What Is Form 8582

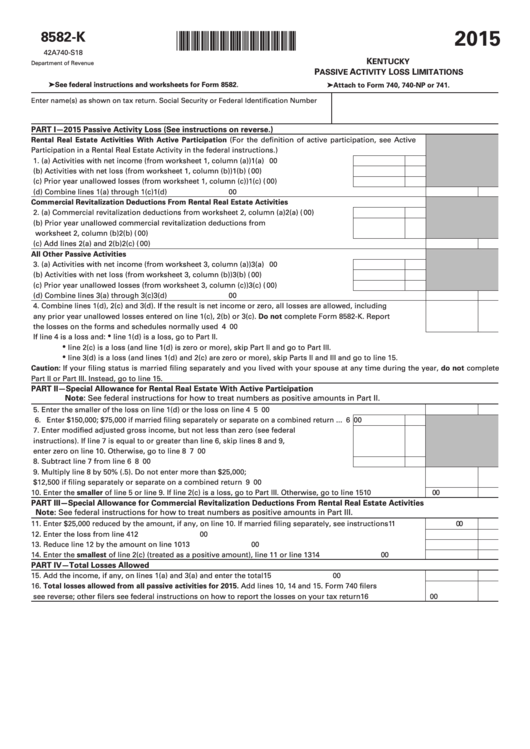

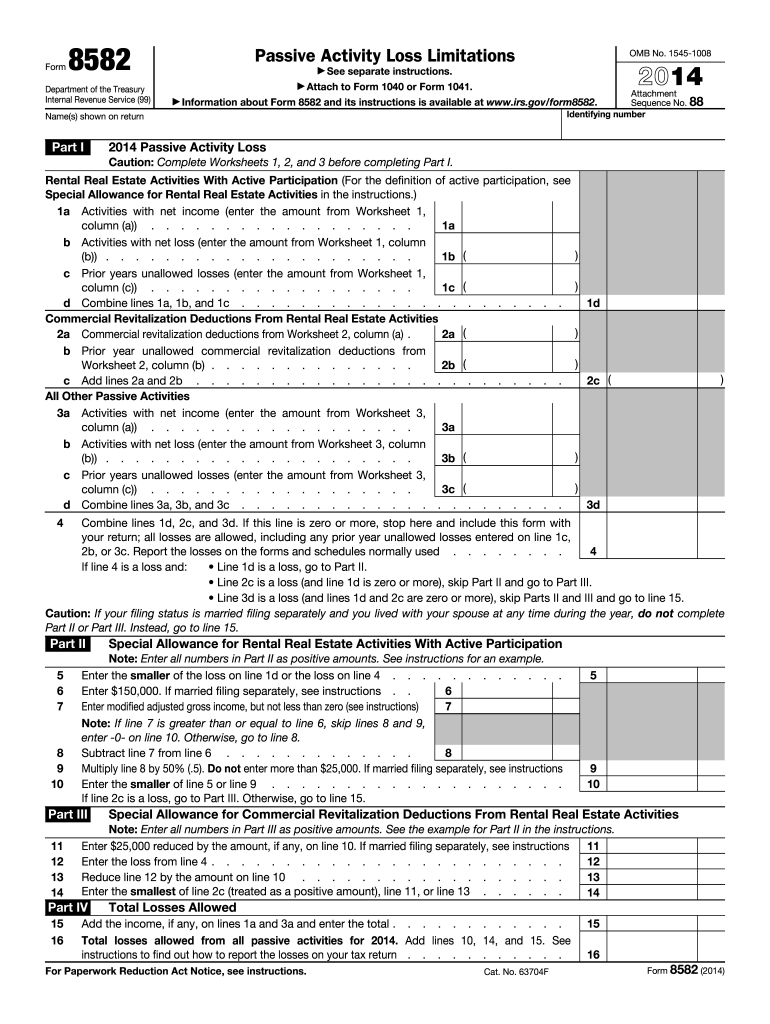

What Is Form 8582 - Per irs instructions for form 8582 passive activity loss limitations, starting page 3: The passive activity loss rules generally prevent taxpayers. This information may affect whether the value of. Web intuit help intuit. From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. Web department of the treasury internal revenue service (99) form 8582. Web open your turbotax return. Web solved•by intuit•145•updated november 30, 2022. Solved • by intuit • 35 • updated july 17, 2023. Web passive activity rules must use form 8810, corporate passive activity loss and credit limitations. What is the form used for? A form that one files with the irs providing information on the recipient of an item or other asset donated to charity. Web intuit help intuit. What is the purpose of the 8582: From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. What is the purpose of the 8582: Web solved•by intuit•145•updated november 30, 2022. A simplified fraction is a fraction that has been reduced to its lowest terms. Complete, edit or print tax forms instantly. Solved • by intuit • 35 • updated july 17, 2023. Solved • by intuit • 35 • updated july 17, 2023. Who must file form 8582 is filed by individuals, estates, and trusts who. Free downloads of customizable forms. Click open form above the forms in my return section. Department of the treasury internal revenue service (99) passive activity loss limitations. In other words, it's a fraction where the numerator (the top. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Web about form 8582, passive activity loss limitations. Edit, sign or email irs 8582 & more fillable forms, register and subscribe now!. Web what is the simplified form of 82/85? The passive activity loss rules generally prevent taxpayers. What is the form used for? A form that one files with the irs providing information on the recipient of an item or other asset donated to charity. Click forms in the header. From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. This information may affect whether the value of. Type 8582 in the type a form name box, press. Free downloads of customizable forms. Noncorporate taxpayers use form 8582 to: Web department of the treasury internal revenue service (99) form 8582. Web open your turbotax return. In other words, it's a fraction where the numerator (the top. Solved • by intuit • 35 • updated july 17, 2023. However, for purposes of the donor’s. Report the application of prior year unallowed pals. A simplified fraction is a fraction that has been reduced to its lowest terms. Common questions about form 8582 in proseries. Web what is the simplified form of 82/85? Complete, edit or print tax forms instantly. Solved • by intuit • 35 • updated july 17, 2023. This information may affect whether the value of. If you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive. What is the purpose of the 8582: Who must file form 8582 is. Web intuit help intuit. Who must file form 8582 is filed by individuals, estates, and trusts who. Click open form above the forms in my return section. The passive activity loss rules generally prevent taxpayers. Edit, sign or email irs 8582 & more fillable forms, register and subscribe now! From 8582, passive activity loss limitations, is filed by individuals, estates, and trusts who have passive. Edit, sign or email irs 8582 & more fillable forms, register and subscribe now! If you actively participated in a passive rental real estate activity, you may be able to deduct up to $25,000 of loss from the activity from your nonpassive. Per irs instructions for form 8582 passive activity loss limitations, starting page 3: However, for purposes of the donor’s. Who must file form 8582 is filed by individuals, estates, and trusts who. Complete, edit or print tax forms instantly. The passive activity loss rules generally prevent taxpayers. In other words, it's a fraction where the numerator (the top. Web form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer can take in a given year. Figure the amount of any passive. Web about form 8582, passive activity loss limitations. Web department of the treasury internal revenue service (99) form 8582. Web form 8582, or passive activity loss limitations, is a form the irs uses to calculate the passive activity loss amount that taxpayers can take in a given year. Web solved•by intuit•145•updated november 30, 2022. Web form 8283 contains more than one item, this exception applies only to those items that are clearly identified as having a value of $500 or less. What is the form used for? Noncorporate taxpayers use form 8582 to: Web what is the simplified form of 82/85? Department of the treasury internal revenue service (99) passive activity loss limitations.Fillable Form 8582K Kentucky Passive Activity Loss Limitations

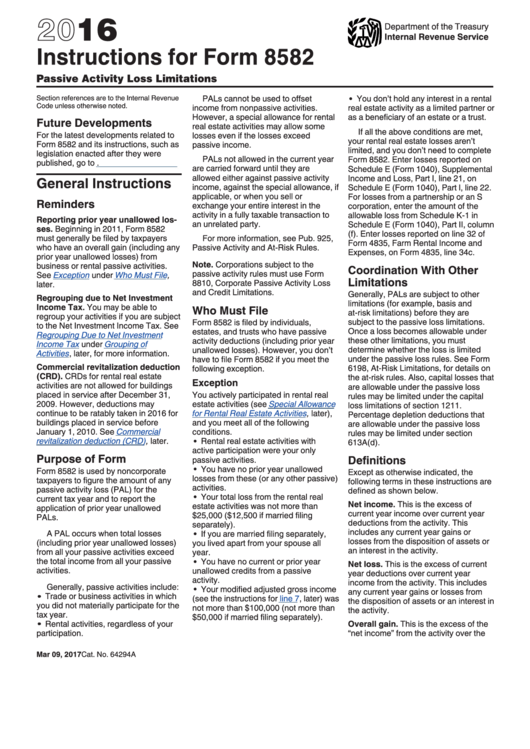

Instructions For Form 8582 2016 printable pdf download

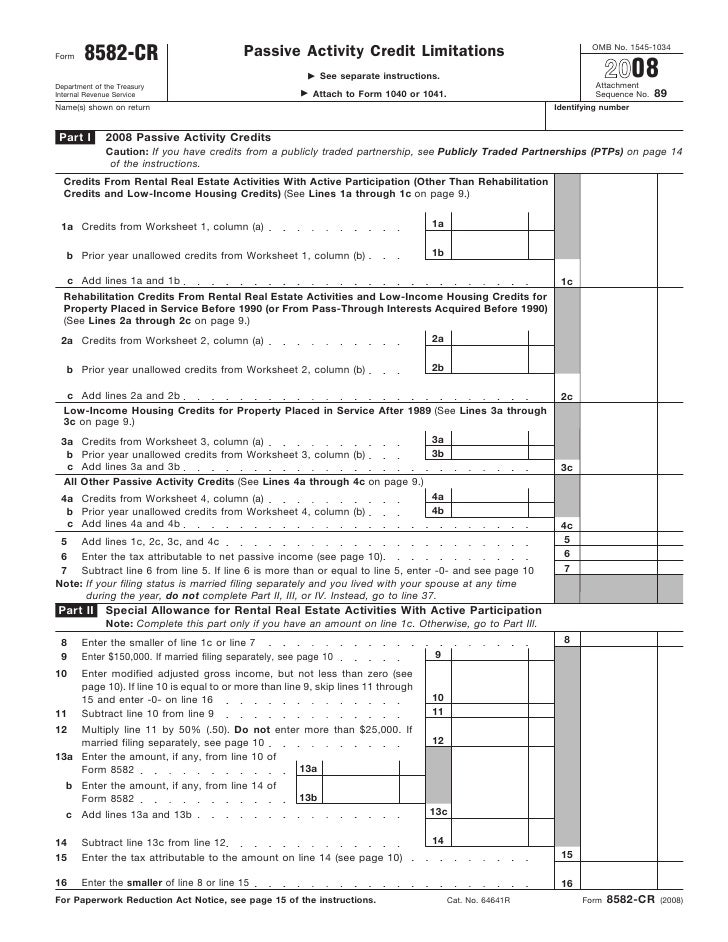

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Form 8582CR Passive Activity Credit Limitations

IRS 8582 Form PAL Blanks to Fill out and Download in PDF

Instructions for Form 8582CR (12/2019) Internal Revenue Service

8582 Form Fill Out and Sign Printable PDF Template signNow

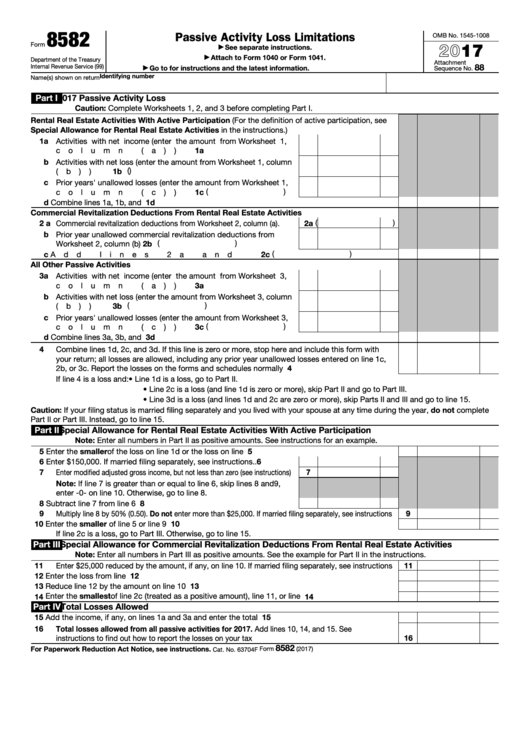

Fillable Form 8582 Passive Activity Loss Limitations 2017 printable

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Related Post: