Va-5 Form

Va-5 Form - Web search for va forms by keyword, form name, or form number. Web if you or the irs changes your federal return, you must file an amended virginia return within one year of the final irs determination. Virginia recently updated a number of forms. Web eforms are fillable electronic forms designed to look and function similar to the paper version of tax returns. You do not need to log in to submit your return through eforms. If the average monthly withholding tax liability is at least $100, but less than $1,000, a monthly filing status will be assigned. Web click the download va form link for the form you want to fill out. Web security and employment forms. Va form 0710 — authorization for release of information—protected under the fair credit reporting act (title 15, section 1681) Form name employer’s quarterly return of virginia income tax withheld tax. You do not need to log in to submit your return through eforms. Returns and payments must be submitted electronically on or before the due date to be considered filed and. Web eforms are fillable electronic forms designed to look and function similar to the paper version of tax returns. This commonwealth of virginia system belongs to the department of. Web search for va forms by keyword, form name, or form number. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax. Web see the following information: Va form 0710 — authorization for release of information—protected under the fair credit reporting act (title 15,. You do not need to log in to submit your return through eforms. You can save it to a different folder if you'd like. Va form 0710 — authorization for release of information—protected under the fair credit reporting act (title 15, section 1681) Web if you or the irs changes your federal return, you must file an amended virginia return. All employers must file all returns and make all payments electronically using eforms,. The pdf will download to your downloads folder. Va form 0710 — authorization for release of information—protected under the fair credit reporting act (title 15, section 1681) Web search for va forms by keyword, form name, or form number. Web va form feb 2011. Web if you or the irs changes your federal return, you must file an amended virginia return within one year of the final irs determination. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax. The pdf will download to your downloads folder. Web. Web if you or the irs changes your federal return, you must file an amended virginia return within one year of the final irs determination. You do not need to log in to submit your return through eforms. Web search for va forms by keyword, form name, or form number. Web click the download va form link for the form. Virginia recently updated a number of forms. Web va form feb 2011. Returns and payments must be submitted electronically on or before the due date to be considered filed and. Quickly access top tasks for frequently downloaded va forms. Web if you or the irs changes your federal return, you must file an amended virginia return within one year of. Web security and employment forms. The pdf will download to your downloads folder. If the average monthly withholding tax liability is at least $100, but less than $1,000, a monthly filing status will be assigned. Web search for va forms by keyword, form name, or form number. You can save it to a different folder if you'd like. Web click the download va form link for the form you want to fill out. Va form 0710 — authorization for release of information—protected under the fair credit reporting act (title 15, section 1681) Web eforms are fillable electronic forms designed to look and function similar to the paper version of tax returns. Web see the following information: Returns and. The pdf will download to your downloads folder. Returns and payments must be submitted electronically on or before the due date to be considered filed and. Web search for va forms by keyword, form name, or form number. You do not need to log in to submit your return through eforms. You can save it to a different folder if. If you file an amended return with any. Web va form feb 2011. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax. Web phone verification is the least recommended option, but if you are unable to verify via text, email, or online, you will need to contact the education call center (ecc). Web security and employment forms. The pdf will download to your downloads folder. You do not need to log in to submit your return through eforms. Web see the following information: Web eforms are fillable electronic forms designed to look and function similar to the paper version of tax returns. Form name employer’s quarterly return of virginia income tax withheld tax. Va form 0710 — authorization for release of information—protected under the fair credit reporting act (title 15, section 1681) Web search for va forms by keyword, form name, or form number. You can save it to a different folder if you'd like. All employers must file all returns and make all payments electronically using eforms,. Virginia recently updated a number of forms. Web click the download va form link for the form you want to fill out. Quickly access top tasks for frequently downloaded va forms. If the average monthly withholding tax liability is at least $100, but less than $1,000, a monthly filing status will be assigned. Web if you or the irs changes your federal return, you must file an amended virginia return within one year of the final irs determination. Returns and payments must be submitted electronically on or before the due date to be considered filed and.va form 3482e Fill Online, Printable, Fillable Blank va221999b

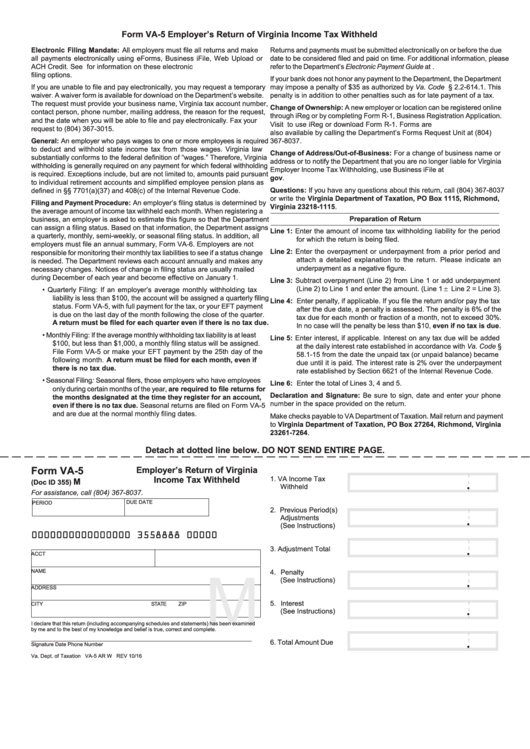

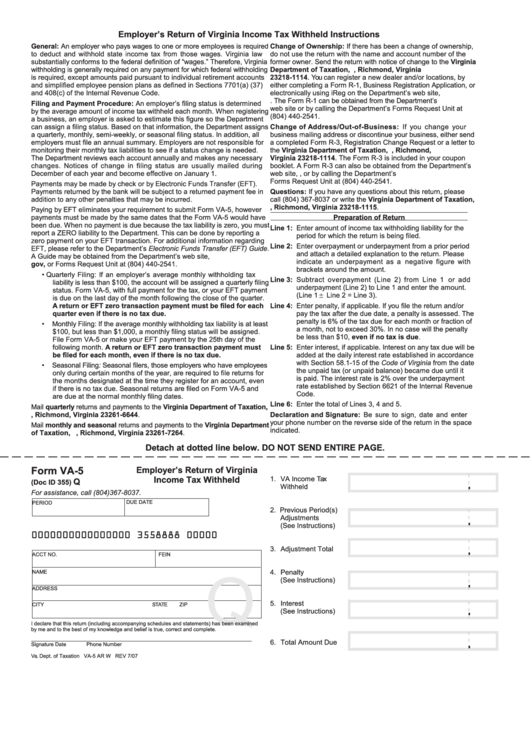

Fillable Form Va5 Employer'S Return Of Virginia Tax Withheld

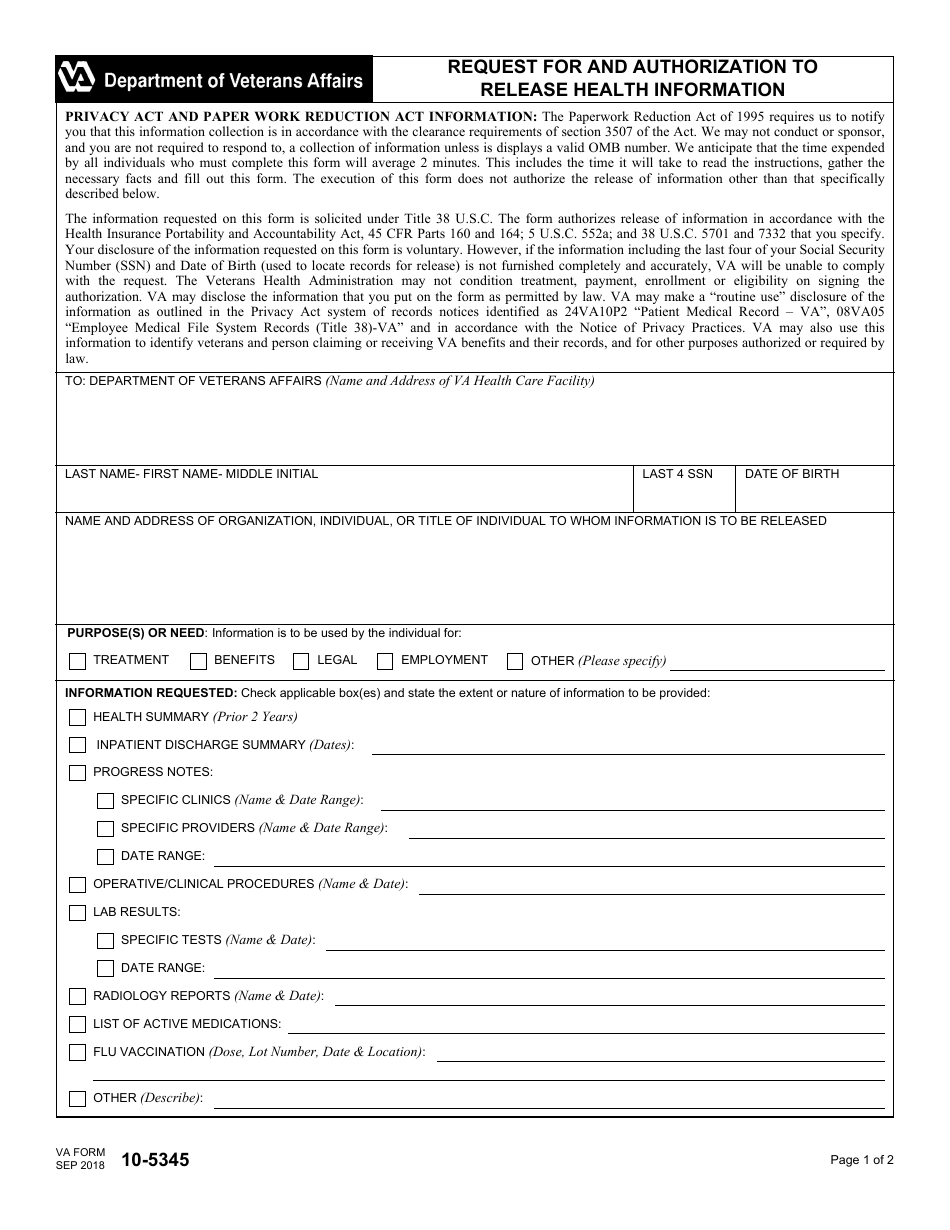

Va Form 10 5345a Fillable and Printable Template in PDF

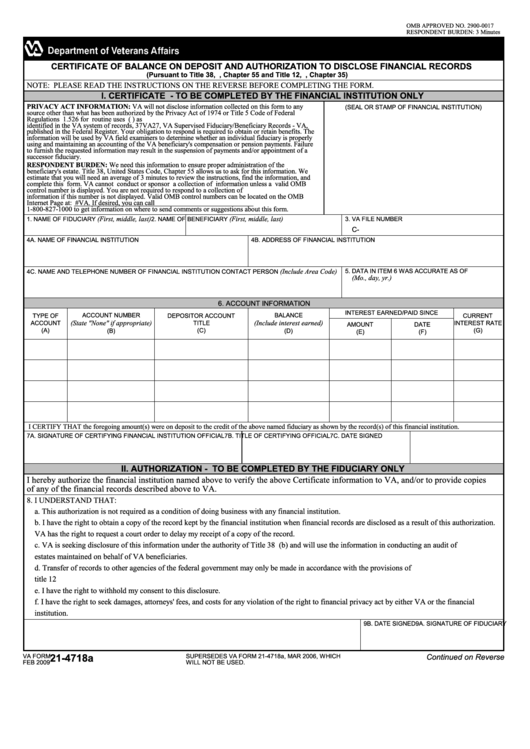

Fillable Va Form 214718a Veterans Benefits Administration printable

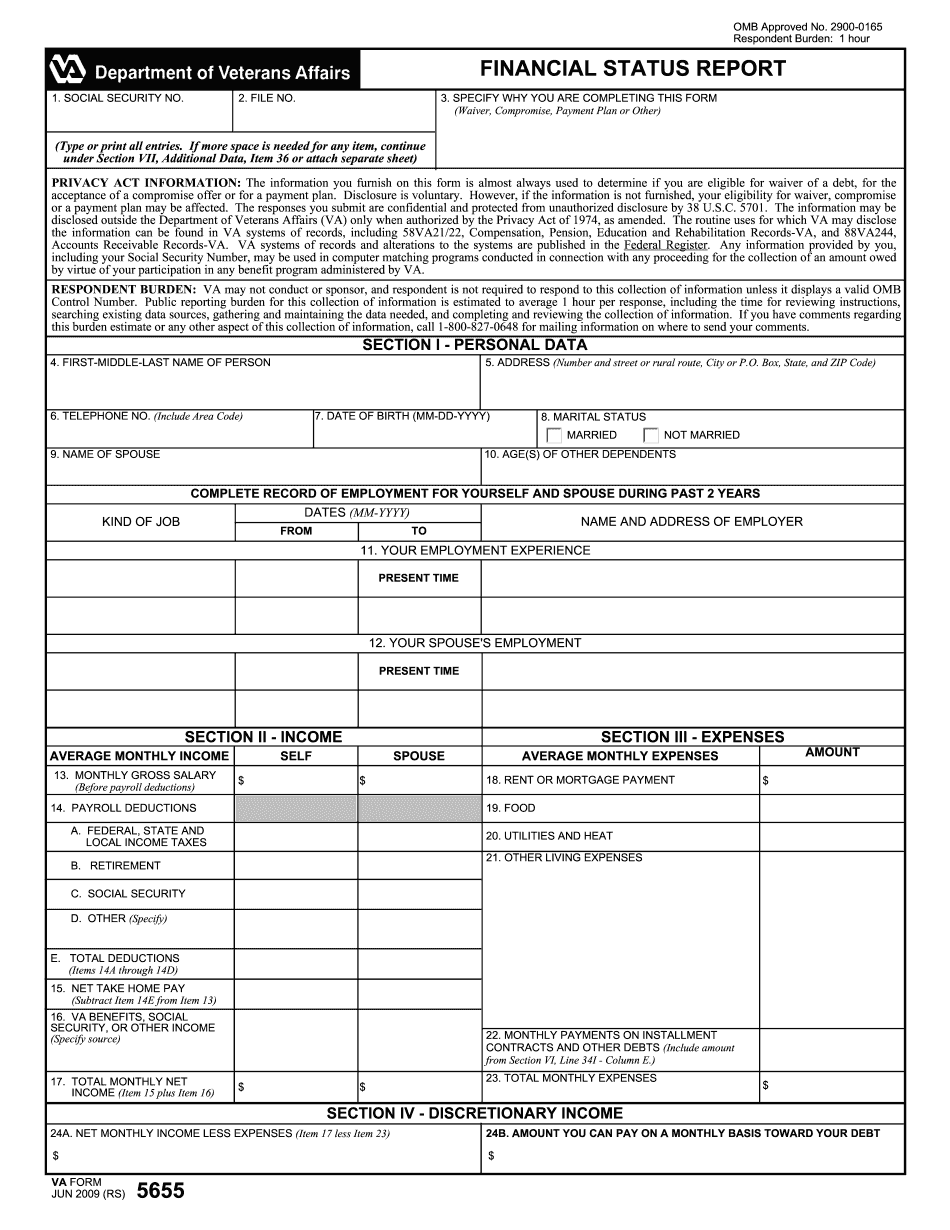

Va form 750 performance appraisal PDF 2023 Fill online, Printable

Va Form 26 6381 Va 6381 form Fill Out and Sign Printable PDF

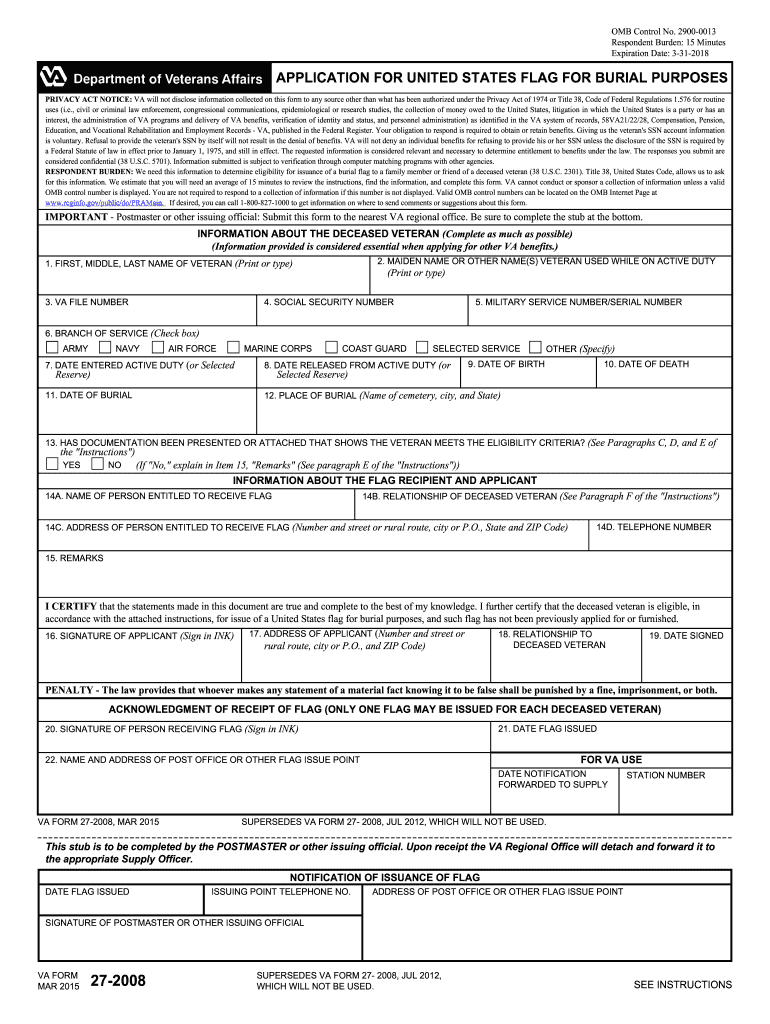

VA 272008 2012 Fill and Sign Printable Template Online US Legal Forms

Free Veterans Affairs Request for and Authorization to Release Medical

Fillable Form Va5 Employer'S Return Of Virginia Tax Withheld

Va Form 26 4555 Fillable Printable Fillable and Printable Template in PDF

Related Post: