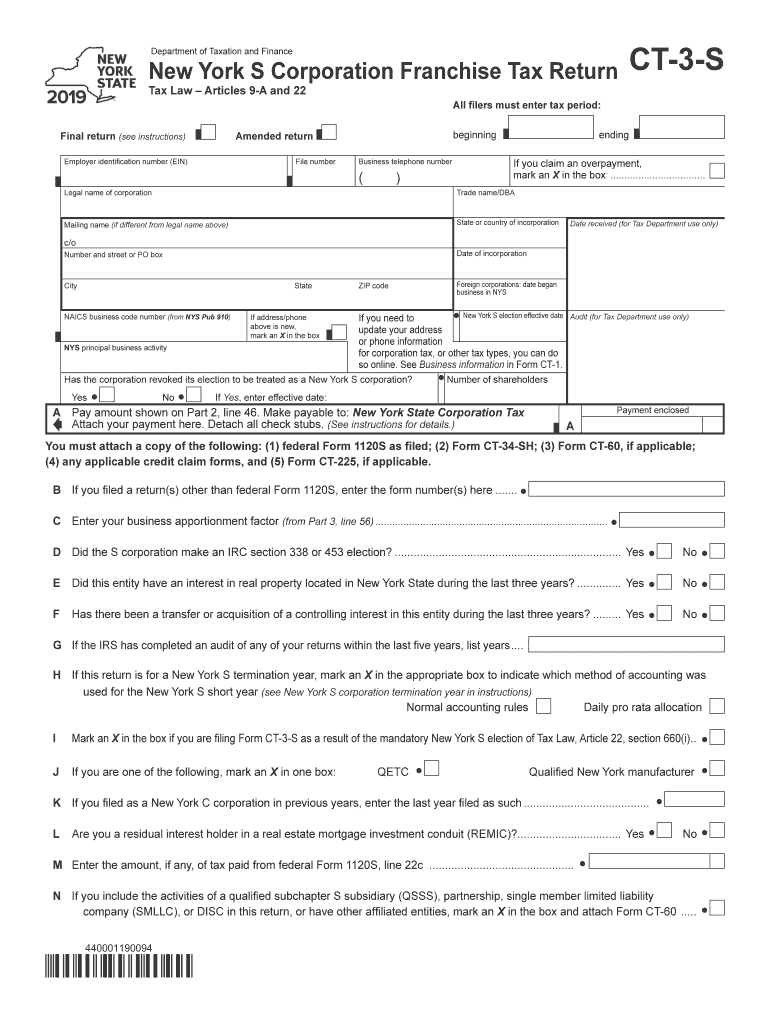

What Is Ct-3 Form

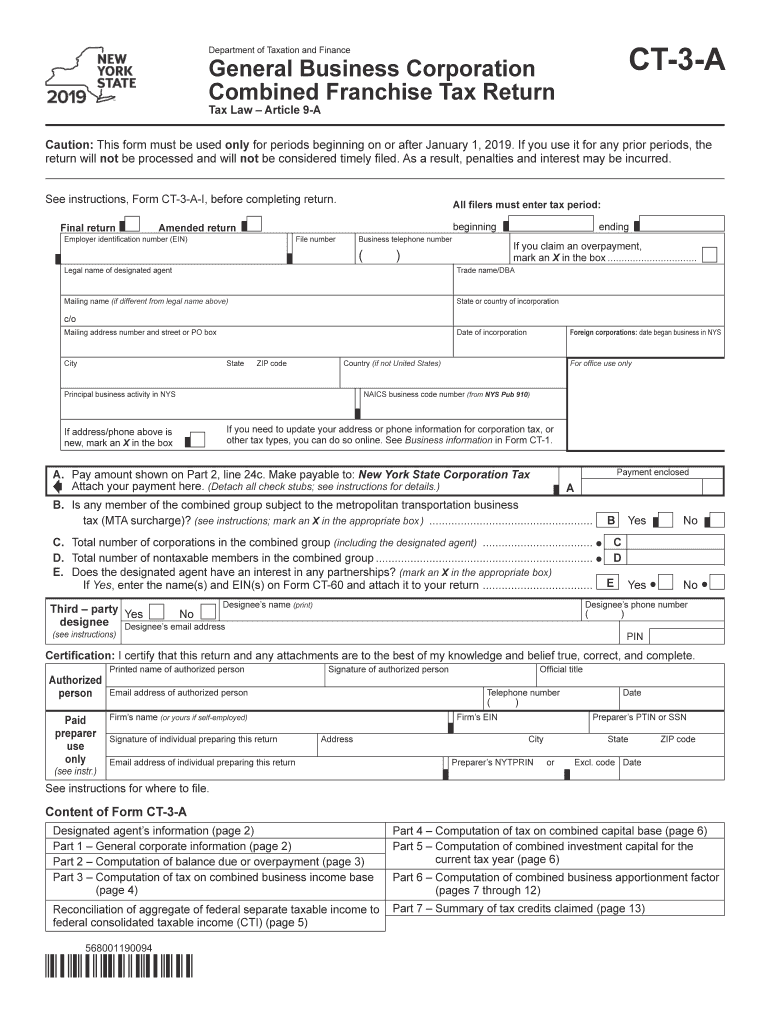

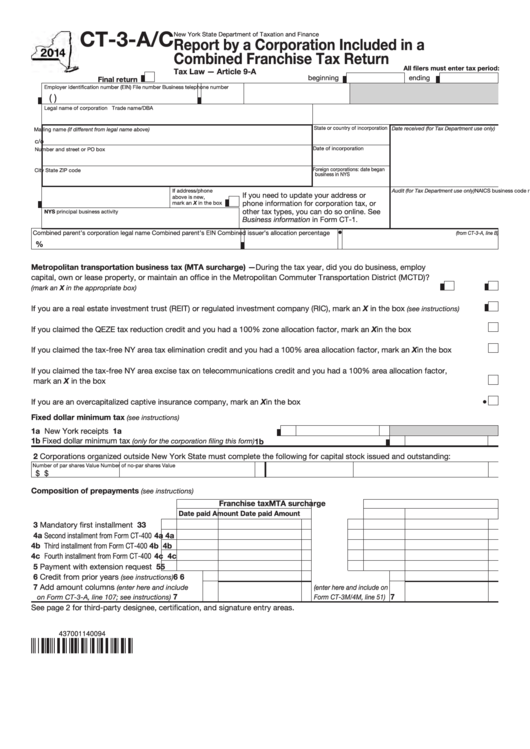

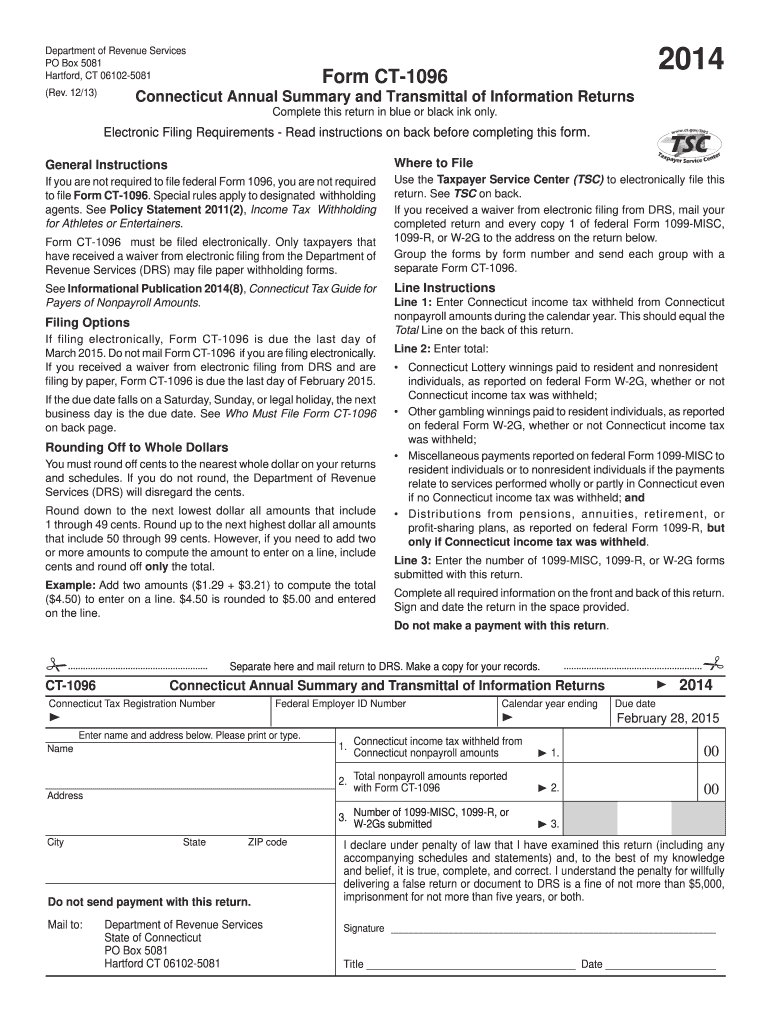

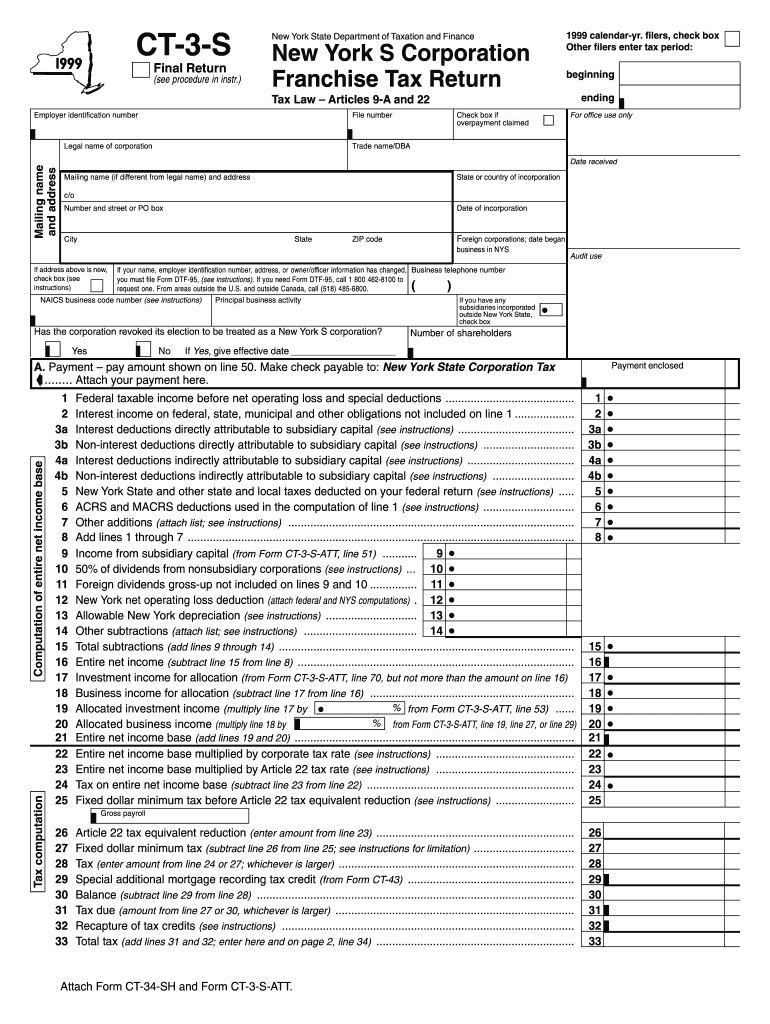

What Is Ct-3 Form - Web corporate tax filing requirements. For part 4, computation of tax on combined capital base, lines 1 and 6, and. See electronic filing requirement, on the reverse. (1) federal form 1120s as filed; For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. Web specify the applicable code below in the space on the front of this form in the request section. 2023 connecticut withholding tax payment form for nonpayroll amounts. However, if your tier 1 employer taxes for. I hereby request the department of motor vehicles to disclose personal. If you claim an overpayment, mark an x in the box all filers must enter tax period:beginning ending file this form with. Web can do so online. 2022 connecticut annual reconciliation of withholding for nonpayroll. For part 4, computation of tax on combined capital base, lines 1 and 6, and. Web connecticut annual reconciliation of withholding. Web in 1993, mr. This form is needed to determine how much. If you claim an overpayment, mark an x in the box all filers must enter tax period:beginning ending file this form with. 2023 connecticut withholding tax payment form for nonpayroll amounts. What is form ct 2? Web can do so online. Web specify the applicable code below in the space on the front of this form in the request section. Web connecticut annual reconciliation of withholding. What is form ct 2? This form is needed to determine how much. However, if your tier 1 employer taxes for. I hereby request the department of motor vehicles to disclose personal. Metropolitan transportation business tax (mta surcharge) during the tax year. Web in 1993, mr. Web connecticut annual reconciliation of withholding. This form is needed to determine how much. Web can do so online. For part 4, computation of tax on combined capital base, lines 1 and 6, and. I hereby request the department of motor vehicles to disclose personal. Web in 1993, mr. Mark an x in the appropriate box). 2023 connecticut withholding tax payment form for nonpayroll amounts. Web corporate tax filing requirements. Web in 1993, mr. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. What is form ct 2? However, if your tier 1 employer taxes for. Web specify the applicable code below in the space on the front of this form in the request section. 2023 connecticut withholding tax payment form for nonpayroll amounts. 2022 connecticut annual reconciliation of withholding for nonpayroll. Web connecticut annual reconciliation of withholding. 2022 connecticut annual reconciliation of withholding for nonpayroll. What is form ct 2? Web corporate tax filing requirements. Web specify the applicable code below in the space on the front of this form in the request section. Web web ct 3 form 2020 use a ct 3 form 2020 template to make your document workflow more streamlined. Metropolitan transportation business tax (mta surcharge) during the tax year. Must be filed electronically unless certain conditions are met. For part 4, computation of tax on combined capital base, lines 1 and 6, and. (1) federal form 1120s as filed; This form must be used only for tax periods beginning on or after january 1, 2022. Web in 1993, mr. Must be filed electronically unless certain conditions are met. If you claim an overpayment, mark an x in the box all filers must enter tax period:beginning ending file this form with. Web can do so online. Mark an x in the appropriate box). 2022 connecticut annual reconciliation of withholding for nonpayroll. What is form ct 2? 2023 connecticut withholding tax payment form for nonpayroll amounts. See electronic filing requirement, on the reverse. Web connecticut annual reconciliation of withholding. If you claim an overpayment, mark an x in the box all filers must enter tax period:beginning ending file this form with. For part 4, computation of tax on combined capital base, lines 1 and 6, and part 6, computation of combined business. (1) federal form 1120s as filed; Web specify the applicable code below in the space on the front of this form in the request section. For part 4, computation of tax on combined capital base, lines 1 and 6, and. This form is needed to determine how much. Web in 1993, mr. Mark an x in the appropriate box). Metropolitan transportation business tax (mta surcharge) during the tax year. Must be filed electronically unless certain conditions are met. Web web ct 3 form 2020 use a ct 3 form 2020 template to make your document workflow more streamlined. Web can do so online. This form must be used only for tax periods beginning on or after january 1, 2022. However, if your tier 1 employer taxes for. I hereby request the department of motor vehicles to disclose personal.2019 Ny Ct 3 a Form Fill Out and Sign Printable PDF Template signNow

Form Ct3A/c Report By A Corporation Included In A Combined

CT 1096, Connecticut Annual Summary and Transmittal of CT Fill Out

NY DTF CT3S 1999 Fill out Tax Template Online US Legal Forms

Not Bad Freeware Blog 501C3 FORM DOWNLOAD

Form CT 3 General Business Corporation Franchise Tax Return YouTube

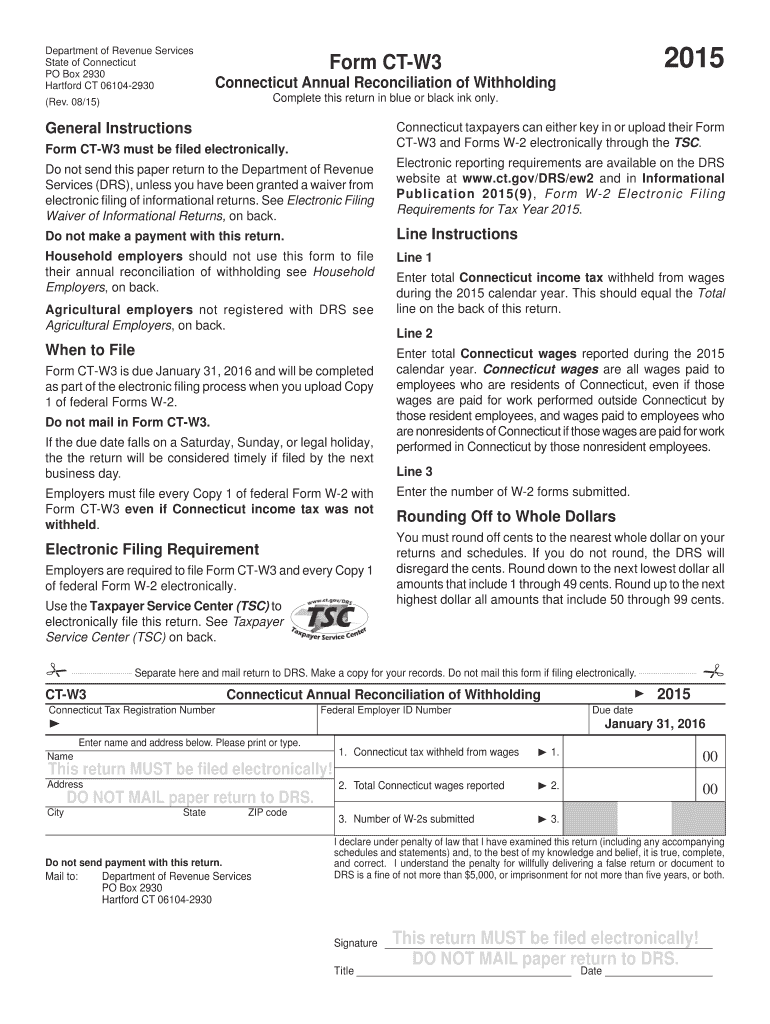

2015 Form CT DRS CTW3Fill Online, Printable, Fillable, Blank pdfFiller

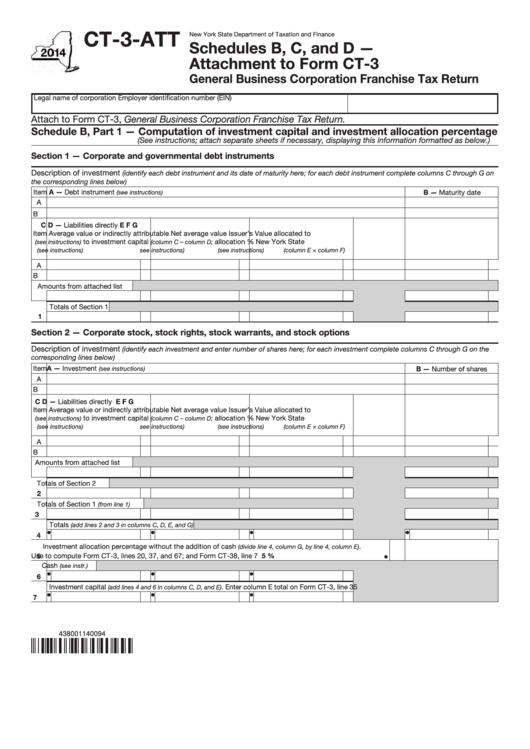

Form Ct3Att Schedules B, C, And D Attachment To Form Ct3

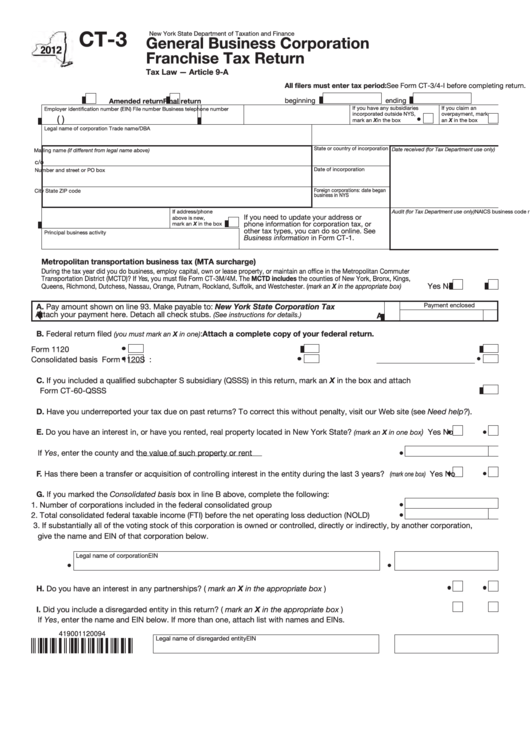

Form Ct3 General Business Corporation Franchise Tax Return New

Ct 3 2019 Form Fill Out and Sign Printable PDF Template signNow

Related Post: