What Is Form 8958

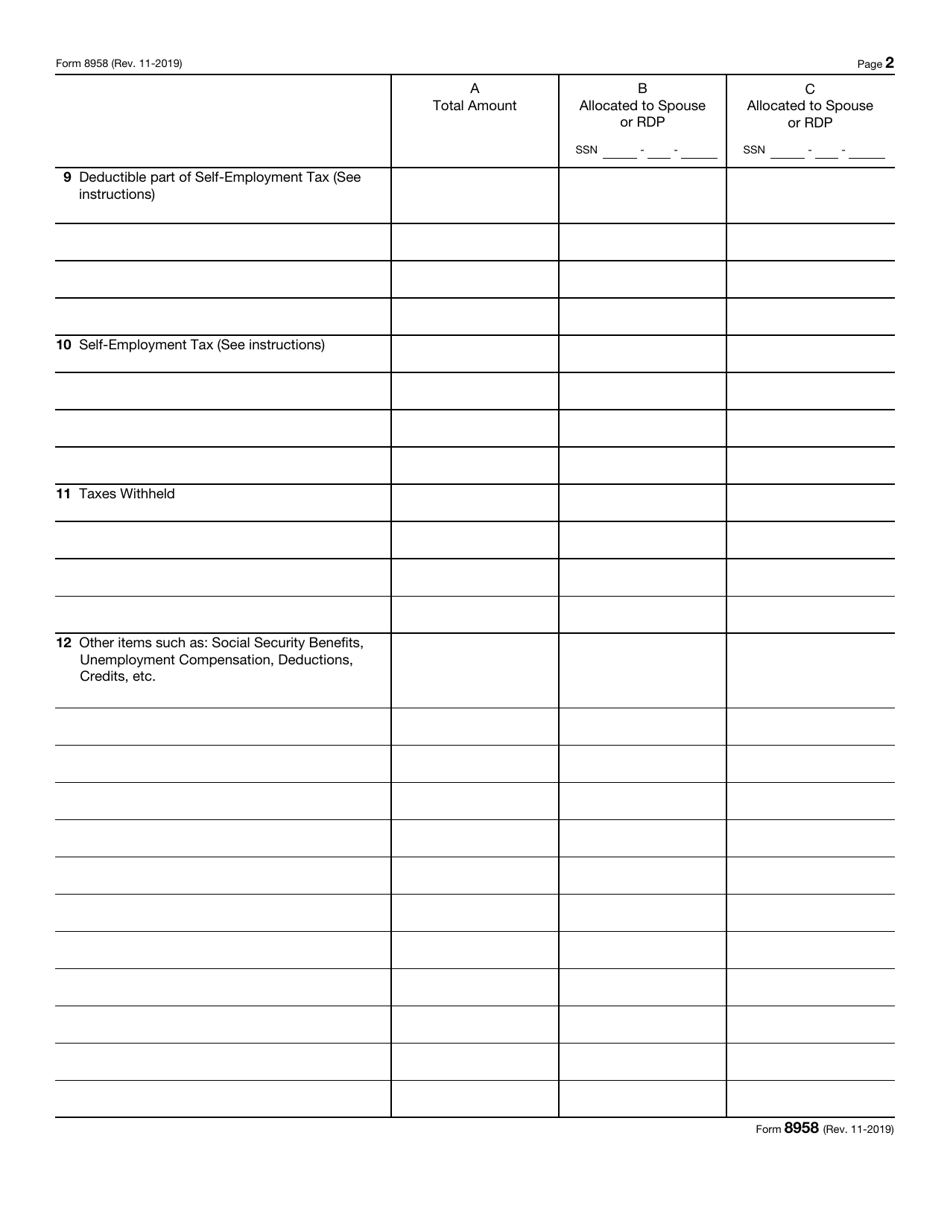

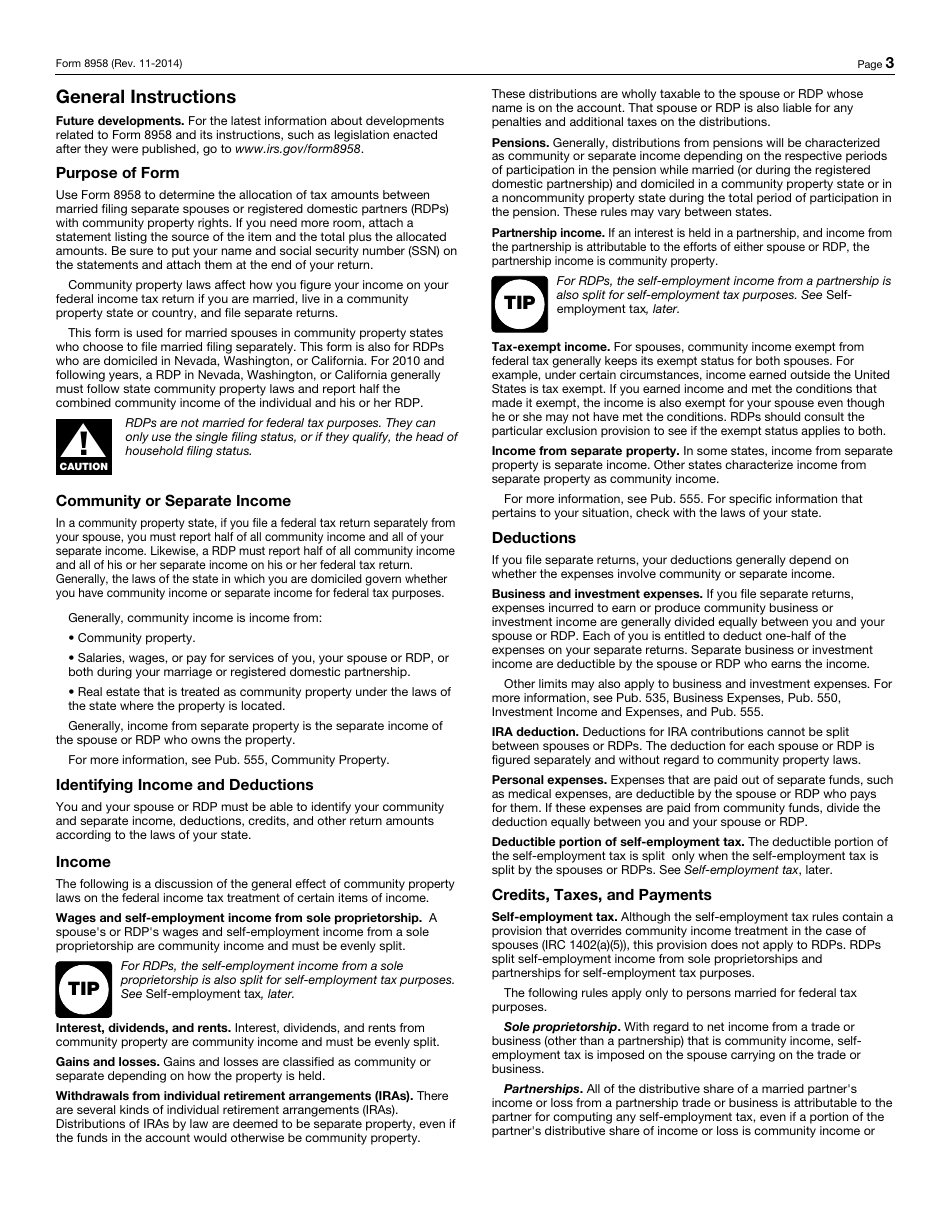

What Is Form 8958 - Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web what is form 8958? Web first, print the form 8958 from each spouse's return in order to complete the spouse column on the other spouse's return: Web the internal revenue service (irs) created form 8958 to allow couples in community property states to correctly allocate income on each spouse that may not. What is the form used for? Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with. Ad edit, fill & esign pdf documents online. Grab exciting offers and discounts on an array of products from popular brands. Web common questions about entering form 8958 income for community property allocation in lacerte. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a. Form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or. Web first, print the form 8958 from each spouse's return in order to complete. November 2019) department of the treasury internal revenue service (99) certain individuals in community property states. Sign in to your taxact. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a. Use this form to determine the allocation of tax amounts between. Form 8958 is transmitted with the. Mved business # motor vehicle enforcement division, 210 north 1950 west, salt lake city, ut 84134 †. Web about form 8958, allocation of tax amounts between certain individuals in community property states. Web complete form and return it with payment (if any) and picture of sign to: Solved • by intuit • 20 • updated august 14, 2023. Community property. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Ad get deals and low prices on taxation forms at amazon. Form 8958 is transmitted with the split returns. Web if your resident state is a community property state, and you file a federal tax return separately. Form 8958 is transmitted with the split returns. Web the domestic revenue service (irs) created form 8958 for allow couples in community property states up correctly allocate income for each spouse that may. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a. Web first, print the form. Web how to properly fill out form 8958 the states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico, and. Web the internal revenue service (irs) created form 8958 to allow couples in community property states to correctly allocate income on each spouse that may not. Ad edit, fill & esign pdf documents online. Web if. Web the domestic revenue service (irs) created form 8958 for allow couples in community property states up correctly allocate income for each spouse that may. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Best pdf fillable form builder. Ad edit, fill & esign pdf documents online. Form. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web the internal revenue service (irs) created form 8958 to. Web the internal revenue service (irs) created form 8958 to allow couples in community property states to correctly allocate income on each spouse that may not. Community property laws apply to married individuals or registered domestic partners. Use this form to determine the allocation of tax amounts between. Web you must attach form 8958 to your tax form showing how. What is the form used for? Best pdf fillable form builder. Web common questions about entering form 8958 income for community property allocation in lacerte. Web if form 8958 is needed, a federal note is produced, and a state ef message may also be produced. Web if your resident state is a community property state, and you file a federal. Web common questions about entering form 8958 income for community property allocation in lacerte. Sign in to your taxact. November 2019) department of the treasury internal revenue service (99) certain individuals in community property states. Mved business # motor vehicle enforcement division, 210 north 1950 west, salt lake city, ut 84134 †. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web how to properly fill out form 8958 the states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico, and. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Ad edit, fill & esign pdf documents online. Grab exciting offers and discounts on an array of products from popular brands. Web the internal revenue service (irs) created form 8958 to allow couples in community property states to correctly allocate income on each spouse that may not. Web what is form 8958? Form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or. Community property laws apply to married individuals or registered domestic partners. Ad get deals and low prices on taxation forms at amazon. Web complete form and return it with payment (if any) and picture of sign to: Web if form 8958 is needed, a federal note is produced, and a state ef message may also be produced. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. What is the form used for? Use this form to determine the allocation of tax amounts between.Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Fill Free fillable Form 8958 Allocation of Tax Amounts 2014 PDF form

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Americans forprosperity2007

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

What is Form 8958 Fill Out and Sign Printable PDF Template signNow

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

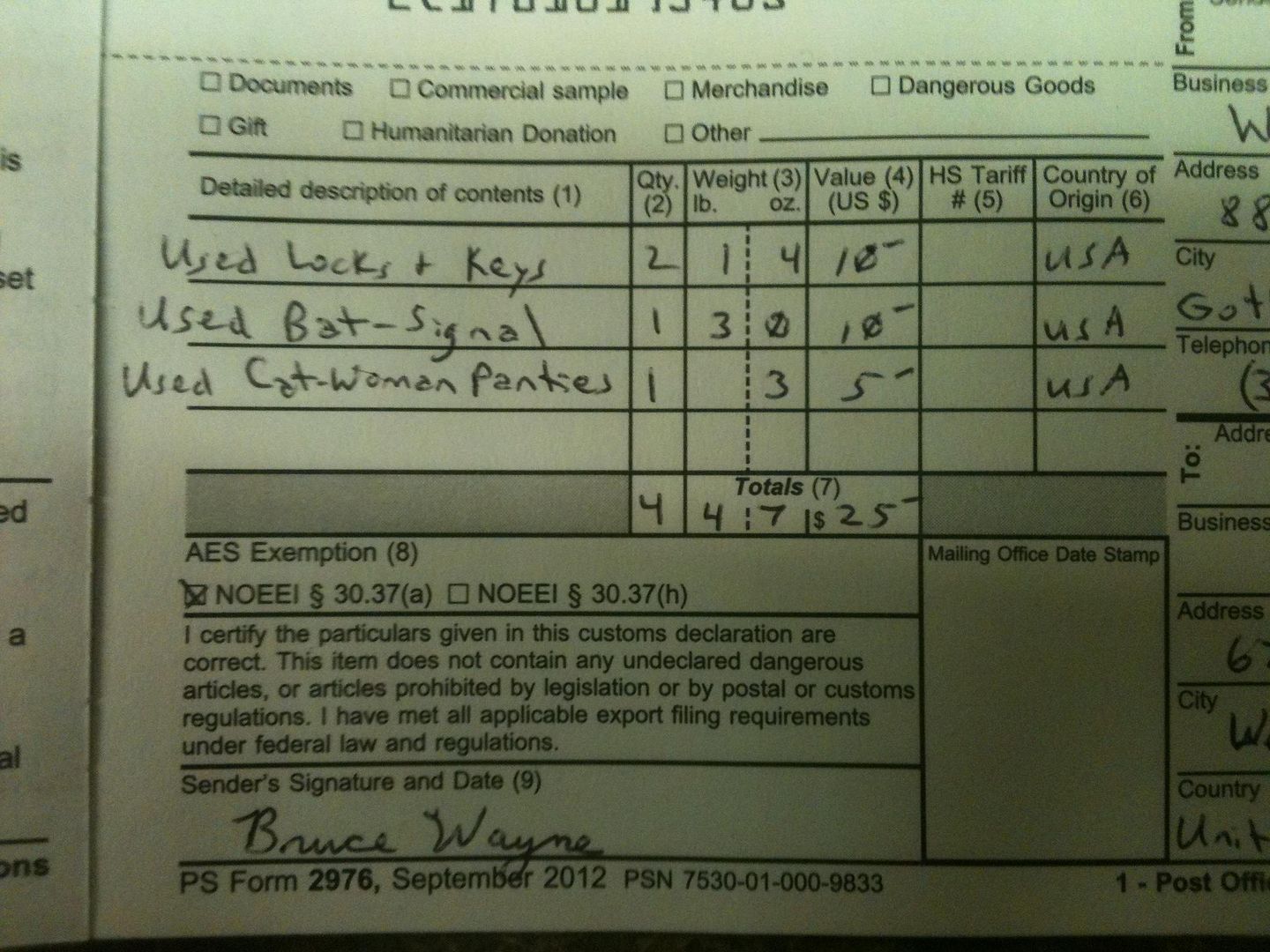

Kool Aid to Norway ASAP.

Community Property Rules and Registered Domestic Partners

Related Post: