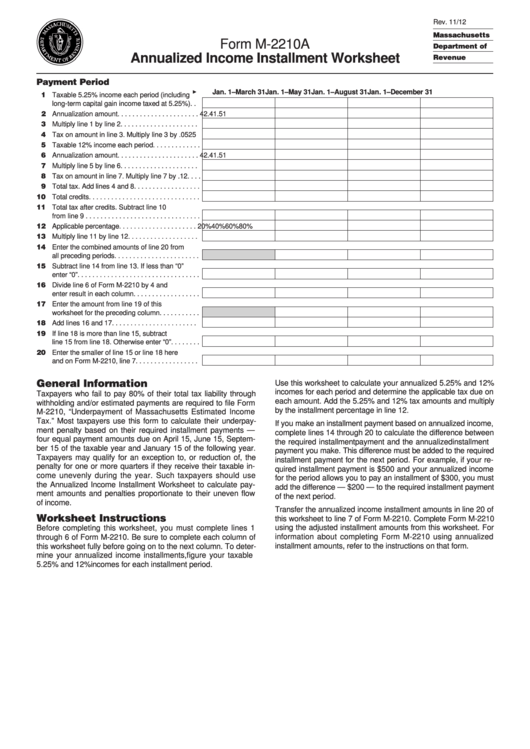

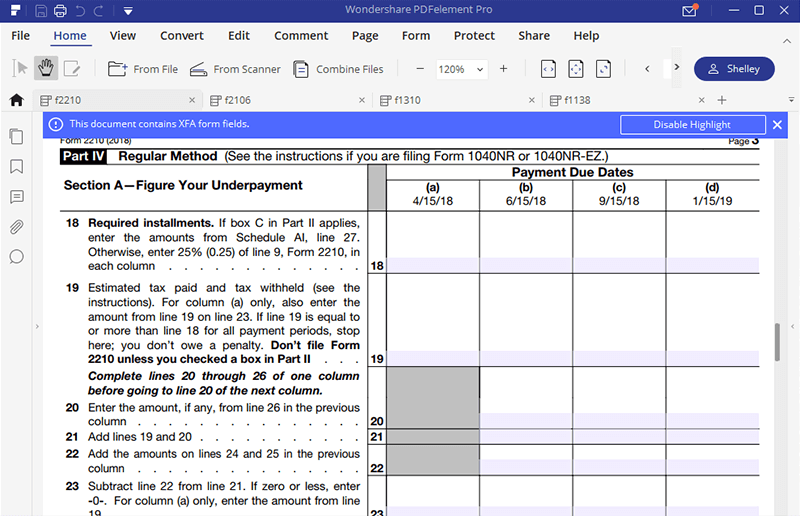

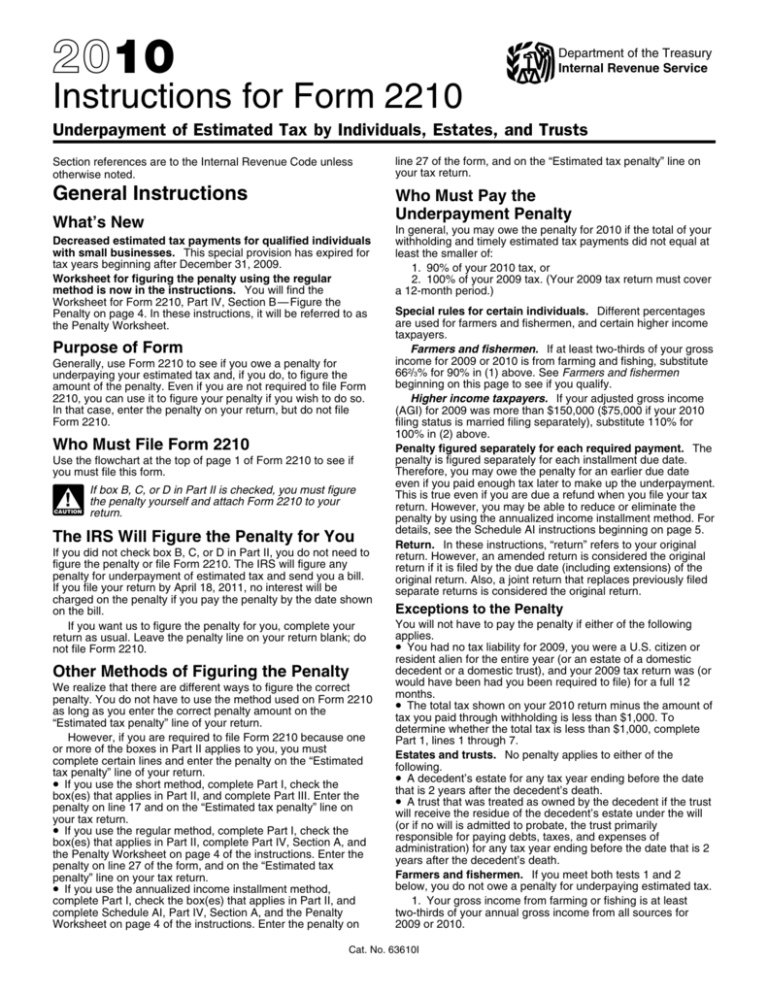

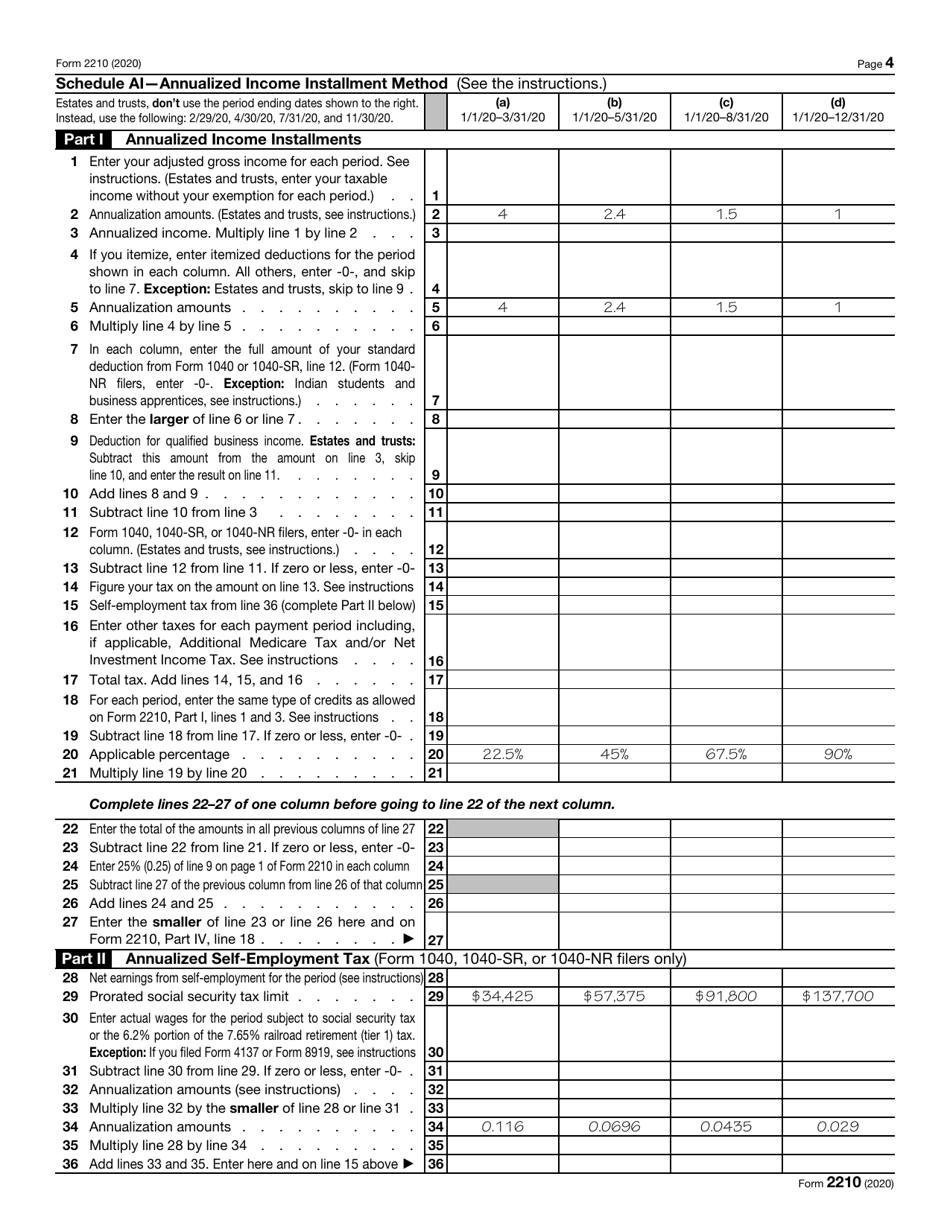

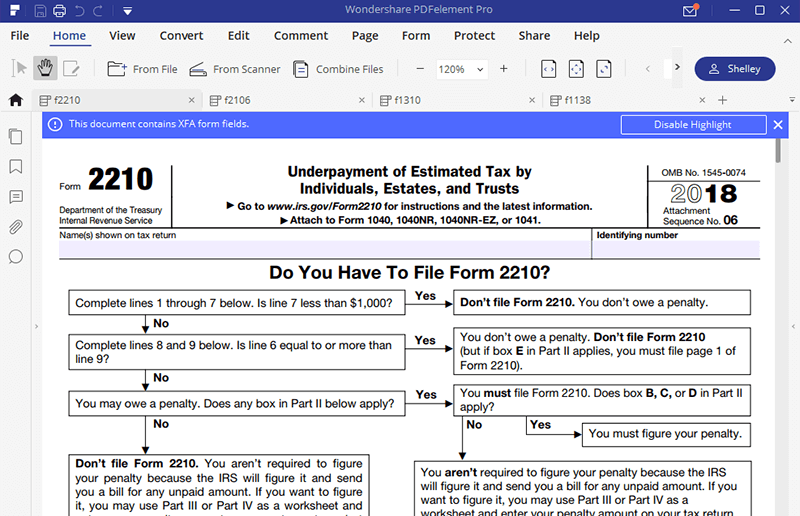

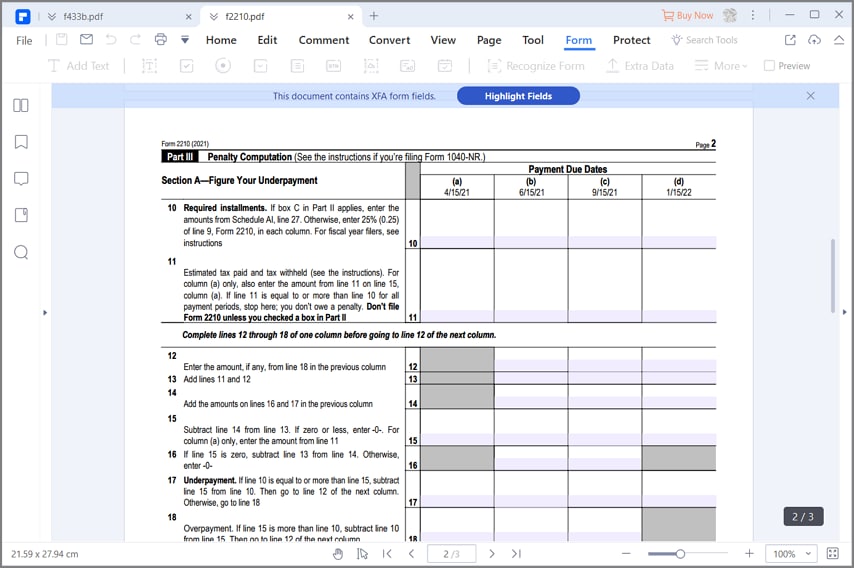

Worksheet For Form 2210 - Form 2210 is used by individuals (as well as estates and trusts) to. It can be used to determine if there is a penalty and you. Web form 2210 is not generated unless there is an underpayment and the form is required. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. This is simply to provide helpful information to the. Find the gcd (or hcf) of numerator and denominator gcd of 22 and 10 is 2; This default setting can be changed for a single return on screen 1 under 2210 options, and. Web if your income is subject to fluctuation, part iv and section b of form 2210 provides a worksheet to compute the variances in your taxable income. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Enter the penalty on form 2210,. Web when an underpayment penalty applies, but form 2210 isn't required, lacerte will generate the 2210 worksheets to figure the penalty amount so that you can. This is simply to provide helpful information to the. It can be used to determine if there is a penalty and you. Web and part iii, section a. For instructions and the latest information. Web when an underpayment penalty applies, but form 2210 isn't required, lacerte will generate the 2210 worksheets to figure the penalty amount so that you can. Find the gcd (or hcf) of numerator and denominator gcd of 22 and 10 is 2; Web worksheet for form 2210, part iv, section b—figure the penalty =iiiii (penalty worksheet) keep for your records. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. For instructions and the latest information. Form 2210 is used by individuals (as well as estates and trusts) to. Web. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web form 2210 can be used as a worksheet and doesn't need to be filed with your tax return in many cases. Web if a penalty is calculated on this worksheet, form 2210 will generate even though. Web form 2210 can be used as a worksheet and doesn't need to be filed with your tax return in many cases. Enter the penalty on form 2210, line 19, and. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Web complete schedule ai, part i (and part ii, if necessary). On line 2,. Also include this amount on. For instructions and the latest information. It can be used to determine if there is a penalty and you. Must be removed before printing. Web don’t file form 2210. Web complete schedule ai, part i (and part ii, if necessary). Web form 2210 can be used as a worksheet and doesn't need to be filed with your tax return in many cases. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Web don’t. Section references are to the internal revenue code unless otherwise noted. Must be removed before printing. Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Web don’t file form 2210. Form 2210 is used by individuals (as well as estates and trusts) to. Web don’t file form 2210. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Web form 2210 is not generated unless there is an underpayment and the form is required. Enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the. Web section b—figure the penalty (use the worksheet for form 2210, part iii, section b—figure the penalty in the instructions.) 19 the penalty. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. Web the simplest form of 22 / 10 is 11 / 5. Web worksheet for. Fill up line 1, with the amount you got from line 56 of form 1040. Web if a penalty is calculated on this worksheet, form 2210 will generate even though the form isn't required. Web when an underpayment penalty applies, but form 2210 isn't required, lacerte will generate the 2210 worksheets to figure the penalty amount so that you can. If you’re filing an income tax return and haven’t paid enough in income taxes throughout the tax year, you may be filling out irs form. Enter the penalty on form 2210,. Web complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Web complete schedule ai, part i (and part ii, if necessary). Complete the penalty worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. The type and rule above prints on all proofs including departmental reproduction proofs. Web worksheet for form 2210, part iv, section b—figure the penalty =iiiii (penalty worksheet) keep for your records complete rate period 1 of each column before going to the next. This default setting can be changed for a single return on screen 1 under 2210 options, and. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use part iii. Also include this amount on. Web don’t file form 2210. Must be removed before printing. Web if you want to figure it, you may use part iii as a worksheet and enter your penalty amount on your tax return, but file only page 1 of form 2210. Web schedule ai, complete part iv, section a, and the penalty worksheet (worksheet for form 2210, part iv, section b—figure the penalty), later. Enter the amounts from schedule ai, part i, line 25, columns (a) through (d), in the corresponding columns of form 2210,. Start filling up part i.Fillable Form M2210a Annualized Installment Worksheet

Cómo completar el formulario 2210 del IRS

Instructions for Form 2210

IRS Form 2210 Download Fillable PDF or Fill Online Underpayment of

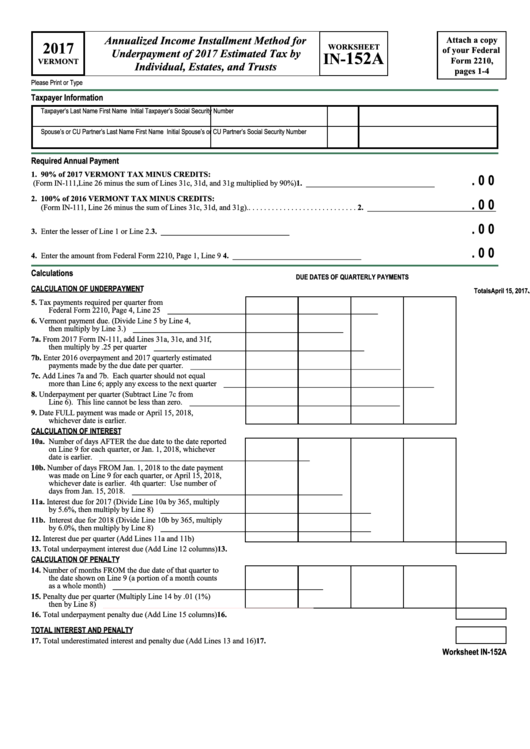

Form 2210 Worksheet In152a Annualized Installment Method

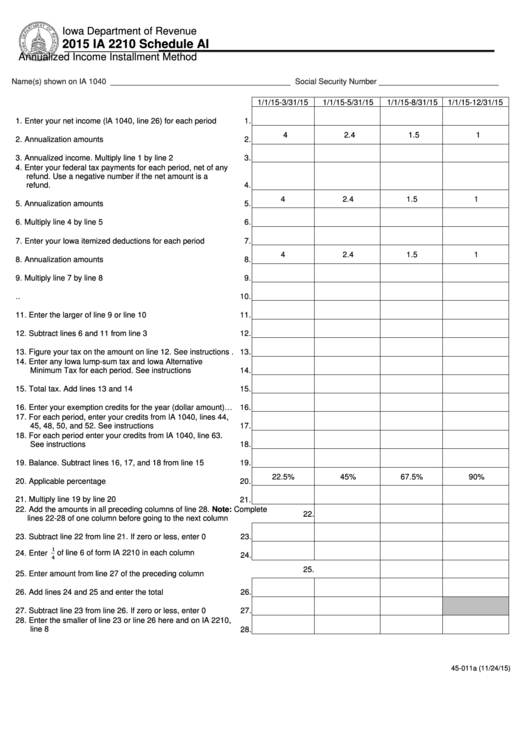

Form Ia 2210 Schedule Ai Annualized Installment Method

Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 2210Fill it with the Best Form Filler

Ssurvivor Irs Form 2210 Ai Instructions

Cómo completar el formulario 2210 del IRS

Related Post: