Wi Form 3 Instructions

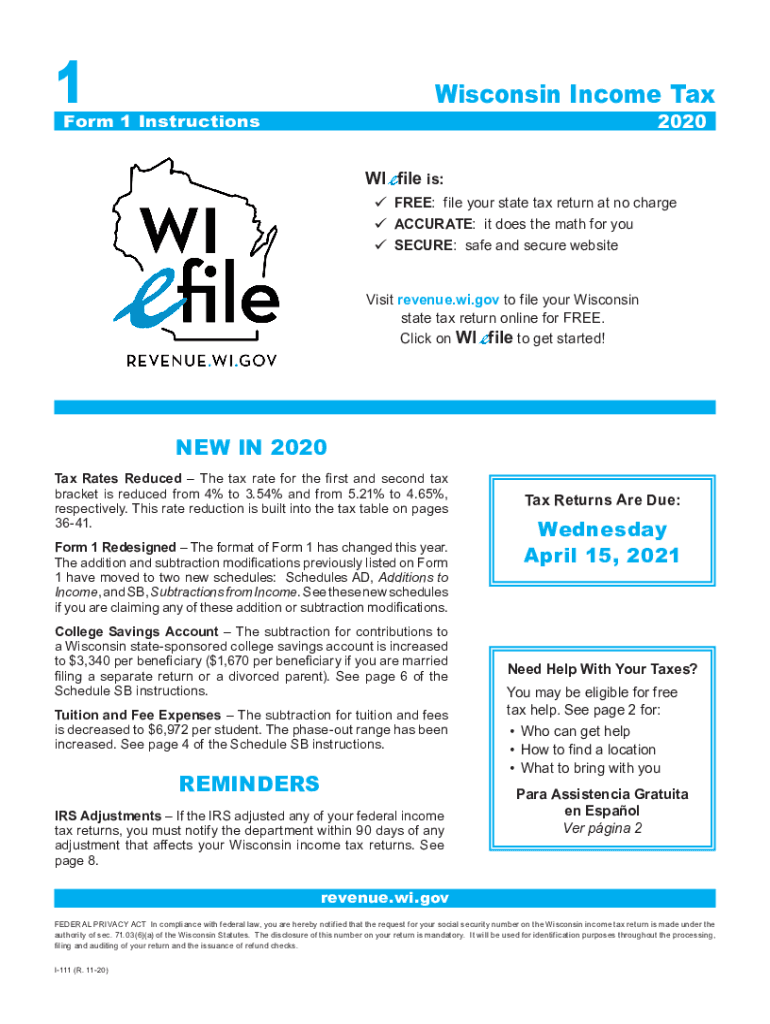

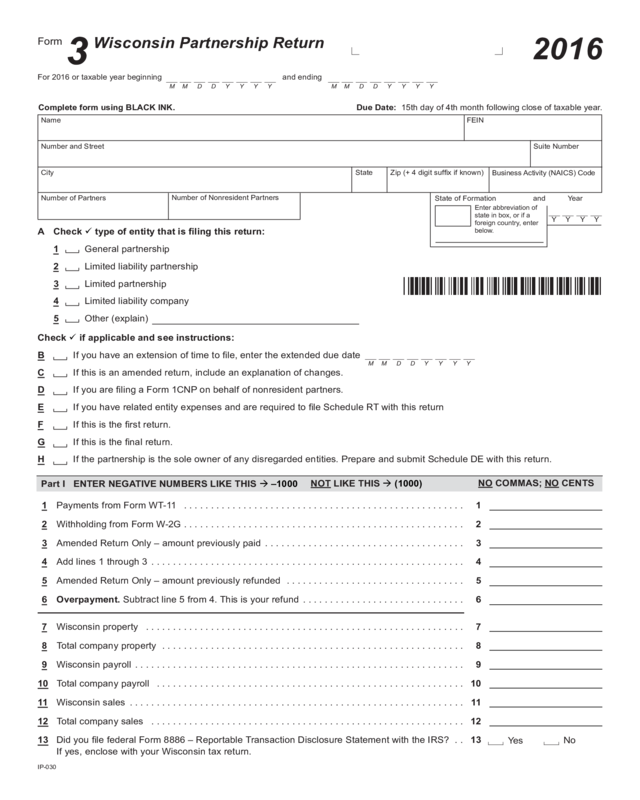

Wi Form 3 Instructions - Partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their income, gains, losses, deductions, and credits. • business transacted in wisconsin, If this is an amended return, include an explanation of changes (include schedule ar) d. Web unless a waiver is approved by the wisconsin department of revenue (“department”). Complete all necessary information in the required fillable areas. Web wisconsin department of revenue: If you have an extension of time to file, enter the extended due date. If you have an extension of time to file, enter the extended due date. If a partnership elects, under irc section 444, to have a taxable year other than a required taxable year, that election also applies for wisconsin. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco, inheritance, lottery, gaming, local government, unclaimed property) Web this form is for income earned in tax year 2022, with tax returns due in. Web 2022 wisconsin form 3 instructions page 32. • business transacted in wisconsin, Web general instructions for form 3. This option will not electronically file your form. Complete all required information in the required fillable fields. More about the wisconsin form 3 tax. Web this form is for income earned in tax year 2022, with tax returns due in. Web wisconsin income tax brackets income tax forms form 3 wisconsin — form 3 partnership return download this form print this form it appears you don't have a. If a partnership elects, under irc section 444, to have a taxable year other. Web general instructions for form 3. Visit the prior year income tax forms webpage. Complete all required information in the required fillable fields. • business transacted in wisconsin, The irc generally applies for wisconsin purposes at the same time as for federal purposes. Armed forces doesn't include the u.s. If this is an amended return, include an explanation of changes (include schedule ar) d. Get ready for tax season deadlines by completing any required tax forms today. More about the wisconsin form 3 tax. Web 2022 wisconsin form 3 instructions page 32. Web this form is for income earned in tax year 2022, with tax returns due in. Ip030, ip 030, ip030, ip 030. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco, inheritance, lottery, gaming, local government, unclaimed property) If a partnership elects, under irc section 444,. Web if applicable and see instructions: Complete, edit or print tax forms instantly. Ip030, ip 030, ip030, ip 030. Complete all necessary information in the required fillable areas. Web if applicable and see instructions: If this is an amended return, include an explanation of changes (include schedule ar) d. Complete all necessary information in the required fillable areas. Web 2022 wisconsin form 3 instructions page 32. Partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their income, gains, losses, deductions, and credits. Web wisconsin department of revenue: If you have an extension of time to file, enter the extended due date. Ad access irs tax forms. Push the date symbol to verify the blank using the particular date. Web 2022 wisconsin form 3 instructions page 32. Web adhere to our easy steps to get your wi form 3 instructions ready quickly: Web unless a waiver is approved by the wisconsin department of revenue (“department”). Ad access irs tax forms. Armed forces doesn't include the u.s. If a partnership elects, under irc section 444, to have a taxable year other. Web this form is for income earned in tax year 2022, with tax returns due in. Web adhere to our easy steps to get your wi form 3 instructions ready quickly: If you have an extension of time to file, enter the extended due date. Ad access irs tax forms. • business transacted in wisconsin, Web if applicable and see instructions: This option will not electronically file your form. If you have an extension of time to file, enter the extended due date. Web 2022 wisconsin form 3 instructions page 32. Ip030, ip 030, ip030, ip 030. Web unless a waiver is approved by the wisconsin department of revenue (“department”). The irc generally applies for wisconsin purposes at the same time as for federal purposes. Partnerships, including limited liability companies (llcs) treated as partnerships, use form 3 to report their income, gains, losses, deductions, and credits. Ip030, ip 030, ip030, ip 030. Web general instructions for form 3. Get ready for tax season deadlines by completing any required tax forms today. Web general instructions for form 3. If this is an amended return, include an explanation of changes (include schedule ar) d. If you have an extension of time to file, enter the extended due date. Merchant marine or the american red cross. Web general instructions for form 3. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco, inheritance, lottery, gaming, local government, unclaimed property) If this is an amended return, include an explanation of changes (include schedule ar) d. If a partnership elects, under irc section 444, to have a taxable year other. Pick the template in the library. Members serving in an area designated or treated as a combat zone are.Form 1 Instructions 2023 Printable Forms Free Online

Wisconsin Withholding Form 2023 Printable Forms Free Online

WI DoR Schedule 3K1 20202022 Fill out Tax Template Online US

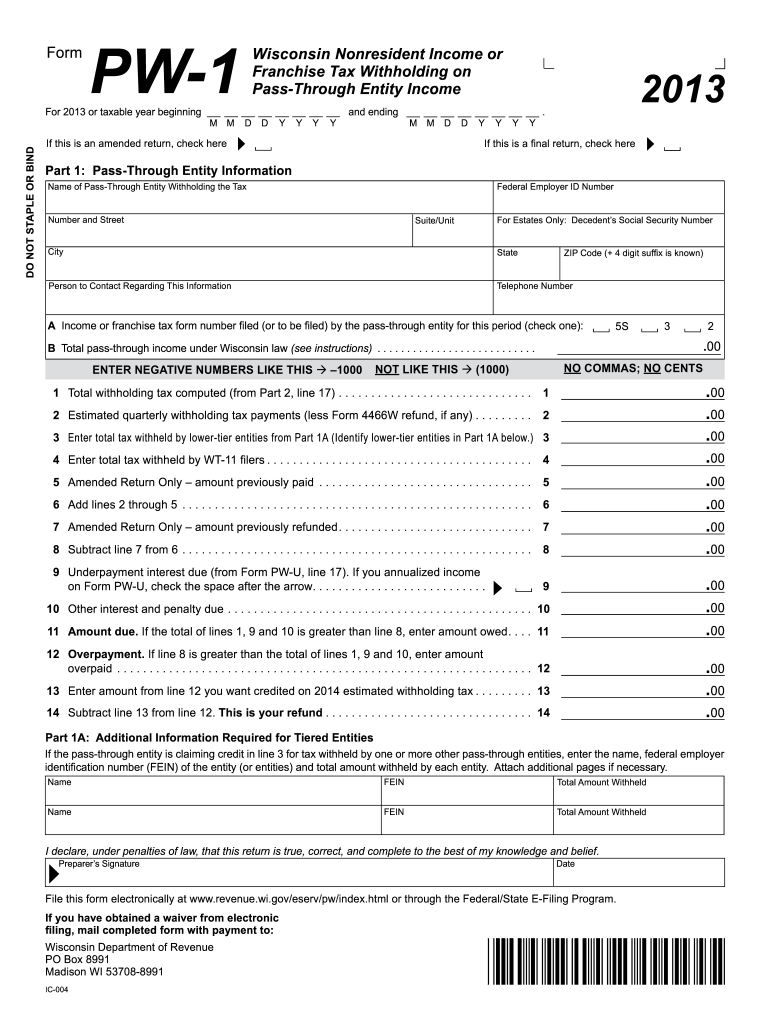

Wisconsin form pw 1 Fill out & sign online DocHub

Learn How to Fill the Form W 3 Transmittal of Wage and Tax Statements

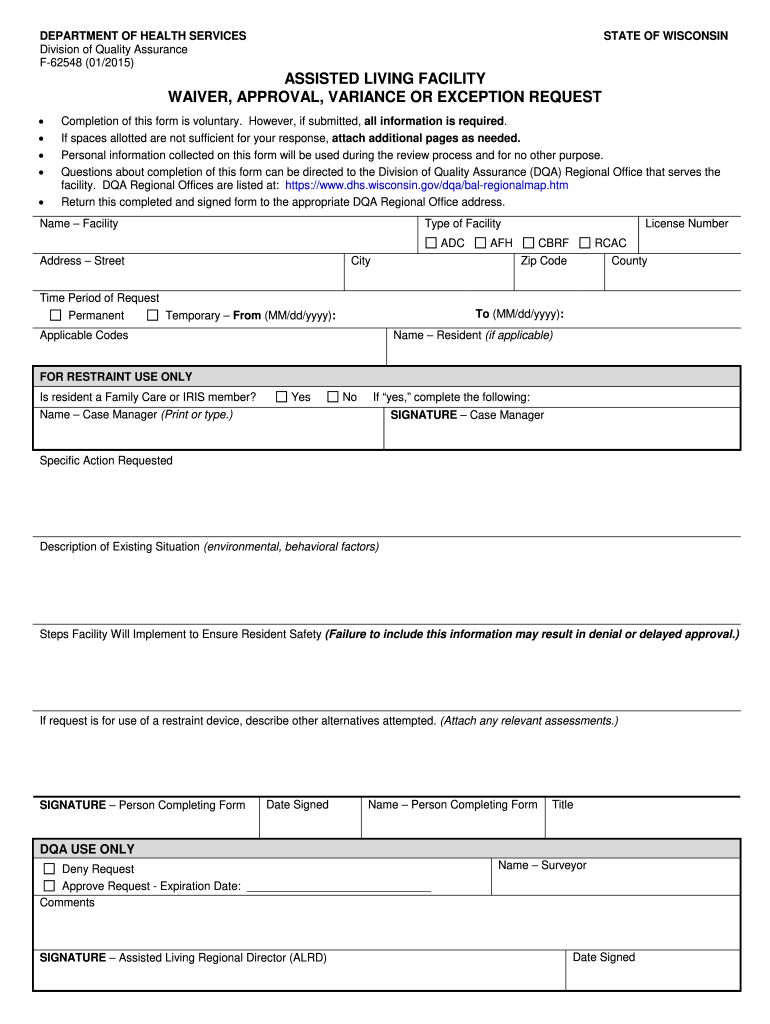

Wi form waiver Fill out & sign online DocHub

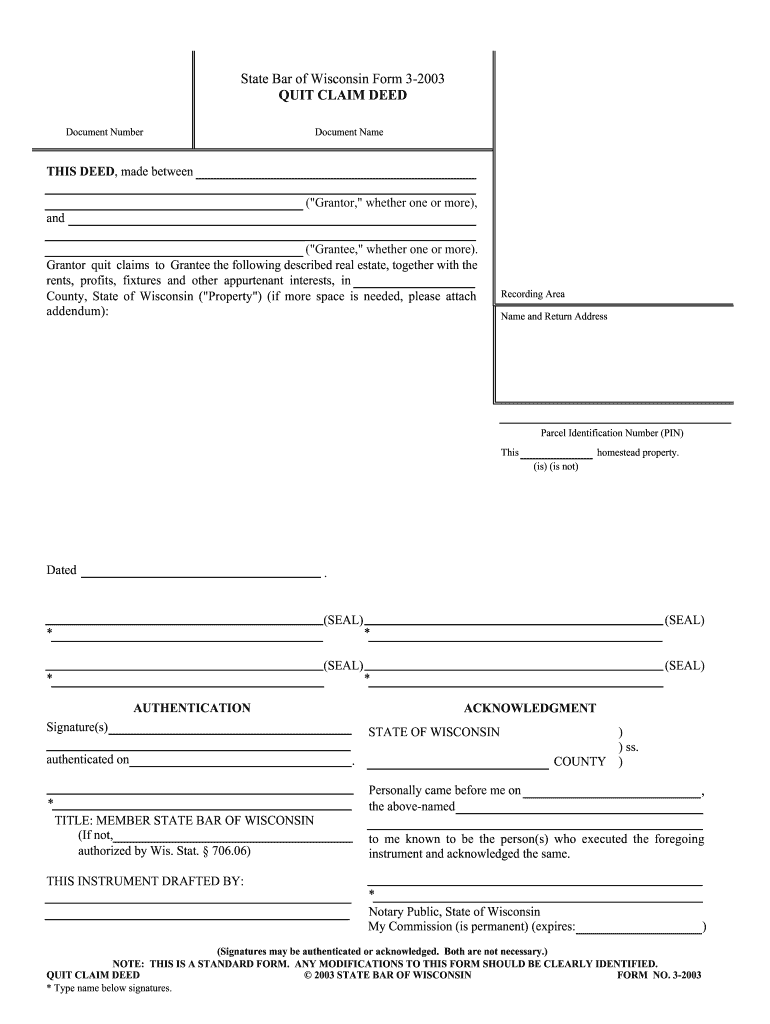

WI Form 320032022 20032022 Complete Legal Document Online US

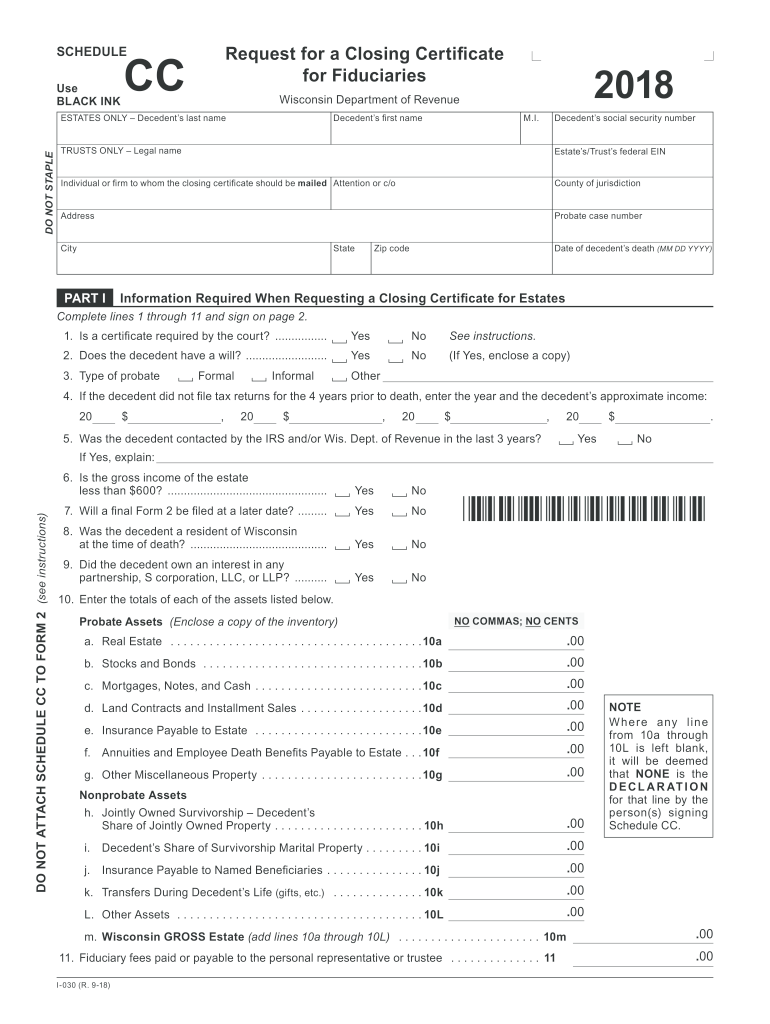

WI DoR Schedule CC 2018 Fill out Tax Template Online US Legal Forms

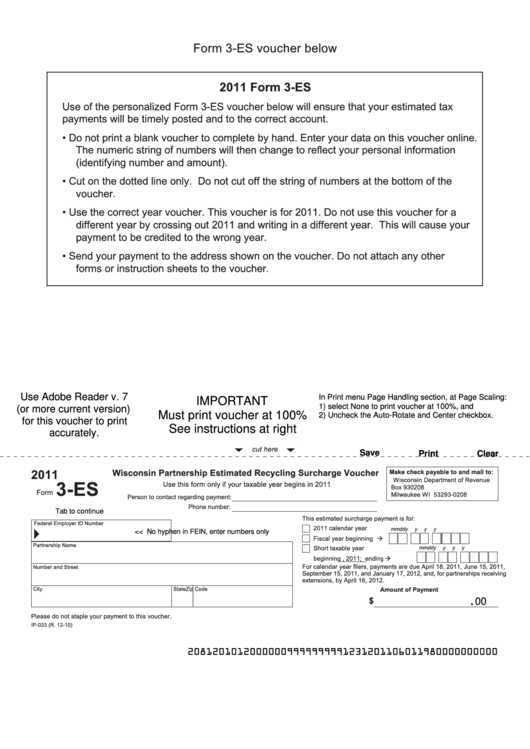

Fillable Form 3Es Wisconsin Partnership Estimated Recycling

2016 Form 3 Wisconsin Partnership Return Edit, Fill, Sign Online

Related Post: