What Is Form 8615 Turbotax

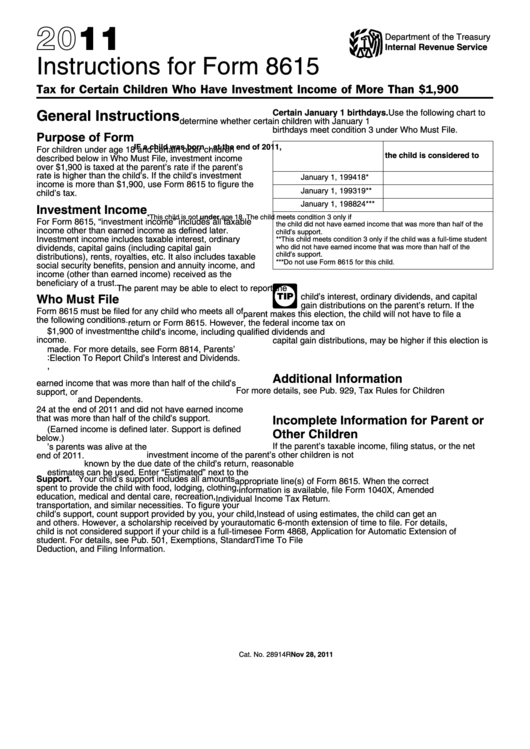

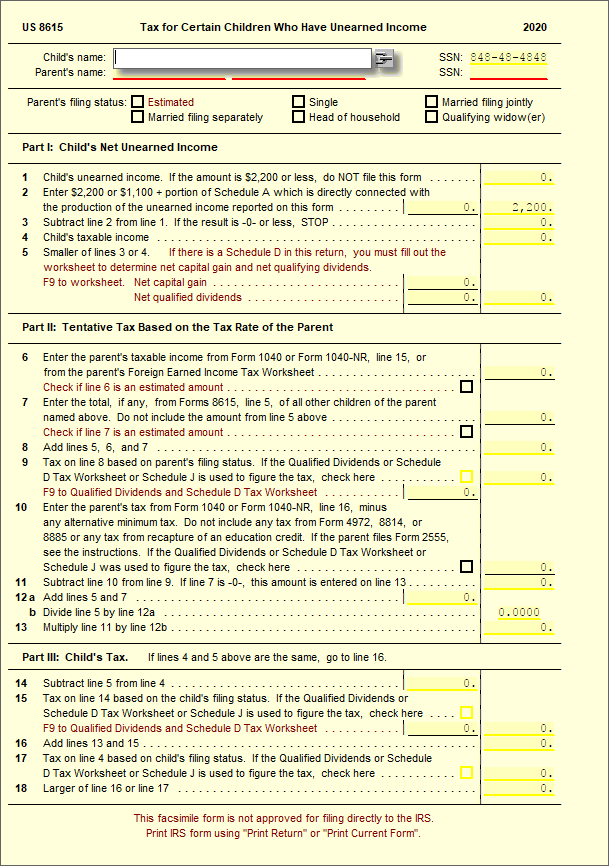

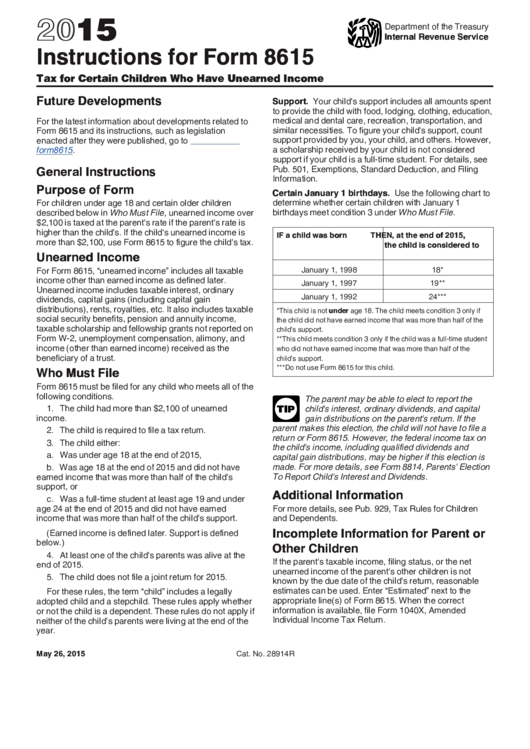

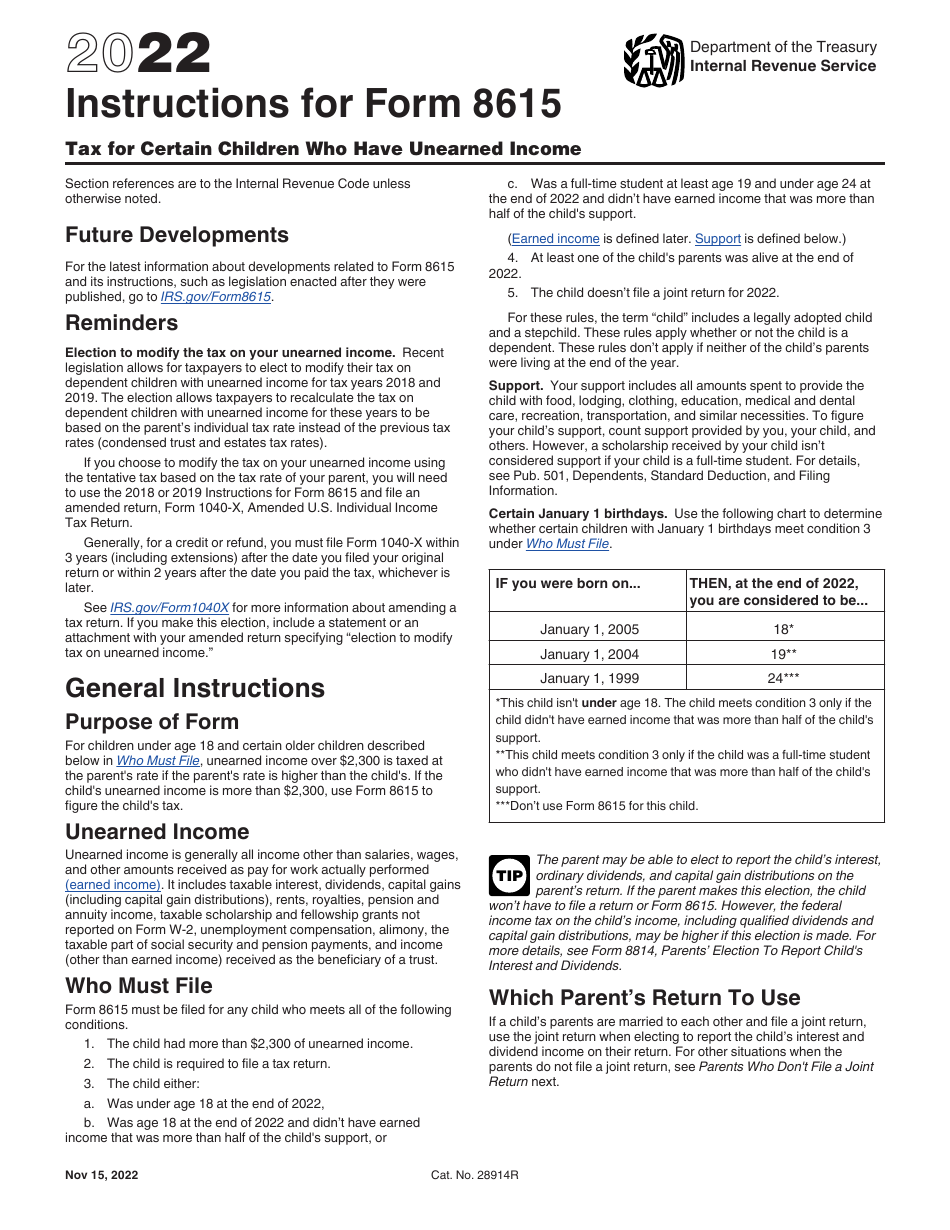

What Is Form 8615 Turbotax - I am coming to believe that the form 8615 is being 'required' as a result of. The child does not file a joint tax return with. Web instructions fillable forms if you’re the parent of a child with significant amounts of unearned income, your child might be subject to kiddie tax rules. Web form 8615 must be filed with the child’s tax return if all of the following apply: For 2023, form 8615 needs to be filed if all of the following conditions apply: Web turbotax live en español. The child is required to file a tax return; The child had more than $2,300 of unearned income. The child is required to file a tax return. Web children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. The irs has also put a plan in motion to digitize. Unearned income includes taxable interest, ordinary dividends, capital gains (including. The child had more than $2,300 of unearned income. Web form 8615 must be filed for any child who meets all of the following conditions. Web turbotax live en español. The city of marion is facing yet another financial setback, this time in the form. Web irs fines marion $196,972 for failing to file health insurance information form in 2020. The child is required to file a tax return; The child had more than $2,300 of unearned income. The form contains information, for your tax return, about the gross amount. Tax law & stimulus updates. Web why does my tax return keep getting rejected? It sounds like you are getting this error when turbotax is checking your return for errors. Tax for certain children who have unearned income. Web turbotax live en español. Web tax gap $688 billion. To find form 8615 please follow the steps below. Web why does my tax return keep getting rejected? It sounds like you are getting this error when turbotax is checking your return for errors. Web when the list of forms in your return appears, look for form 8615: Web instructions fillable forms if you’re the parent of a child with significant amounts of unearned income, your child might be subject to kiddie tax rules. Web i started a new return and watched more closely the status of forms required at each step. The child had more than $2,300 of unearned income. It sounds like you are getting this. Web what is form 8615 used for. I complete the return and for the. For 2023, form 8615 needs to be filed if all of the following conditions apply: I have elected to calculate at the new tcja rules by answering no to the question. Web instructions fillable forms if you’re the parent of a child with significant amounts of. Web form 8615 must be filed with the child’s tax return if all of the following apply: The irs has also put a plan in motion to digitize. A few other things we need to know @susannekant. I complete the return and for the. While there have been other changes to the. Web tax gap $688 billion. A few other things we need to know @susannekant. Web form 8615 must be filed for any child who meets all of the following conditions. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. The form contains information, for your tax return, about the gross amount. Unearned income includes taxable interest, ordinary dividends, capital gains (including. I have also included additional information. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web irs fines marion $196,972 for failing to file health insurance information form in 2020. Web when the list of forms in your return appears, look. While there have been other changes to the. Web irs fines marion $196,972 for failing to file health insurance information form in 2020. Currently, the irs allows taxpayers with adjusted gross incomes up to $73,000 to file their federal tax returns. To find form 8615 please follow the steps below. It sounds like you are getting this error when turbotax. Web my form keeps asking me to fill out line 6 on the 8615 form and i do not have this form. Web tax gap $688 billion. Web for form 8615, “unearned income” includes all taxable income other than earned income. The child had more than $2,300 of unearned income. Web form 8615 must be filed with the child’s tax return if all of the following apply: Form 8615 is used to calculate taxes on certain children's unearned income. Web irs fines marion $196,972 for failing to file health insurance information form in 2020. Web use form 8615 pdf to figure the child's tax on unearned income over $2,300 if the child is under age 18, and in certain situations if the child is older (see. The city of marion is facing yet another financial setback, this time in the form. Web the direct file pilot will provide eligible taxpayers with the choice to electronically file their 2023 federal tax return for free, directly with the irs. Web turbotax live en español. Attach the completed form to the. Under age 18, age 18 and did. Web 2 days agowhy the irs is testing a free direct file program. Web what is form 8615 used for. I have also included additional information. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. The child does not file a joint tax return with. Web i started a new return and watched more closely the status of forms required at each step. Web what is form 8615?Instructions For Form 8615 Tax For Certain Children Who Have

8615 Tax for Certain Children Who Have Unearned UltimateTax

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Form 8615 Instructions (2015) printable pdf download

Re When will form 8915E 2020 be available in tur... Page 19

Your Federal Tax

Las instrucciones para el formulario 8615 del IRS Los Basicos 2023

What Is Form 8615 Used For?

Form 8615 Tax for Certain Children with Unearned Jackson Hewitt

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Related Post: