Uva Tax Exempt Form

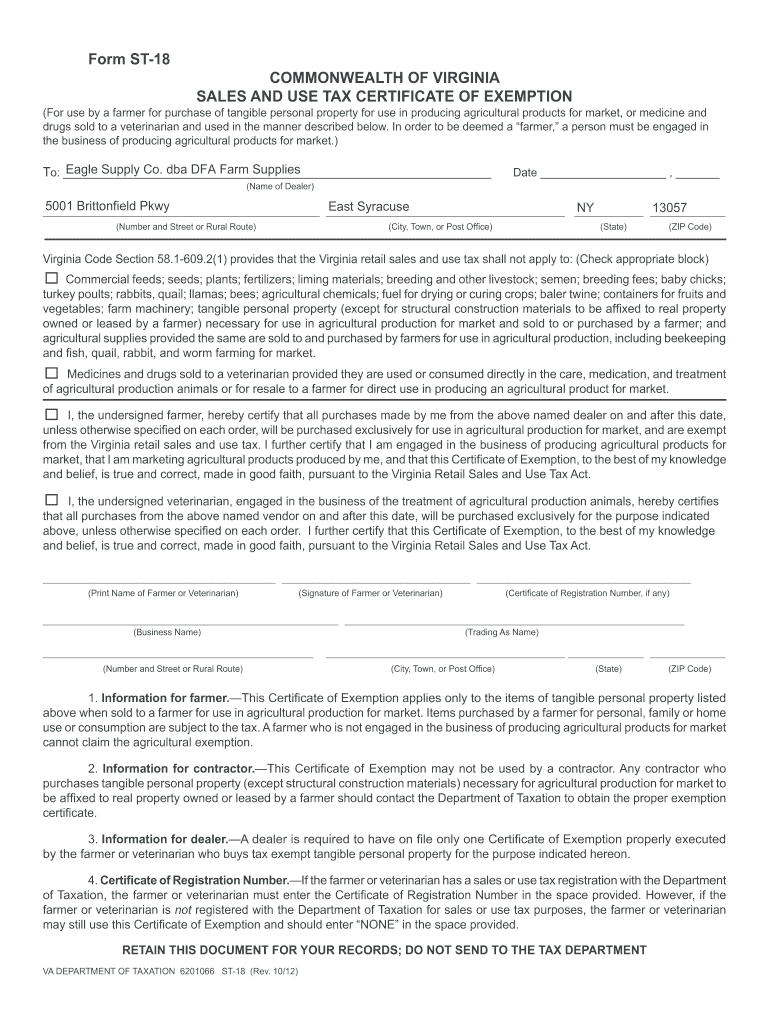

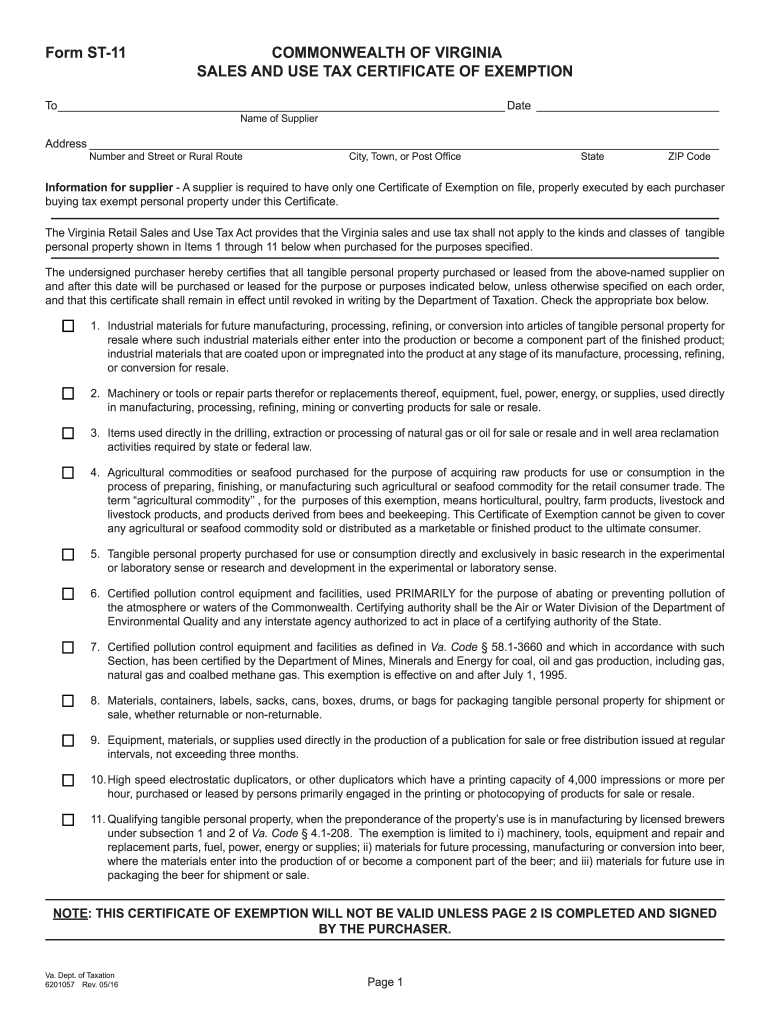

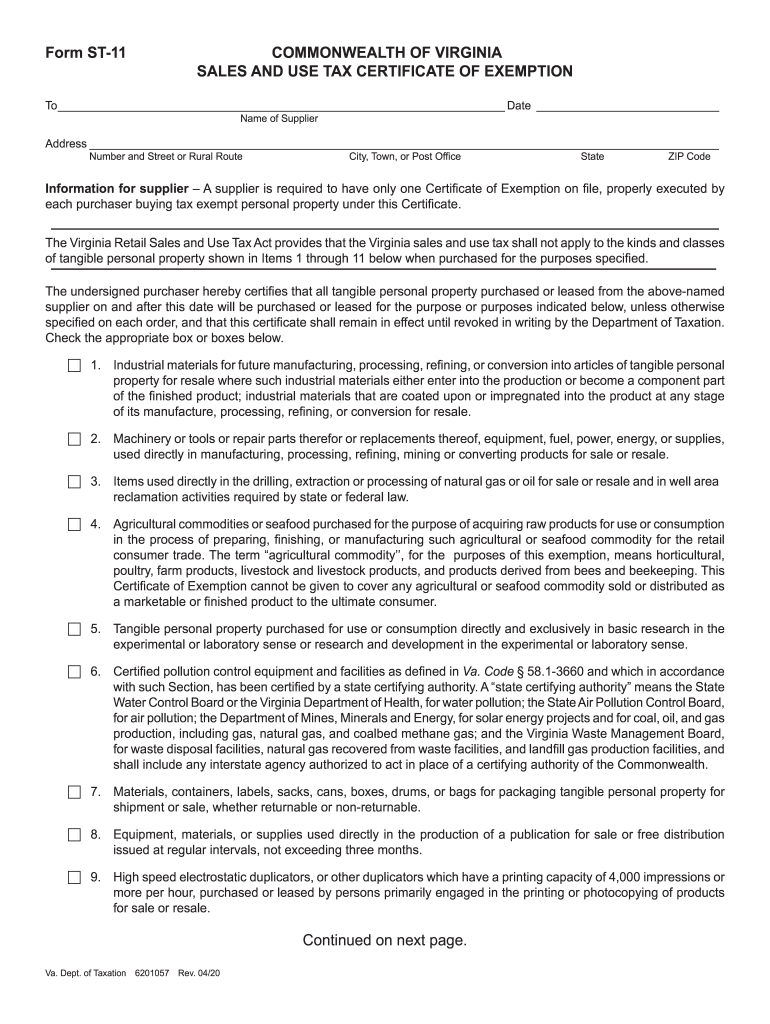

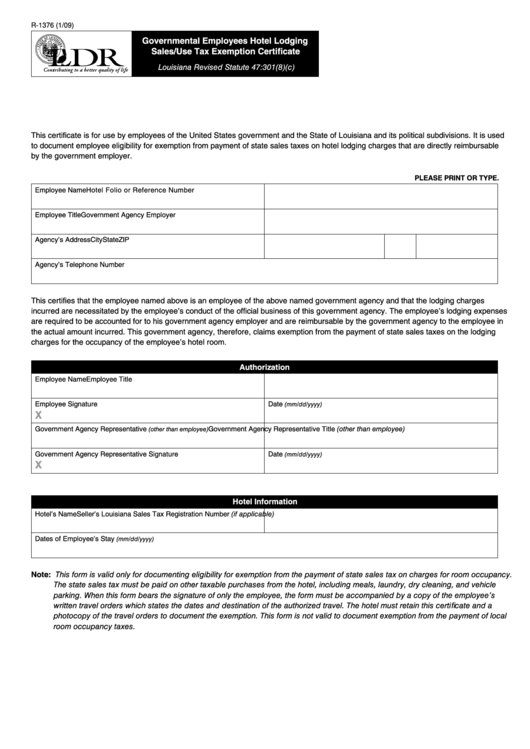

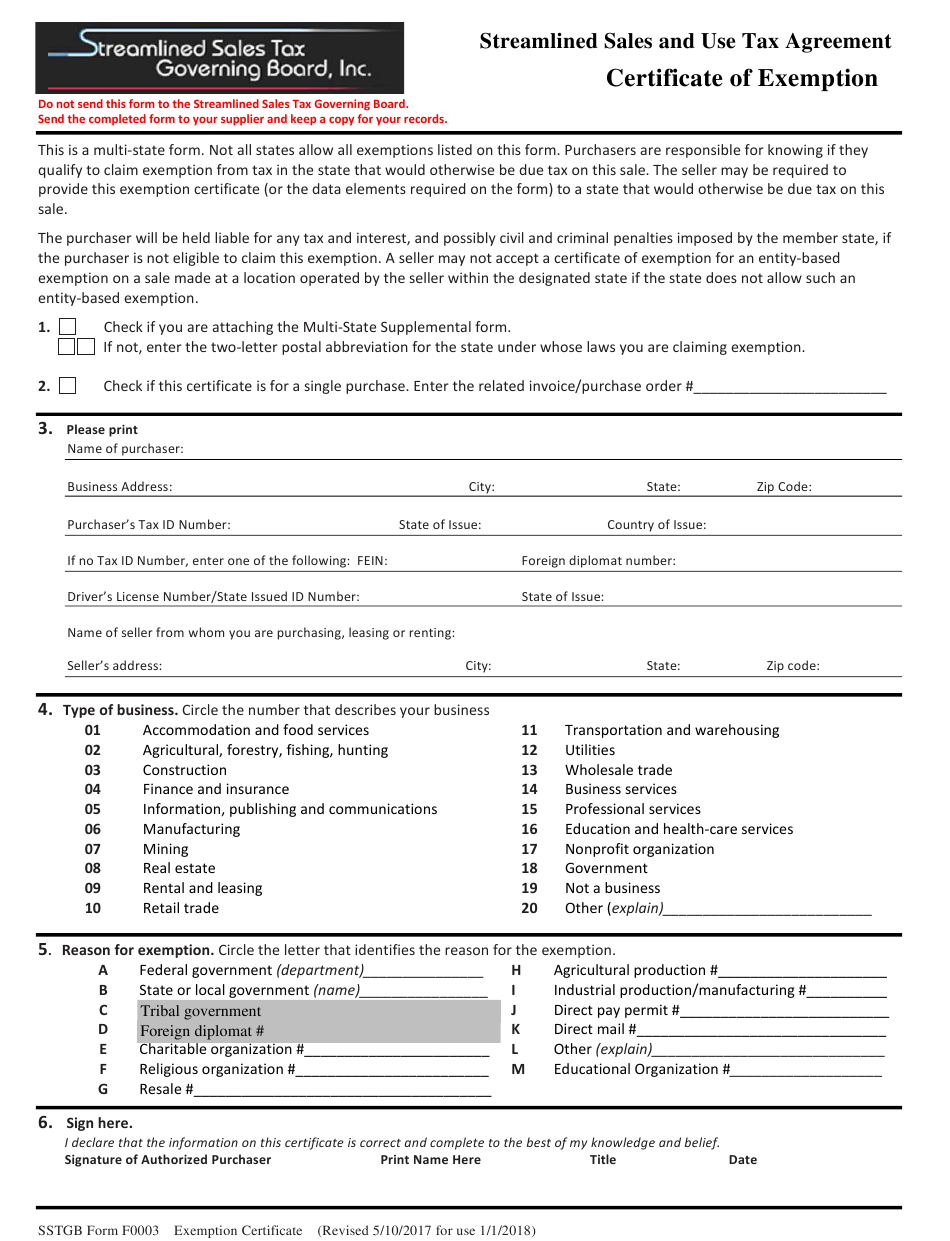

Uva Tax Exempt Form - Virginia allows an exemption of $930* for each of the following: Box 1 will show the total payments received for qtre in a given calendar. Web the state and local income tax from virginia schedule a, line 5a (not to exceed $10,000 or $5,000 if married. Web if a supplier requires proof of exemption, the commonwealth of virginia sales and use tax exemption form and communications sales and use tax certificate of exemption. Web this login form accepts credentials issued by uva health it or academic it. Web virginia sales and tax exemption certificate. Communications sales and use tax certificate of exemption. Web as a state agency, the university is exempt from paying sales and use tax. A common exemption is “purchase for resale,” where. Web commonwealth of virginia sales and use tax certificate of exemption. Web sales to the university are normally exempt from state taxes. Web sales & vat tax; A common exemption is “purchase for resale,” where. Invoices resulting from this purchase will be free of federal excise and transportation taxes. Complete the applicable lines below 1. A common exemption is “purchase for resale,” where. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. Virginia allows an exemption of $930* for each of the following: Web as a state agency, the university is exempt from paying sales and use tax. Invoices resulting from this purchase will. [noun] radiation that is in the region of the ultraviolet spectrum which extends from about 320 to 400 nm in wavelength and that causes tanning and contributes to aging of. Complete the virginia sales and use tax registration. Complete the applicable lines below 1. Web as a state agency, the university is exempt from paying sales and use tax. Communications. Communications sales and use tax certificate of exemption. Box 1 will show the total payments received for qtre in a given calendar. A common exemption is “purchase for resale,” where. Can't find the hr policy you need? Deduction you are claiming on the virginia return, enter zero on. Communications sales and use tax certificate of exemption. Box 1 will show the total payments received for qtre in a given calendar. Complete the virginia sales and use tax registration. Web if a supplier requires proof of exemption, the commonwealth of virginia sales and use tax exemption form and communications sales and use tax certificate of exemption. Invoices resulting from. Communications sales and use tax certificate of exemption. Can't find the hr policy you need? And use tax certificate of exemption. Web if a supplier requires proof of exemption, the commonwealth of virginia sales and use tax exemption form and communications sales and use tax certificate of exemption. A common exemption is “purchase for resale,” where. Departments must follow university policies and. Web this login form accepts credentials issued by uva health it or academic it. For use by the commonwealth of virginia, a political subdivision of the. Web sales & vat tax; Web the state and local income tax from virginia schedule a, line 5a (not to exceed $10,000 or $5,000 if married. Web sales to the university are normally exempt from state taxes. For use by a virginia dealer who purchases tangible personal property for resale, or for. Departments must follow university policies and. Web virginia sales and tax exemption certificate. Communications sales and use tax certificate of exemption. Deduction you are claiming on the virginia return, enter zero on. Present a copy of this certificate to suppliers. Communications sales and use tax certificate of exemption. Web commonwealth of virginia sales and use tax certificate of exemption. Web as a state agency, the university is exempt from paying sales and use tax. Yes select yes if your state exempt sales are fully. Virginia allows an exemption of $930* for each of the following: Commonwealth of virginia sales and use tax certificate of exemption. Each filer is allowed one personal exemption. Present a copy of this certificate to suppliers. For use by a virginia dealer who purchases tangible personal property for resale, or for. Present a copy of this certificate to suppliers. Each filer is allowed one personal exemption. Web if a supplier requires proof of exemption, the commonwealth of virginia sales and use tax exemption form and communications sales and use tax certificate of exemption. A common exemption is “purchase for resale,” where. Virginia allows an exemption of $930* for each of the following: Commonwealth of virginia sales and use tax certificate of exemption. Web virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. [noun] radiation that is in the region of the ultraviolet spectrum which extends from about 320 to 400 nm in wavelength and that causes tanning and contributes to aging of. Departments must follow university policies and. Yes select yes if your state exempt sales are fully. Web the state and local income tax from virginia schedule a, line 5a (not to exceed $10,000 or $5,000 if married. Web virginia sales and tax exemption certificate. And use tax certificate of exemption. Virginia sales & use tax exemption certificate. Box 1 will show the total payments received for qtre in a given calendar. Communications sales and use tax certificate of exemption. Web before exempting a sale from tax, the selling unit is responsible for obtaining a sales exemption certificate from the purchaser valid in the jurisdiction in which the purchaser. Deduction you are claiming on the virginia return, enter zero on. Web as a state agency, the university is exempt from paying sales and use tax.Form St 18 Fill Online, Printable, Fillable, Blank pdfFiller

Commonwealth of virginia sales and use tax exemption forms Fill out

St 13 form virginia Fill out & sign online DocHub

Federal Government Hotel Tax Exempt Form Virginia

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

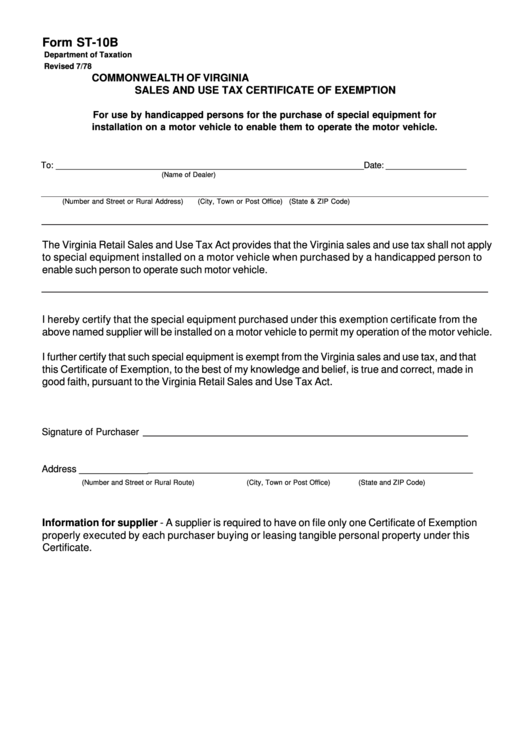

Virginia Sales Tax Exemption Form St 10

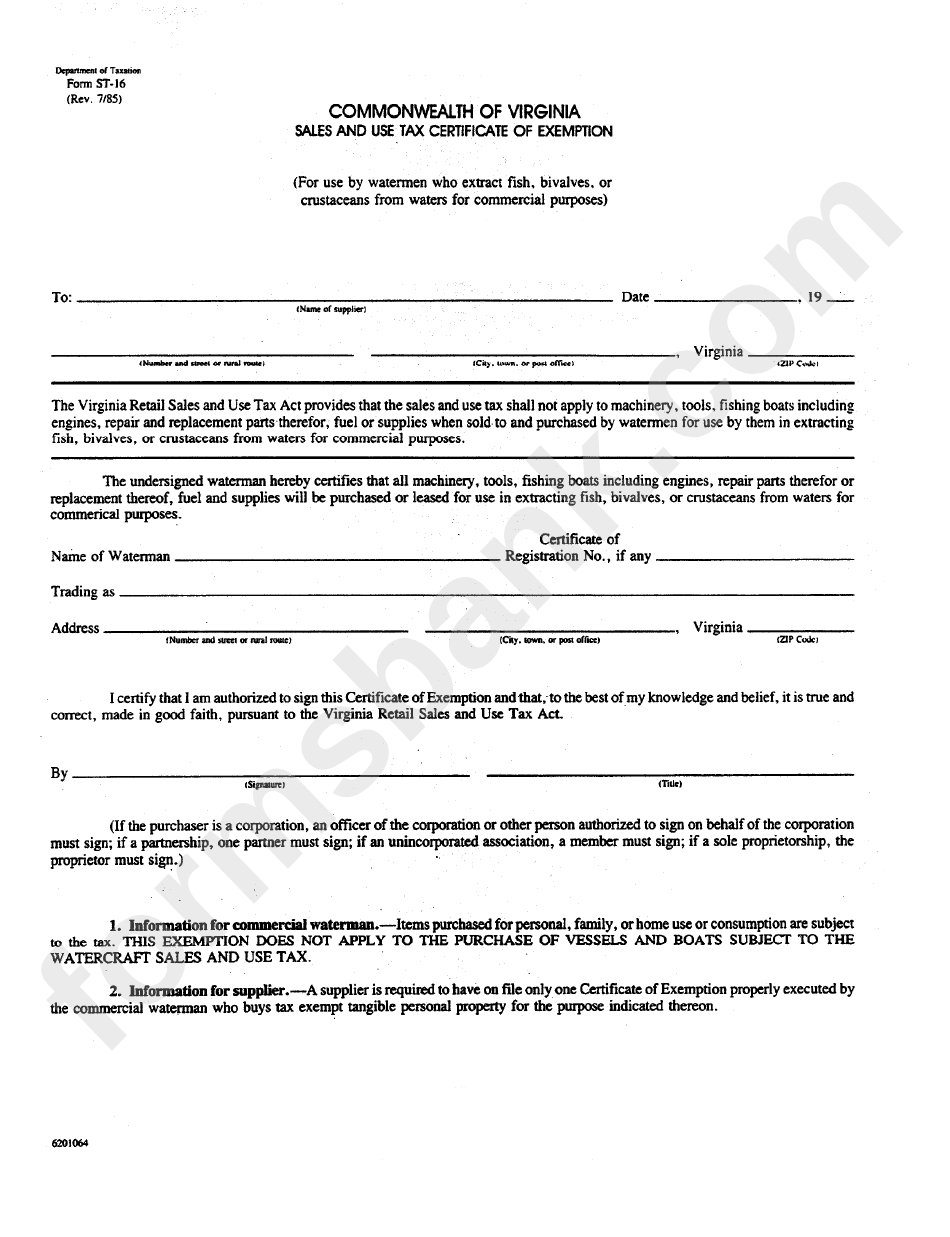

Fillable Form St 16 Sales And Use Tax Certificate Of Exemption

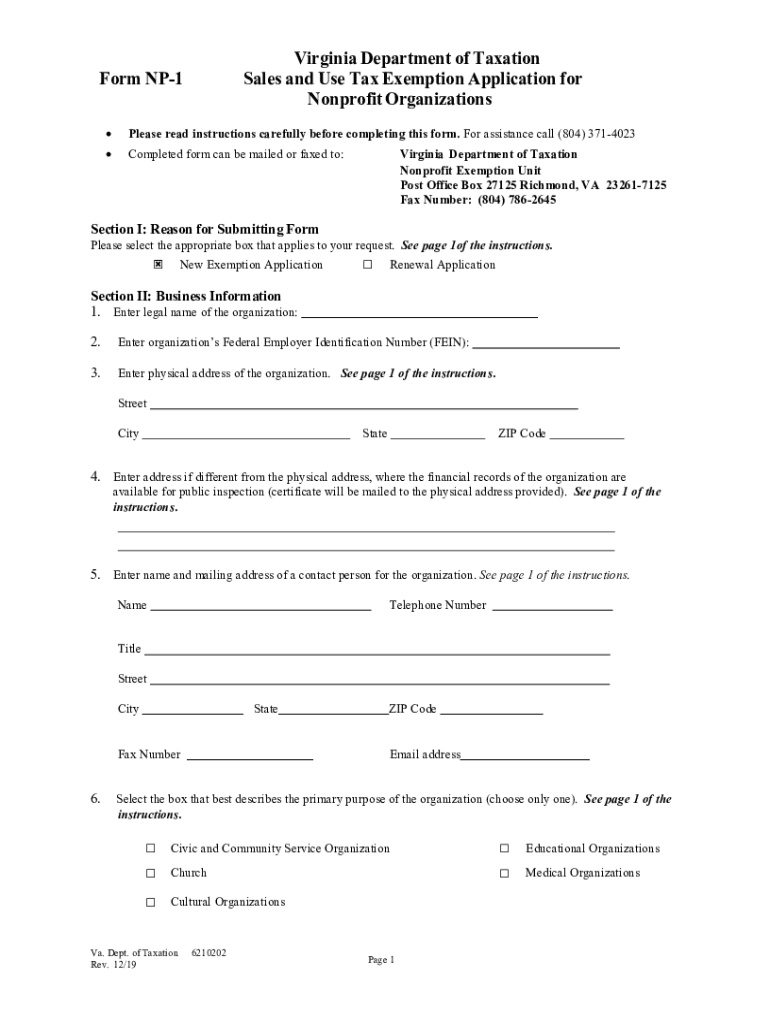

20192022 VA Form NP1 Fill Online, Printable, Fillable, Blank pdfFiller

West Virginia Tax Exemption Certificate Form

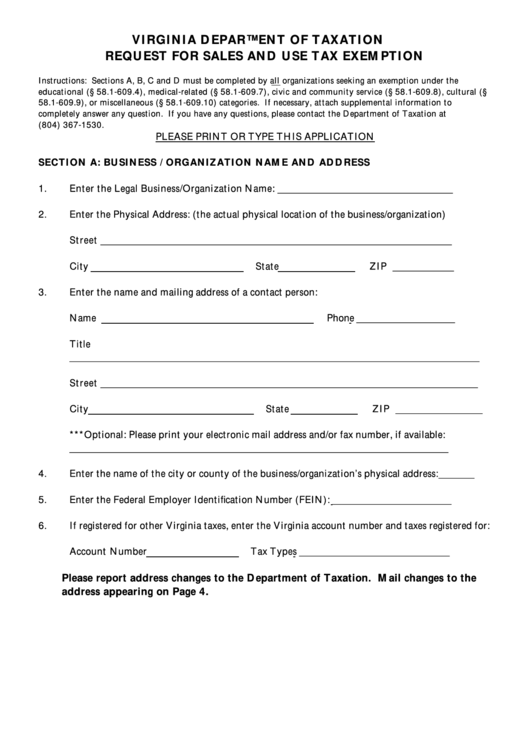

Request For Sales And Use Tax Exemption Virginia Department Of

Related Post: