Who Is The Withholding Agent On Form 590

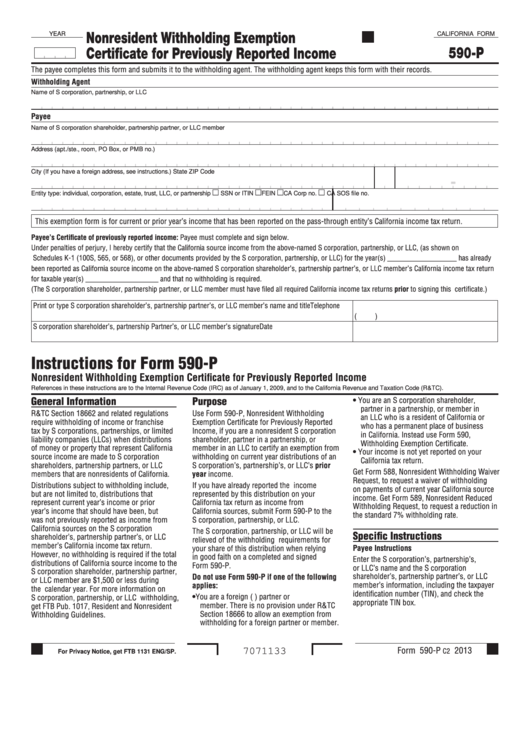

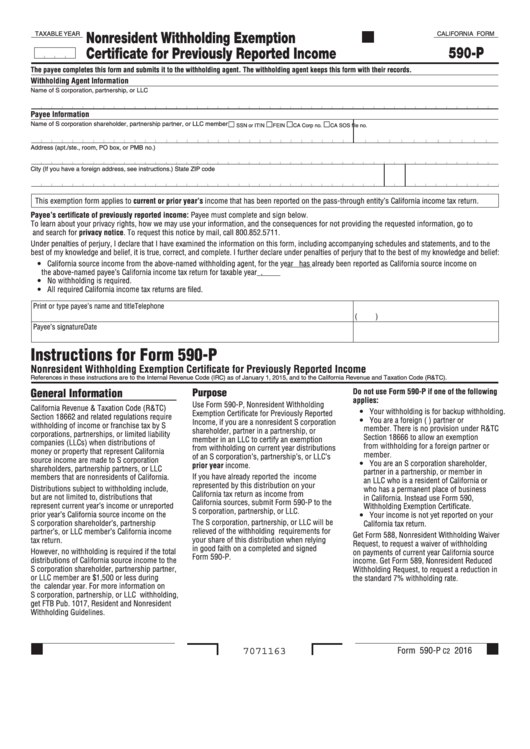

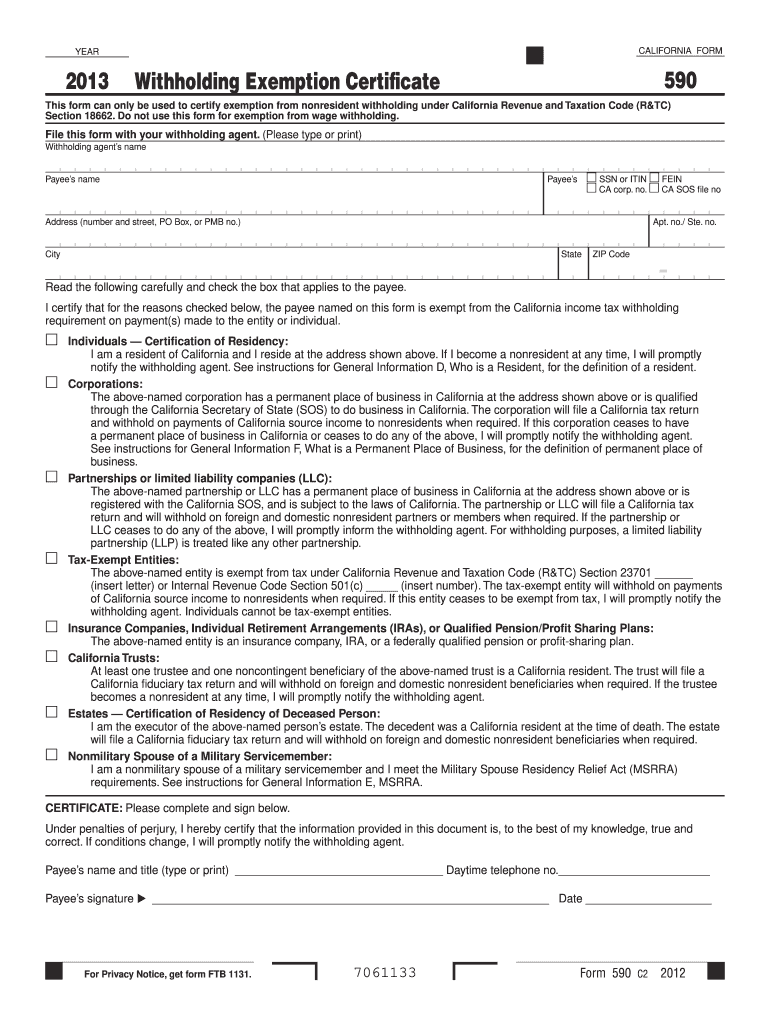

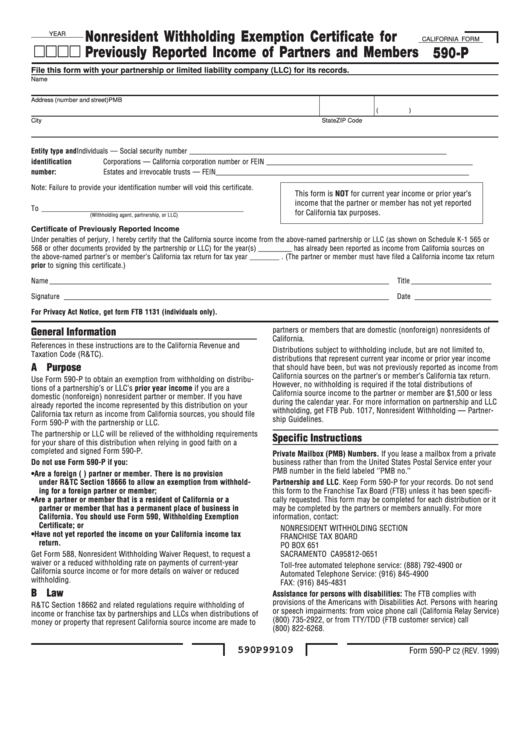

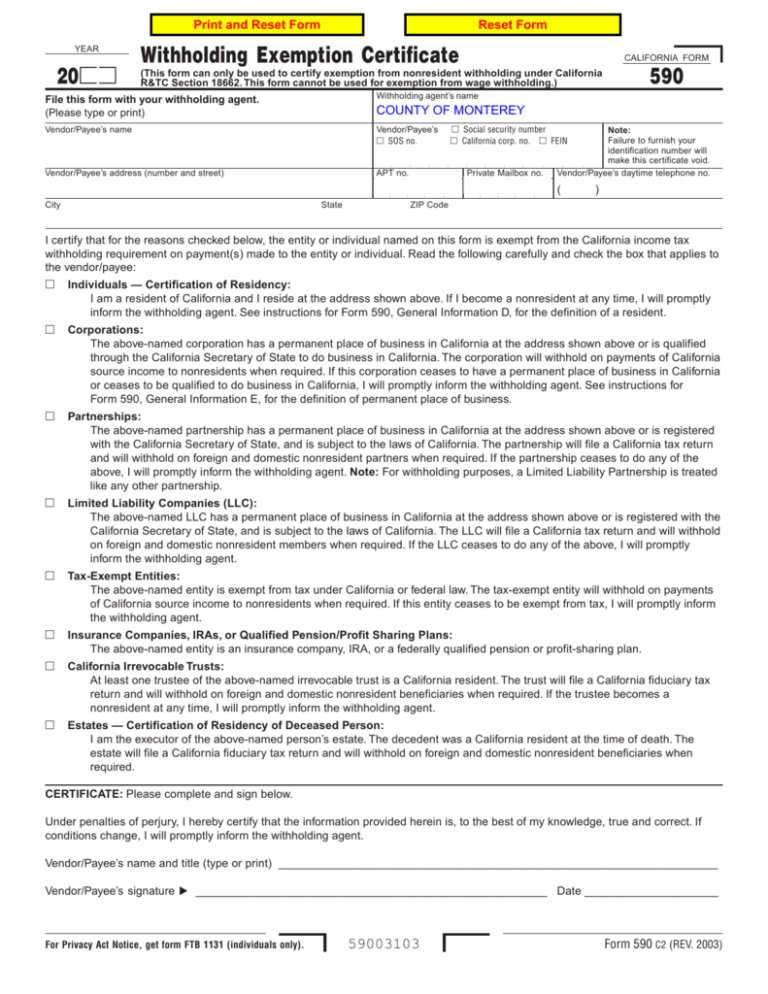

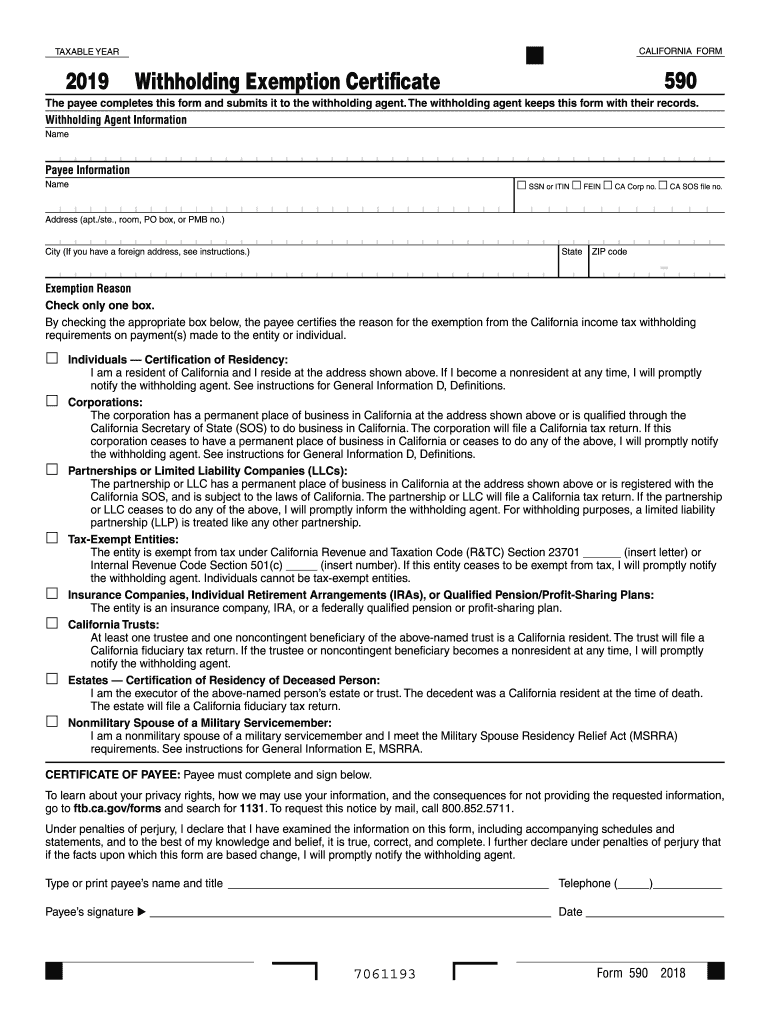

Who Is The Withholding Agent On Form 590 - A company i work for sent me form 590 to submit to them. The withholding agent keeps this form with. The withholding agent is then relieved of the withholding requirements if the agent relies. Web the payee completes this form and submits it to the withholding agent. The payment is to an estate and the decedent was a california resident. Web you are a withholding agent if you are a u.s. The withholding agent is then relieved of the withholding requirements if the. Web individuals — certification of residency: The payee completes this form and submits it to the withholding agent. For more information, go to. Web the payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with their records. The payee completes this form and submits it to the withholding agent. The withholding agent keeps this form with. The withholding agent will then be relieved of the. The withholding agent will then be relieved of the. The withholding agent is then relieved of the withholding requirements if the. Web withholding agent withholds 7% of all california source payments to a nonresident payee that exceed $1,500 in a calendar year, unless payee qualifies for reduced or waived. For more information, see general information b, income subject to withholding.. The withholding agent keeps this form. Complete and present form 590 to the withholding agent. The payee completes this form and submits it to the withholding agent. Web the withholding agent keeps this form with their records. Web use form 590 to certify an exemption from nonresident withholding. Web withholding agent withholds 7% of all california source payments to a nonresident payee that exceed $1,500 in a calendar year, unless payee qualifies for reduced or waived. For more information, see general information b, income subject to withholding. The withholding agent keeps this form. The payee completes this form and submits it to the withholding agent. The company that. We last updated the withholding exemption. Web california residents or entities should complete and present form 590 to the withholding agent. Web form 590 unless notified by the franchise tax board (ftb) that the form should not be relied upon. The withholding agent keeps this form. California revenue and taxation code (r&tc) section 18662 requires withholding of income or franchise. An incomplete certificate is invalid and the withholding agent should not. The payments are subject to backup withholding. The payee completes this form and submits it to the withholding agent. Web you are a withholding agent if you are a u.s. The withholding agent keeps this form with their records. The withholding agent keeps this form. Or foreign person that has control, receipt, custody, disposal, or payment of any item of income of a foreign person. The withholding agent keeps this form with their records. For more information, see general information b, income subject to withholding. Web a withholding agent is required to withhold from all payments or distributions of. Web use form 590 to certify an exemption from nonresident withholding. The payee completes this form and submits it to the withholding agent. For more information, go to. Web the withholding agent is the entity that withholds money. The withholding agent keeps this form with their records. California revenue and taxation code (r&tc) section 18662 requires withholding of income or franchise tax on payments of california source income made to nonresidents of california. The withholding agent keeps this form with their records. Web use form 590 to certify an exemption from nonresident withholding. Web form 590 unless notified by the franchise tax board (ftb) that the form. For more information, go to. The withholding agent will then be relieved of the. We last updated the withholding exemption. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. The payee completes this form and submits it to the withholding agent. Web form 590 and submit it to the withholding agent before payment is made. The withholding agent keeps this form. Ftb form 590, withholding exemption certificate : Web the withholding agent is the entity that withholds money. The payee completes this form and submits it to the withholding agent. California revenue and taxation code (r&tc) section 18662 requires withholding of income or franchise tax on payments of california source income made to nonresidents of california. Web form 590 unless notified by the franchise tax board (ftb) that the form should not be relied upon. Web i have california based company. The payment is to an estate and the decedent was a california resident. The company that sent the form? Web withholding agent withholds 7% of all california source payments to a nonresident payee that exceed $1,500 in a calendar year, unless payee qualifies for reduced or waived. Web you are a withholding agent if you are a u.s. The withholding agent keeps this form with their records. Or foreign person that has control, receipt, custody, disposal, or payment of any item of income of a foreign person. A company i work for. For more information, go to. Web a withholding agent is required to withhold from all payments or distributions of california source income made to a nonresident payee unless the withholding agent receives a. The withholding agent will then be relieved of the. The payee completes this form and submits it to the withholding agent. Web individuals — certification of residency:Fillable California Form 590P Nonresident Withholding Exemption

California Form 590P Nonresident Withholding Exemption Certificate

2013 Form 590 Withholding Exemption Certificate ftb.ca.gov Fill

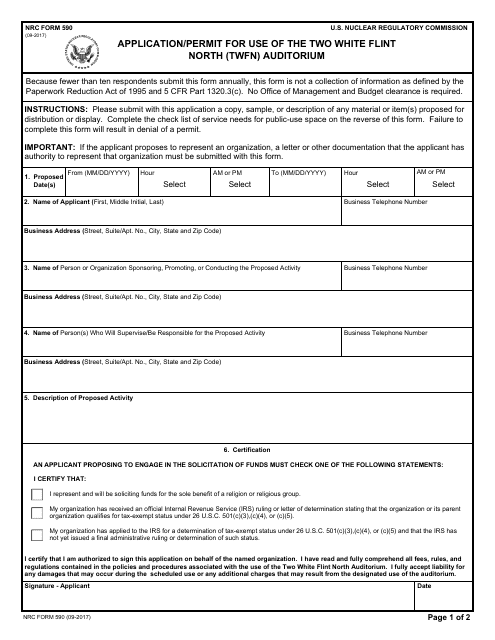

NRC Form 590 Fill Out, Sign Online and Download Fillable PDF

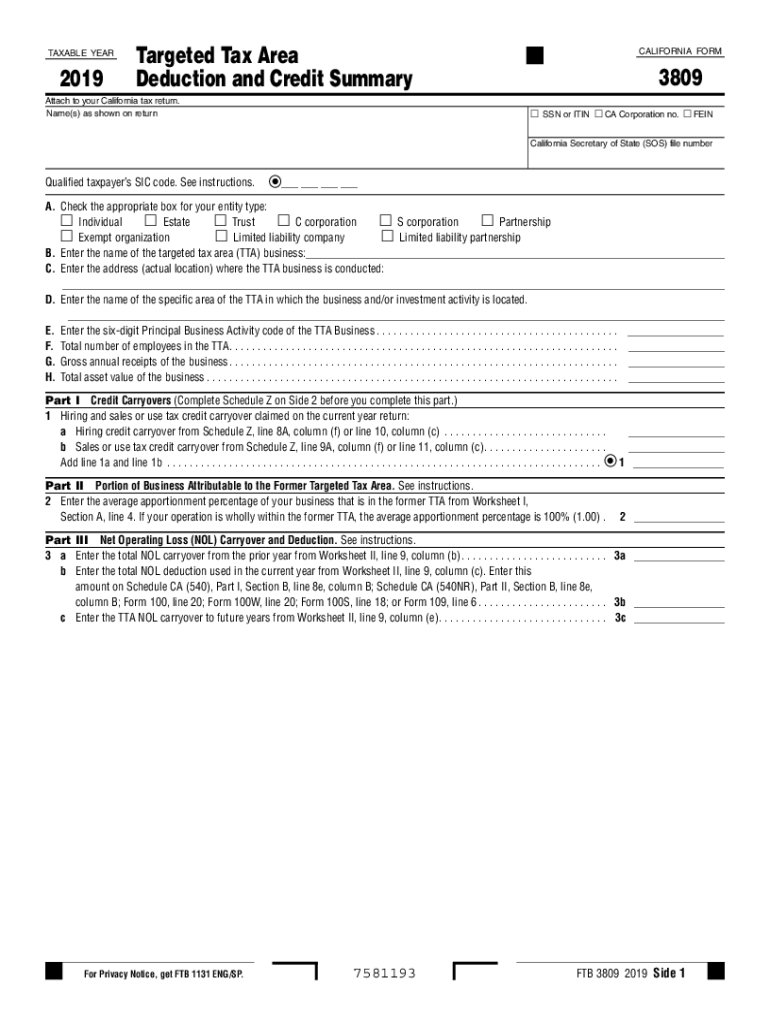

Fillable Form 3809 Fill Out and Sign Printable PDF Template signNow

Form 590P Nonresident Withholding Exemption Certificate For

LOGO

Form 590 Withholding Exemption Certificate

CA FTB 590 2019 Fill out Tax Template Online US Legal Forms

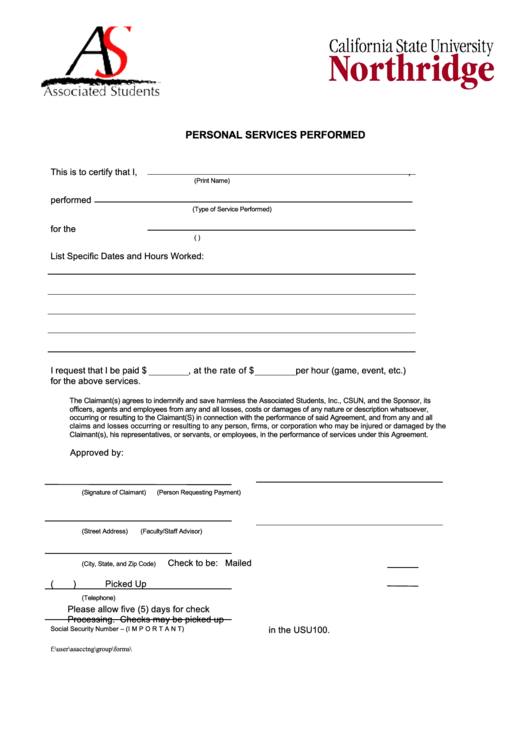

Fillable Personal Services Performed Form/california Form 590

Related Post: