Who Files Form 7203

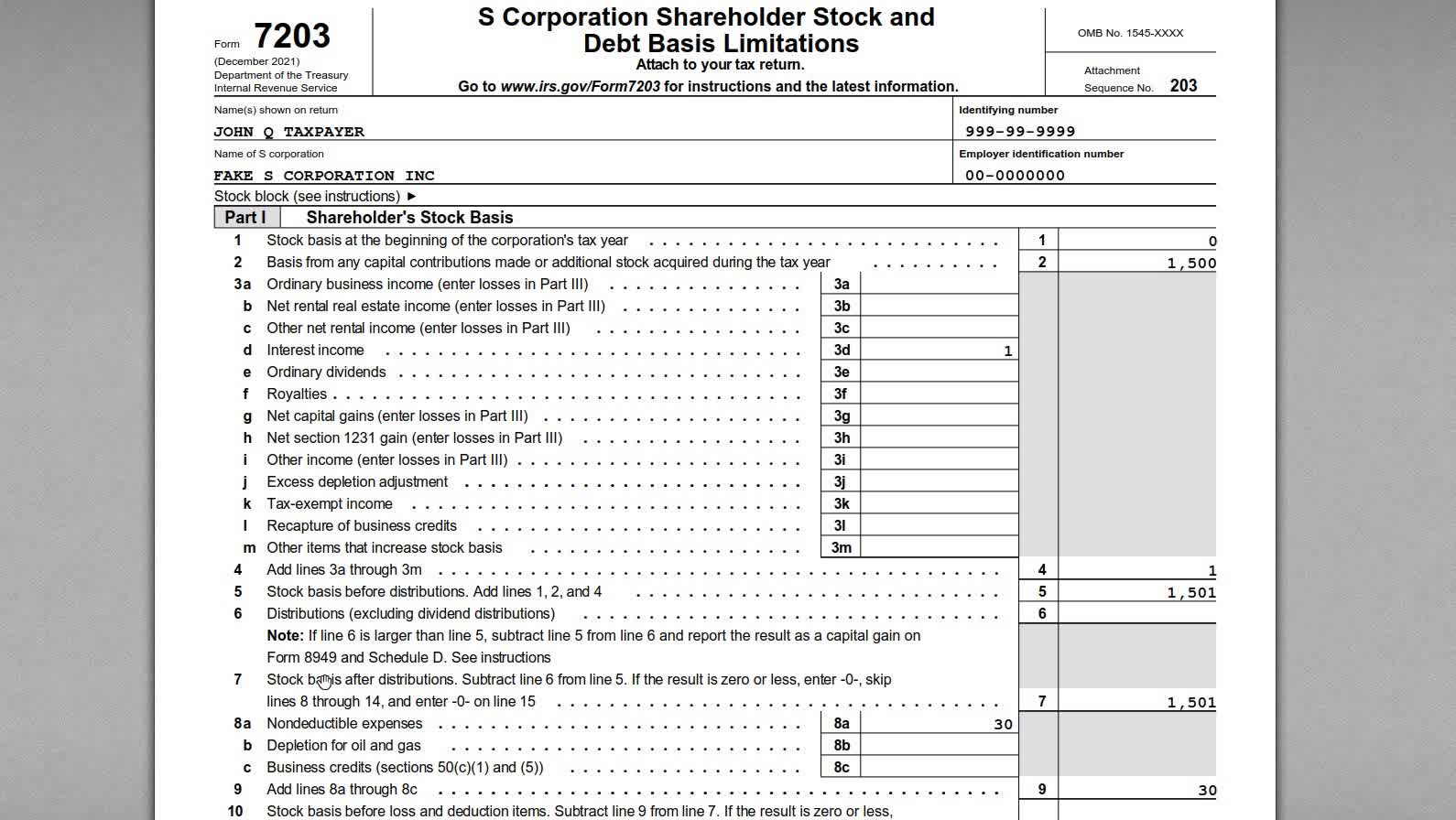

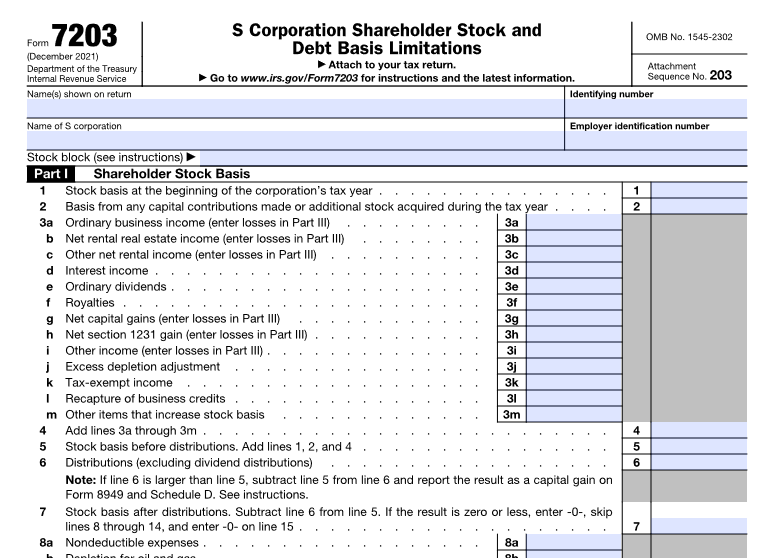

Who Files Form 7203 - Web irs proposes new form 7203 for s corporation shareholders to report basis computations with form 1040. Go to www.irs.gov/form7203 for instructions and the latest information. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: Seek a deduction for their proportionate share of an overall loss. Web who has to include form 7203? Form 7203 is filed by s corporation shareholders who: Web page last reviewed or updated: Claims a deduction for a loss, disposes of their. Web who files form 7203. July 19, 2021 by ed zollars, cpa. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Go to www.irs.gov/form7203 for instructions and the latest information. Web s corporation shareholder stock and debt basis limitations. July 19, 2021 by ed zollars, cpa. Web irs proposes new form 7203 for s corporation shareholders to report basis computations. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Is claiming a deduction for the shareholder's share of the s corporation’s loss, received a. July 19, 2021 by ed zollars, cpa. Seek a deduction for their proportionate share of an overall loss. This form is required to be. July 19, 2021 by ed zollars, cpa. Web who files form 7203. This requirement applies to s corporation shareholders that do any of the following: Web s corporation shareholder stock and debt basis limitations. S corporation shareholder stock and debt basis limitations section references are to the internal revenue code unless otherwise noted. Web who has to include form 7203? Web irs proposes new form 7203 for s corporation shareholders to report basis computations with form 1040. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Received a loan repayment from the. Web you must complete and file form 7203 if you’re an s corporation. This requirement applies to s corporation shareholders that do any of the following: Web form 7203 is actually prepared and filed by shareholders, not the s corporation itself. Web up to 10% cash back but a shareholder must file form 7203 if he or she: Received a loan repayment from the. The irs is looking to see documentation to support. The irs is looking to see documentation to support corporate losses. Web form 7203 is actually prepared and filed by shareholders, not the s corporation itself. Web irs proposes new form 7203 for s corporation shareholders to report basis computations with form 1040. Web who is responsible for filing form 7203? December 2022) s corporation shareholder stock and debt basis. This form is required to be attached. Web irs proposes new form 7203 for s corporation shareholders to report basis computations with form 1040. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web s corporation shareholder stock and debt basis limitations. Form 7203 is filed by s corporation shareholders who: This form is required to be attached. Form 7203 is filed by s corporation shareholders who: Web who has to include form 7203? Form 7203 is submitted by shareholders of s corporations who: Form 7203 is filed by s corporation shareholders who: This requirement applies to s corporation shareholders that do any of the following: Attach to your tax return. The irs is looking to see documentation to support corporate losses. Seek a deduction for their proportionate share of an overall loss. Web irs proposes new form 7203 for s corporation shareholders to report basis computations with form 1040. This requirement applies to s corporation shareholders that do any of the following: The irs is looking to see documentation to support corporate losses. July 19, 2021 by ed zollars, cpa. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Form 7203 is filed by s corporation shareholders who: Attach to your tax return. S corporation shareholder stock and debt basis limitations section references are to the internal revenue code unless otherwise noted. Received a loan repayment from the. The irs is looking to see documentation to support corporate losses. Web who files form 7203. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Web effective for 2021, the internal revenue service (“irs”) requires s corporation shareholders to prepare and attach form 7203, s corporation shareholder stock and. Web the new form is required to be filed by an s corporation shareholder to report shareholder basis. This requirement applies to s corporation shareholders that do any of the following: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an. Go to www.irs.gov/form7203 for instructions and the latest information. Web due to these challenges, the treasury department and the irs intend to issue a notice providing penalty relief for qualifying farmers and fishermen filing forms. Web who is responsible for filing form 7203? December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Form 7203 is submitted by shareholders of s corporations who: Web you must complete and file form 7203 if you’re an s corporation shareholder and you: S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web s corporation shareholder stock and debt basis limitations. Web form 7203 is actually prepared and filed by shareholders, not the s corporation itself. Seek a deduction for their proportionate share of an overall loss.Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

IRS Form 7203 Multiple Blocks of S Corporation Stock YouTube

How to Complete IRS Form 7203 S Corporation Shareholder Basis YouTube

How to Complete IRS Form 7203 S Corporation Shareholder Basis

SCorporation Shareholders May Need to File Form 7203

Everything You Need to Know About the New IRS Form 7203 for S

CMS849 20192021 Fill and Sign Printable Template Online US Legal

IRS Form 7203 Fileable PDF Version

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

Fill Free fillable IRS PDF forms

Related Post: