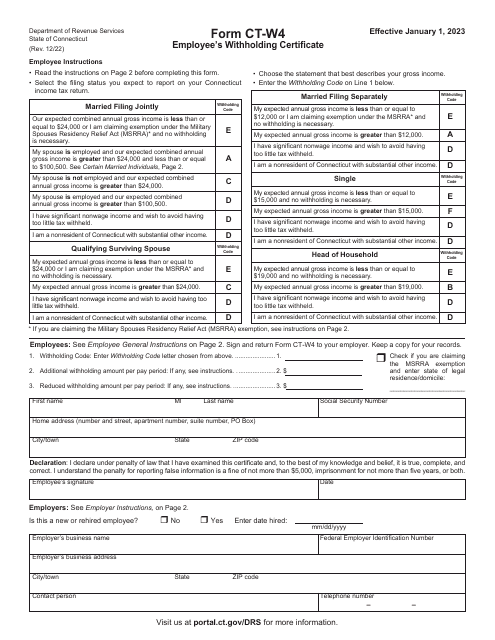

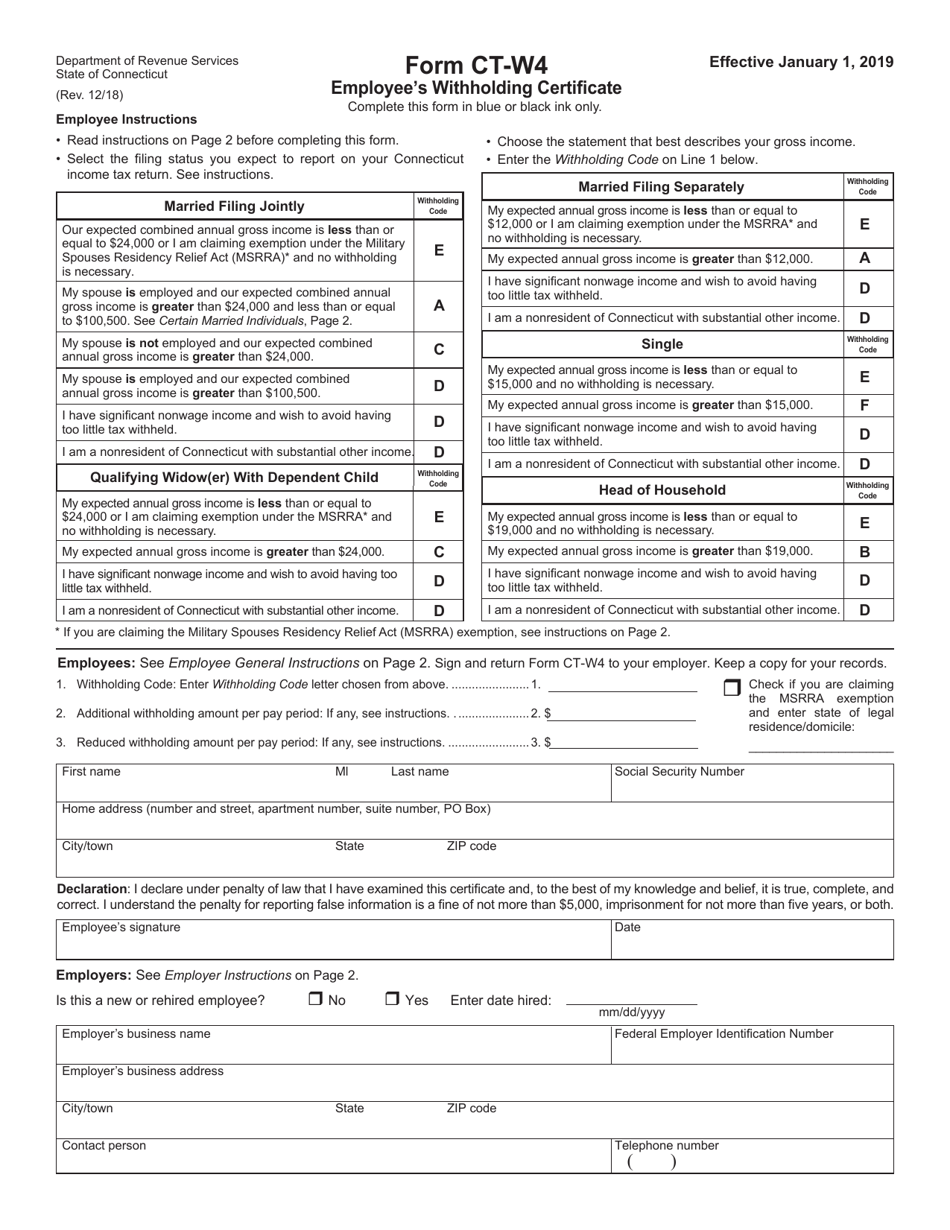

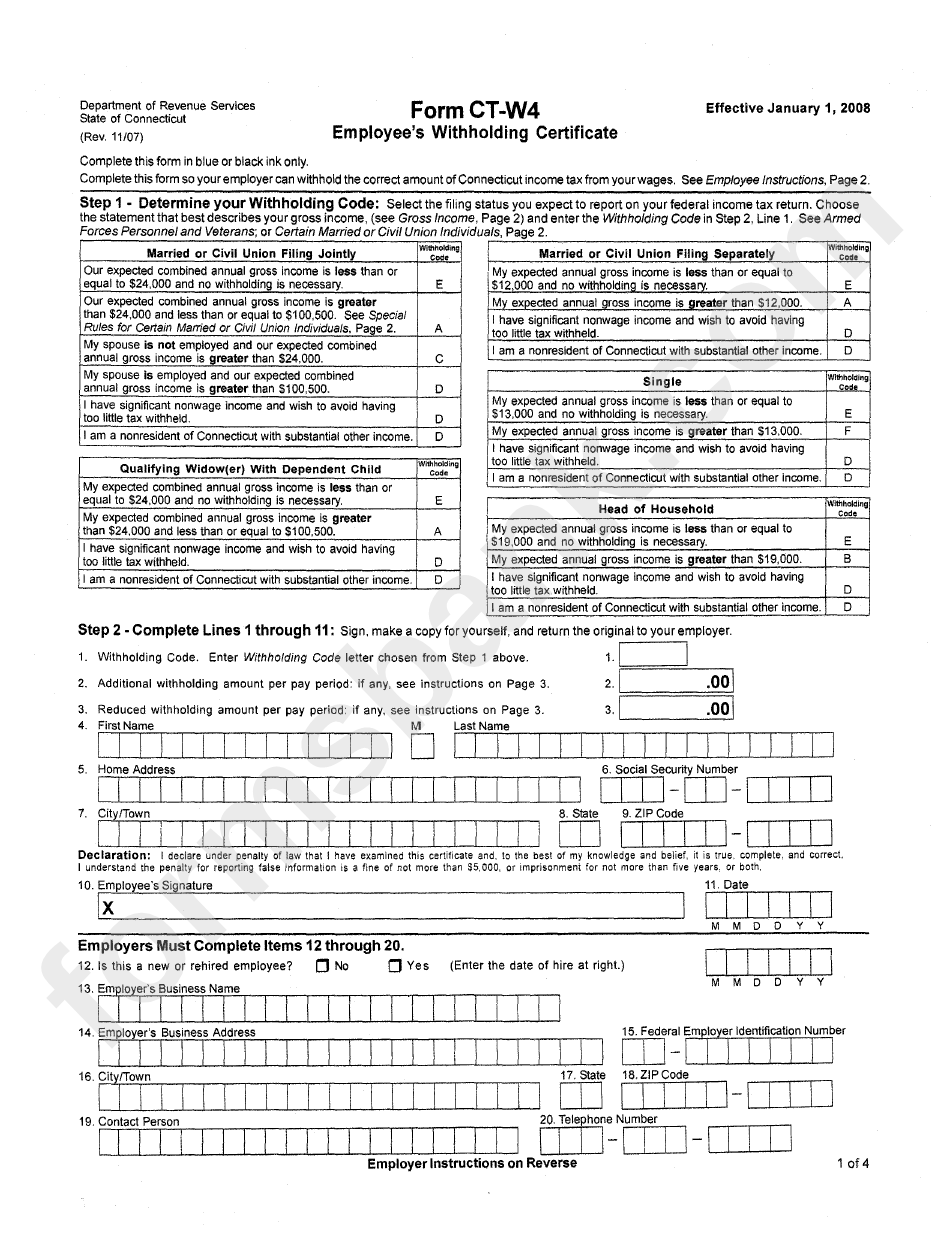

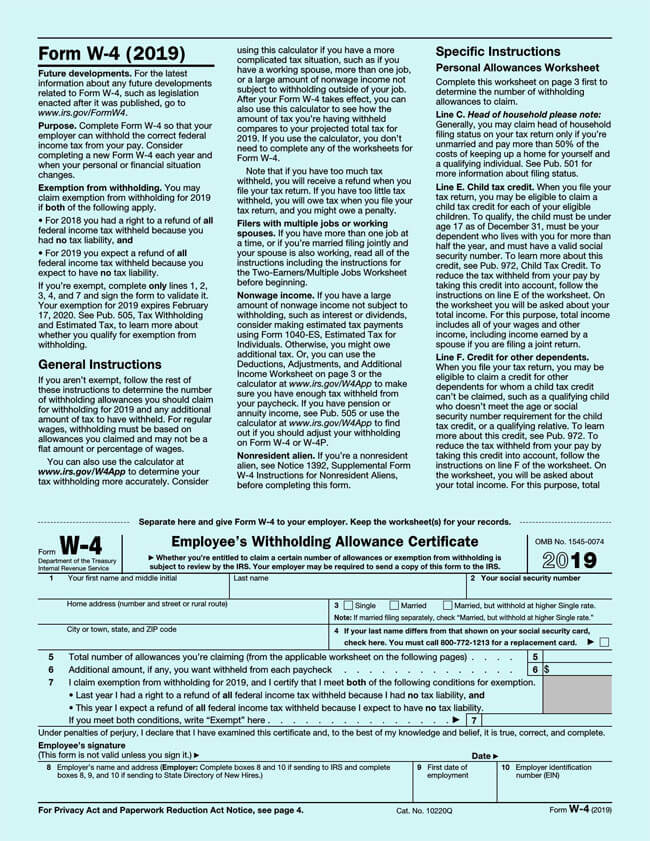

W4 Form Ct

W4 Form Ct - State exemptions acceptable exemption data: (your withholding will be most accurate if you. Keep a copy for your records. Determine the total number of allowances field as. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. You just need to file a different form,. Leave those steps blank for the other jobs. If too little is withheld, you will generally owe tax when you file your tax return. Office of research, ct‑w4 folly brook blvd wethersfield ct 06109 options, visit the dol website at www.ctdol.state.ct.us or call. Complete, edit or print tax forms instantly. Leave those steps blank for the other jobs. You just need to file a different form,. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Employee instructions read the instructions on page 2 before completing. Leave those steps blank for the other jobs. State exemptions acceptable exemption data: Employee instructions read the instructions on page 2 before completing. Web an electronic filing or electronic payment requirement. Keep a copy for your records. Employee instructions read the instructions on page 2 before completing. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Department of the treasury internal revenue service. (your withholding will be most accurate if you. Keep a copy for your records. Determine the total number of allowances field as. Web an electronic filing or electronic payment requirement. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Get ready for tax season deadlines by completing any required tax forms today. See employer instructions, on page 2. If too little is withheld, you will generally owe tax when you file your tax return. 12/21) employee’s withholding certificate complete this form in blue or black ink only. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain. Department of the treasury internal revenue service. Is this a new or rehired employee? Complete, edit or print tax forms instantly. You just need to file a different form,. State exemptions acceptable exemption data: 12/21) employee’s withholding certificate complete this form in blue or black ink only. Office of research, ct‑w4 folly brook blvd wethersfield ct 06109 options, visit the dol website at www.ctdol.state.ct.us or call. See employer instructions, on page 2. Employee instructions read the instructions on page 2 before completing. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain. Department of the treasury internal revenue service. Leave those steps blank for the other jobs. Is this a new or rehired employee? Web an electronic filing or electronic payment requirement. Get ready for tax season deadlines by completing any required tax forms today. Web an electronic filing or electronic payment requirement. Employee instructions read the instructions on page 2 before completing. Get ready for tax season deadlines by completing any required tax forms today. If too little is withheld, you will generally owe tax when you file your tax return. State exemptions acceptable exemption data: 12/21) employee’s withholding certificate complete this form in blue or black ink only. Complete, edit or print tax forms instantly. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Get ready for tax season deadlines by completing any required tax forms today. If too little is. Employee instructions read the instructions on page 2 before completing. A, b, c, d, or f tsp deferred: 12/21) employee’s withholding certificate complete this form in blue or black ink only. Leave those steps blank for the other jobs. Determine the total number of allowances field as. Complete, edit or print tax forms instantly. Web an electronic filing or electronic payment requirement. (your withholding will be most accurate if you. Is this a new or rehired employee? You just need to file a different form,. Get ready for tax season deadlines by completing any required tax forms today. Keep a copy for your records. See employer instructions, on page 2. If too little is withheld, you will generally owe tax when you file your tax return. State exemptions acceptable exemption data: Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Form ct‑w4p is for connecticut resident recipients of pensions, annuities, and certain other deferred compensation, to tell payers the correct amount of connecticut. Office of research, ct‑w4 folly brook blvd wethersfield ct 06109 options, visit the dol website at www.ctdol.state.ct.us or call.Form CTW4 Download Printable PDF or Fill Online Employee's Withholding

Form CTW4 Fill Out, Sign Online and Download Printable PDF

Free Printable W 4 Forms 2022 W4 Form

Form Ct W4 2008 printable pdf download

Form W4 Complete Guide How to Fill (with Examples)

Download Connecticut Form CTW4 (2013) for Free TidyTemplates

How to fill out w4 Fill online, Printable, Fillable Blank

W 4 Employee's Withholding Allowance Certificate 2021 2022 W4 Form

Connecticut W4 App

Fill Free fillable W4 Fillable (Central Connecticut State University

Related Post: