What Is A K40 Tax Form

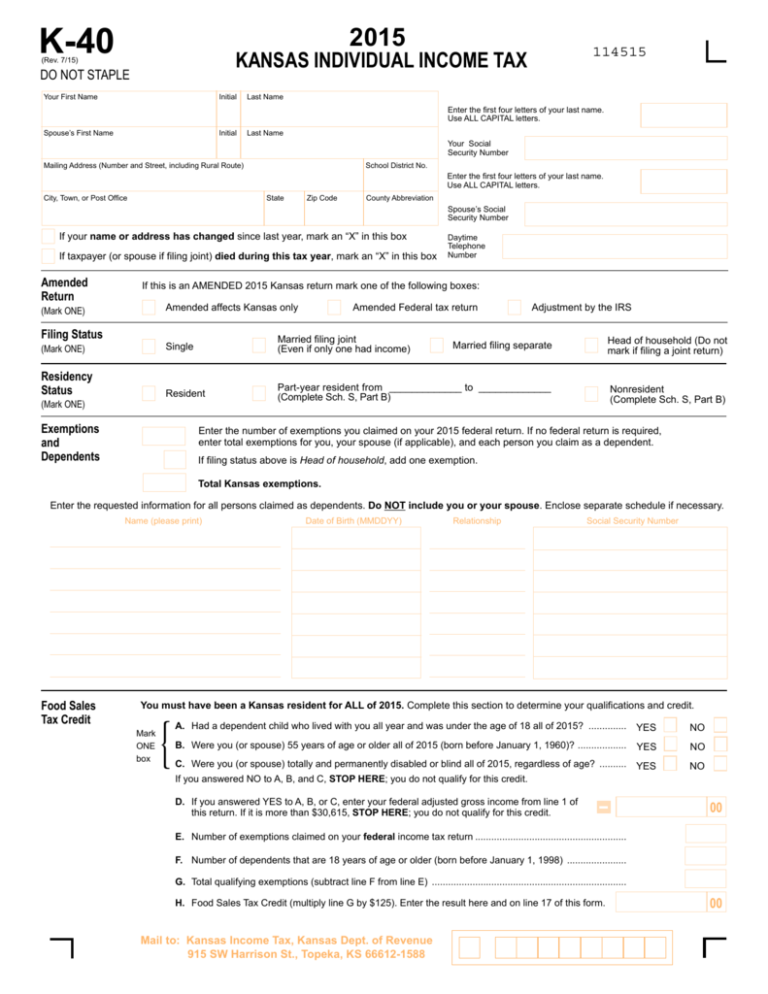

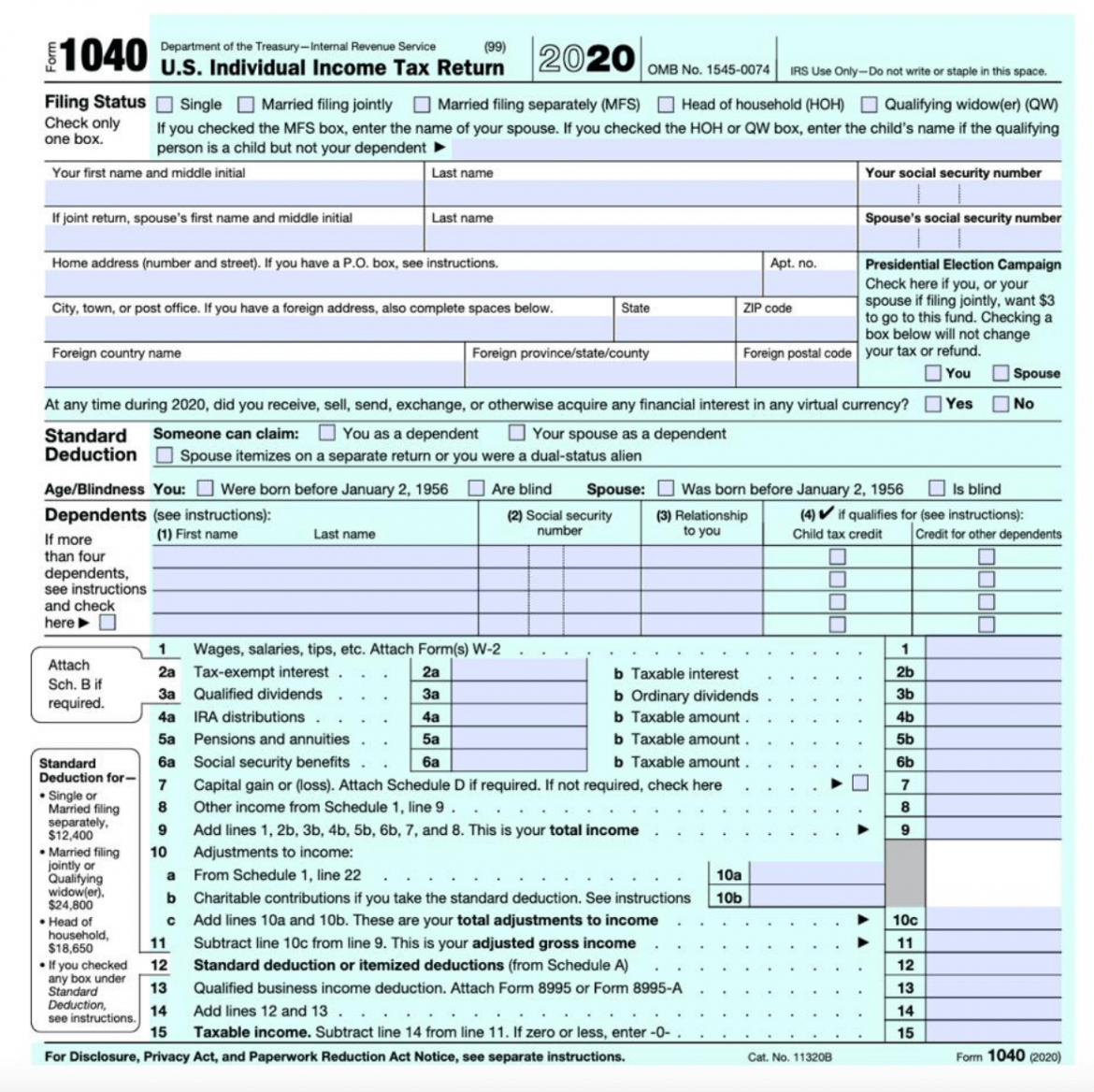

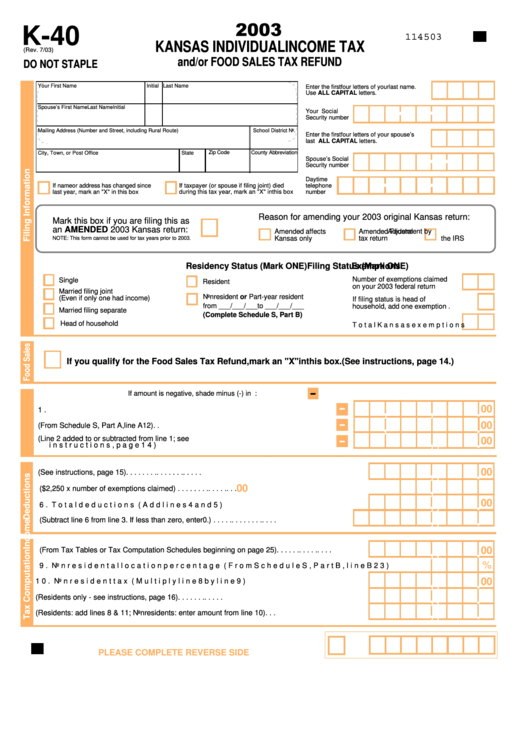

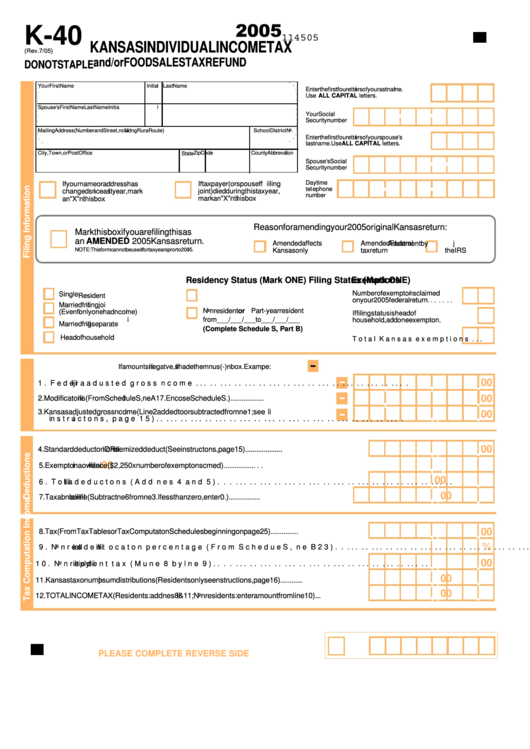

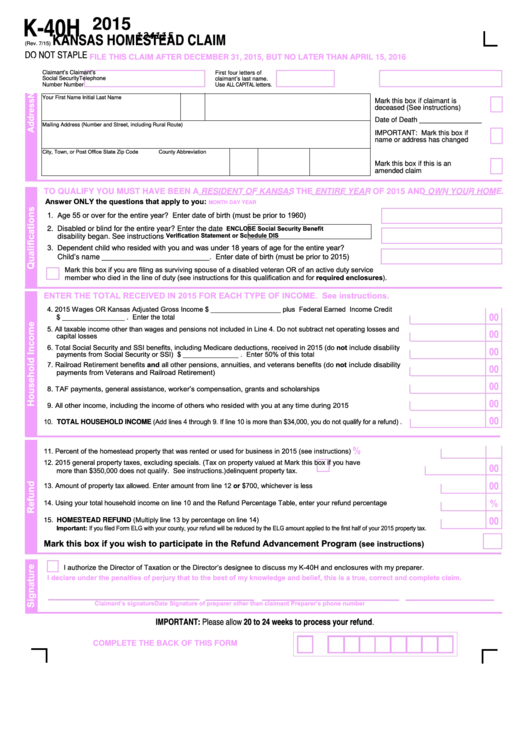

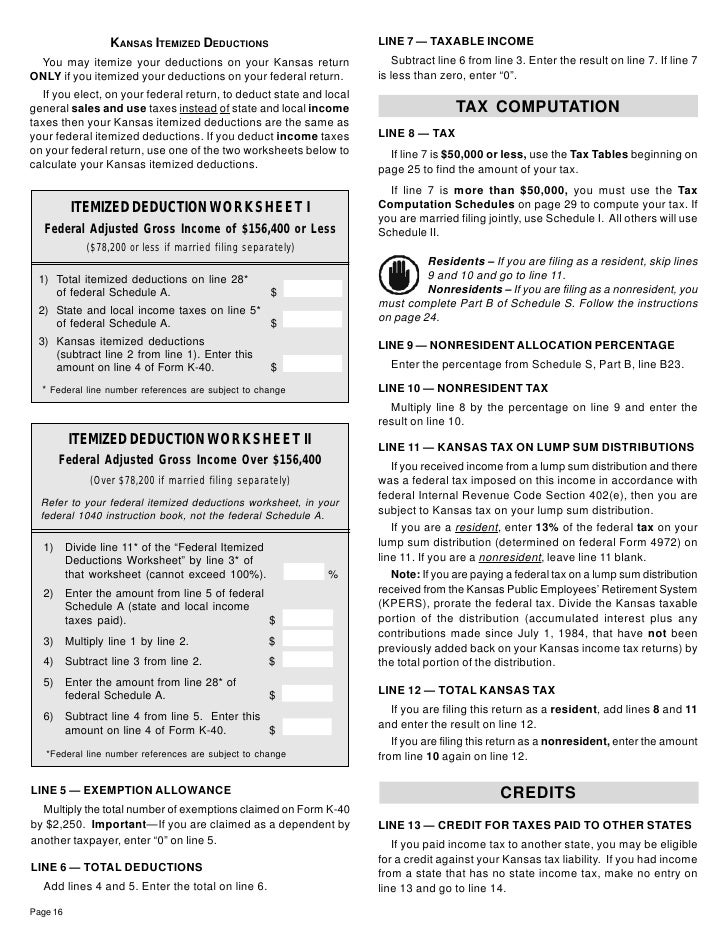

What Is A K40 Tax Form - States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Web died during this tax year, mark an “x” in this box. These 2021 forms and more are available: Direct file will be a mobile. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web adjusted gross income chart for use tax computation. Web 18.food sales tax credit (from line h, front of this form) 19.tax balance after credits (subtract lines 17 and 18 from line 16: Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs. Web the tax scope for the pilot is still being finalized. $27,700 (up from $25,900 in 2022) single taxpayers. Web employer's quarterly federal tax return. Time’s up for millions of americans: For example, if the kansas adjusted gross income on line 3 is $32,000,. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. The final deadline to file your 2022 taxes is october 16. The form determines if additional taxes are due or if the filer will receive a tax refund. Millions of people file every year for an. Time’s up for millions of americans: These 2021 forms and more are available: States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Web employer's quarterly federal tax return. The form determines if additional taxes are due or if the filer will receive a tax refund. Web kansas income tax forms kansas printable income tax forms 74 pdfs kansas has a state income tax that ranges between. Web no, form 1040 and form 1099 are two different federal tax forms. The form determines if additional taxes are due or if the filer will receive a tax refund. Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs. Amended return (mark. Time’s up for millions of americans: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Millions of people file every year for an. These 2021 forms and more are available: For example, if the kansas adjusted gross income on line 3 is $32,000,. Time’s up for millions of americans: Web employer's quarterly federal tax return. Web form 1040 is used by citizens or residents of the united states to file an annual income tax return. (updated january 9, 2023) 2. Cannot be less than zero) use tax. $27,700 (up from $25,900 in 2022) single taxpayers. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. The final deadline to file your 2022 taxes is october 16. Amended return (mark one) if this is. Web adjusted gross income chart for use tax computation. (updated january 9, 2023) 2. Web form 1040 is used by citizens or residents of the united states to file an annual income tax return. The form determines if additional taxes are due or if the filer will receive a tax refund. Web died during this tax year, mark an “x”. These 2021 forms and more are available: Amended return (mark one) if this is an amended 2019 kansas return mark one of the following. This is the kansas individual tax return. The final deadline to file your 2022 taxes is october 16. Direct file will be a mobile. Cannot be less than zero) use tax. Web died during this tax year, mark an “x” in this box. We last updated the individual. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. This is the kansas. Web kansas income tax forms kansas printable income tax forms 74 pdfs kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the. Direct file will be a mobile. For example, if the kansas adjusted gross income on line 3 is $32,000,. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a. Form 1040 is a form that you fill out and send to the irs reporting your income, deductions,. $27,700 (up from $25,900 in 2022) single taxpayers. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Amended return (mark one) if this is an amended 2019 kansas return mark one of the following. Web form 1040 is what individual taxpayers use to file their taxes with the irs. Time’s up for millions of americans: The form determines if additional taxes are due or if the filer will receive a tax refund. Web eligible taxpayers may choose to participate in the pilot next year to file their tax year 2023 federal tax return for free, directly with the irs. These 2021 forms and more are available: This is the kansas individual tax return. Web the standard deduction amounts for 2023 tax returns (those filed in 2024) are: The final deadline to file your 2022 taxes is october 16. Web the tax scope for the pilot is still being finalized. Cannot be less than zero) use tax. Web no, form 1040 and form 1099 are two different federal tax forms. Web adjusted gross income chart for use tax computation.Current K40 tax form Kansas Department of Revenue

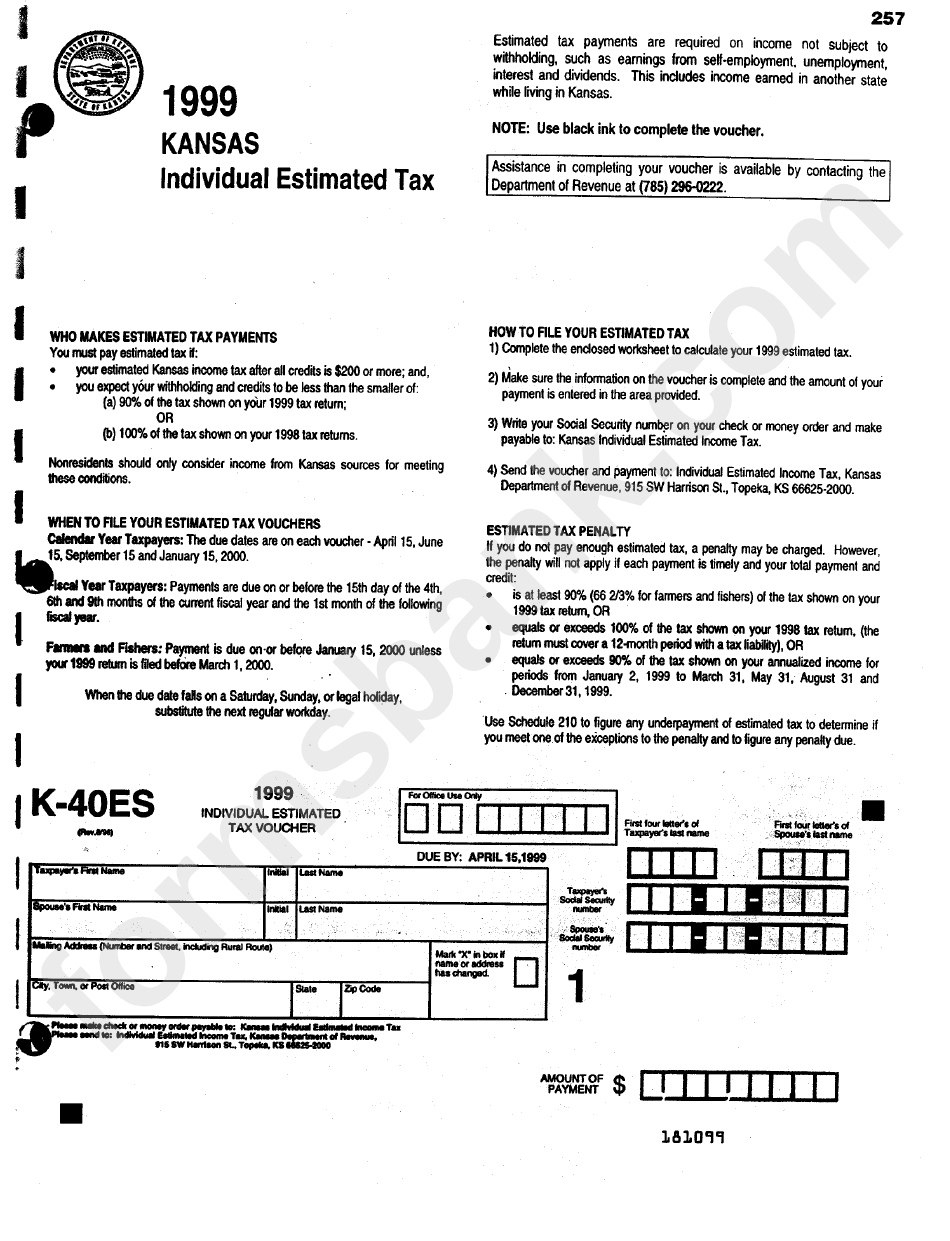

Fillable Form K40es Individual Estimated Tax Kansas Department Of

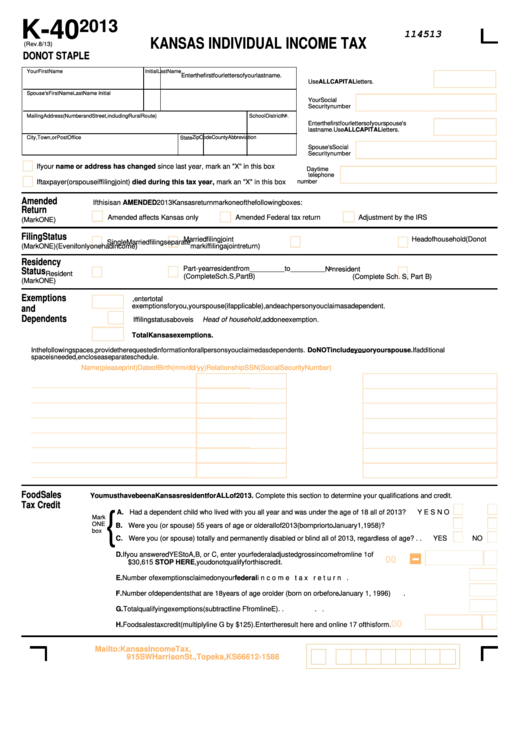

Fillable Form K40 Kansas Individual Tax 2013 printable pdf

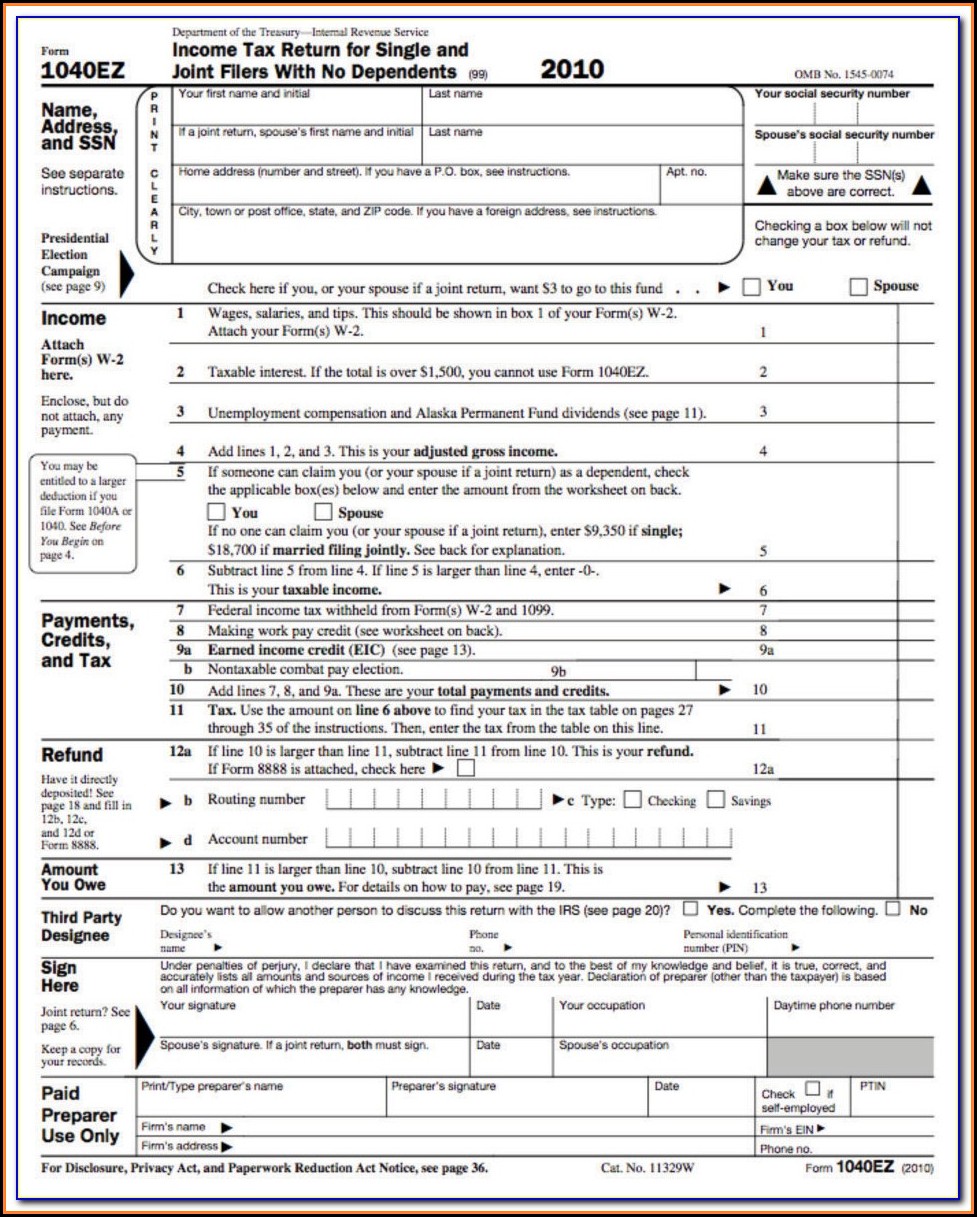

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Form K40 Kansas Individual Tax 2005 printable pdf download

Fillable Form K40h Kansas Homestead Claim 2015 printable pdf download

KS DoR K40 2011 Fill out Tax Template Online US Legal Forms

k40 inst 07

Related Post: