What Is Form 8862 Turbotax

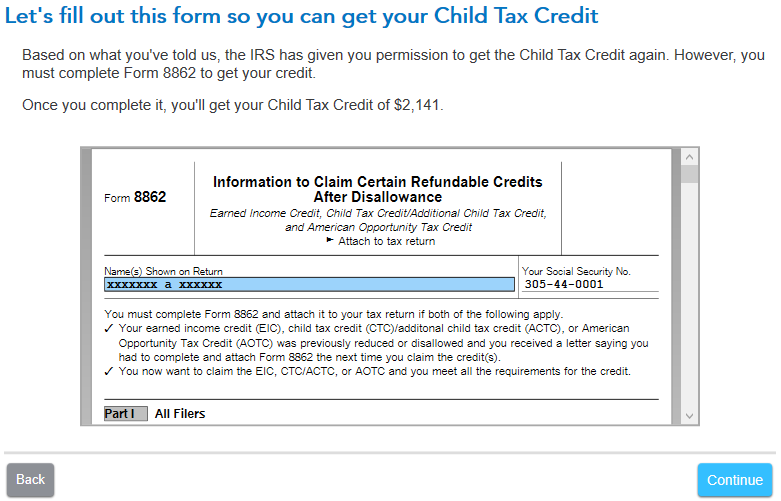

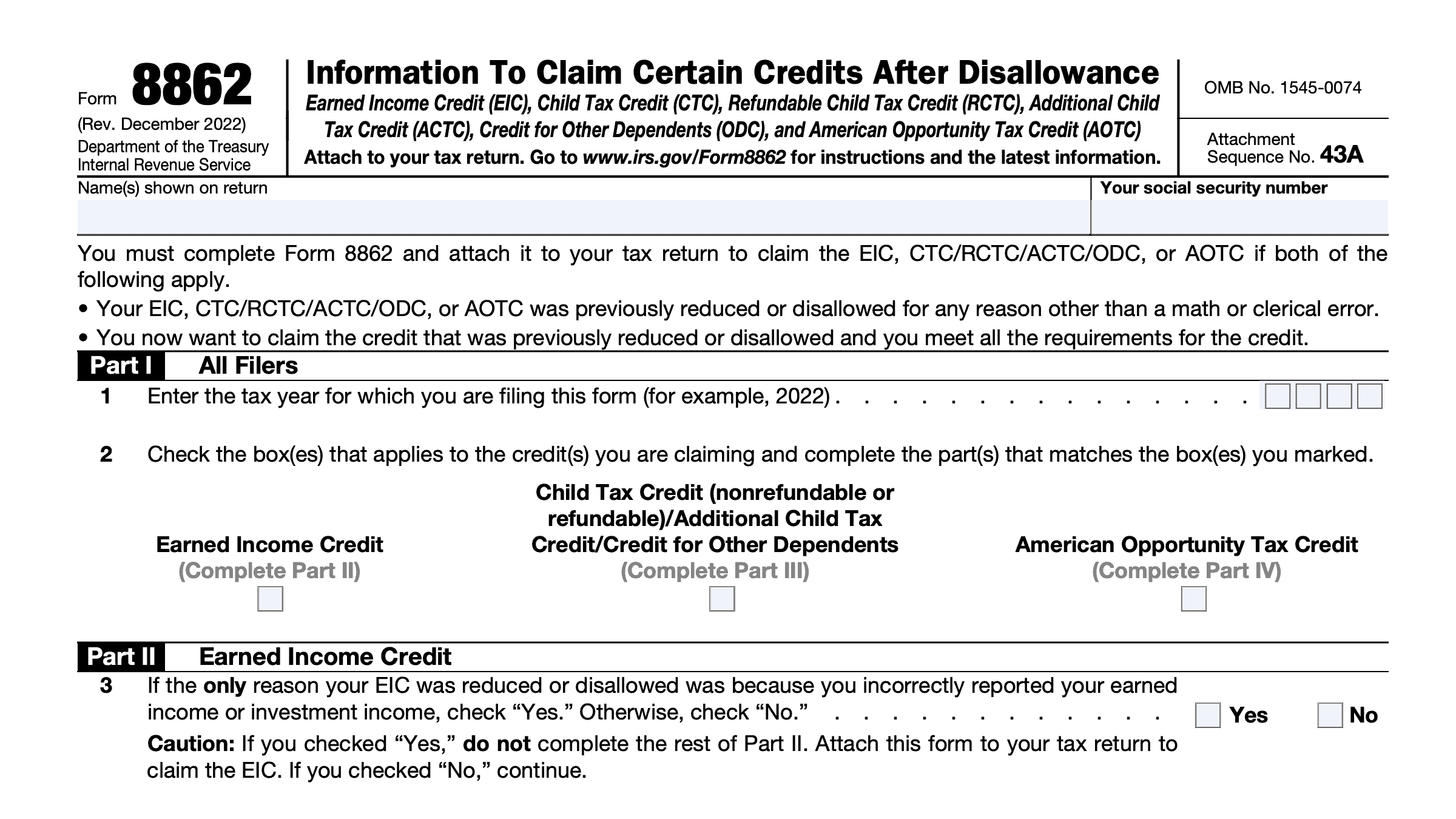

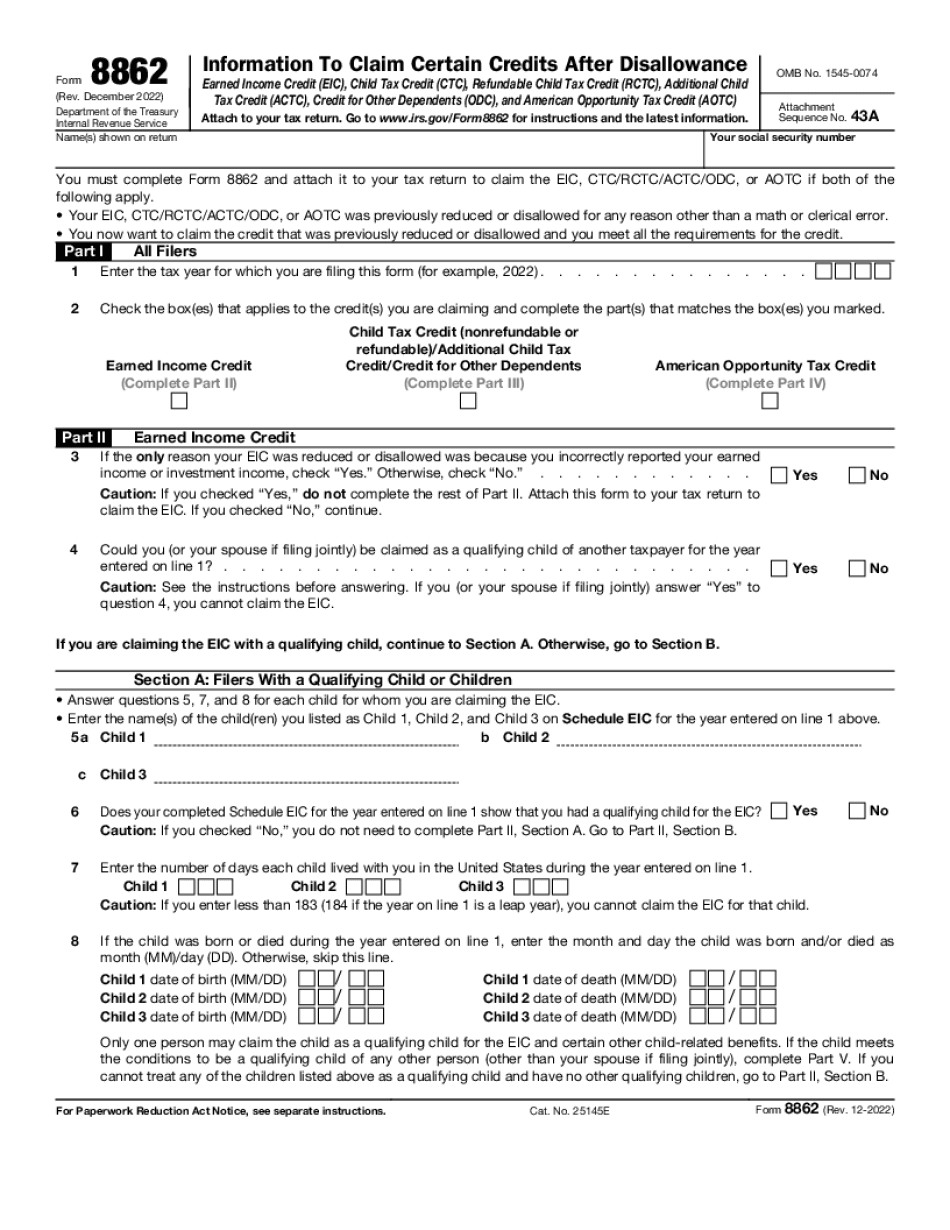

What Is Form 8862 Turbotax - Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. How to file eitc and child tax credit for free: Send filled & signed form or save. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web get the free form 8862 2018. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Then click on jump to 8862 that appears in search results. Open form follow the instructions. Web march 26, 2020 7:26 am. Download or email irs 8862 & more fillable forms, register and subscribe now! Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. As. Taxpayers complete form 8862 and attach it to their tax return if: Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. This takes you to the. Web march 26, 2020 7:26 am. ★ ★ ★ ★ ★. To regain your tax credits,. It is when your eic is disallowed or reduced for some type of clerical or mat. Open form follow the instructions. Solved • by turbotax • 7270 • updated february 25, 2023. Web what is the 8862 tax form? Ad save time and money with professional tax planning & preparation services. How to claim refundable credits after disallowance form 8862? Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. To regain your tax credits,. Web. Screen, check the box next toi/we got a. Watch this turbotax guide to learn more.turbotax home:. Turbotax can help you fill out your. This takes you to the. Web 1 best answer. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical. Turbotax can help you fill out your. Then click on jump to 8862 that appears in search results. Web turbotax help intuit. Web go to search box in top right cover and click. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Get ready for tax season deadlines by completing any. Web irs form 8862 is used to claim theearned income tax credit (eitc), it the eitc was disallowed or reduced, forreasons other than math or clerical errors, after. Screen, check the box next toi/we got a. As mentioned above, the irs form 8862 turbotax is required if your eic was disallowed or reduced. Easily sign the form with your finger.. Web what is error code 8862 turbotax? Solved • by turbotax • 7270 • updated february 25, 2023. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Then click on jump to 8862 that appears. Easily sign the form with your finger. March 23, 2022 6:03 pm. Download or email irs 8862 & more fillable forms, register and subscribe now! Information to claim certain credits after disallowance. Web irs form 8862 is used to claim theearned income tax credit (eitc), it the eitc was disallowed or reduced, forreasons other than math or clerical errors, after. How do i know if my irs is disallowed from eic? Information to claim certain credits after disallowance. Irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical. Web by filing irs form 8862, you may be able to provide additional information and demonstrate that you meet the requirements for that tax credit. This takes you to the. Taxpayers complete form 8862 and attach it to their tax return if: Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. Web file form 8862. Download or email irs 8862 & more fillable forms, register and subscribe now! How do i enter form 8862? Then click on jump to 8862 that appears in search results. Open form follow the instructions. Pay the lowest amount of taxes possible with strategic planning and preparation Web what is the 8862 tax form? ★ ★ ★ ★ ★. Screen, check the box next toi/we got a.how do i add form 8862 TurboTax® Support

IRS Form 8862 Diagram Quizlet

IRS Form 8862 Claiming Certain Tax Credits After Disallowance

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 Turbotax Fill online, Printable, Fillable Blank

How to file form 8862 on TurboTax ? MWJ Consultancy turbotax YouTube

Form 8862 Printable Transform your tax workflow airSlate

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)