Where To File Form 8868

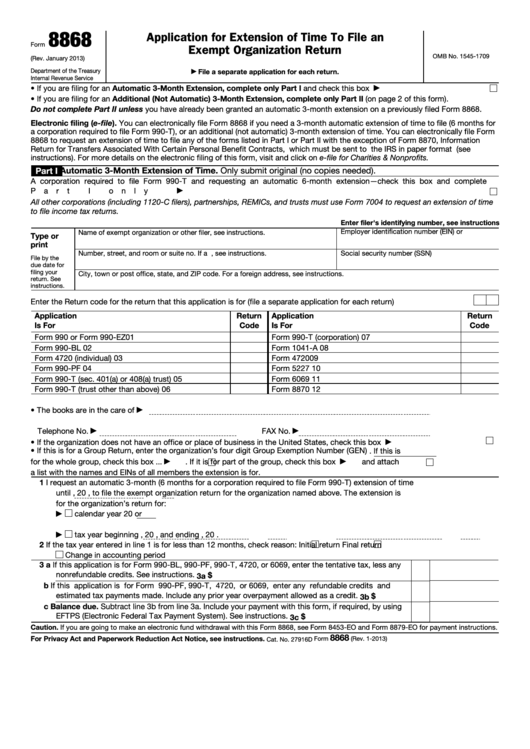

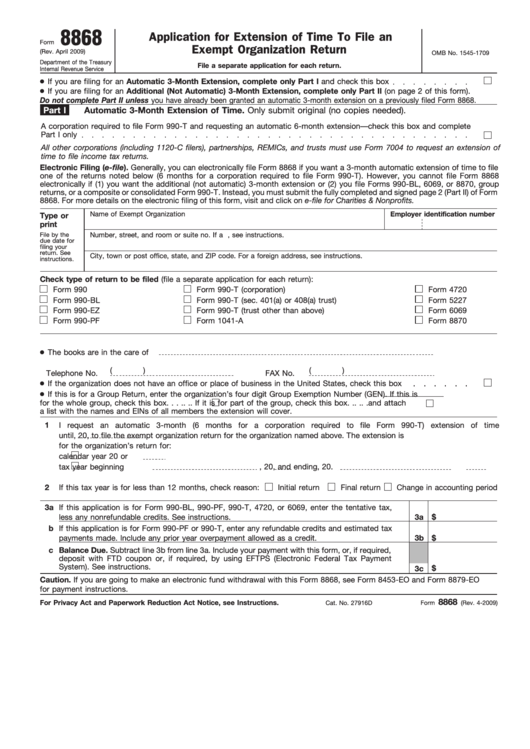

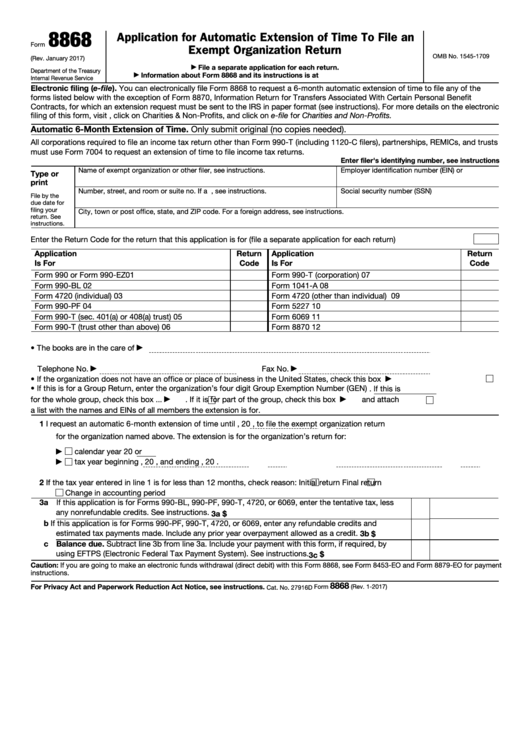

Where To File Form 8868 - Download or email irs 8868 & more fillable forms, register and subscribe now! However, the irs suggests filers file electronically for quick. Below are solutions to frequently asked questions about filing fiduciary extensions in lacerte. Web when to file file form 8868 by the due date of the return for which you are requesting an extension. File 8868 now to avoid 990 late filing. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web when filing your nonprofit tax extension form 8868 you'll need, 1. Web how to file form 8868? So if a nonprofit organization is willing to extend the. Web there are several ways to request an automatic extension of time to file your return. Web when filing your nonprofit tax extension form 8868 you'll need, 1. Application for automatic extension of time to file an exempt organization return. File 8868 now to avoid 990 late filing. Web to file form 8868 using taxact: On smaller devices, click in the upper left. Below are solutions to frequently asked questions about filing fiduciary extensions in lacerte. Web there are several ways to request an automatic extension of time to file your return. Web to file form 8868 using taxact: Tax liability and payment for 2022. Ad access irs tax forms. You can electronically file form 8868 if you need a 3. Form 8868 for 2022 is due by may 15, 2023. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web when to file file form 8868 by the due date of the return for which you are requesting an extension. Below are solutions to. Web when filing your nonprofit tax extension form 8868 you'll need, 1. Application for automatic extension of time to file an exempt organization return. Where to file if you do not file electronically, send the application to:. First step in filing this tax extension form is to enter the. Ad download or email irs 8868 & more fillable forms, register. Complete, edit or print tax forms instantly. First step in filing this tax extension form is to enter the. Web irs form 8868 is used to request an additional time to file your 990 nonprofit tax returns. Web to file form 8868 using taxact: On smaller devices, click in the upper left. First step in filing this tax extension form is to enter the. Filing form 8868 can be done electronically or by sending the application in paper format. Electronically file or mail an form 4868, application for automatic extension of. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms,. January 2022) department of the treasury internal revenue service. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web to file form 8868 using taxact: You can electronically file form 8868 if you need a 3. File 8868 now to avoid 990. First step in filing this tax extension form is to enter the. Ad access irs tax forms. However, the irs suggests filers file electronically for quick. Where to file if you do not file electronically, send the application to:. Application for automatic extension of time to file an exempt organization return. January 2022) department of the treasury internal revenue service. Form 8868 is used by an exempt organization to request an automatic 3. Below are solutions to frequently asked questions about filing fiduciary extensions in lacerte. Electronically file or mail an form 4868, application for automatic extension of. Web irs form 8868 is used to request an additional time to file. Form 8868 is used by an exempt organization to request an automatic 3. Tax liability and payment for 2022. Where to file if you do not file electronically, send the application to:. You can electronically file form 8868 if you need a 3. Filing form 8868 can be done electronically or by sending the application in paper format. File 8868 now to avoid 990 late filing. However, the irs suggests filers file electronically for quick. First step in filing this tax extension form is to enter the. Download or email irs 8868 & more fillable forms, register and subscribe now! Web how to file form 8868? Where to file if you do not file electronically, send the application to:. Form 8868 for 2022 is due by may 15, 2023. Below are solutions to frequently asked questions about filing fiduciary extensions in lacerte. Electronically file or mail an form 4868, application for automatic extension of. Web to file form 8868 using taxact: Filing form 8868 can be done electronically or by sending the application in paper format. Application for automatic extension of time to file an exempt organization return. Ad access irs tax forms. Form 8868 is used by an exempt organization to request an automatic 3. January 2022) department of the treasury internal revenue service. You can electronically file form 8868 if you need a 3. Complete, edit or print tax forms instantly. Organization details such as name, address, ein/tax id, tax year. So if a nonprofit organization is willing to extend the. On smaller devices, click in the upper left.Fillable Form 8868 Application For Extension Of Time To File An

File Form 8868 Online Efile 990 Extension with the IRS

File Form 8868 Online Efile 990 Extension with the IRS

IRS Extension Form 8868 of Time To File an Non Profit or Exempt

Fillable Form 8868 Application For Extension Of Time To File An

Form 8868 Application for Extension of Time to File an Exempt

File Form 8868 Online Efile 990 Extension with the IRS

Fillable Form 8868 Application For Automatic Extension Of Time To

How To File Form 8868 With YouTube

Form 8868 Fillable and Editable PDF Template

Related Post: